Sound United Sale to Harman is Still on Track for Year-End

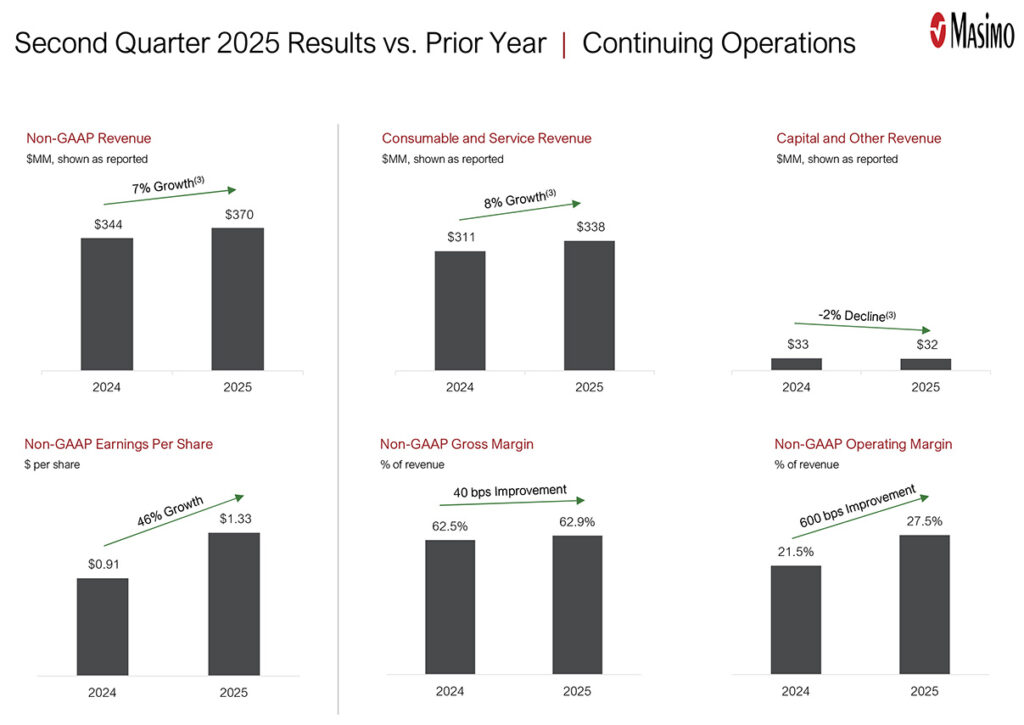

After markets closed on Tuesday, Masimo Corporation [Nasdaq: MASI] released its results for the second quarter of Fiscal Year 2025, and to my eyes, they looked really solid. Revenues grew by a respectable 8%, operating profits grew by 54%(!), operating margins improved by 520 basis points (that’s 5.2% more than last year), and earnings per share shot up an eye-popping 78%(!) What’s not to like?

Yet on Wednesday, the first trading day after these results were announced, the value of MASI shares actually dropped 12%! What?!?!

See more on the Q2 Masimo results and the market reaction…

The reaction from Wall Street kind of blew my mind. Think about it for a moment. Masimo’s fiscal 2025 second quarter is the ninety-day period that ended June 28, 2025. In this quarter that started April 1st, an entirely new management team is trying to hit its stride, and suddenly, on April 2nd, the Trump Administration announces Liberation Day and launches a global, multinational trade war, with tariffs that were sure to disrupt and impact product pricing, parts pricing, and supply chain partners.

Holy Cow!

Then, while you are busy getting a handle on that, your company undergoes a cyberattack, shutting down your systems, taking you offline, and disrupting ordering and factory production. At the same time, you are in the middle of high-stakes negotiations to sell Sound United, a high-priority goal now emerging in a sea of high-priority goals!! Then your COO decides to quit, and you have to scramble to make sure all of his mega-important duties are covered.

Holy cow!

