CEO Articulates a New Strategy…But, Is It Really New?

Calling 2025 a “transitional” year, new Sonos, Inc. (Nasdaq: SONO) CEO Tom Conrad suggested the company turned a corner in the fourth quarter, as part of reporting its financial results for fiscal 2025, the year that ended on September 27, 2025. However, I couldn’t help but notice company executives were carefully choosing their words in describing the company’s performance – referring to just certain key Q4 numbers and “adjusted” results. This always makes me want to take a deeper look, and when I looked at fiscal 2025’s total performance, it was disappointing, with revenues continuing to decline and losses progressively increasing…again.

Even in the fourth quarter, which the executives did want to talk about, the company lost $37.9 million.

Learn all about how Sonos performed in fiscal 2025…

In announcing fiscal 2025 Q4 and full-year fiscal performance, the company started first by highlighting select results in the last quarter of the year. Revenues, they proclaimed proudly, increased 13% in the quarter, coming in at $287.9 million versus $255.4 million last year. Both GAAP and non-GAAP gross margin came in “at the high end of our guidance range,” CFO Saori Casey said on a conference call with analysts, while costs were reduced.

Q4 Results Were Not Entirely Rosy

There were a couple of more examples like that. Still, not all was rosy. For example, in Q4 the company generated an operating loss of $34.4 million…and a net loss of $37.9 million. Yes, both of these losses were lower than the losses that occurred in the same quarter last year…but it’s hard to brag about performance improvement when you are still losing money.

The picture becomes a little clearer as we look at the total fiscal year 2025 results. I would also suggest that one marginally improved quarter does not a turnaround make…

Q4 marked a strong finish to a transitional year for Sonos. We restored the quality of our software, strengthened our leadership team, and refocused on the areas where we’re truly differentiated. As we turn the page on a new chapter and lay the foundation for our next phase of growth, our strategy is clear: to unite every dimension of sound – through world-class hardware, software, and design – into one seamless platform for the home.

Tom Conrad, Sonos Chief Executive Officer

A Deep Dive into the Data

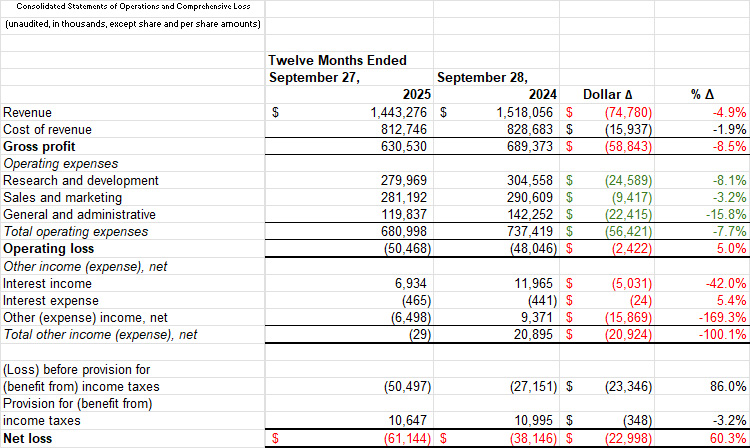

So let’s dig into the company’s fiscal 2025 results. Please pardon the somewhat crude spreadsheet I’ve prepared for you below. While all of this data comes from the company’s 10-K SEC filing, they didn’t have anything formatted like this, where you can easily see the fiscal 2025 result directly compared line item by line item – including both the dollar delta (difference) and the percentage delta.

Total Annual Revenues Declined 5%

As you can see, while the company highlighted a 13% increase in Q4 revenue, for the year, revenues dropped $74.8 million or 5%. Cost of revenues dropped as well, but not by the same percentage (or more). Consequently, gross profit dropped by $58.8 million or 8.5%.

The company says that its revenue decline was “driven by challenges resulting from our app rollout in May 2024 and softer demand due to market conditions…” Even though the app disaster was Q3 of fiscal 2024, the issues raised by the app problems did extend into fiscal 2025.

