Founded in 1894, it is a mark of their long-term brand success that Gibson has become such a large and far-flung international organization. In a cursory review of documents submitted to the court as part of their bankruptcy filing shows, legendary performers such as Muddy Waters, BB King, Elvis Presley, Pete Townsend, Keith Richards, Duane Allman, Elvis Costello, Lenny Kravitz, Slash, Dave Grohl, Joe Bonamassa all used various Gibson products that, in some cases, became a signature of that performer. And yes, the bankruptcy filing promotes these iconic names.

Founded in 1894, it is a mark of their long-term brand success that Gibson has become such a large and far-flung international organization. In a cursory review of documents submitted to the court as part of their bankruptcy filing shows, legendary performers such as Muddy Waters, BB King, Elvis Presley, Pete Townsend, Keith Richards, Duane Allman, Elvis Costello, Lenny Kravitz, Slash, Dave Grohl, Joe Bonamassa all used various Gibson products that, in some cases, became a signature of that performer. And yes, the bankruptcy filing promotes these iconic names.

But from these Gibson filings, we’ve learned so much more…

Gibson Brands Inc. (GBI) has filed for bankruptcy in what is often referred to as a pre-packaged bankruptcy – meaning it was pre-negotiated with principal creditors for quicker processing. Like all court cases, bankruptcy is a litigation process that is usually quite time-consuming and can drag on for years. However, if debtor and debt holders can agree on all major points of dispute, as well as on a plan of attack, the time it takes to process a bankruptcy can be dramatically shortened.

