Sonos, Inc. (Nasdaq: SONO) released its financial results for the third quarter of Fiscal Year 2025, which included a double-digit percentage revenue decline and a significant net loss in the millions of dollars. Yet Sonos management declared victory with new CEO Tom Conrad calling the quarter a “…solid step forward for Sonos,” and CFO Saori Casey joining in by saying, “Q3 was another quarter of solid execution…”

Are we watching the same movie here?

See all the details on the Sonos Q3 of fiscal 2025 financial performance

So this was the first earnings release with Tom Conrad as permanent CEO and it is always interesting for me to see the approach new management takes in its earnings report. This management team, as managed by Conrad, takes a noticeably different approach than the previous team under Patrick Spence.

Team Conrad Delivers Less Transparency

Those differences offer a bit of a mixed bag. Under Conrad, there is a little less of the bold boasting and sometimes misleading marketing jargon posing as results. Less fluff, more buttoned-down data is a refreshing change. However, this does not mean that Team Conrad is more transparent. In fact, you have to be even more diligent to dig up a real picture of the results generated by this regime.

It’s not that they hide the results; it’s just that they don’t necessarily make it easy for the reader to understand just what the results mean. Let me give you an example. In the release announcing its results, it is customary to start with bullet points of key performance data. Here is what the company published in this quarter’s release…

Third Quarter Fiscal 2025 Financial Highlights (unaudited)

- Revenue of $344.8 million

- GAAP gross margin of 43.4%, Non-GAAP gross margin of 44.7%

- GAAP net loss of ($3.4) million, GAAP diluted loss per share (EPS) of ($0.03)

- Non-GAAP net income of $22.6 million, Non-GAAP diluted EPS of $0.19

- Adjusted EBITDA of $36 million

As you can see, the company included a list of results for the quarter. However, it is customary to include information on how each of these results compares to last year’s results, including the amount booked in the same quarter last year, and often, both a dollar and percentage difference to give the reader context for how the quarter this year compares to past performance.

With the style of reporting under this new management, you have to dig deeper to find the performance from last year, and only then do you have the proper context to determine how good or bad this report is. There are a lot of little tricks like that throughout the report for this quarter. None of this is illegal, nor does it even violate SEC rules…but it does display a subtle but real attempt to obfuscate the real story by deliberately employing a lack of transparency.

