We have been closely following – first Gibson Guitar and then Gibson Brands – from their decision in 2012 to shoot for the stars by using OPM (other people’s money) to make highly leveraged…and highly questionable…acquisitions of various consumer electronics brands (a category in which the CEO and his team had no experience) to their recent 2018 bankruptcy. Gibson was trying to diversify their musical instrument business into something that now former CEO Henry Juszkiewicz called a music lifestyle brand. Instead, they wound up in bankruptcy.

We have been closely following – first Gibson Guitar and then Gibson Brands – from their decision in 2012 to shoot for the stars by using OPM (other people’s money) to make highly leveraged…and highly questionable…acquisitions of various consumer electronics brands (a category in which the CEO and his team had no experience) to their recent 2018 bankruptcy. Gibson was trying to diversify their musical instrument business into something that now former CEO Henry Juszkiewicz called a music lifestyle brand. Instead, they wound up in bankruptcy.

Gibson Brands

Docs Show Gibson Bankruptcy Bigger Than You Think

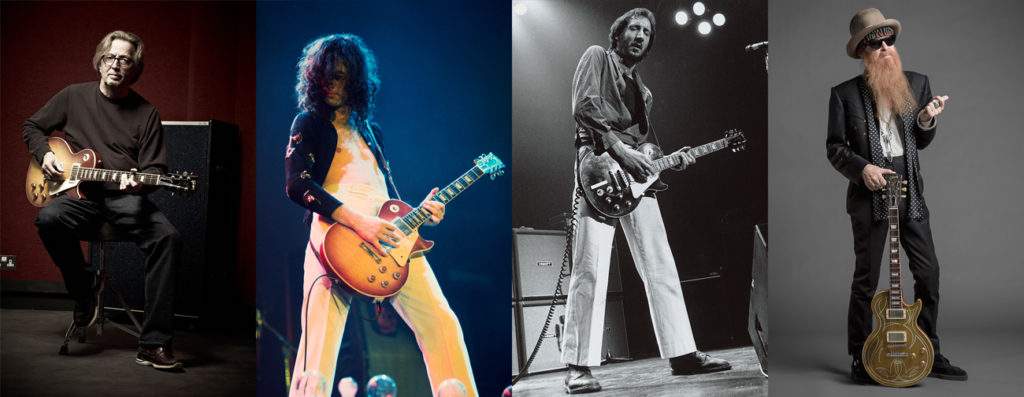

Founded in 1894, it is a mark of their long-term brand success that Gibson has become such a large and far-flung international organization. In a cursory review of documents submitted to the court as part of their bankruptcy filing shows, legendary performers such as Muddy Waters, BB King, Elvis Presley, Pete Townsend, Keith Richards, Duane Allman, Elvis Costello, Lenny Kravitz, Slash, Dave Grohl, Joe Bonamassa all used various Gibson products that, in some cases, became a signature of that performer. And yes, the bankruptcy filing promotes these iconic names.

Founded in 1894, it is a mark of their long-term brand success that Gibson has become such a large and far-flung international organization. In a cursory review of documents submitted to the court as part of their bankruptcy filing shows, legendary performers such as Muddy Waters, BB King, Elvis Presley, Pete Townsend, Keith Richards, Duane Allman, Elvis Costello, Lenny Kravitz, Slash, Dave Grohl, Joe Bonamassa all used various Gibson products that, in some cases, became a signature of that performer. And yes, the bankruptcy filing promotes these iconic names.

But from these Gibson filings, we’ve learned so much more… [Read more…] about Docs Show Gibson Bankruptcy Bigger Than You Think

Gibson Brands Files for Bankruptcy

BREAKING NEWS

Filing Pre-Negotiated with Bondholders, CEO & Pres Stay thru Transition

Gibson Brands Inc. announced today that it has filed for bankruptcy under Chapter 11 of the U.S. Bankruptcy Code. Chapter 11 denotes the company plans a reorganization and the company says it has reached an agreement with certain existing bondholders called a “Restructuring Support Agreement.” This agreement is with holders of more than 69.0% of the debt due in 2018

Gibson Brands Inc. announced today that it has filed for bankruptcy under Chapter 11 of the U.S. Bankruptcy Code. Chapter 11 denotes the company plans a reorganization and the company says it has reached an agreement with certain existing bondholders called a “Restructuring Support Agreement.” This agreement is with holders of more than 69.0% of the debt due in 2018

See more on this anticipated development… [Read more…] about Gibson Brands Files for Bankruptcy

A Gibson Pile-On: Now Hit With a $50 Million Lawsuit

Gibson Brands CEO Henry Juszkiewicz has been very busy lately as he scrambles to arrange a $550 million bailout package in a desperate attempt to avoid bankruptcy for the storied brand. But he’s about to get a little busier as one of Gibson Guitar’s vendors, Tronical of Hamburg, Germany, sues the company for $50 million it says it is owed.