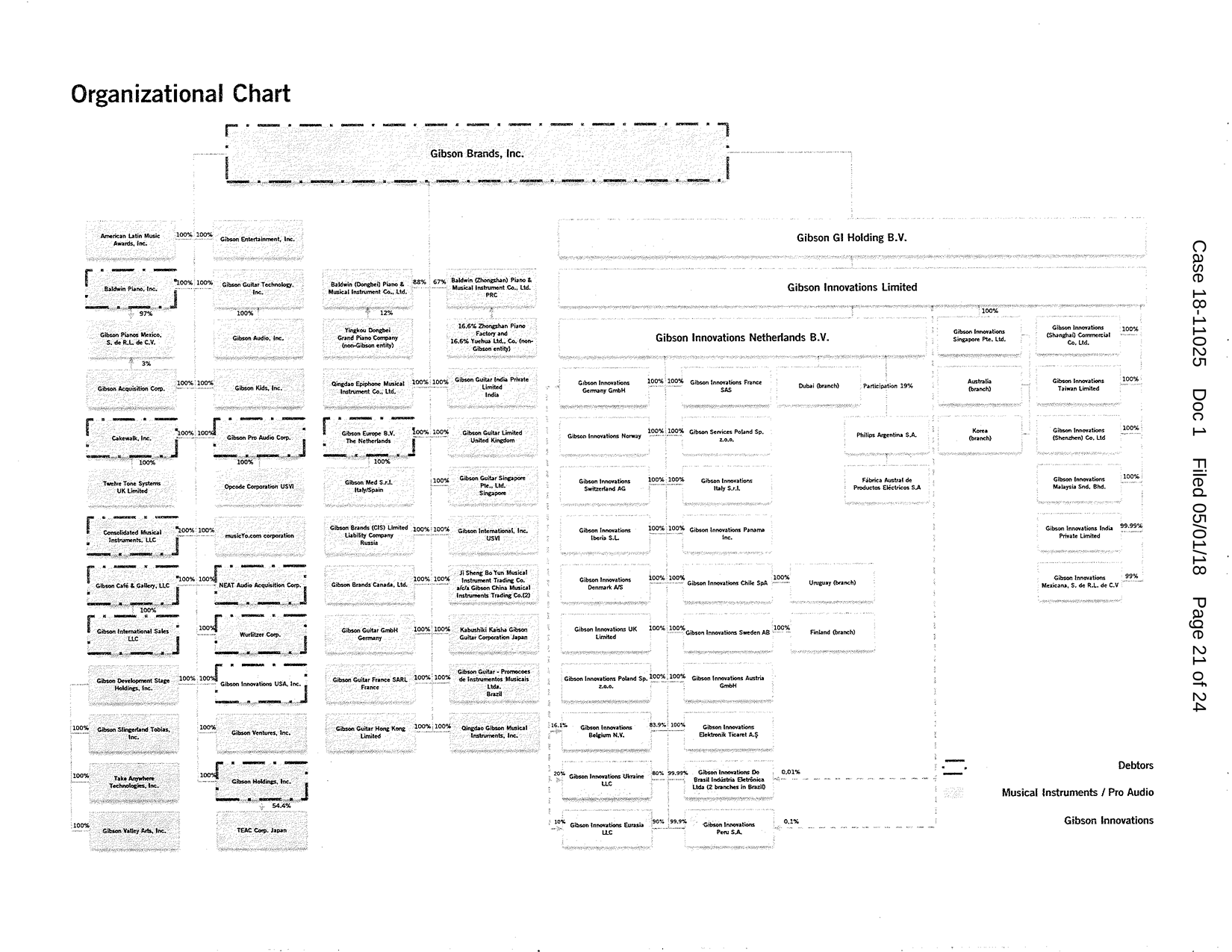

In a review of some of the materials filed with the court in this bankruptcy, we were left with a better appreciation of both how large Gibson Brands has become, and how many subsidiaries and divisions were directly involved in this process. There are even more divisions indirectly involved, making this bankruptcy one of the more complex ones we’ve reviewed.

The Many Companies in This Bankruptcy

Our study has revealed that this process involves multiple Gibson Brands-related entities. Specifically, this bankruptcy involves 12 separate companies, which are shown in the list below.

- Baldwin Piano, Inc.

- Cakewalk, Inc.

- Consolidated Musical Instruments, LLC

- Gibson Brands Inc.

- Gibson Café & Gallery, LLC

- Gibson Europe B.V.

- Gibson Holdings, Inc.

- Gibson Innovations USA, Inc.

- Gibson International Sales LLC

- Gibson Pro Audio Corp.

- Neat Audio Acquisition Corp.

- Wurlitzer Corp.

Most of these companies are incorporated in the state of Delaware, but not all of them. Gibson Pro Audio is incorporated in California, Cakewalk is incorporated in Massachusetts, and Gibson Europe is incorporated in The Netherlands. Each of these entities have Boards of Directors, each of whom had to independently meet, discuss, and ratify sets of resolutions related to this bankruptcy. It is truly a blizzard of paper.

While Gibson has filed a motion with the court to consolidate the proceedings for efficiency, even this is not as easy as it sounds. The fact is, each of these entities are connected to this matter in different ways and have different issues resulting from the financial challenges of GBI. Many of those differences are material, and different filings are often forced to delineate those differences.

Who Owns Who?

Gibson Brands, Inc. owns 100% interest in all of these independent companies. Henry Juszkiewicz owns 36% of the equity interest in GBI and President David Berryman’s Berryman Limited Partnership, LP owns 49% of the equity interest in GBI. No other person holds 10% or more of GBI.

By the way, there is a whole roster of other entities and individuals who own a small piece of Gibson Brands. Many of those – but not all – had names that ended in Juszkiewicz. One of them is Onkyo Corporation of Osaka, Japan who retains 1% of Class A shares, and 1% of Class B shares of Gibson Brands. We’re not sure why…

Sorting out the ownership and relationship between all of these companies is a little confusing. Adding to the confusion, many of these companies own partial of full equity interest in other companies as well. To help the court sort this all out, the company provided an organization chart to graphically show these relationships. In our mind, this only serves to show just how complex this bankruptcy is. See this organization chart below…

Top 30 Unsecured Creditors

When filing bankruptcy, debtors must identify their top 30 unsecured creditors and the amount they are owed. Often, much can be gleaned from both the names on the list, and the amount of their debt. In most cases, unsecured creditors are lucky to get pennies on the dollar after secured creditors are first resolved.

Here are the top 5 of the top 30 unsecured creditors identified by Gibson:

| # | Creditor | Location | Amount |

|---|---|---|---|

| 1 | Evervictory Electronic B.V.I. | Taiwan | $2,851,790 |

| 2 | Pacific Western Timbers, Inc. | Bremerton, WA | $971,758 |

| 3 | TKL Products Corp. | Oilville, VA | $842,986 |

| 4 | North American Wood Products, LLC | Portland, OR | $468,767 |

| 5 | PTSAMICK | Indonesia | $453,665 |

Most of the names on this top 30 unsecured creditor list are parts suppliers, logistics companies and the like, with names that are not particularly recognizable. But there are a few familiar names including KPMG, LLP, a major accounting and auditing company (owed $400,000); NPD Intelect, LLC, a major market research and market data company (owed $333,606); and Somera Road, a real estate investment company involved in buying some of Gibson’s real estate (owed $99,605).

