Politan’s Koffey Makes Move to Seize Control of Company

One business day after Masimo Corp. [Nasdaq: MASI] announced plans for a spin-off of its Consumer division, the business unit formed by the acquisition of Sound United, activist investor Politan Capital Management and its CIO Quentin Koffey – a current Masimo Director – announced the nomination of two more independent director candidates for the Board of Directors. In a statement accompanying the announcement, Koffey takes the gloves off alleging Board dysfunction, uncooperative management, and says Kiani’s desire for control “is troubling.”

Pop a fresh bowl of popcorn and settle into a comfortable chair…things are getting pretty interesting in this story of escalating boardroom and management drama.

See more on the rising drama at Masimo

Last Friday, after the close of financial markets, Masimo surprised everyone by announcing that its Board of Directors had authorized management to plan a spin-off of the company’s Consumer division. This immediately caught my eye as the company’s consumer division is made up principally of the key audio brands it added when it acquired Sound United back in February 2022.

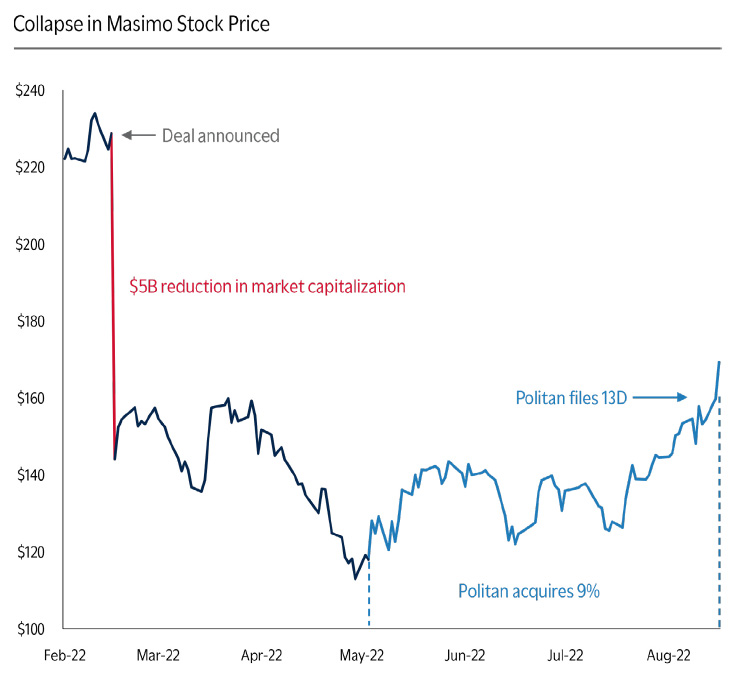

Spin-Off Announcement is Popular with Investors; Stock Value Rises

I had predicted that this spin-off of the Consumer division was likely to be popular with investors, most of whom were not happy with the acquisition of Sound United from the very beginning. Investors had demonstrated their dissatisfaction by initially selling off the stock and then voting to put two new independent Directors on the Masimo Board. These Directors had been nominated by the activist investment group Politan Capital Management. One of those new Masimo Directors was Politan Founder and Chief Investment Officer Quentin Koffey, who along with Michelle Brennan – another Politan nominee – was voted onto the Board in June 2023.

It was clear change was coming. In fact, my headline on that post was Masimo Shareholders Elect Politan Nominees to Board; Sound United Future is Cloudy We are now beginning to see that change play out and the clouds gathering around the Sound United business unit are getting substantially larger and exponentially darker.

On Monday, one business day after the company announced the spin-off, share value of Masimo stock rose $4.50/share to close at $139.43, more than 3.3% higher than the close on Friday (before the announcement) of $134.93.

Koffey Tells Investors They Need More Independent Directors; IOW He Needs Control

That same day, Politan Capital Management distributed a solicitation to investors proposing the addition of two new independent directors. They make no bones about it, this move is to give Politan a majority – and control – of the Masimo Board of Directors.

Politan’s solicitation took potshots at Masimo management generally and landed some heavy blows on Joe Kiani specifically. The solicitation tells investors it “…has serious concerns given Masimo’s broken governance and lack of independent oversight.”

Politan still holds 8.9% of all of Masimo’s shares and it sought to let investors know that since its candidates joined the Board, serious governance problems have persisted.