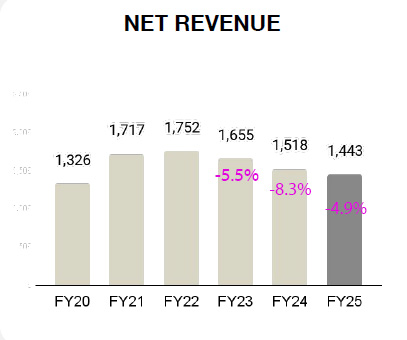

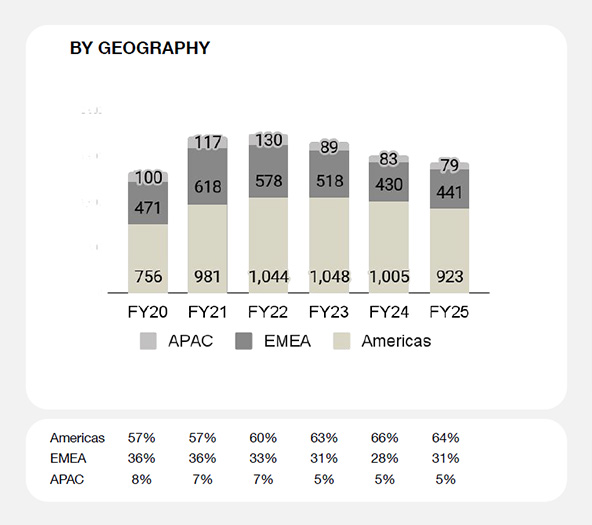

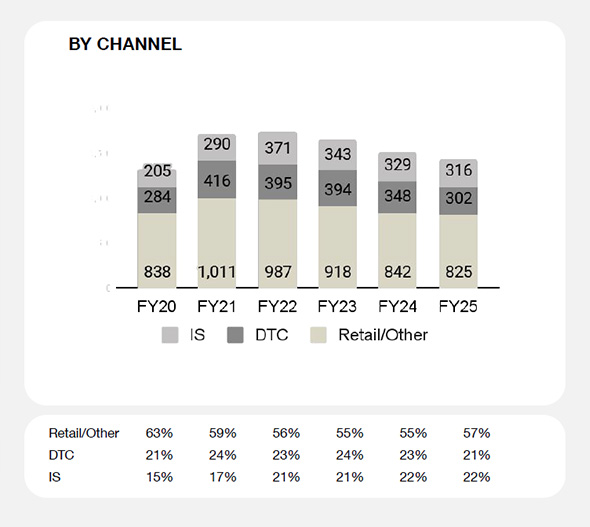

Problems Began Before the App Rollout Fiasco

But a further review of the data suggests that the company’s problems predated the app rollout fiasco. As you can see above, revenues have steadily declined since 2022, when they reached a high watermark of $1.75 billion. Note that the company introduced the highly anticipated high-performance Ace headphones in the third quarter of fiscal 2024. Patrick Spence, the previous CEO, had estimated Ace would contribute at least $100 million to annual revenues. That didn’t happen… Or at least, it hasn’t happened yet.

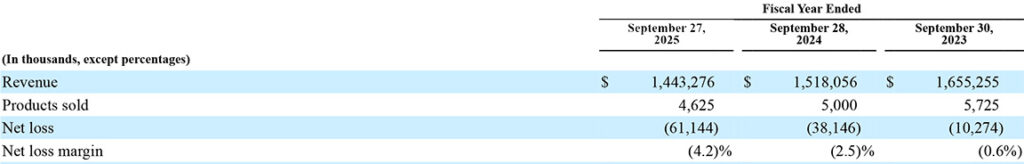

The company included a table in its 10-K of “Key Metrics.” This also helps to show the company’s challenges over the last few years.

More Metrics the Company Calls ‘Key’

In this table, you can get a better sense of the scale of the issue. Not only did revenue is dollars decline in each of the last three years, but unit shipments of all Sonos products declined as well. Looking at the “Products sold” line above, you can see that unit shipments declined 12.7% in 2024 to 5 million units, compared to 5.7 million units in 2023. Shipments declined again in 2025 to 4.6 million units, down 375,000 units or by 7.5%.

So revenues are down, unit shipments are down, and net loss is increasing.

I should note that the “Key Metrics” table above in the actual 10-K filing had a couple of more rows that presented non-GAAP (generally accepted accounting principles) analyses (adjusted EBITDA and adjusted EBITDA margin) that were more positive. But I am not a fan of “adjusted” non-GAAP numbers and generally stick to GAAP presentations, so I deleted those rows for this article.

The Profit Picture

The profit picture also seems challenged. If you refer back to my spreadsheet at the top of this story, you can see that the company’s operations generated an operating loss of $50.5 million. This is $2.4 million or 5% higher than the operating loss of $48.0 million in fiscal 2024. In addition to that, the proverbial – and literal – “bottom line” is a net loss of $61.1 million in fiscal 2025. This means that the company’s net loss increased by more than 60% versus the net loss of $38.1 million in fiscal 2024,

However, there are some bright spots in this report, mostly thanks to a prodigious effort by the company to cut its expense base down and help to drive profit leverage. Unfortunately, this effort resulted in two rounds of layoffs at the company, the first a 6% headcount reduction and the second an even heavier 12% workforce reduction.

