A new survey of U.S. companies by KPMG reports that they are already feeling the pain of the Administration’s new tariff program, which is still under negotiation with countries around the world. Even at current levels, U.S. businesses have been impacted, reporting they are experiencing declining gross margins…will be forced to further raise prices…are already being impacted by consumer pushback…have suffered sales declines from retaliatory tariff increases in other countries, and more.

Overall, it’s a pretty sobering look at the impact of tariffs on companies now, and a scary foretelling of what they anticipate in a darkened future.

See more on this eye-opening KPMG study on the impact of tariffs

In a survey released on Tuesday by accounting and audit giant KPMG LLP, 300 companies reported that the changing tariff program has already impacted them, and they have every reason to believe that a greater impact is yet to come. The survey was conducted of 300 large U.S. companies that do business globally across a wide range of industries, including Retail, Consumer Goods, Technology, and more.

Businesses Can Only Eat the Trade Costs ‘For So Long Before Raising Prices’

As a report in Axios noted, “[b]usinesses can only eat trade costs for so long before raising prices, fueling the tariff-driven inflation many economists fear.” However, the survey makes clear that prices are definitely going to be increased this year, whether the company has already passed on an increase before now, or whether it has chosen to eat the increase to this point.

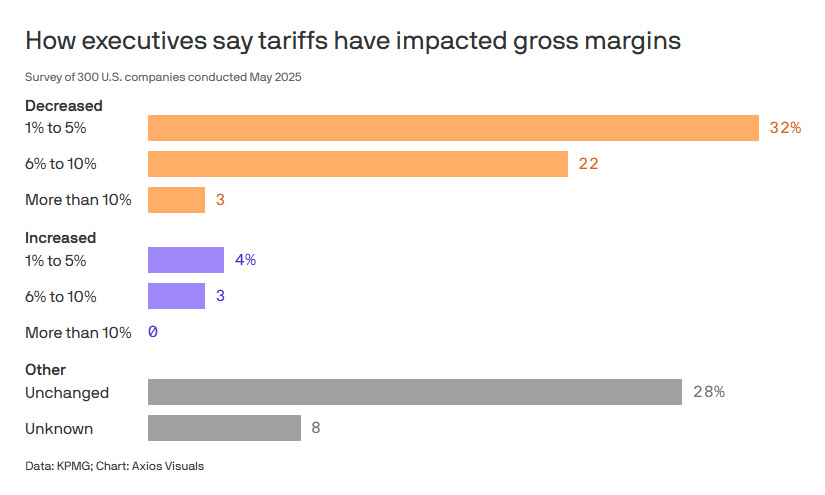

As you can see in the graph above, which shows the KPMG data interpreted by Axios graphic artists, a majority of companies (57% or nearly 6 out of every 10) note that their gross margins have declined by anywhere from 1% to more than 10%. The largest group, at 32% of all respondents, reports a 1%-5% decline in gross margin. Fully 22% report a GM drop of 6%-10%, with another 3% seeing GM drop more than 10%.

On the flip side, 7% of respondents say that, so far, their Gross Margins have actually increased between 1%-10%. Finally, 28% of respondents reported no change in their Gross Margin.

KPMG Called the Drop in Profits a ‘Potential to Influence Economic Forecasts’

Axios highlighted the fact that one-in-four (25%) of the survey respondents reported a Gross Margin drop of more than 6%, which is likely a meaningful impact on their financial results. KPMG themselves called out the fact that with the majority of companies reporting a meaningful drop in Gross Margins, “This highlights the direct impact on profitability and potential to influence economic forecasts and market trends.”

