In a public press release and a filing with the Securities and Exchange Commission (SEC), Masimo Corporation (Nasdaq: MASI) revealed that CEO, Chairman and Founder Joe Kiani resigned his position as CEO on September 19, 2024, in the wake of learning that William Jellison and Darlene Solomon, both Politan nominees, had been elected to the Board of Directors by a decisive margin. The Board has appointed an interim CEO and launched a search for a new permanent CEO.

See all the latest Masimo news as a new day dawns at the company

Making good on his vow, Joe Kiani notified the Board of Directors on September 19, 2024, the same day as the company’s 2024 Annual Stockholders Meeting, that he was resigning his position as CEO of Masimo. Later again on the same day, Kiani filed a lawsuit in California state court against the company seeking declaratory relief “that he had validly terminated his employment for ‘Good Reason.'” This is an important clause in his contract with very specific wording, as it potentially triggers a massive payment to Kiani of hundreds of millions of dollars. The Board is currently evaluating both Kiani’s letter of resignation and the lawsuit he filed against the company.

In the meantime, the Board has appointed Michelle Brennan, a former Johnson & Johnson executive and current member of the Board, as the interim CEO. The Board has also retained Korn Ferry, one of the leading executive search firms in the U.S., to conduct a search for candidates for the permanent Chief Executive Officer position.

Efficiently Summarized: An Election…A Resignation…An Appointment

In an efficient summation of the situation, the company notes in its announcement that the election of Jellison and Solomon as Directors, the resignation of Joe Kiani as CEO, and the appointment of Michelle Brennan as interim CEO, are all effective immediately.

Much to the delight of investors – the war is over…a new day is finally dawning at Masimo.

The company made a couple of other key announcements as well. First, it has announced that the company remains “committed to [a] review of strategic alternatives for [the] consumer businesses, with assistance from leading financial and legal advisors.” Second, the company also announced, perhaps to project an image of “business as usual,” that it reaffirms its financial guidance for the third quarter of Fiscal 2024.

Interim CEO Brennan Has An Impressive Resume

The company noted that Michelle Brennan, as a Director on the Board, is not just a convenient option for interim CEO, she is also highly qualified. It notes that as a senior executive at J&J, “she oversaw medical device businesses globally as well as consumer pharmaceutical businesses.” Also, Brennan is said to have “…successfully scaled multiple businesses to achieve market-leading growth and led efforts to invest in innovation that resulted in successful new product launches.”

In addition to her extensive career at J&J, Brennan also sits on the Boards of Cardinal Health, Inc., and Perosphere Technologies, Inc. She also holds a Bachelor of Science in Business Administration from the University of Kansas.

Excited to ‘Work With Our Employees’ to Ensure ‘Seamless Service and Support’

I am grateful for the trust of the Board and excited by the opportunity to help Masimo continue to grow and lead as an innovation-focused company. As we go through this transition, the Board and management team are excited to learn from and work with our employees, while focusing on ensuring seamless service and support for our customers.

Michelle Brennan, Interim CEO & Masimo Board Member

Masimo also released the vote totals on the four proposals that were presented to stockholders: #1 – The election of two Class II directors; #2 – Ratify the selection of Grant Thornton LLP as Masimo’s independent registered public accounting firm; #3 – An advisory vote on the compensation of the Company’s named executive officers; and #4 – To approve a stockholder proposal (put forth by Politan) to repeal any provision of, or amendment to, the Company’s Bylaws subsequent to April 20, 2023.