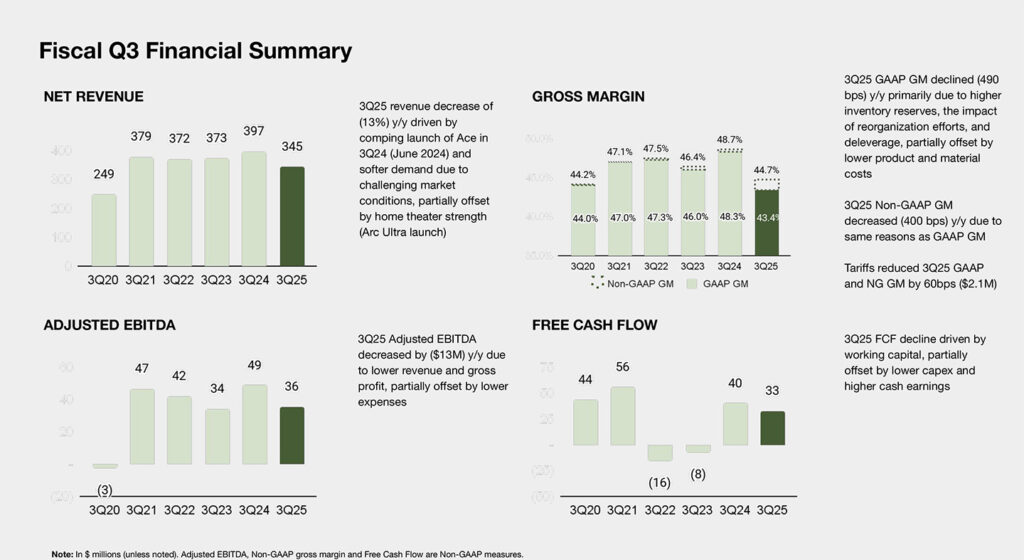

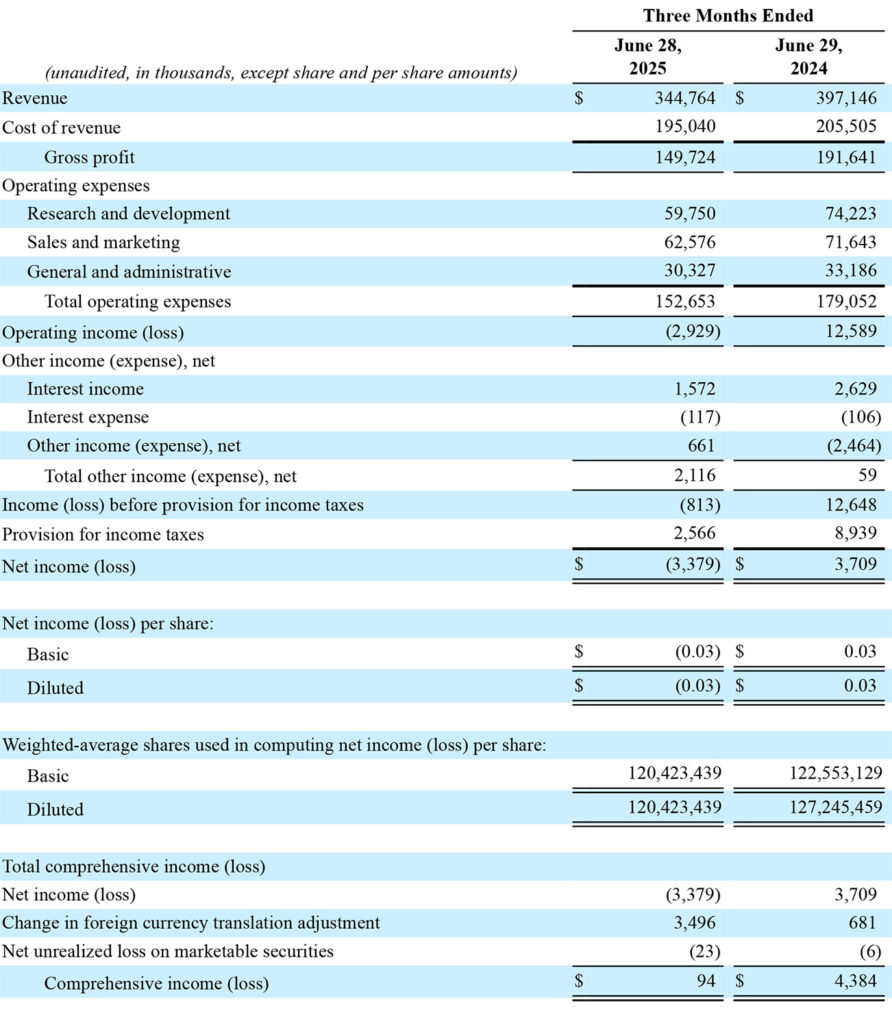

A Closer Look at Q3 Fiscal 2025 Results

In any event, let’s dig into the company’s performance for Q3 of fiscal 2025, the 90-day period that ended June 28, 2025. Revenues in the quarter this year came in at $344.8 million, down $52.4 million or a concerning 13.2% as compared to revenues of $397.1 million in the same quarter in fiscal 2024. The company also shipped 1.1 million units this year, which was 202,000 or 15.8% fewer units than the 1.3 million shipped the same quarter the previous year.

Note that the Ace headphones were launched during this quarter in 2024, so that likely accounts for some of this difference.

Q3 was a solid step forward for Sonos. We’re returning to our founding principles of craftsmanship, customer-first design, and innovation while advancing our vision of Sonos as a platform where hardware and software come together to deliver unique, seamless experiences. With a focused roadmap, a powerful brand, and a commitment to operational excellence, I’m confident we’re making progress toward delivering long-term growth.

Tom Conrad, Sonos Chief Executive Officer

The company says that the revenue decline was largely due to “lapping the launch of Ace” last year (with no similarly huge product launch in the quarter this year). It also pointed to softer consumer demand “due to challenging market conditions.”

