Gentex Corporation (Nasdaq: GNTX) announced the results of its financial performance for the fourth quarter and full year of fiscal 2025 – the period that ended on December 31, 2025. Management expressed satisfaction with 2025’s results, which it says were achieved despite several challenging headwinds impacting performance.

Learn more about Gentex’s fiscal 2025 results…

While Gentex produced a segmented report containing both its fourth-quarter numbers and its full-year results, I will focus on the full-year outcome, which includes the fourth-quarter data as well. Zeeland, Michigan-based Gentex CEO Steve Downing touted the company’s fiscal 2025 results, which he noted the team delivered in the face of several challenging headwinds.

What were those headwinds? Far and away the most challenging headwind is the Trump administration’s tariff program, introduced on what the President called “Independence Day” in April 2025.

As Both an Importer and Exporter, Tariffs are Complex

For companies like Gentex, a global reshifting of tariff programs both by the U.S. government and trading partners around the world, dramatically complicates international commerce. It can also dramatically increase the cost of doing business. This is because Gentex is both an importer of parts, technologies, and assemblies…as well as an exporter to countries around the world, such as China.

Other than just the dollar impact of having to pay tariffs on its import portfolio, tariffs levied on Gentex exports by other countries around the world – almost all of whom increased their tariffs either in a retaliatory response or just to offset the cost of doing business with the U.S. – increase the cost of Gentex products and potentially dampen demand (sales). So, for example, Gentex sales in China collapsed by 29%, as import partners there stopped using Gentex products and sought less expensive alternatives made by local producers.

Other headwinds were restructuring disruptions and charges, the VOXX International (parent of Onkyo, Integra, and Klipsch) acquisition, a declining automotive production market, cost inflation, and more. Remember that the VOXX acquisition took place at the beginning of the second quarter in April 2025.

A Deeper Dive into Fiscal 2025 Results

So with all of this in mind, let’s dig into the numbers.