Last place, or at least they are listed in last place at #30, is Koninklijke Philips, N.V. Note that Philips is a highly featured name throughout these filings as Gibson makes no bones that problems associated with their purchase of Philips accessory division turned out to be a major driving force in Gibson’s downfall. Philips is listed as the #30 top unsecured creditor, but the amount of the unsecured claim is listed as “Undetermined.” Gibson also notes – not surprisingly – that this claim is “Disputed.” We suspect that Philips’ claim is probably much higher than is represented by their listing as the 30th largest unsecured creditor.

Incidentally, Gibson provided a total list of creditors in their filings as well. It was truly impressive – 66 pages long with single-spaced text, listing between 55-65 creditors on each page. This was literally thousands of creditors, large and small.

How Did This Bankruptcy Come About?

As we’ve previously reported, back in 2012, Henry Juszkiewicz made the decision to diversify Gibson Guitar’s business by branching into what he thought was a related industry – consumer electronics. Using borrowed money, Juszkiewicz went on a shopping spree buying significant or even controlling stakes in well-known brands such as Onkyo (and Integra), Teac/TASCAM, and Philips global accessory business (operating under the Woox name).

Using debt to buy companies is a common practice (often called a leveraged buyout) when the buyer believes that with an influx of cash, the target company will see improved financial results. These improved result in the form of dramatic growth in sales and profits is absolutely necessary to help pay off the debt used to acquire the company.

The Dangers of Highly Leveraged Acquisitions

In this case, the companies purchased did not see a major upswing in their business, which meant that Gibson was now burdened with this massive debt – ultimately more than $500 million – and the onerous impact of the carrying and servicing this much debt. Gibson began having credit issues, including downgrades of their rating by major credit rating agencies – often leading vendors to cut credit lines.

From the Declaration of Brian J. Fox: “In particular, during the period between October and December 2017, the GI Business [Gibson Innovations] lost approximately $100 million of vendor credit terms when, after a ratings downgrade, it lost credit insurance from three government-sponsored trade credit insurance providers.”

$100 Million of Lost Purchasing Power in Just 90 Days

Losing $100 million in purchase power is a big impact, even on a big company like Gibson. The company got caught in a classic downward spiral where they didn’t have the credit line necessary to buy the products they needed to sell more goods. And this resulted in a further downward spiral in their sales.

As Gibson themselves noted in this material – when business levels decreased, the company didn’t even have enough cash to pay severance in order to cut staffing levels to meet their new lower level of business. Management lost credibility with their noteholders and the company had run out of options.

Company Owners Meet with Major Holders of Gibson Debt

Gibson shareholders, principally Juszkiewicz and Berryman, met with an ad hoc group of noteholders representing 69% of all outstanding notes, who were not happy and wanted new management. The parties came together to negotiate what they call a “Restructuring Support Agreement” which included many elements both parties required.

For the shareholders, this new RSA includes:

- a new $135 million of debtor-in-possession financing that the company desperately needs to maintain operations.

- a restructuring that eliminates much of the debt that has been strangling the company over the last few years.

- an orderly, pre-negotiated bankruptcy, to shed even more of the unsecured debt – and dropping the consumer electronics business – further aiding the company moving forward.

For the noteholders, this new RSA includes:

- shedding the consumer electronics businesses and a renewed focus on the musical instrument business for which the company has been known for more than a generation and which has been more profitable for them lately

- the appointment of Alan J. Carr of Drivetrain as an independent director of the corporation. Carr is a turnaround specialist.

- the appointment of Brian J. Fox as the company’s Chief Restructuring Officer (CRO). Fox is from Alvarez & Marsal North America and is a financial and operations restructuring expert.

- a ‘change of control’ with a defined path for the exit of both Juszkiewicz and Berryman within a one year time frame. In short, “their equity interests in the Debtors [Gibson] will be cancelled under the plan…”

- a smooth transition to new management with existing management both agreeing to marshal the transition with a sound financial incentive to do so.

At the end of the day, Gibson will emerge with a reworked balance sheet showing much less debt, a working DIP line of credit for fresh money to run operations, a new focus on their core musical instrument business which has been profitable recently, and – most importantly many think – new management with fresh eyes to run the business.