Stockholders Voted on Four Proposals, Including New Directors; Here is the Final Tally

The final vote tallies are shown below…

| Proposal #1 – Director Vote | NOMINEES | FOR | AGAINST |

|---|---|---|---|

| Company Nominees | |||

| Christopher Chavez | 14,041,676 | 34,706,178 | |

| Joe Kiani | 19,484,844 | 29,263,821 | |

| Politan Group Nominees | |||

| William Jellison | 34,080,277 | 14,668,350 | |

| Darlene Solomon | 29,813,741 | 18,934,883 |

| Proposal #2 – Ratify Grant Thornton | FOR | AGAINST | ABSTENTIONS | BROKER NON VOTES |

|---|---|---|---|---|

| 47,817,976 | 856,797 | 75,175 | – |

| Proposal #3 – Advisory Vote on NEO Compensation | FOR | AGAINST | ABSTENTIONS | BROKER NON VOTES |

|---|---|---|---|---|

| 31,525,446 | 17,074,692 | 149,809 | – |

| Proposal #4 – Repeal Any Bylaw Changes Since 4/20/23 | FOR | AGAINST | ABSTENTIONS | BROKER NON VOTES |

|---|---|---|---|---|

| 34, 821,698 | 13,788,696 | 139,554 | – |

Time to Get Down to Business; Top Advisors Retained

In addition to finding a new CEO, the company’s announcement projected an air of getting down to business. And key item #1 – as I’ve been noting all along – is to dispose of Sound United. Or as the company puts it, “The Board remains committed to the previously announced review of alternatives for both the consumer audio and consumer healthcare businesses.”

The company has retained Centerview Partners and Morgan Stanley as its financial advisors and Sullivan & Cromwell is its legal advisors. Clearly, this won’t be a “shoot from the hip” affair as it likely thinks was done previously when the Kiani-controlled company acquired Sound United. Rather, these advisors will assist in a thoughtful assessment of potential paths and opportunities.

Why Companies Hire Advisors to Pursue Strategic Alternatives

Companies hire advisors like Morgan Stanley for its deep connections throughout the financial and business communities to better identify likely candidates. I would expect this process to yield potential candidates fairly soon. Even the new Masimo now says, “The Board looks forward to providing updates in the near-term regarding value-creation initiatives, including this strategic review.” [Emphasis added]

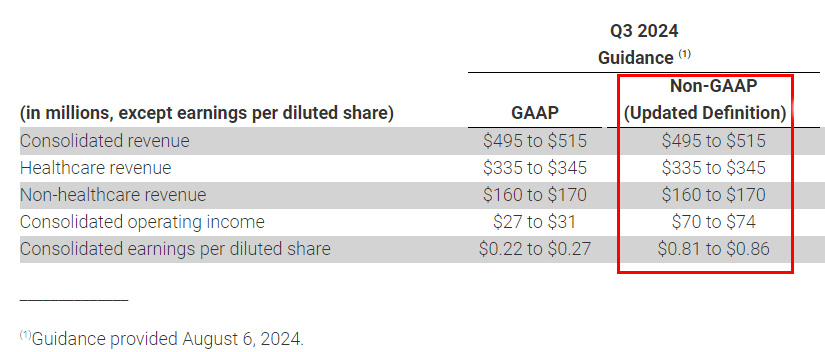

A Reaffirmation of Previously Provided Guidance, But Look Who Gave It

The last interesting point I’d like to bring to your attention is the company’s reiteration of its previously provided guidance (see the table above). First, like the rest of the announcement, this section was also remarkable in its dispassionate tone and workman-like approach. This announcement revealed massive actions taking place at the company – actions that will forever change the vector of its future, yet it remained quite professional in its tone and phrasing.

The same was true of this reaffirmation of its previously provided guidance for its anticipated third quarter of Fiscal 2024 performance. Nothing changed, but I did note that it specifically said it was reiterating its “non-GAAP” guidance. Originally, it had provided both GAAP and non-GAAP numbers, so this seems to be an effort to establish a little wiggle room.

But here’s the really interesting point – the announcement provided this quote, “We are excited about the strong momentum of the business and its future prospects for growth. We look forward to providing more details on the upcoming third quarter earnings call next month.”