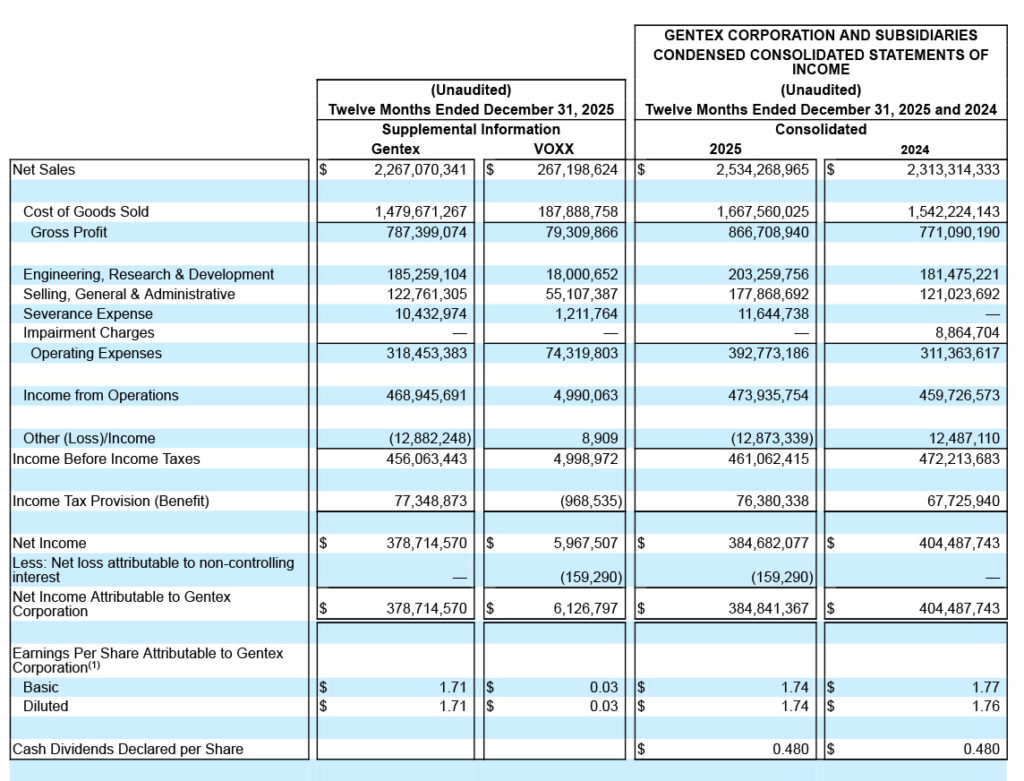

SALES, AS REPORTED: Net sales in calendar 2025 (Gentex’s fiscal year is the same as the calendar year) came in at $2.53 billion, up $220 million or 10% as compared to net sales of $2.31 billion in calendar 2024. Keep in mind, this total includes the contribution of the VOXX International acquisition for all but Q1 of 2025, or the first 90 days of the year.

VOXX net sales under Gentex came in at $267.2 million for Q2-Q4 in 2025. The company gives no historical data on VOXX to evaluate this result. But I can tell you that pre-Gentex VOXX sales in 2024 were $468.9 million. This means that VOXX sales dropped around 43% Year-over-Year. Keep in mind, however, the 2024 VOXX result is for a full four-quarter year.

In order to estimate a sales number for VOXX’s Q1, if we assume a flat line calculation for VOXX, that would imply sales of approximately $117.2 million for Q1. Add that to the $267.2 million and you get a pro forma total of around $384.4 million. And that means that VOXX’s numbers were still down, albeit a more modest decline of 18% or so.

Going Organic

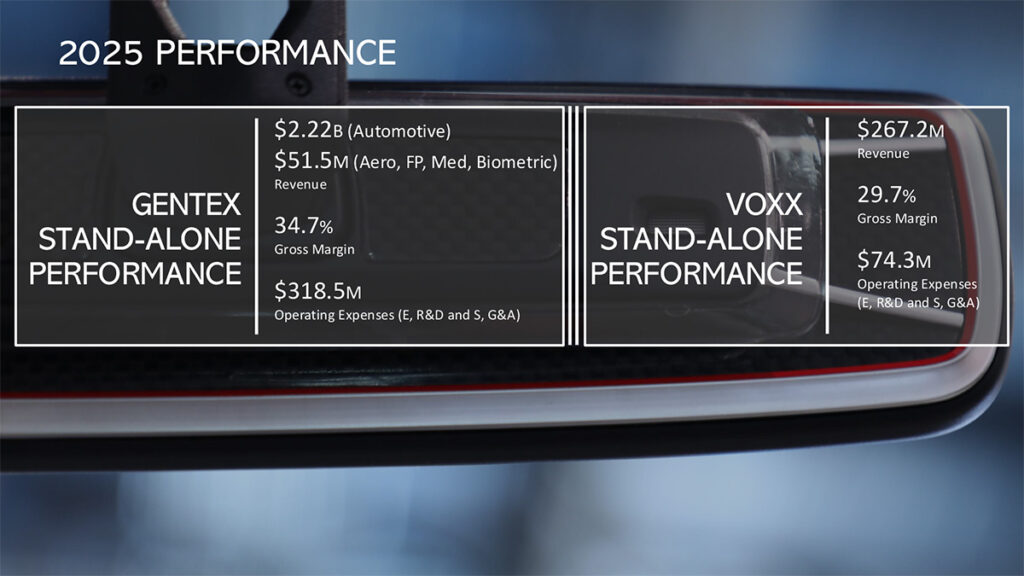

SALES, ORGANIC: If we take VOXX’s contribution out of the numbers, we get a more organic, or apples-to-apples, comparison of Gentex’s performance from 2024 to 2025. In this case, organic net sales for 2025 came in at $2.27 billion, down $46.2 million or 2%.

