Last week, Masimo Corporation (Nasdaq: MASI) finally announced the long-anticipated sale of its Masimo Consumer division – the audio division created after its acquisition of Sound United back in February 2022 – to Harman International Industries Incorporated. Harman is a division of Samsung Electronics with a large automotive electronics business, along with professional audio and high-end audio businesses as well.

But is this truly a good home for Sound United?

Learn more about Harman acquiring Sound United from Masimo

Ever since Politan Capital Management and its Chief Investment Officer Quentin Koffey succeeded in winning a majority of seats on the Masimo Board of Directors last fall, the clock began ticking on the tenure of Sound United (known as Masimo Consumer) as part of the company. Koffey had made it well known that the company would jettison Sound United as quickly as possible so that Masimo could refocus its energy on its core professional healthcare business.

Sound United Sold for $350 Million

Over the intervening months, there were many rumors that the company was in discussion with one or more interested parties, and now we’ve learned that the winner was Harman, who has agreed to acquire Sound United for $350 million in an all-cash transaction. The deal is expected to close by the end of 2025.

Finding the right home for this business has been a stated priority of the new Board from day one, and this transaction represents an important milestone as we continue to position the Company to achieve our goals of accelerating revenue growth while delivering disciplined margins. Masimo has tremendous opportunities ahead and we are confident we have the right healthcare-focused strategy, experienced leadership team and culture of innovation in place to build on our significant positive momentum.

Quentin Koffey, Vice Chairman of Masimo Board of Directors

Koffey Told Kiani He’d Give Sound United Away; This is Close to That

Interestingly, in the lead-up to the 2024 Masimo Stockholders Meeting, Founder and former CEO Joe Kiani had claimed that Koffy had suggested it would be in the company’s best interest to – if necessary – give the Sound United unit away. That is nearly what they did by agreeing to sell its billion-dollar baby for just $350 million.

This acquisition represents a strategic step forward in the expansion of HARMAN’s core audio business and footprint across key product categories such as Home Audio, Headphones, Hi-fi components, and Car Audio. It complements our existing strengths and opens new avenues for growth. Sound United’s portfolio of world-class audio brands including Bowers & Wilkins, Denon and Marantz, will join HARMAN’s iconic family of brands, including JBL, Harman Kardon, AKG, Mark Levinson, Arcam, and Revel. Built on a shared legacy of innovation and excellence in audio technology, this combined family of brands, together with the talented employees of both companies, will deliver complementary audio products, strengthen our value proposition and offer more choices to consumers.”

Dave Rogers, President of Harman’s Lifestyle division

A Shockingly Low Valuation for Such Great Brands

The first thing that hit me about this deal was the purchase price, which seemed shockingly low. Masimo acquired Sound United in 2022 for $1.025 billion. Two years later, Harman took it off of Masimo’s hands for just $350 million – fully 66% less than what they paid for it…in what looks to me like a pretty amazing bargain.

Sound United is a provider of historically significant, high-performance audio brands such as Bowers & Wilkins (B&W), Denon, Marantz, Polk Audio, Definitive Technology, Classé, and HEOS. At the time of its acquisition by Masimo, Sound United was generating around $900 million in revenues. However, Masimo dictated a new mission for the group, which was to lead its charge into the consumer health segment. Kiani had a plan known as his “hospital-to-home” strategy and Sound United’s HEOS wireless technology was to be an important part of that initiative, as well as its strong partnership with the consumer market retailers facilitating end-user sales of a new series of consumer-targeted healthcare products.

Harman Enters the Arena

Unfortunately, this muddling of the company’s mission as exemplified by its decades of audio excellence, led to a protracted period of struggling to enter the consumer health realm…punctuated by decline in its audio business, with deteriorating sales and profits. At the same time, consumer health products were slow in coming and not very successful. Part of the reason for this is that Masimo’s mission got equally muddled as it became entangled in a costly and long-lived legal battle with none other than Apple, Inc.