Politan Directors Have Been Working for 18 Months to Get a Spin-Off of Masimo Consumer

When shareholders overwhelmingly elected Michelle Brennan and me to the Masimo Board last year, we were optimistic we could work productively with the rest of the Board to drive positive change. Unfortunately, our efforts were continually rebuffed, as Chairman & CEO Joe Kiani refused to give us basic information, denied us access to management, repeatedly held Board meetings excluding us, and refused to even consider allowing any review of capital allocation or strategy.

Statement of Quentin Koffey, CIO of Politan Capital Management and Masimo Director

Koffey went on to tell investors that the Politan’s Directors have been working for eighteen months to get management to seriously address spinning-off the Consumer division. Then, in another direct shot at Kiani, Koffey added:

‘Politan Has Serious Concerns’; Intriguing Details on the Spin-Off

However, at this stage the Board has been provided zero details, and Politan has serious concerns given the lack of basic governance and oversight we have observed since joining the Board. Information is controlled tightly by the Chairman & CEO and almost never shared. As a result, no independent director

Koffey

knows basic facts such as what COGS, SG&A or R&D dollars are actually spent on. There is no budget approval process by the Board, thereby allowing the Chairman & CEO to spend however much he wants on whatever he wants without Board review, authorization or even knowledge.

In my story posted last Friday announcing the spin-off of Masimo Consumer, I had expressed some skepticism that Kiani had come up with this plan, knowing that this was a key goal of Politan and Koffey. Now we get some more details…and they are intriguing. It now looks as though Kiani sought to get out in front of coming moves by Koffey.

Without Proper Oversight, Kiani Will Seek to ‘Maintain His Control and Influence’

According to Koffey, how this spin-off is managed is critical, noting that “there would be vital considerations around the allocation of Masimo’s intellectual property and the control of a potential SpinCo. We have serious concerns that Mr. Kiani, without proper oversight, will seek to push through a spin-off with poor corporate governance and IP arrangements where assets are allocated in such a manner designed to maintain his control and influence of both separated companies.”

The Politan CIO added that Kiani knew Koffey would be nominating more directors in an effort to take control of the Board…and then the Friday announcement came out.

‘A Rushed Friday Afternoon Announcement…’

“A rushed Friday afternoon announcement that the Company was exploring the Separation – which came after being informed that Politan intended to nominate directors this week – only further confirms our concerns,” Koffey wrote in the statement. “This is why it is clearer than ever that a majority of truly independent directors are needed at Masimo…”

Koffey said that Politan retained “an independent, nationally recognized search firm” to locate potential Director candidates “with crucial expertise that is sorely needed on the Board.” He then nominated and supplied the background information on the following two candidates:

Dr. Darlene Solomon

“Dr. Darlene Solomon is a scientist by training who recently completed a 39-year career at Agilent Technologies, Inc., where she served in numerous leadership roles, including as Chief Technology Officer and Senior Vice President under three successive CEOs, and helped define the company’s technology strategy and R&D priorities. Having helped oversee three different separations of Agilent, Avago and Keysight as part of Agilent’s corporate transformation toward becoming a market-leading life sciences and diagnostics company, she brings critical expertise that would inform the appropriate division of Masimo’s IP in a separation of its Consumer Business, as well as the understanding of how best to lead and retain technical talent while executing forward-looking business growth for the Company.”

William ‘Bill’ Jellison

“William ‘Bill’ Jellison is a veteran medical technology executive and finance expert with decades of relevant experience, including as the former Chief Financial Officer of Stryker Corporation. Bill would bring extensive medical technology and financial oversight expertise. He would also be a natural fit to chair the Board’s Audit Committee, which has not been chaired by a director with any audit committee or even public company board experience in nearly five years. Bill also presided over billions of dollars of M&A transactions during his tenure as Chief Financial Officer and would bring significant experience to the evaluation of a separation transaction at Masimo.”

Masimo Management Has Yet to Respond

Politan’s investor outreach was distributed this Monday, and so far, as of the writing of this article mid-day Tuesday, there has been no response from Masimo management. While a response is not required, I suspect Kiani may want to try and counter the unflattering characterization of his management of the company.

I have had many Strata-gee readers tell me of their disdain for “activist investors.” But no matter how you view them – and much to the chagrin of CEO Kiani – Quentin Koffey does a good job of connecting with investors by speaking their language. He also is able to tap into their frustration with the turn of events at Masimo – clearly Kiani’s doing – that caused such a massive drop in the value of their investment.

So hold on! It’s going to be a wild ride!

See more on Masimo at masimo.com.

Leave a Reply