Gentex Corporation (Nasdaq: GNTX) announced its financial results for the fourth quarter (4Q) and full year (FY) of Fiscal 2024. The results spooked investors as the company appeared to be cruising to a solid, probably single-digit growth year through the first three quarters. In fact, the company was predicting a year of record net sales through the first nine months of 2024. Then…the fourth quarter happened…

Analysts on an earnings call had a lot of questions about management’s guidance miss, the reasons for the performance decline at the end of the year, and what the company plans to do with Voxx when the deal finally closes.

See more on the Gentex results for 2024 and what happened in the 4Q…

Gentex Corp. is a Zeeland, MI-based manufacturer of auto parts for the automotive industry. They describe themselves as “…a leading supplier of digital vision, connected car, dimmable glass and fire protection technologies.” But, by far, its biggest product category is automotive mirrors, both interior and exterior.

Auto Parts Maker Gentex was Crusing Toward a Good Year, Then…

In mid-December 2024, Gentex announced its intention to acquire Voxx International Corporation (Nasdaq: VOXX) in an all-cash transaction for $7.50/share for all outstanding shares. The deal includes all of Voxx, including its Premium Audio Company division which manages three audio brands – Onkyo, Integra, and Klipsch. Interestingly, Gentex has no existing audio business experience – so this is a dramatic (and perhaps a little suspicious) potential diversification from its core auto parts business.

Things seemed to be going fairly well for Gentex in 2024 until the end of the third quarter when it was time to provide updated guidance for the fiscal year – just one quarter away from completion. This guidance was revised downward slightly and reiterated as late as early October (in the fourth quarter). The problem is, apparently things in November and December went awry. And it was this fact, a guidance miss that hit so quickly…and so unexpectedly…that financial analysts kept asking management to explain what happened during a Q&A session on the quarterly earnings call.

A Sobering Fourth Quarter Result

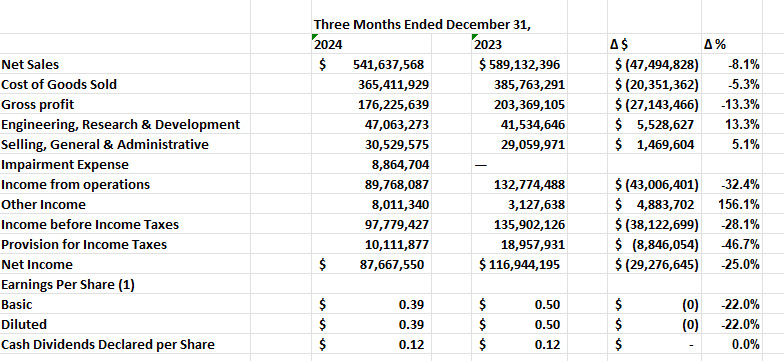

So, I’m going to start with the fourth quarter performance, as it is where all the action was. Gentex reported net sales of $541.6 million in the quarter, a result that was down $47.5 million or off 8% as compared to net sales of $589.1 million in the fourth quarter of fiscal 2023. Like I said, this result was a complete surprise to everyone, including Gentex management apparently – although the company did adjust its annual guidance downward at the end of 3Q which now, in retrospect, looks like a bit of foreshadowing.

After reporting the net sales number for the fourth quarter – and perhaps in an effort to provide an excuse for its revenue miss – the company told investors that in industry-wide data, light vehicle production decreased by 5% quarter-over-quarter in its principal markets of North America, Europe, Japan, and Korea. Gentex said it was a combination of this production weakness, along with what it calls the “build-mix” weakness that led to their “lower-than-forecasted revenue.”

CEO: ‘Significant Weakness in Our Primary Markets’

During the fourth quarter, there was significant weakness in our primary markets that impacted both light vehicle production volumes and product mix during the quarter (sic). We believe that a number of our OEM and Tier 1 customers looked to improve their incoming inventory levels during the quarter, and built a weaker mix of vehicles versus the trends we have seen over the last several quarters. As an example, approximately one half of our revenue shortfall in the fourth quarter came from lower-than-expected full display mirror unit shipments. Unfortunately, these changes all occurred within the quarter causing a significant variance from our beginning of quarter forecast.