Yet in spite of all of this taxing turmoil – all happening concurrently in Q2 – the company does not blow up; plentiful new hires join the company to help carry the load. The company’s new management and the entire team pull together to turn in a stellar financial performance…in line with, or even better than (in some cases), expectations. Nothing builds a team like being forced to walk through the flames of hell together!

Core Healthcare Revenue Continues to Grow

So, before I offer thoughts on why the value of Masi stock got dumped on the next day, let’s dig into the quarterly earnings performance. Keep in mind, these numbers no longer include Sound United results in the totals. Sound United has been reclassified as “held-for-sale” and “discontinued operations.” There was some selective release of Sound United results, but most of what you’ll see here is solely Masimo’s professional healthcare results…the business that investors wanted the company to focus on.

‘Investing in Our Core Healthcare Business’

We once again delivered strong results in the second quarter as our core health care business continued to demonstrate strong growth and earnings. We are intensely focused on building our leading position in pulse oximetry to increase our market share in key global markets and advanced monitoring categories, and on driving commercial excellence throughout the organization. We have also expanded our leadership team to ensure that we have the right people and pillars in place to execute our growth strategy. Notably, our team has been highly effective in the implementation of tariff mitigation measures, allowing us to guide to a tariff impact that is 50% less than our original estimate. Each of these factors is contributing to our positive momentum and we are investing in our core healthcare business to achieve our goals and potentially accelerate our long-range revenue growth.