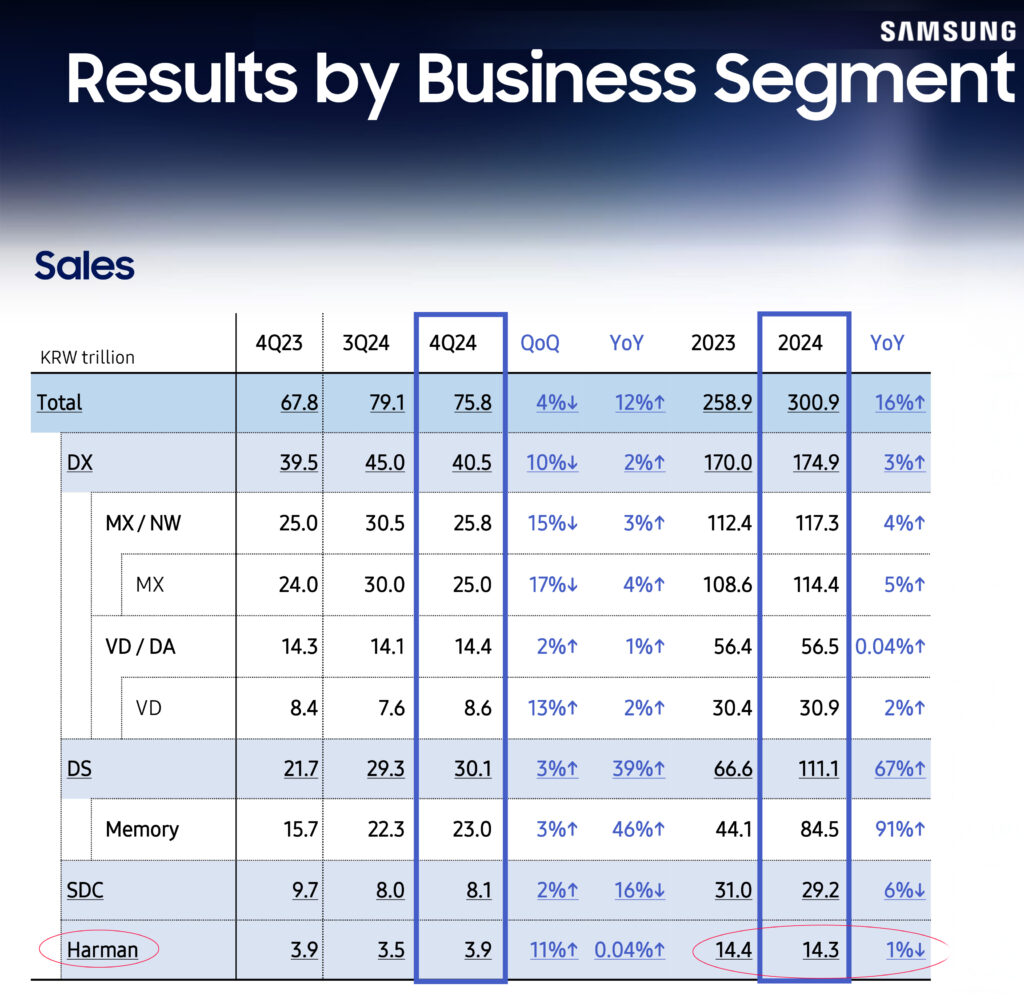

Launched by two engineers in the 1950’s – Sidney Harman and Bernard Kardon – Harman International has grown into a diversified group of brands and businesses that all swirl around an audio core. Acquired in 2017, Harman Industries is a relatively small part of the massive $215 billion Samsung Electronics business (2024). Contributing less than 5% to consolidated revenues, Harman is a relatively small part of a massive South Korean behemoth – but it is not small. With segment revenues of around $10.2 billion (2024), it remains a significant player in the overall audio business.

It is an audio conglomerate, and that concept encompasses both good and bad elements.

Wargaming Out Possible Scenarios

Over the last few months, I’ve been wargaming various scenarios that Masimo might pursue in disposing of Sound United. I spoke with several other industry executives to get their perspectives. The least popular option we collectively imagined – and perhaps how many Strata-gee readers might feel – would have been the sale of the company to a private equity group.

What’s wrong with private equity? For the most part, private equity is looking for a relatively quick turnaround – and their goal is to maximize their payoff. Often, they engage in tactics to artificially inflate the value of a company, but that actually leaves the underlying company in a weaker condition than they were previously. We’ve seen this movie before and it usually does not end well.

Acquisitions Often Fail

So for many I spoke with, the sale of the company to another industry manufacturing concern who understands audio sounds like a great option. But you see, I’ve studied corporate strategy – and the stats are bleak. Depending on the study you choose to go with, somewhere between 7-9 out of every 10 acquisitions fail to increase shareholder value. That was certainly the case in Masimo’s acquisition of Sound United…Masimo lost hundreds of millions on that folly.

At the end of the day, it comes down to the goal of the acquirer…as they are now driving the bus. So here then are some of my thoughts on the situation as it sits.