Steve Downing, Gentex Prresident and CEO

Turning to profits, Gentex reported that its gross margin in the fourth quarter was 32.5%, a significant two-point decline compared to a gross margin of 34.5% in the same quarter last year. The company attributed this decline to the lower-than-expected sales volume, weaker product mix, and the “inability to leverage overhead costs.” It noted that these factors offset ground the company had made in a multi-quarter effort to reduce material purchasing costs.

Operating Expenses Increased 22%

Not helpful in a quarter of sales declines and compressed margins, operating expenses during the quarter actually increased by a painful 22% to $86.5 million. The company says this is due to “staffing and engineering related professional fees, with total operating expense for the quarter also impacted by intangible asset impairment charges of $8.9 million related to a technology acquired in 2020.”

What is an “impairment charge”? I don’t have enough detail from this report to answer that question specifically in Gentex’s case, but it typically means that a past acquisition is worth less today than it was at acquisition and the company must adjust its financials to recognize that diminished value. [NOTE: this is an ominous sign, with the company now in the process of another acquisition…the acquisition of Voxx.]

Income From Operations and Net Income are Down

Continuing to analyze profits, Gentex reported income from operations in 4Q of $89.8 million. This is down by $43 million or 32.4% lower than income from operations of $132.8 million in the last quarter of the previous fiscal year. Ouch!

Which takes us to the bottom line. The company says that net income in the fourth quarter came in at $87.7 million, down $29.2 million or 25% as compared to net income of $116.9 million in the same quarter in fiscal 2023. On a per-share basis, earnings work out to $0.39 versus last year’s $0.50 in the 4Q.

So what does this challenging fourth quarter mean for the full fiscal year? Let’s take a look…

Fiscal 2024 Full Year Results, A Record By the Skin of Its Teeth

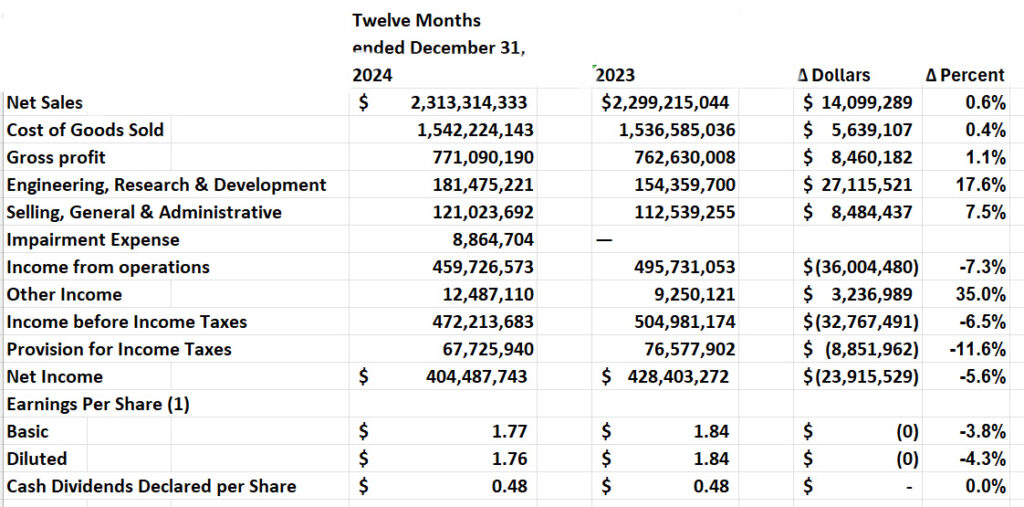

In one way, the company did deliver on its promise to have a record year…just barely. Net sales in fiscal 2024 were $2.31 billion or up just around $10 million or so over net sales of $2.30 billion in fiscal 2023. That is a company record…they call it a 1% increase over fiscal 2023. My calculator puts it more like a .6% increase…just hitting a new record by the skin of their teeth. That’s pretty much flat, in my eyes.

The company tells investors they achieved this record result even in the face of “…light vehicle production in 2024 that decreased year-over-year by more than 4% in the Company’s primary markets.”

Gross Margin Increases Just One-Tenth of One Percent

Gross margin in the fiscal year was 33.3% as compared to gross margin of 33.2% in fiscal 2023 – up just one-tenth of one percent due to “supplier cost reductions” and “lower freight costs.”