Who was that quote attributed to? It was said to be from “Chief Financial Officer Micah Young and Chief Operating Officer Bilal Muhsin. Muhsin, you may recall, had notified the Board recently that if Kiani was removed from control of the company, he would resign his position. There is no inkling here the COO is leaving – let alone 300 other employees who submitted letters suggesting they would quit as well. There was some evidence to suggest these commitments were coerced by management.

On Wall Street, the Masimo Stock Party is Still Going On

On Wall Street today, markets were mixed with the Nasdaq up just 0.04%. But investors still are celebrating the new improved Masimo, the value of its shares, trading as MASI, closed up an impressive +6.02% to $133.77.

For more information on Masimo, visit masimo.com.

I have no skin in this game but the acquisition of Sound United by Masimo made no sense to me. In addition to this, I haven’t seen anything that would reflect what Masimo did to enhance the performance of these brands. Obviously, this is all looking from the outside in.

Many have seen the same things you mention here. In fact, the opposite seems to be the case – Sound United seems to have suffered under Masimo’s management.

…”suffered under Masimo’s management.”

Well, yeah. In the just-out November issue of Stereophile, Editor Jim Austin writes about the gutting of Classe’, in which long-time engineers and dev folk created a line of new and pretty special products—and when Masimo took over, everyone was let go. There are no dedicated Classe’ employees at this point, no further products in the pipeline.

In one of the most-nonsensical, disingenuous, and downright insulting to the intelligence statements I’ve ever read from any PR-type or even politicians—an unnamed Masimo Consumer spokesperson said, “While each brand has its own dedicated strategy within Masimo’s consumer division, we do not have brand-specific employees; everyone in our division is a steward of our full portfolio of brands.”

To me this indicates that their perception of their brands is that the talents of staff and the character of brands are simply interchangeable, and thus discharging brand-builders like the crew at Classe’

is a non-event. This denies the special skills of engineers, the brand-knowledge required to successfully help brands develop, and the knowledge of sales and marketing types who have loyally helped support individual brands.

As a marketer who has spent many years developing brands and highlighting the unique attributes of each,, this strikes me as not just utter horseshit, but a really, really bad idea in terms of growing brands.

Whatever. Let’s hope that the new regime can find a sympathetic owner for SU who actually has knowledge of and affection for the audio biz.

Fingers crossed.

It is always entertaining to hear Jim Austin discuss business concepts, but he should be paying attention to his own house. AVTech Media the parent of Stereophile has taken a turn for the worse in the last couple of years.

Bill, engineering and marketing talent is more flexible than you think. The folks at Classe’ may have worn out their welcome and not developed distinctive products to compete in their price range or marketed them well enough to justify their continued employment.

Are there any knowledgeable audio people who can afford Sound United?

Well, Jim’s got nothing to do with issues at AV Tech—-if anything, the mag under his care is the only thing keeping the group afloat.. t”The owners have made a number of mystifying moves during their ownership, but the latest big move —-killing Sound & Vision print—-was inevitable, and possibly long overdue.

As far as “knowledgeable audio people”—-those with sufficient money to buy SU have generally gotten that money by cashing out. So, I don’t think you can look to that small group.

I do know several guys in VC and PE who are ardent audiophiles, all of whom have said they’d never put their money—-or OPM—-in audio companies.

You’ve seen the way those guys have handled investments in audio companies —1they realize they can’t get the 15% they normally expect, and pass it on to another…umm…enthusiast.:-)

No clue who will buy this, but I suspect it’ll get split up almost immediately.

And then it starts. another round….

Bill, all Jim had to do was read John Atkinson’s 2020 review of a Classe’ amp and he would know why Masimo cut loose all the Classe’ staff.

What is obvious is audio doesn’t scale well. It seems you can do well with a good origin story, an accessible founder and good customer service. But signal engineering talent doesn’t flock to the audio band. And if you have high level marketing and sales skills you don’t waste your talent in audio. These are reasons why audio acquisitions fail more often than other business acquisitions which don’t have that great a track record.

Private Equity is about hitting home runs to cover losses. Why invest in an industry with little potential for home runs?