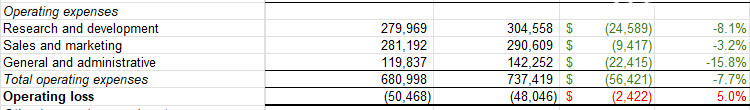

A Substantial Reduction in Operating Expenses

See all of those green numbers on the spreadsheet? They are indicating the rather dramatic amount of cost reductions by category. Overall, the company was able to reduce operating expenses by a substantial $56.4 million or 7.7%. Unfortunately, it wasn’t quite enough to get them to an operating profit, but it certainly eased the pain of the loss by a substantial amount.

We closed out Fiscal 2025 on a high note as we delivered strong Q4 financial results with 13% revenue growth and solid positive Adjusted EBITDA. Over the course of Fiscal 2025, we executed on our pivotal transformation work, becoming a leaner, more focused organization with sharper financial discipline. As we enter Fiscal 2026, we’ll remain disciplined as we focus on returning to durable top-line growth — balancing continued profitability improvements with reinvesting efficiency gains.

Saori Casey, Sonos Chief Financial Officer

Sonos CEO Declares a New Strategy…Or Is It?

On the conference call with analysts, Conrad launched into a relatively long diatribe on his creation of a new strategy. He sounded excited and committed. But frankly, much of his narrative was more conceptual, and it was kind of hard to understand just exactly what he was suggesting pragmatically. At first, I thought it was just me. Perhaps I was having a dense day. But when they moved into the Q&A portion of the call, at least three analysts, sounding confused, tried to get greater clarity as to just exactly what he was suggesting.

I will give you a slightly condensed version of what Conrad excitedly declared on the call with analysts.

He began by reviewing the year just completed, with perhaps the most important statement being: “We restored the quality of our software,” Conrad said with conviction. “And now [we] can speak confidently about the new capabilities we’re delivering across the Sonos experience.”

Rebuilt Leadership Team; New Chief Marketing Officer; New Product & Engineering Process

Conrad reminded analysts that the leadership team has been rebuilt, including adding a new Chief Marketing Officer (Coleen DeCourcy) this coming January. He added that the company has been reorganized (without mentioning the layoffs) – specifically noting a new process in product and engineering: “…and as a result, today we’re executing with greater urgency, focus, and effectiveness.”

Then he rhetorically stuck a Sonos flag in the ground and dramatically declared: “The company doesn’t just need more discipline, better execution, and a revitalized team; we need a new strategy.”

Conrad Has Been Part of Sonos for Eight Years

Let me remind you that Conrad is not new to the company. He has been on the Sonos Board of Directors since 2017, an eight-year tenure during which the company’s fortune rose and…then…fell. As one of the directors, Conrad carries a share of the responsibility for all of it.

Now he says that while in the past Sonos produced excellent products, when “thinking about what hardware to make, what software experiences to deliver, and how to bring these offerings effectively to market, we’ve lost focus on what makes us different and better, and what’s more, we’ve lacked an organizing theory of the case.” He’s about to change that…

It’s All About the System

While others sell fragments – a soundbar for the TV, headphones for the commute, Bluetooth for the beach – Sonos is every dimension in sound for the home: music, movies, stories, rooms, formats, conversations, and control – all connected into a single, cohesive, and radically easy System. The pursuit of this System is now our organizing lens for decisions – and the foundation of our durable advantage.

Tom Conrad

The CEO went on to describe Sonos products as a sort of “independent” connectivity center for first and third-party experiences. “It’s why today Spotify, Apple Music, YouTube Music, Amazon Music, and over a hundred others all thrive on Sonos,” he said. “It’s also why we bring together Bluetooth, Airplay, Spotify Connect, and analog sources alongside formats like Dolby Atmos and lossless audio to uniquely deliver every dimension of sound.”

Sonos Will Pursue AI

Conrad also tipped off analysts that Sonos sees Artificial Intelligence (AI) in its future. “Casting into the future, we see a world where live, natural conversations with AI personalities are as commonplace as smartphones are today – and we believe Sonos’ expertise in internet-connected, voice-enabled, personal hardware products for the home can position us at the center of these interactions,” Conrad told analysts.