Despite the many headwinds that impacted revenue and gross margins in 2024, we were able to continue to make improvements to the gross margin profile of the Company. The improvements made in 2024, combined with our targeted improvements for 2025, provide the roadmap and plan to achieve a target of

Steve Downing

approximately 35% gross margin by the end of 2025,

Operating Expenses Increased 17%; The Bottom Line Dropped 5.6%

Operating expenses were $311.4 million, a $44.5 million or 17% cost-side increase. The reason for this notable increase is that the company says it “has been investing heavily in engineering capability over the last two years in order to support the elevated rate of launches driven by customer awards, to accelerate our research and development activity necessary to execute the new technologies and product roadmaps showcased at CES, and to fund R&D activity required to achieve product redesigns in support of our cost improvement initiatives.”

The bottom line for fiscal 2024? Net income for the full year came in at $404.5 million. This is $23.9 million or 5.6% less net income compared to the $428.4 million in net income in fiscal 2023. So a less than 1% increase in sales resulted in a drop of 5.6% in net profits.

Segment Sales Results

The company disaggregated its total net sales number down to select product groups. The numbers are s follows…

- Automotive net sales in the fourth quarter were $531.3 million compared to $578.7 million last year…a drop of $47.4 million or 8.2%

- Automotive net sales in the full fiscal year were $2.26 billion in 2024 versus $2.25 billion in fiscal 2023, an increase of $10 million or about four-tenths of a percent.

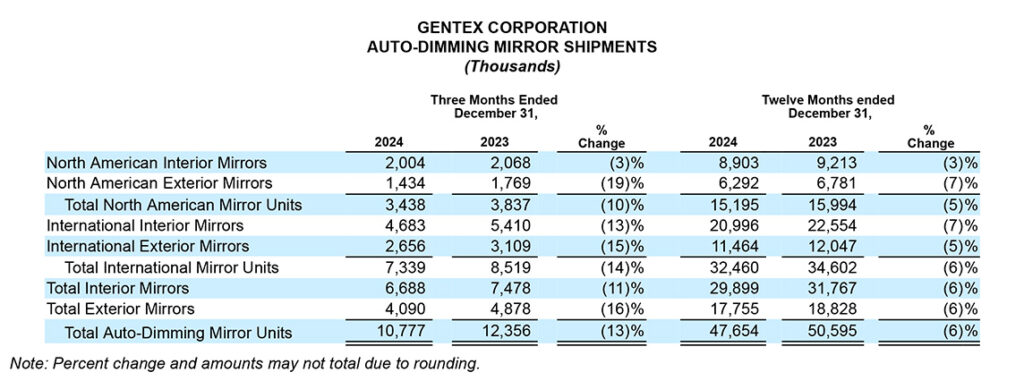

- The company noted that overall automobile mirror unit shipments declined by 6% versus fiscal 2023, but its Full Display Mirror line saw unit shipments increase by 21% to 2.96 million units.

- Other net sales (dimmable aircraft windows, fire protection products, and medical products) in the fourth quarter of fiscal 2024 came in at $10.3 million, down $200k or 2% compared to net sales of $10.5 million in the same quarter last year.

- Fire protection sales increased by 5% in the quarter YoY

- Dimmable aircraft windows decreased by 23%

- Medical product sales were $600k

- Other net sales for the full fiscal 2024 year came in at $48.6 million, compared to Other net sales of $44.6 million in fiscal 2023. This is a $4 million or 9% increase.

- Fire protection sales increased 4% YoY

- Dimmable aircraft windows increase by 9%

- Medical product sales were $1.4 million

A Robust Question-and-Answer Session with Analysts

The company offered an impressive presentation for financial analysts on a conference call the day these results were announced. Impressive I might add for the fact that the Q&A session lasted a full hour or so and a serious contingent of analysts participated in the event – including analysts from JP Morgan, Morningstar, Goldman Sachs, Robert W. Baird & Co, UBS Equities, and more.

Most of the analysts closely questioned CEO Downing and other managers on the details of how they missed their target. But the other question of the day centered around the recently announced acquisition of Voxx, including the Robert W. Baird & Co. analyst who asked Downing to comment on when the Voxx acquisition will close and if he could share “…maybe a couple of strategic imperatives once you close the deal just in terms of key action items that investors should expect in 2025.