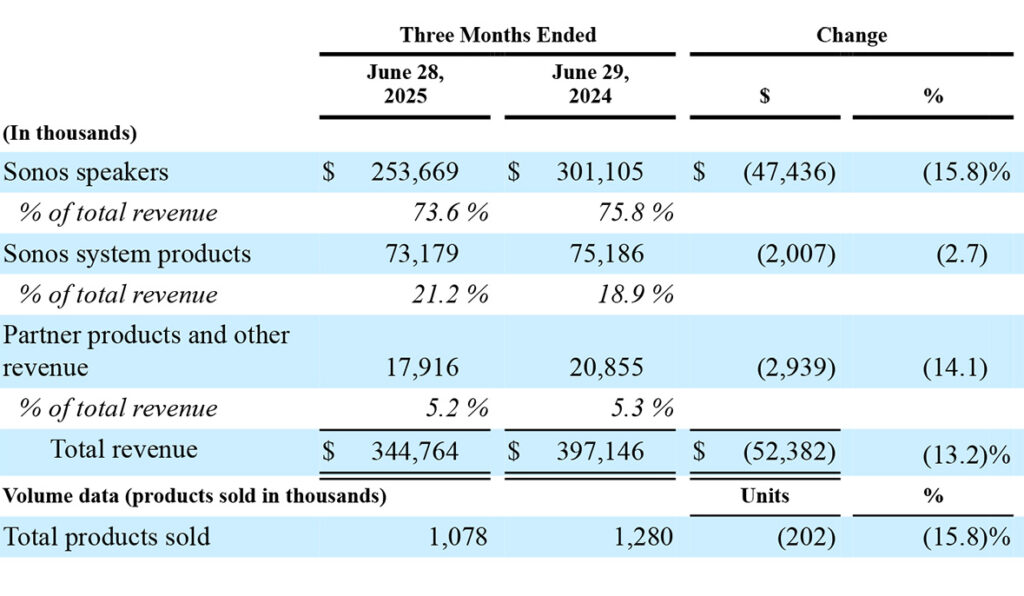

Revenue Breakdown by Product Series

Sonos products are broken down into three main series or lines – Sonos Speakers (including all-in-one speakers, portables, home theater, and headphones), Sonos System Products (including Port & Amp which facilitate traditional wired products to operate in the Sonos wireless ecosystem), and Partner Products (includes products sold in conjunction with partners, such as Sonance and Audi; as well as Sonos Radio, accessories, and more). All three series of products saw their revenues decline in the third quarter.

Sonos Flagship Category, Sonos Speakers, Sees Revenues Decline $47.4M

Without a doubt, Sonos Speakers is the company’s biggest category, typically representing 75% or more of total sales. In the third quarter, Sonos Speakers’ revenue came in at $253.7 million, down $47.4 million or 15.8% as compared with category revenues of $301.1 million in the same quarter last year. The top category dropped to 73.6% of total revenue from 75.8% in Q3 of fiscal 2024.

The next largest category, although it is a distant second place, is Sonos System products, which in this quarter came in at $73.2 million, down more than $2.0 million or 2.7% compared to revenues of $75.2 million in the quarter last year. Because this category declined less than the others, it actually gained share…moving to 21.2% of total revenues compared to 18.9% of total revenues in the Q3 last year.

Finally, we turn to Partner Products, the company’s smallest product series. This division recently got even smaller when its partnership with IKEA fell apart. Now at around just 5% of total revenues, Partner Products saw revenues of $17.9 million, down $2.9 million or 14.1% compared to revenues of $20.9 million in the same quarter last year. The category saw its share of total revenues drop from 5.3% last year to 5.2% in fiscal 2025.

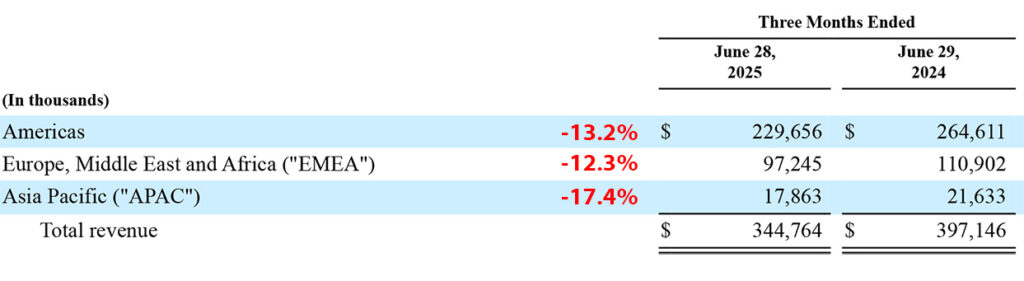

Revenues by Geographic Region

Much like the product category analysis above, revenues by Geographic Region also declined in all regions. Sonos tracks revenues by three main geographic areas: The Americas (North & South America), EMEA (Europe, Middle East, Africa), and APAC (Asia-Pacific).

The company offered no explanation for the revenue declines in a specific geographic region, beyond the overall explanation for the revenue declines as a whole. And while I’m sure these are all a disappointment for the company, the Americas result in particular had to really hurt. After all, the U.S. market is far and away its largest market.

The company has always had an undue reliance on U.S. market performance, despite an effort to spread the good word on Sonos as a sound experience company in other markets around the globe. They always have, and still do, struggle to gain traction in these other markets.

The Profit Picture is a Little Blurry This Quarter

There was something I noticed as I reviewed their Consolidated Statements of Operations that struck me as odd. Of course, the revenue decline was obvious…but “Cost of revenue,” or what many companies call Cost of Goods Sold (COGS) had dropped as well (due to lower sales). But what jumped out at me was the dramatic decline in Gross Profit.