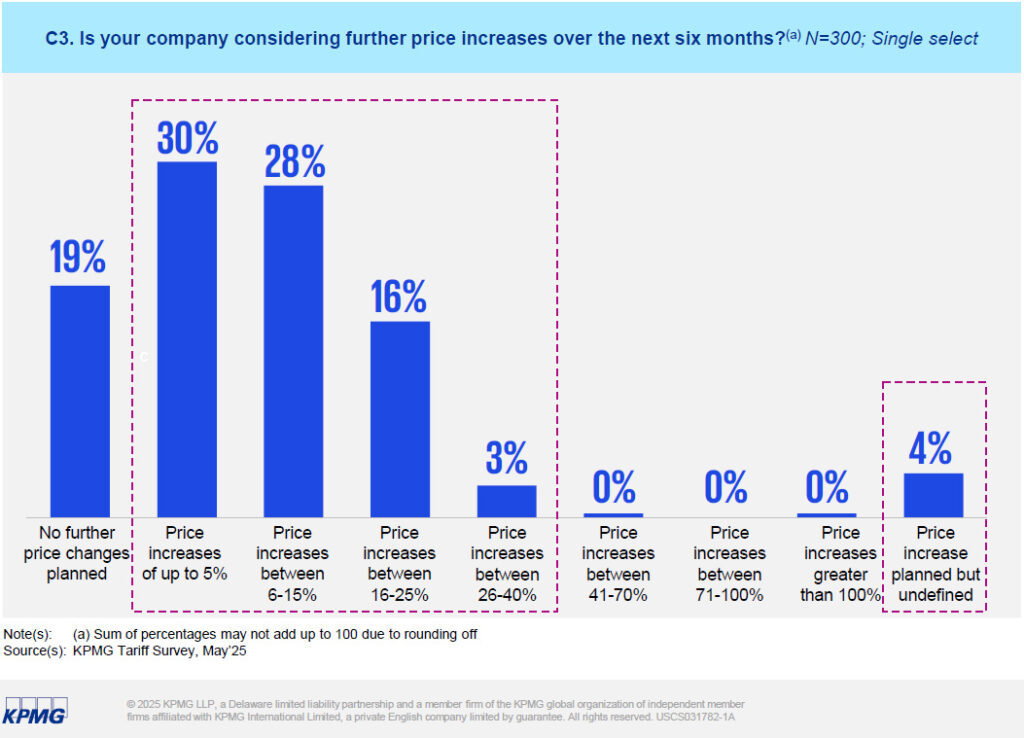

Companies have scrambled to take steps to minimize the impact of the new tariffs. Yet despite these efforts – which included optimizing supply chains, lowering costs/overhead, and with a majority (73%) already passing on price increases equal to about 50% of the impact of the tariffs – it would appear from this survey that more price increases are imminent. More than 80% of the survey respondents said they will be forced to raise prices over the next six months, while 19% said no further price increases were necessary.

More Than 80% Say They’ll Increase Prices in the Next Six Months

Again, the largest group of 30% of respondents say they’ll raise their prices by “up to 5%” within the next six months. The next biggest group at 28% plan to raise prices by “6%-15%” in the same time frame. About 3% of respondents say their prices will increase between “26%-40%” over the next six months.

But wait! Won’t that cause sales to taper off? Almost half of the respondents (45%), when asked “Have you seen changes in customer demand for your products/services?”, said that they have already been impacted. In fact, 34% of respondents point to “customer pushback” as a significant challenge they face in managing tariff-related issues.