So now Tronical gets in line behind Gibson bondholders seeking payment… [Read more…] about A Gibson Pile-On: Now Hit With a $50 Million Lawsuit

Options Narrowing as Gibson & KKR Talks Fail

We learned last week that talks between Gibson Brands and deal making king KKR Credit Advisors fell apart in a dispute over “the appropriate consideration for the various parties involved,” according to a statement from Gibson Brands. As yet another bail-out opportunity slips by them, Gibson Brands sees their options narrowing, with an August deadline on a required financial restructuring of more than $500 million of debt rapidly approaching.

We learned last week that talks between Gibson Brands and deal making king KKR Credit Advisors fell apart in a dispute over “the appropriate consideration for the various parties involved,” according to a statement from Gibson Brands. As yet another bail-out opportunity slips by them, Gibson Brands sees their options narrowing, with an August deadline on a required financial restructuring of more than $500 million of debt rapidly approaching.

See more on this dire situation at Gibson Brands… [Read more…] about Options Narrowing as Gibson & KKR Talks Fail

Gibson, After Light Pruning, Plans Global Layoffs

Hundreds of Employees Facing Pink Slips

Gibson Brands, a major provider of musical instrument and consumer electronics products, is in the midst of a widely reported liquidity crisis. With more than $500 million dollars in notes coming due late this summer, the company is seeking a knight in shining armor to ride in on a white horse with a big bag of money to refinance the company’s crushing debt.

To make the company appear attractive to a lender or investor, at the end of February the company sold off its shuttered Cakewalk division and laid off about 15 employees from its famous Custom Shop. Now we learn the company is planning more substantial layoffs across the board.

See more on this latest development at Gibson… [Read more…] about Gibson, After Light Pruning, Plans Global Layoffs

Gibson Sells One Division & Cuts Staff in Another

The news and events surrounding troubled guitar and consumer electronics company Gibson Brands, Inc. seem to be moving at a rapid pace with almost daily revelations as the company struggles to survive ahead of a massive debt due-date just a few short months away. We learned over the last few days that Gibson has sold their recently shuttered Cakewalk Inc. division and laid off staff in their famous Custom Shop operation.

The news and events surrounding troubled guitar and consumer electronics company Gibson Brands, Inc. seem to be moving at a rapid pace with almost daily revelations as the company struggles to survive ahead of a massive debt due-date just a few short months away. We learned over the last few days that Gibson has sold their recently shuttered Cakewalk Inc. division and laid off staff in their famous Custom Shop operation.

See more about the continued dramatic developments surrounding Gibson… [Read more…] about Gibson Sells One Division & Cuts Staff in Another

Of Gibson, S&P Says: ‘Default is Imminent’

S&P Global Ratings, part of top credit rating agency Standard and Poor’s, this week lowered their rating of Gibson Brands, Inc. to “CCC-” – down one step from the already low rating of “CCC.” Their outlook on Gibson? “Negative.” A rating of CCC- means that “default is imminent.”

S&P Global Ratings, part of top credit rating agency Standard and Poor’s, this week lowered their rating of Gibson Brands, Inc. to “CCC-” – down one step from the already low rating of “CCC.” Their outlook on Gibson? “Negative.” A rating of CCC- means that “default is imminent.”

See more on this latest torpedo to hit the good ship Gibson… [Read more…] about Of Gibson, S&P Says: ‘Default is Imminent’

CEO Says Gibson Will Dump Brands

Financials Show Sales & Profits Continue to Slide

Gibson Brands CEO Henry Juszkiewicz continues to profess confidence that the company will be able to successfully refinance their over $500 million debt before a mid-year maturation comes due. Telling the Nashville Post that the company is going through a little “spring cleaning,” Juszkiewicz says the company already dropped their Cakewalk music software group, and other brands in their portfolio are next to go. But a financial report to bondholders shows continued deterioration of both sales and profits, suggesting that simply pruning a few brands from the portfolio may not be enough to attract new investors or lenders.

See more on the dire situation at Gibson Brands… [Read more…] about CEO Says Gibson Will Dump Brands

Gibson CEO Turns to PR to Stop Crashing Reputation

Company Rehires CFO With Debt Deadline Fast Approaching

As the music world media continues to trumpet the news of the potential impending collapse of Gibson Brands, noting large outstanding debts and the exit of the company’s CFO, Gibson CEO Henry Juszkiewicz launches a PR blitz to try and stem the collapse of the company’s reputation. It is a critical time for Juszkiewicz, as he is engaged in trying to refinance the company whose huge debt portfolio of over $500 million comes due in just a few short months. To try and stem the tide, Gibson released a couple of press releases last week claiming, in essence and improbably, that things are just fine.