Why were organic sales down? The company cites tariffs and counter-tariff actions, “and the resulting reduction in demand for exports of the Company’s products into the China market.” The company also pointed to data showing that there was a decline of 1% in light vehicle production – adding that if you only looked at Gentex’s “primary regions,” its sales were actually up 1% (in those specific regions, which also experienced a 1% drop in auto production). However, that does not really apply to an organic analysis, which examines and shows that sales declined by 2% overall.

We came into 2025 with a focus on growth and improving profitability and hoping for a stable end market. Instead, we were confronted with a dynamic marketplace including headwinds created by the volatility of tariffs, counter-tariffs, weakening production in our primary markets, and cost inflation. Despite these challenges, our team delivered impressive results.

Steve Downing, Gentex Corp. President and CEO

Gross Margin and Gross Profit Dollars Analyses

The company reported that gross profit margin in 2025 was 34.2%, up about 90 basis points as compared to the gross profit margin of 33.3% in fiscal 2024. The company says that gross margin improvements were largely due to “purchasing cost reductions, continuing operational efficiencies, and favorable product mix.” These were partially offset by tariff-related costs not reimbursed.

GROSS PROFIT DOLLARS, AS REPORTED: Gross profit dollars as reported were $866.7 million in 2025, up $95.6 million or 12.4%. That is an impressive increase indeed.

GROSS PROFIT DOLLARS, ORGANIC: Organic gross profit dollars in 2025 came in at $787.4 million, up $16.3 million or just 2.1% over 2024’s gross profit dollars of $771.1 million.

Operating Expense

I mentioned above that net sales, as reported, grew about 10%. While a double-digit sales increase is nice, the company also reported that operating expenses, as reported, also grew over 26%.

OPERATING EXPENSES, AS REPORTED: Operating expenses as reported in 2025 come in at $392.8 million, an $81.4 million or 26.2% increase over operating expenses of $311.4 million in the previous year. Gentex says that VOXX accounted for $74.3 million of that increase…with no further details revealed.

OPERATING EXPENSES, ORGANIC: On an organic basis, operating expenses increased to $318.5 million, up $7.1 million or 2.3% as compared to 2024.

While the company reported increased investment in all expense categories, such as Engineering, Research & Development…and Selling, General & Administrative, I think the addition of $11.6 million in severance expenses was a major contributor to this expense increase.

The Profit Perspective

INCOME FROM OPERATIONS, AS REPORTED: Income from operations in 2025, as reported, came in at $473.9 million, up $14.2 million or 3% as compared to income from operations of $459.7 million in the previous year.

INCOME FROM OPERATIONS, ORGANIC: On an organic basis, income from operations came in at $468.9, up $14.2 million or 2% compared to last year.

However, due in part to a $12.9 million charge to Other (Loss)/Income (appears to be related to acquisition costs and severance expenses), the company’s net income declined.

NET INCOME, AS REPORTED: As reported, net income was $384.7 million, a decline of $19.8 million or 4.9% as compared to net income of $404.5 million in 2024.

NET INCOME, ORGANIC: Organic net income was $378.7 million, down $25.8 million or 6.4% as compared to net income in the previous year.

On a per share basis, earnings per share of $1.77 in 2024 dropped to $1.74 this year as reported. This drops to an eps of $1.71 on an organic basis.

