In a new filing with the Securities and Exchange Commission (SEC), Masimo Corporation (Nasdaq: MASI) updated regulators on its progress in recovering from a recent cyberattack that took its major systems offline for several days and disrupted manufacturing. The company also notified the SEC that as part of its participation in certain investment conferences coming up over the next few weeks, it intends to reiterate its updated outlook for expected financial performance over the remainder of fiscal 2025, as originally announced on May 6, 2025.

See more on the latest SEC filing by Masimo…

Masimo has assured government regulators that it has a firm handle on the situation in the wake of a cyberattack that had dramatically impacted operations recently, including disrupting order processing, distribution of goods, and manufacturing. Strata-gee was the first to report a strange system outage at the company on May 1st.

About two weeks after my report appeared, Masimo filed a notification with the SEC confirming that on April 27, 2025, it had detected an intrusion, or what they called “unauthorized activity” in on-premise company systems. Said the filing: “Upon detection, we activated our incident response protocols and implemented containment measures, including proactively isolating impacted systems.” The company also notified law enforcement and launched an investigation.

New SEC Filing Has Pertinent and Important Company Updates

This new filing provides some pertinent – and important – updates on the status of this cyberattack. First, it tells the SEC that the cyberattack (a “cybersecurity-related incident”) is not expected “…to materially impact the Company’s revenue for the fiscal year 2025, or to prevent the Company from fulfilling customer orders received to date or meeting seasonal demand.”

We also learn that Masimo possesses “cybersecurity insurance” and it expects “…that the majority of out-of-pocket remediation costs incurred by the Company in connection with the incident will be covered by such insurance, and that any such costs will be non-recurring.” Masimo staff continues to work with third-party cybersecurity professionals in the process of fully remediating systems…and with law enforcement, as part of its investigation into the source of this incident.

Reports a Near Full Recovery from Cyberattack

Most importantly, Masimo says that its manufacturing operations are running “at near full capacity” and that other key processes, such as order entry, distribution, and shipping “are fully operational.” This means that the really devastating elements of the cyberattack appear to be behind it now. However, the company has not said whether any data was compromised, or whether it maintained any kind of confidential or sensitive patient data on the systems that may have been exposed or otherwise compromised.

Perhaps we’ll learn more once the investigation is complete.

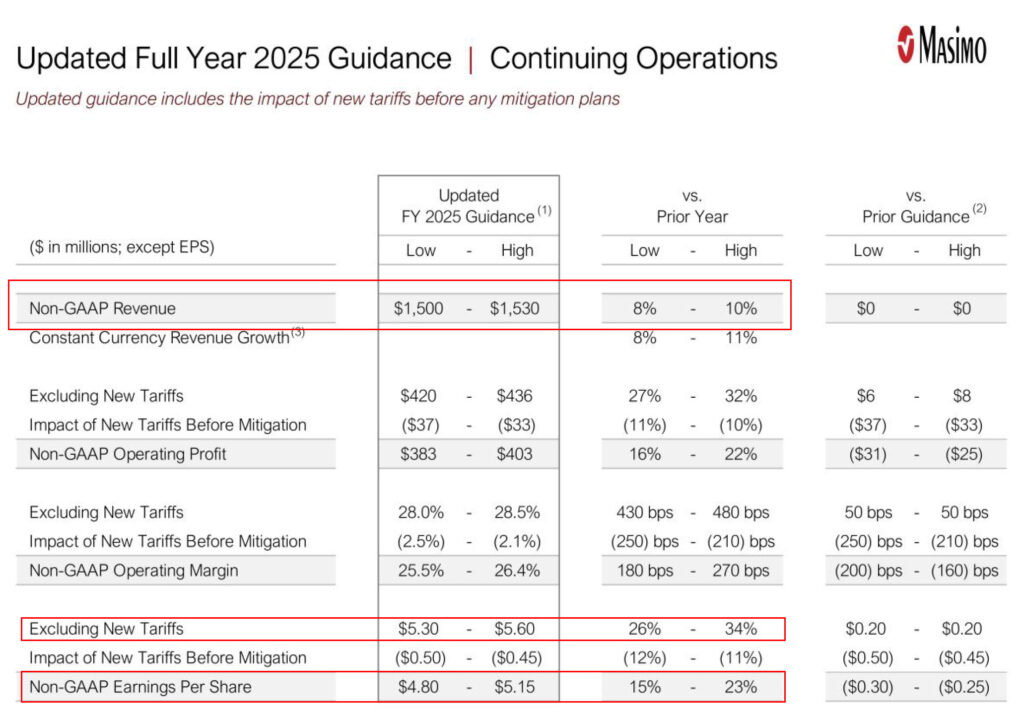

The company has updated its go-forward guidance for its financial performance in fiscal 2025 – reiterating the numbers it provided on May 6th but adjusted from previous estimates provided in February. Mostly, the company simply added the impact of tariffs to their estimates – providing the figures both with and without the impact of tariffs.

Fiscal Year 2025 Guidance

To keep it simple here, the company is projecting total fiscal 2025 revenues (non-GAAP) of between $1.5 billion – $1.53 billion. This works out to somewhere between an 8% to 10% increase over total revenues of $1.395 billion in fiscal 2024. Remember, this estimate excludes the former Masimo Consumer division – the Sound United audio business – which is in the process of being sold to Harmon International.

While 8%-10% growth is a solid revenue increase, especially during this time of disrupted international trade matters, the real story for the company in the wake of its disposal of Sound United is an expected significant positive impact on profits. The company is estimating non-GAAP earnings per share of between $4.80 – $5.15 with tariffs included. That is a 15% – 23% increase in net profits.

Revenues May be Good, but Profits are Even Better

But the non-tariff profit analysis yields an even better result. Excluding tariffs, the company projects non-GAAP earnings per share of $5.30 – $5.60. That’s an even more impressive increase of 26% – 34% in net profits.

The Form 8-K filing with the SEC was signed by Micah Young, Masimo’s Executive Vice President & Chief Financial Officer.

Learn more about Masimo by visiting masimo.com.

Leave a Reply