Gibson will also maintain a position in pro audio, which included KRK, Cerwin Vega and Stanton brands. Gibson maintains that KRK has substantial market share in the studio monitor business and they wish to maintain that. The company continues to hold a majority of Teac/TASCAM – their 54% share is valued at $63.5 million and the company is looking to “monetize” these shares…in other words, to sell them off.

Gibson/Onkyo Association is Over, as Gibson Transitions Out of Consumer Electronics

What we know is this: Onkyo and Integra ended their connection to Gibson well before this bankruptcy. Over the last few months, shares have reverted back to other predominantly Japan-based investment groups. There is one document in the large volume of Gibson bankruptcy filings that mentions Integra as part of Gibson, but we have reason to believe that this may be a simple error.

Since their deal ended with Gibson, Onkyo has gone on to do a global deal with TCL Multimedia, who will offer certain products with the Onkyo brand name around the world. We have no specifics on any plans relative to Integra, either with TCL or anyone else at this time.

Juszkiewicz and Berryman Given Limited Contracts…and Millions of Dollars

As we mentioned, both Juszkiewicz and Berryman will have their ownership equity in Gibson cancelled as part of this deal. However, in order to facilitate a smooth transition to new management, the RSA includes a provision to retain their services.

- David Berryman (current Gibson President) will receive a 1-year employment agreement with a salary and bonus totalling $3.35 million. He will also receive a package of 5-year warrants exercisable for up to 2.25% of the equity of the new, post-bankruptcy Gibson.

- Henry Juszkiewicz (current Gibson CEO) will receive a 1-year consulting agreement with fees totaling $2.1 million to be paid in quarterly installments. Like Berryman, Juszkiewicz will also be offered a package of 5-year warrants exercisable for up to 2.25% of the equity of the new, post-bankrupt Gibson. Juszkiewicz will also receive a percentage of the profits on the sale of Teac shares the company owns – up to a maximum value of $1.5 million. This is for his “future assistance in monetizing the Debtors’ interest in TEAC.”

Both men will also receive health benefits and other benefits consistent with their current existing benefits plans during the time of their agreements. Interestingly, there is no explanation in the plan for why Berryman’s agreement is termed as an “employment agreement” while Juszkiewicz’s deal is called a “consulting agreement.” Perhaps this is an oversight, or possibly there is some unexplained significance to this language.

From Bankruptcy to New Company…All in Just Five Months

Finally, we turn to the plan’s anticipated timing, which is unusually quick for a bankruptcy. However, considering that many of the stickiest issues have already been pre-negotated by the principal parties, not too unusual.

From the filing, the proposed schedule – which needs to be approved by the judge – is as follows:

- Filing Chapter 11 Cases – May 1,2018

- Interim DIP Order (an order from the court authorizing the debtor in possession funding) – 3 business days following the Petition Date

- Final DIP Order – 35 days following the Petition Date

- Filing motion extending time to assume/reject leases – 10 days following the Petition Date and entry of an order approving said motion 30 days following the Petition Date

- Filing of a Plan/Disclosure Statement – June 4, 2018

- Entry of a Disclosure Statement Order – July 13, 2018

- Entry of Confirmation Order – September 7, 2018

- Plan Effective Date – September 24, 2018

A Sweet Tune – The First Day of the Rest of Their Lives

If Gibson is able to wrap up this process in only five months, that would be an unusually quick bankruptcy. There is much yet to transpire. For example, what about those unsecured creditors? Will they agree to this plan (they get a vote too)? What will their payout be against the money they are owned? Will new parties emerge to file claims and upend the plan?

One thing is for sure – if this process goes according to plan, we will see a new, leaner, more focused Gibson Guitar very soon. For Gibson Guitar fans, this is good news indeed.

Learn more about the musical instruments of Gibson at: www.gibson.com.

I wonder if the new owners know that the Epiphone factory near Qingdao is built on “Farm land” not zoned for manufacturing. That factory at the time of construction was built illegally. Not many knew this and as a former General Manager this was something that came out while I was there. In addition, if that factory is still part of the deal, new management should look at EPA violations unless those have been cleaned up since I was there. 24 Paint booths would dump 12 booths of water each day and alternating between the 24 booths.

The booths need water treatment and vapor emissions. When I was there the local Environmental people were being paid under the table to look the other way.

I write this as my recollection and opinion only. Some of these issues may have been resolved since I was there. No previous Managers ever addressed these issues and I don’t know if Scott and Lloyd knew about these issues after I left.

Bobby,

Some very good questions indeed.

THANKS!

Ted