2025 Revenue Disaggregation

In the earnings report, the company provided a brief breakdown of revenue by category for three main categories. That breakdown is as follows…

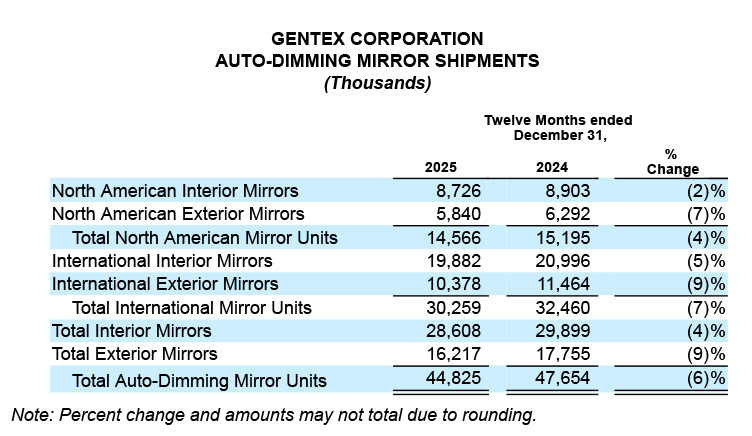

Gentex Automotive – For calendar 2025, Gentex Automotive net sales were $2.22 billion, down $40 million or 2% compared to automotive net sales of $2.26 billion in calendar 2024. The company noted that its shipments of auto-dimming mirrors, its key product, were down 6%.

Other Net Sales – This category includes dimmable aircraft windows, fire protection products, medical products, and biometric products. Net sales in this Other category in calendar 2025 were $51.1 million, up $2.5 million or 5.1% compared to sales of $48.6 million in 2024.

VOXX – VOXX sales for the last three quarters of calendar 2025 came in at $267.2 million.

Guidance for 2026 Financial Performance

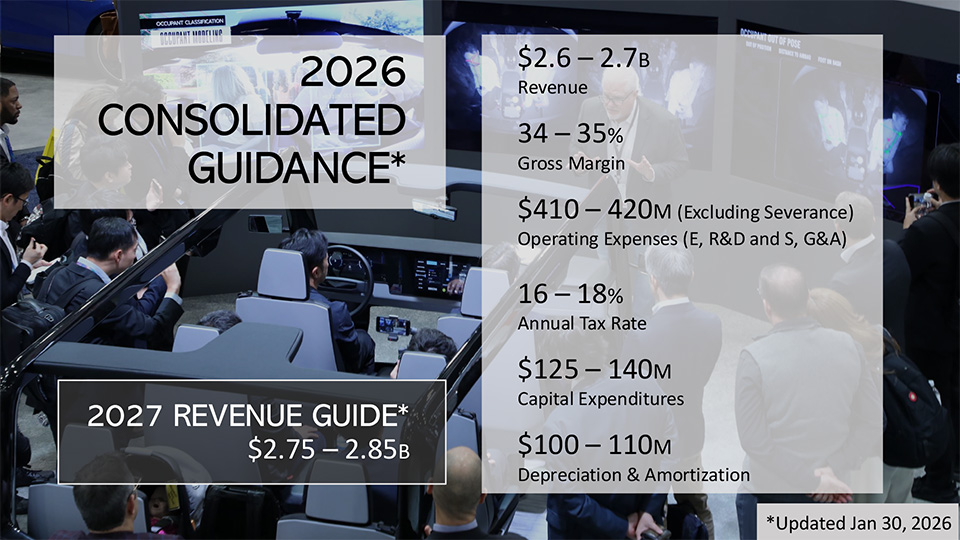

In presenting its guidance – an estimation of expected financial performance in calendar 2026 – the company started out by noting that industrywide light vehicle production forecasts show an expected decline of 1% in automakers’ production for 2026. Considering this forecast, from S&P Global Mobility, along with market conditions in the company’s primary markets, the continued impacts on the China market from tariffs, “and the expected incremental sales contribution from the VOXX acquisition,” the company’s 2026 guidance is as follows…

As shown in the 2026 guidance graphic above, you can see that the company anticipates an increase in revenues in 2026 of about 4.7% at the midpoint revenue of $2.65 billion. They also anticipate a small 30 basis point improvement in gross margin to 34.5%, as compared to the gross margin of 34.2% realized in 2025.

For More Information…

Learn all about Gentex and its products by visiting gentex.com.

Leave a Reply