Adding to Woes – A Double Whammy as Sales are Dropping in Foreign Markets

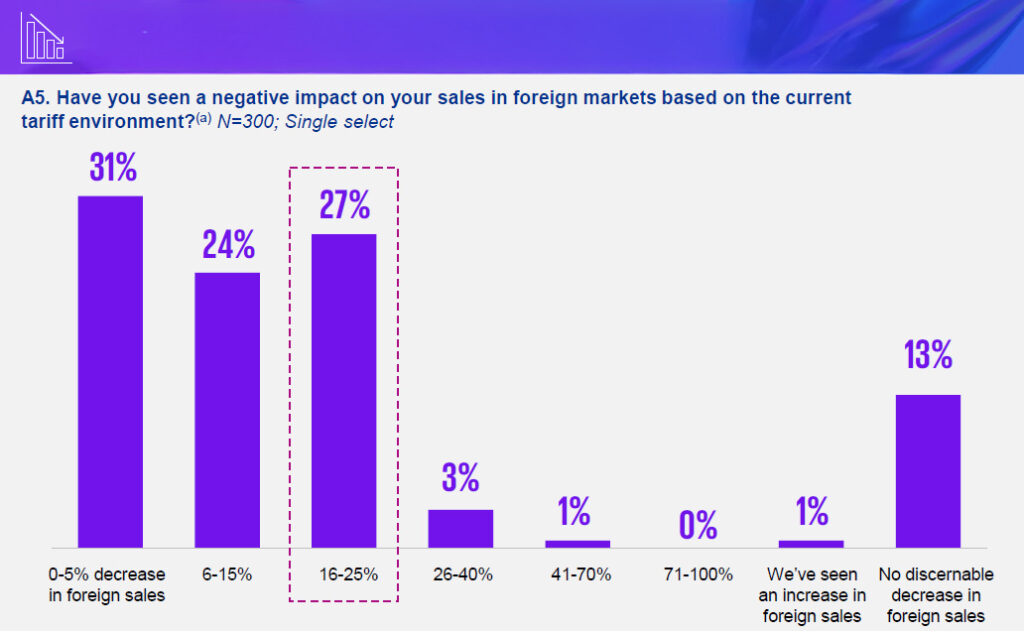

The other shoe to drop that is negatively affecting companies is the ugly reality of retaliatory tariffs being imposed in response to the U.S.’s moves. Fully 83% of respondents reported that their sales in China have dropped as a result of the impact of that country’s retaliatory tariffs. Keep in mind that China is the second-largest economy in the world, and many companies do a large amount of business there.

Beyond China, in responding to a question on the impact on their sales on a more global basis, almost three out of ten respondents (27%) said their global export sales have declined by 16%-25%. Another 3% say their global sales have declined by 26%-40%, with another 1% saying their sales have dropped 41%-70% from the tariff disruption.

Collateral Damage From Tariff-Related Intl Trade Disruption – Capital Investment Delays

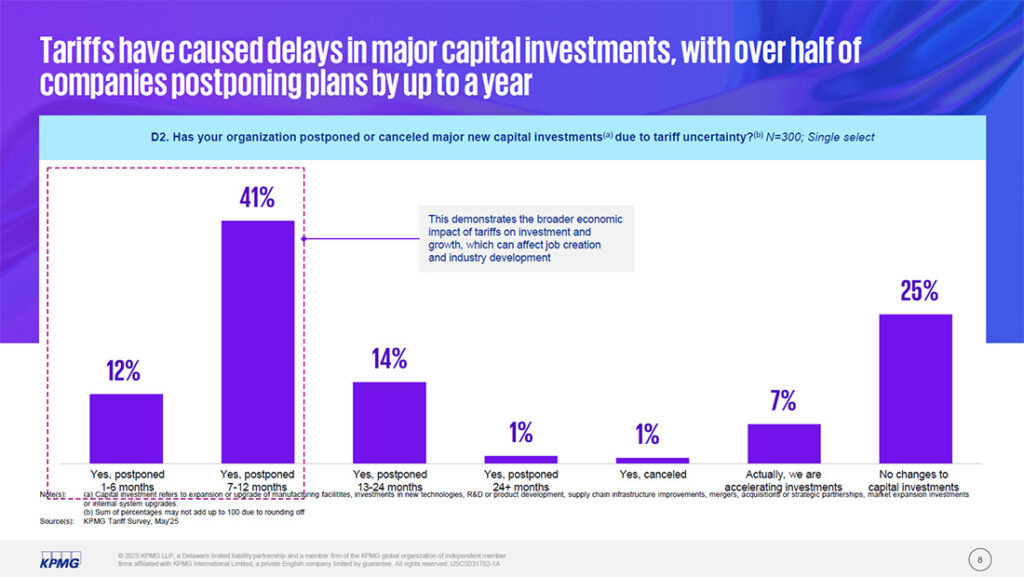

The study goes well beyond these points to more deeply research what strategies and tactics companies are employing to deal with the disruption to international trade from this tariff program. But one interesting element – you might call it collateral damage – is that almost 70%, seven out of ten respondents, reported that their company has postponed capital investment programs for anywhere from 1 month to 24 months. And 1% reported cancelling their capital investment plans altogether as a result of the trade disruption from tariffs.

As you can see in the graph above, a majority of respondents (53%) reported postponing capital investment for either 1-6 months (12%) or 7-12 months (41%). Capital investment is resources companies spend to acquire everything from buildings, machinery, equipment, and more to help drive business growth and expansion – perhaps even leading to increased hiring. Capital investment typically refers to fixed assets, but can include things like software and technology.

Even KPMG referred to this finding by noting, “This demonstrates the broader economic impact of tariffs on investment and growth, which can affect job creation and industry development.”

For More Information…

Learn more about KPMG by visiting kpmg.com/us/en.html.

Leave a Reply