Then, suddenly, the tone changed. The product-oriented executive went from visionary futurist to CEO. And equally quickly, I began to suspect this new strategy was not so new. Conrad began to describe what he called “…a compounding model” that would underpin the vision.

A New Compounding Model Sounds Very Familiar

There were two main elements to Conrad’s compounding model, and he began to describe them. As he spoke, I started to get a strong feeling of familiarity, as though somehow I’d heard all this before…an intense sensation of déjà vu.

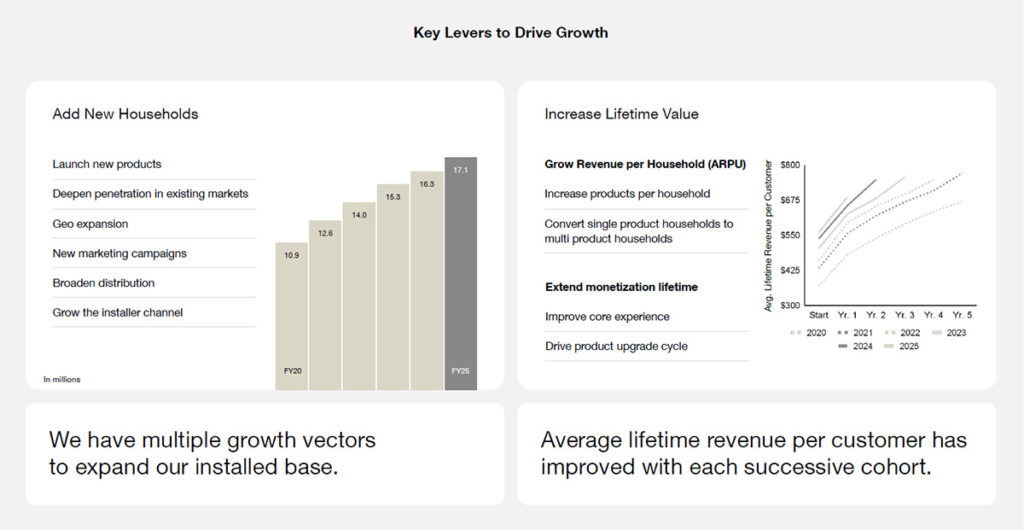

The two elements of his compounding strategy are: 1) Generating new Sonos households, and 2) Increasing the lifetime value of new customers. Generating new households simply means bringing more new customers into the Sonos ecosystem. Increasing lifetime value is getting current Sonos owners to buy more Sonos products.

Conrad’s ‘Compounding Model’ is the Same as the Former CEO Spence’s ‘Flywheel’

Now I know where I’ve heard this before…in previous Sonos earnings calls. Former CEO Patrick Spence used to regularly refer to what he called the Sonos “flywheel.” This referred to growing its installed base of customers and then incrementally selling all their previous customers more Sonos products. In all of their presentations, they would provide an update on the number of new Sonos households, the number of devices per home, and the average increase in Sonos devices per home. There were single-model households and multi-model households.

The more Conrad spoke, the more I realized that this was precisely what he was referring to. He used different words, but he was describing the same mechanism. Conrad says the company will create “great gateway products” with “sharper marketing” and continued international growth to generate new households.

Sonos Will Seek to Deepen Its Relationship with Every Sonos Household

Increasing lifetime value will be all about “deepening our relationship within every household,” which he says starts with engagement. The plan is to get multi-unit homes – currently averaging 4.49 Sonos models – to six units per household. Conrad says this is a $5 billion opportunity.

And converting single-product households to multi-unit households, he says, is a $7 billion opportunity. This yields them a combined $12 billion opportunity, “just within our existing base,” Conrad explained. That’s a big step up from last year’s total revenues of $1.4 billion.

Analysts Were a Little Excited, a Little Confused, and a Little Skeptical

Analysts listening to this presentation were a blend of a little bit excited, a little bit confused, and a little bit skeptical. At the end of the day, it’s always great to hear an excited vision of big things to come, but analysts have heard big plans from Sonos executives before…that didn’t work out.

So the challenge will be to turn these wide-eyed visions into a reality. And executing on that vision…well, that is the hard part.

Learn more about Sonos by visiting sonos.com.

Transitioning down more like it. Tech-challenged and innovation-deprived.

Wonder how WiiM is affecting the Sonos market share?

Hi Greg,

During the presentation to analysts, executives showed data placing Sonos with #1 market share. I can’t vouch for the accuracy of that, as I was unfamiliar with the research firm named, but that is what they are telling analysts.

Thanks for your comment!

Ted