As I mentioned above, revenues declined by a disappointing 13.2%. However, Gross Profit dollars dropped by an even more concerning 21.9%. Why such a hard hit to GP? Sonos said that its Gross Margin had dropped by 490 basis points (nearly 5%!) “…due to an increase in inventory-related write-downs, the impact of reorganization efforts, and deleverage resulting from lower revenue…”

Company Details Added Costs, Including Tariffs; Will Need to Raise Product Prices

Doing a little more digging, I discovered that the company had booked inventory value write-downs of $39 million in 2025, an amount that was $8.7 million or 17.1% greater than the inventory write-offs of $33.3 million in the comparable 9-month period last year. The company also reported $2 million in restructuring charges in the quarter.

Tariffs hit Sonos in the quarter, causing the company to incur $2.1 million in tariff-related expenses in the quarter. Looking forward, the company says it expects the tariff impact to increase to $5 million in Q4. And looking on into the next fiscal year, Conrad told analysts, “We continue to work closely with our contract manufacturers and our channel partners to share tariff costs, though it has become clear that we will need to raise prices on certain products later this year.”

Q3 was another quarter of solid execution, with revenue above the high end of our guidance, and Adjusted EBITDA at the high end of the range. This marks our fourth consecutive quarter of delivering on our top and bottom line guidance while navigating a complex environment marked by tariffs and an uncertain macroeconomic backdrop.

Saori Casey, Sonos Chief Financial Officer

Two Rounds of Layoffs Reduce Remaining 2025 Overhead by $20 Million

Zooming in on restructuring for a moment, the CEO and CFO both mentioned the company’s “cost transformation initiative” that started in 2024 and continues on to fiscal 2025 as well. Most notably, there have been two rounds of staff terminations. The first round of layoffs occurred in August 2024, when the company instituted a restructuring plan that resulted in the dismissal of approximately 6% of the staff. Then again, in February 2025, the company had another round of layoffs even larger than the first one, with about 12% of the staff let go.

According to an SEC filing on the matter, the company said, “This cost transformation also involved charges related to rationalization of its product roadmap.” The company also dismissed former CEO Patrick Spence. As a result of these restructurings, the company expects to enjoy a cost benefit of approximately $20 million for the remainder of fiscal 2025.

Despite Best Efforts, Profits Turn to Losses

You can clearly see the effort the company expended to keep operating costs under control as all three major operating expenses – Research and development, Sales and marketing, General and administrative – had double-digit percentage declines. Yet despite Sonos management’s concerted cost transformation initiative, the company saw the quarter slip into an Operating Loss of $2.9 million, a $15.5 million swing in profits to the negative from an Operating Income of $12.6 million in the same quarter last year.

Likewise, Net Income also went underwater, as the company reported a Net Loss of $3.4 million. This was a more than $7 million swing in profits to the negative as compared to the Net Income of $3.7 million booked in the same quarter last year.

Why Sonos Executives Claimed Victory in the Face of These Challenging Results

So how was Tom Conrad and Saori Casey able to so confidently speak as though the quarter was a great victory, when sales declined and the company slipped into operating and net losses? Simple, they played the expectations game. In the wake of the Great App Disaster of 2024, the company began downgrading its guidance for future performance for the company, coming to lower estimated revenues and profits that would be easier to hit.

Let me give you an example of how this worked. In a conference call with financial analysts, CFO Saori Casey said this, “Q3 revenue declined 13% year over year versus our guidance of down 22% to 14%.” So analysts hear the company beat expectations, with revenues down “only” 13%…after telling the market to expect a decline of somewhere between down 14% to down 22%.

Shares in Sonos are Down 12.6% YTD

That may be a way to effectively control Wall Street’s reaction to the results, but I think the reality speaks for itself. They may honestly feel – as they told analysts – that the company has turned a corner, but they can’t be truly satisfied with the quarter’s results.

The fact is that, as of the close of markets on Thursday, the value of shares in Sonos is down on a year-to-date basis by 12.6%. That’s not a great result for investors who would be better off putting their money into a high-yield savings account. Compare that with the S&P 500 which is up 9.89% in the same period.

Mixed Ratings by Analysts

Furthermore, Yahoo Finance shows that of the four analysts following the company, two have a “buy” rating on it, one has a “hold” rating on it, and one has an “underperform” rating (just one step above a “sell” rating) on it. That is hardly a rousing endorsement by the analyst community.

Learn more about Sonos by visiting sonos.com.

Leave a Reply