Harman is Largely an Automotive Electronics Company; It May Repurpose Sound United Brands

Here is how Samsung describes Harman: “Harman competes in the automotive and lifestyle audio industries. The automotive component business accounts for the largest portion of Harman’s business, and it operates business in areas such as digital cockpits, car audio, and telematics.”

That’s right, the majority of its business comes from automotive electronics – it was a leader in building infotainment products for cars. It is possible that Harman bought Sound United specifically for the purpose of expanding the brands it can offer to a wider range of automobile brands and models.

In the acquisition game, it’s the “Golden Rule,” meaning he with the gold (in this case, Harman) rules, and Sound United now lives to serve the needs of the new parent company. Actions taken by the new owner, may – or may not – be good for the Sound United brands.

There Will Almost Certainly be a Culling of Brands

In looking at the spectrum of brands under Harman and the spectrum of brands under Sound United, we see a lot of potentially parasitic crossover conflict in its newly expanded product family portfolio. For example, the key products for Denon and Marantz are their powerful audio video receiver (AVR) models…but Harman has invested much in ARCAM AVRs and a newly launched line of JBL AVRs.

The same can be said for high-end, high-performance speakers. Sound United brings the much loved B&W like of audiophile loudspeakers to the Harman House. But Harman has invested much in their Revel line over the years, and these two lines likely are head-to-head competitors.

I could go on, but you get the idea. It is quite possible that management will engage in greater marketing efficiency by culling down the lines and that means something will have to go. And that something, just might be your favorite Sound United brand.

An Imperfect Steward of Brands

Harman was one of the first companies in our industry that aggressively pursued a strategy of growth by acquisition of other companies. Like many acquirers, they immediately seek certain efficiencies by eliminating redundancies to drive profitability. In other words, their acquisitions are often accompanied by layoffs at the target company. I get the business side of that, but it can often change the nature of the acquired business.

So look…nobody’s perfect – myself included. But I feel as though Harman has been an imperfect steward of some of the brands that they’ve acquired or managed over the years. Brands like Harman Kardon AVRs have transformed into a line of Bluetooth speakers…Infinity, a once powerful premium floorstanding and bookshelf speaker line has been turned into a quirky line of car speakers, marine speakers, motorcycle speakers and the like.

Will Sound United brands go through such transformations?

What Might Help; Company Looks to Audio

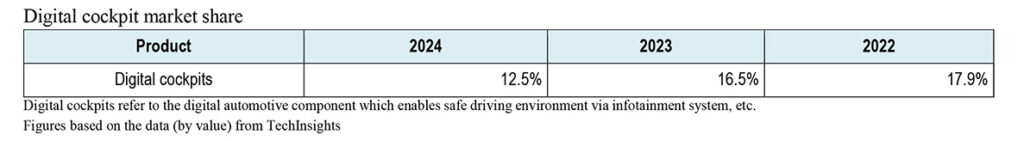

In recent data from Samsung, we got some interesting clues as to trends impacting the Harman business that might be helpful for Sound United’s brands. After boasting about the trend to SDV – software-defined-vehicles – a technology in which Harman feels it has an advantage over others, the company revealed that Harman has been losing market share in the digital cockpit business – from 17.9% of the market in 2022, to 12.5% share of the market in 2024.

The company indicates that it is looking for growth in audio to help offset the difficult and competitive automotive sector. Says the Samsung report, “The consumer audio market is expected to see high growth in segments such as TWS (true wireless stereo) headphones, home audio products, and gaming headphones, and consumer desire is continuing to grow for premium audio experiences such as high-quality and lossless sound.”

In 2023, Harman surprised many by acquiring Roon Labs, in part to help drive growth in the premium audio playback market. And premium audio is a market that Sound United knows well.

Summing up 2024 & Looking Ahead to 2025, Samsung Offered This…

“Harman is positioned to stay at the forefront in the digital cockpit and car audio markets, which are key markets for in-cabin experiences in the automotive component industry… Amid the shift toward software-defined vehicles, Harman remains committed to elevating customer in-cabin experiences by consistently pursuing the development of distinctive, innovative technologies.”

See more on Harman at harman.com.

While I appreciate the analysis, the idea that Harman’s investment in Arcam and JBL AVRs somehow spells trouble for Denon and Marantz overlooks both market dynamics and brand strategy. Harman acquired the crown jewels of the AVR category — brands with unmatched heritage, engineering depth, and market share. Denon and Marantz aren’t redundant; they’re foundational. Suggesting otherwise feels more like clickbait than serious industry insight.

Ted,

I hope you are recovering.

I can’t find any enthusiasm for the sale of Sound United to Harmon.

Thanks Steve!

Ted