Katie Szyman, Masimo Chief Executive Officer

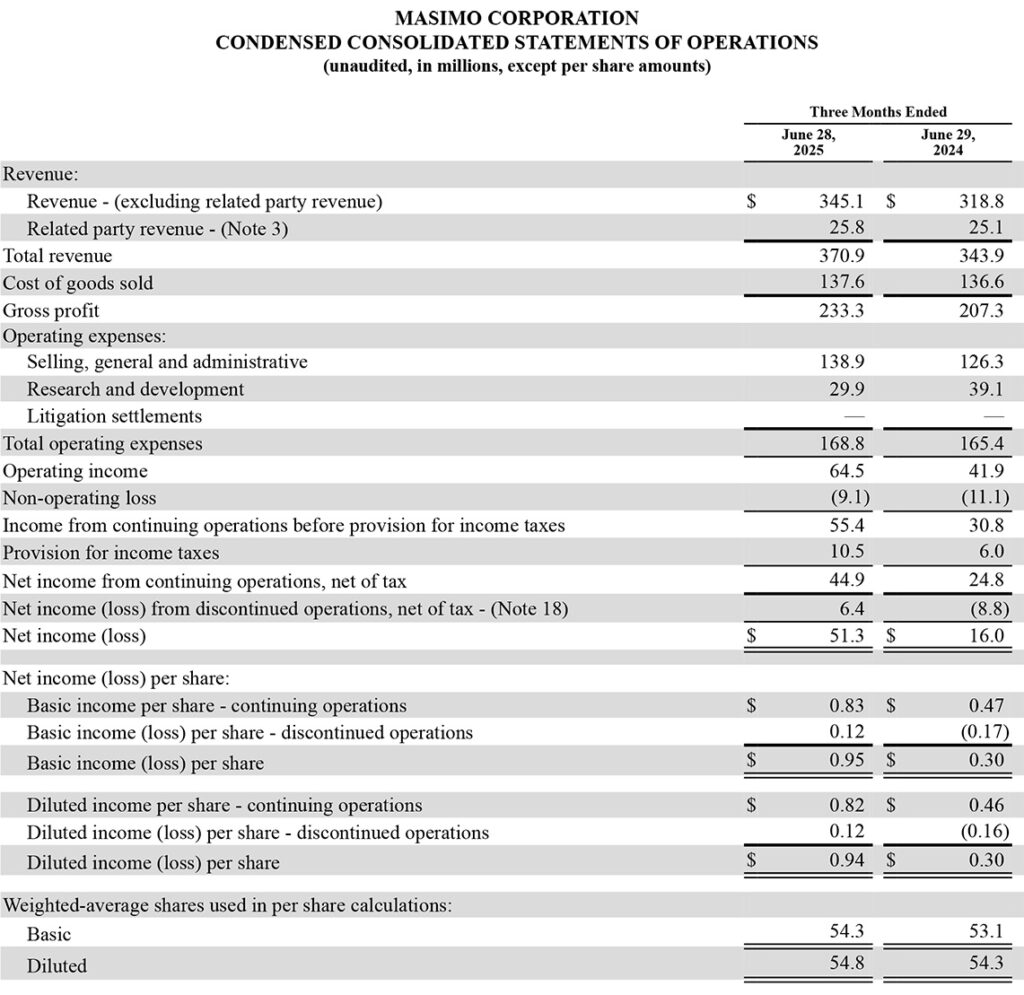

Total Revenue came in at $370.9 million, up $27 million or 7.9% compared to revenues of $343.9 million in the same quarter last year. The company says the growth was largely driven “by increased consumable sales, which was [partially] offset by lower capital sales.” Masimo also noted that it shipped around 63,100 noninvasive technology boards and instruments in the quarter this year, while in the comparable quarter last year, 58,600 units were shipped. Many analysts carefully watch both consumables sales and technology board unit shipments as indicators of the overall health (pun intended) of the company’s sales.

Gross Profit Dollars came in at $233.3 million, which is a $26.0 million or 12.5% increase over the gross profit dollars of $207.3 million in the second quarter of fiscal 2024. The increase was largely due to improved sales leverage, “operational efficiencies and product cost reductions, partially offset by $1.9 million of incremental tariffs.” So even with new tariffs kicking in, the company was able to produce a double-digit percentage increase in gross profit dollars generated.

Like Revenues, Profits Grew at Masimo…by Even More

Operating Income was $64.5 million in the quarter. This was an increase of $22.6 million or 54% over the operating income of $41.9 million in the same quarter last year. Operating income benefited from the company’s efforts to keep costs in line, providing greater leverage from the sales increase. The company did see Selling, General and Administrative costs increase, mostly due to higher legal and professional fees as it worked to get past the cyberattack, as well as ongoing litigation with Apple, Kiani and others. But this SG&A increase was offset by lower Research and Development expenses due to “lower compensation and stock-based compensation expense, along with other employee-related costs of approximately $8.2 million, lower project expenses of approximately $1.7 million, and lower amortization expense…”

Operating margin this year was a more robust 17.4%, up 78% over the operating margin of 12.2% in the same quarter last year. While the company did not specifically comment on this milestone, I suspect operating margin benefited from getting the Sound United business off its books…as well as the other items mentioned above.

The bottom line – Net Income – which was just $16.0 million in the second quarter of fiscal 2024, soared $35.3 million or 220.6% to $51.3 million in the second quarter this year. That makes income per share (also known as earnings per share) of $0.82 fully diluted (continuing operations) or 80% higher than EPS of $0.46.

How Did Sound United Fare in the Quarter?