Analyst: What are Your ‘Strategic Imperatives’ in 2025 With Voxx? CEO: We’ll Get Back to You

On the first item, Downing said they expect the transaction to close around the end of the first quarter of 2025…the quarter we’re in now. On the second question of “strategic imperatives” – in other words what are you going to do with it (Voxx) – Downing side-stepped it. The CEO says once the deal is closed, “…we’ll be talking about other disclosures that we’ll be making about the future of that business.”

Finally, after several questions from different analysts trying to get some specificity on what to expect from the Voxx acquisition, both the CEO and the CFO told analysts that it will take the company 18-24 months to digest the acquisition and form a go-forward strategy…so standby for more on that.

CFO on Voxx: There are Immediate Cost Savings Opportunities

However, in a question from the JPMorgan analyst, CFO Kevin Nash did point out that there are some immediate “cost savings” opportunities. “I mean some of those costs go away right away…things like insurance, and SEC, and auditors – and those types of things. And then beyond that is really looking at the strategic part of the business [to find more cost savings opportunities].”

Nash also mentioned additional savings could come from joint purchasing arrangements. “And leveraging our spend, we’re a bigger company [with a] bigger electronic spend,” Nash said. “They buy a lot of electronics.”

CFO: We Can Become a Manufacturer of Voxx Stuff; CEO: Voxx Will Provide Capital We Can Use

Finally, Nash added this tidbit, “And then longer term, looking at strategic places where we can become a manufacturer of some of the stuff that they [Voxx] make.”

Downing also jumped in and added this thought, “But then more importantly, if we’re successful in the integration [of Voxx], it will actually provide additional capital that we can use towards our capital allocation strategy.”

Here’s the Thing

Gentex announced its intention to acquire Voxx on December 18, 2024. By then, its management almost certainly knew the reality that its fourth-quarter results were not going to be good. And it was easy to sense the nervousness of analysts who saw a quick and unexpectedly rapid deceleration of the company’s business.

Yet even knowing that reality, the company launched an acquisition of Voxx. Just a coincidence? I doubt that but at the same time, the company – at least for now – is failing to explain the logic of this acquisition.

The Ghost of Masimo’s Acquisition of ‘Sound United’; Wall Street Reacts to Gentex Results

And that, folks, feels very much like when Masimo announced the acquisition of Sound United back in 2022. Masimo also did not share its vision with investors about why the Sound United acquisition made sense. Downing suggests they will be able to better address those questions/issues after the closing.

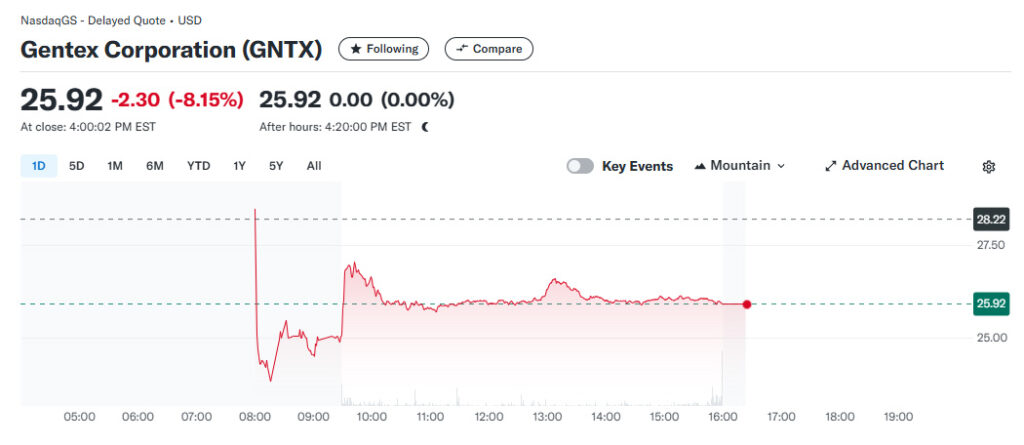

Gentex released its financial results before markets opened on January 31, 2025. If you look at the stock chart above you can see how investors reacted to its results. After opening the day at $28.22, shares in GNTX immediately dropped and ultimately dropped by $2.30 to close at $25.92…a loss of 8.15% of its value by the close of the market that day.

Learn more about Gentex by visiting gentex.com.

As a major supplier of automotive mirrors, Centex is in a good position to repeat Harman’s successful audio ventures.