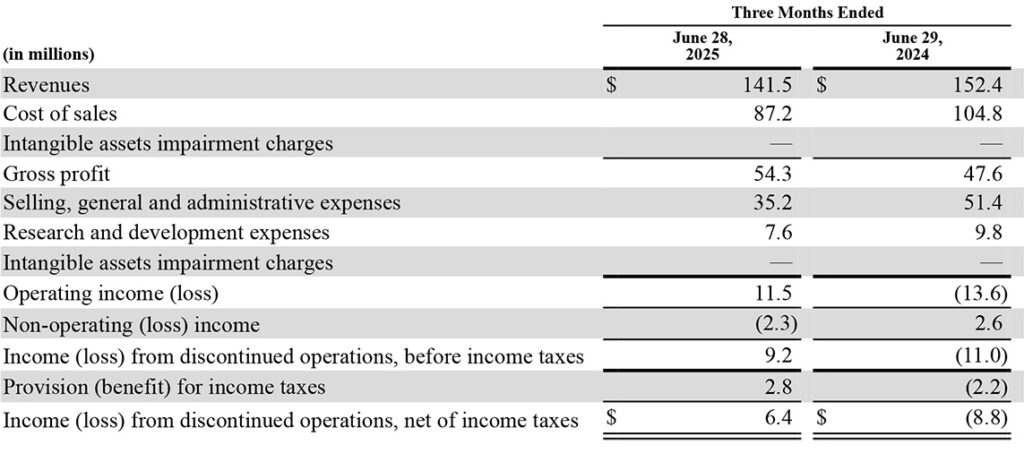

As I previously mentioned, Sound United’s performance is not included in the consolidated results as the former Masimo Consumer group is off the books as discontinued operations. Still, the company provided key performance data for investors’ information.

Sound United Revenues in the quarter were $141.5 million, down $10.9 million or 7.2% as compared to revenues of $152.4 million in Q2 of fiscal 2024. While revenues continued to trend downward, the company exercised strong discipline in cost control and, as a result, generated an Operating Income of $11.5 million. This was way better than the operating (loss) the division booked in the quarter last year of ($13.6 million). As a result, Sound United generated a Net Income (before taxes) of $6.4 million.

Sale to Harman ‘Remains on Track’ for End-of-Year Closing

While the continued deterioration of revenues at Sound United remains troubling, the effort to reduce expenses and produce higher profitability on lower revenues is a good sign of greater operational efficiencies. It’s clear that Sound United management is not just dog-paddling while waiting for the deal with Harman to close and then move forward on a new mission.

And on the subject of the deal getting done, Chief Financial Officer (CFO) Micah Young had this to say to financial analysts on the earnings call: “Finally, the divestiture of Sound United, announced last quarter, remains on track to close by the end of the year, subject to obtaining necessary regulatory clearance.”

Deal Subject to ‘Waiver of Certain Conditions’

Masimo acquired Sound United in February of 2022 for $1.025 billion. This past May, the company announced it had reached a deal with Harman International Industries Incorporated, a subsidiary of Samsung Electronics Co., to sell Sound United for just $350 million in cash. Now in due diligence, the deal is subject to full satisfaction of various terms and conditions, certain adjustments, and “waiver of certain conditions” – as well as regulatory approvals.

What will Masimo do with the proceeds of this transaction? CFO Young said on the earnings call that, “Regarding the use of proceeds, we anticipate share repurchases will be our priority as we believe it will be more accretive at our current share price.”

Why Share Prices Declined the Day After Earnings Were Released

So why did shares of MASI decline the next day? I can only offer conjecture on this, as Wall Street is often an enigma. Let me say, however, I’ve recently observed this same phenomenon with other companies’ stock swings. For example, yesterday another industry stock – Universal Electronics Inc. – issued an earnings release in which it announced it had beat estimates on both revenues and earnings. Yet in early and mid-day trading today, its stock is down 17%.

But there was something I noticed in the Q&A portion of the Masimo earnings call with analysts that is perhaps a clue to this mystery. In questioning management during the call, analysts seemed to be seeking even more than the generally positive results the company was reporting. It felt as though they were saying that “good” results were just not good enough.

Revamping Commercial Operations

During her prepared presentation, CEO Katie Szyman told analysts how she had completely revamped the company’s “commercial” operations. This is corporate-speak for reorganizing the sales department. Several new top-level executives were added, including Greg Meehan as Chief Commercial Officer with “over 25 years of experience building and optimizing commercial organizations in the medical technology industry,” and Tim Benner as Chief Marketing and Strategy Officer who “has an impressive track record of overseeing the launch and commercialization of transformational therapies…for market leading companies.”

Szyman went on to tell analysts that these new leaders were added “…to bring a strong focus on commercial execution.” She also revealed that the company has “strategically aligned our U.S. sales force, moving from specialty teams centralized by product category to regionally led groups within our pulse oximetry infrastructure.” Why did they do this? “We believe we have the best pulse oximetry sales force in the industry and we want to leverage the strength of that team to pull through other categories and increase our market position across all categories long term…”

Sounds Smart to Me

To me, this sounds smart. It has long been suspected that the company has been really only successful in pulse oximetry and has had a very spotty record of success in other categories. It seems that Szyman is suggesting that the company has to up its game in all of its categories to fuel greater growth and grab greater market share across the board.

But two different analysts questioned this approach. To the company, this is a smart and professional approach to better execute on sales of all core categories beyond just pulse oximetry. But to some analysts, this sounded like incrementalism that would only yield small levels of growth across multiple individual categories.

Some Analyst Skepticism

Said one analyst of Szyman’s long explanation of its strategy, “There’s a lot of incremental sounding stuff in there… When would you want us to hold you accountable for potential acceleration of the top line?”

Added another, “You mentioned the goal to improve share [market share in categories additional to pulse oximetry]… Can you gain share with just more sales force focus, or do you need a new product story tied to these expected share gains?”

As Good as the Results Were, Wall Street was Looking for More

The first analyst above is concerned that the company’s strategy, even if successful, will only result in small incremental added sales in smaller, ancillary markets. The second analyst is concerned that there is too much focus on sales force matters and not enough focus on blockbuster new products.

I think that Wall Street had been looking for some dramatic new moon-shot products that would serve to turbocharge the company’s top-line revenues. As good as Masimo gave…Wall Street wanted more. That’s a little unrealistic considering the dramatic management overhaul is still in the early months of its tenure.

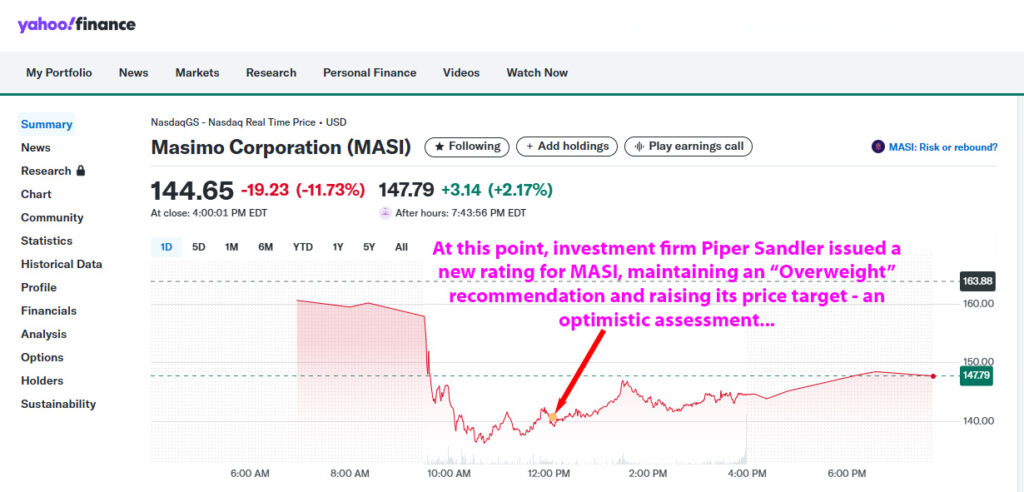

MASI Value Dropped Nearly 12%, Then Recovered

In any event, the value of MASI stock fell nearly 12% the day after the earnings release. However, if you look at the chart from Yahoo Finance above, you will notice that nearing the end of the trading day, and on into after-hours trading, MASI stock began to recover.

Perhaps fueling that partial recovery, in the early afternoon, investment firm Piper Sandler issued a new rating for MASI in which it maintained an overweight recommendation and increased its target price from $200 to $210 – an optimistic assessment. On Yahoo Finance, we find that of the eight investment firms following Masimo: two rate MASI a “Hold,” four rate it a “Buy,” and two rate it a “Strong Buy.”

Learn more about Masimo Corp by visiting masimo.com.

Leave a Reply