Gentex Corporation (Nasdaq: GNTX) has reported its financial results for the second quarter of Fiscal 2025, the 90-day period that ended on June 30, 2025. For the most part, results looked better than initially expected, although much of the upside improvement in revenues was largely thanks to the acquisition of VOXX Int’l, the company that owns audio brands Onkyo, Integra, and Klipsch as well as other automotive electronics brands. That acquisition closed on April 1, the first day of the second quarter.

However, the profit contribution of VOXX was a different story.

Learn all about the Gentex results in its second quarter

So we have to acknowledge the 800-pound gorilla in the room. Gentex’s acquisition of VOXX literally closed on April 1, 2025. Then, on April 2, 2025, the Trump administration announced what it called “Liberation Day,” launching a massive global tariff program that ultimately at one point reached 145% assessment increase (for imports from China)…throwing the business world into turmoil. Looked at through that lens, Gentex has much to be pleased with in this report.

First Gentex Report to Include VOXX, PAC, Onkyo, Klipsch, Integra

However, having said that, while the tariff situation is not yet settled, it is far more controlled now and most companies – like Gentex – have adjusted operations, rejiggered suppliers/supply chain, (cutting costs as much as possible) and raised prices to adjust for the new tariff levels. While the situation couldn’t necessarily be described as “normal” – it’s more like “normal-ish,” – business is proceeding mostly uninterrupted.

With this being the case, I will turn my usual critical eye to this Gentex financial report – the first one in which VOXX and Premium Audio Company (PAC) (Onkyo, Integra, and Klipsch) are included in its results.

Before I begin, let me say that I couldn’t help but to shiver, as I felt a distinct chill down my spine reviewing this report, listening to management, and hearing the probing questions from financial analysts. It reminded me of something…

Why? Because in the shadows and echoes of all of them, I distinctly hear the ghost of Masimo & Sound United…

Getting Down to Gentex’s Performance

The great American writer and humorist Samuel Clemens (aka Mark Twain) is widely credited with saying, “History doesn’t repeat itself, but it rhymes.” That quote feels quite proper in recognizing how Gentex is incorporating VOXX/PAC into its operations in a way that echoes how Masimo incorporated Sound United into its operations. Later below, I’ll get into how the Gentex/VOXX/PAC combination is rhyming with the Masimo/Sound United combination…

But first, let’s get into Gentex’s performance in the quarter. Let me say here, I would appreciate a little more transparency from Gentex. The way they presented their results was, first, they would announce combined results (with Gentex & VOXX results summed)…then they note the performance variation as compared to the same period from the year before. Of course, in the year before, they did not have VOXX/PAC in their numbers…so revenues jump up quite nicely – but there is no “organic” comparison on the VOXX/PAC numbers. The company only provides what they call “core” Gentex (non-VOXX) numbers compared to previous Gentex-only results.

Key Fiscal 2025 Second Quarter Results

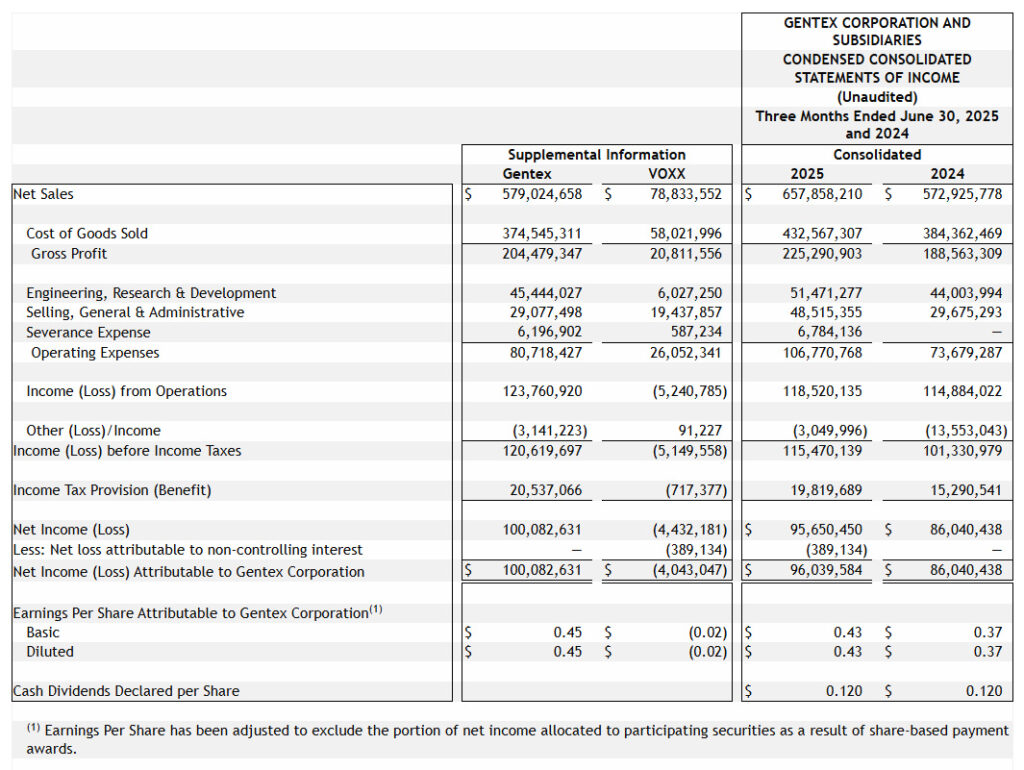

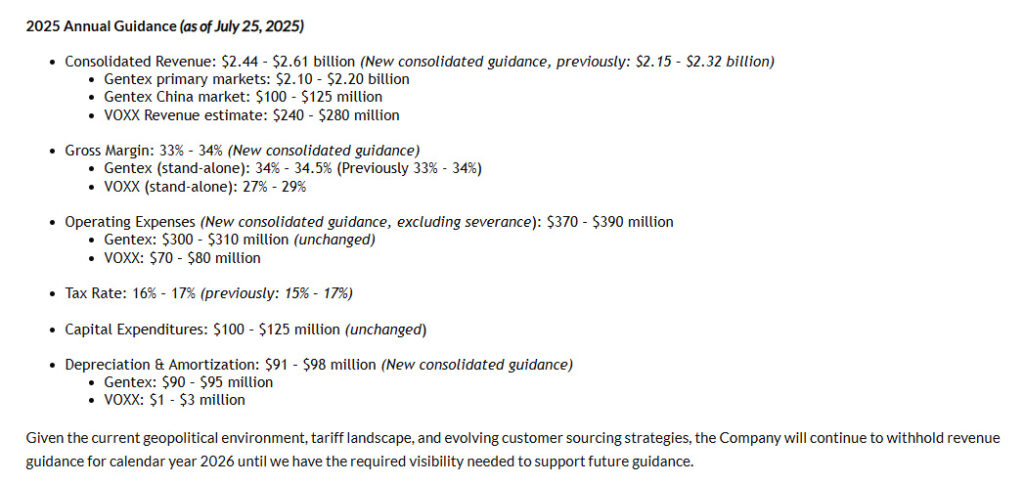

Gentex reported consolidated net sales in the quarter this year of $657.9 million, which is an increase of $85.0 million or 15% when compared to net sales of $572.9 million in the second quarter of Fiscal 2024, “…which did not include VOXX.” “Core” Gentex revenue (minus the VOXX numbers) came in at $579.0 million this year, which is a 1% increase or essentially flat compared to the same quarter the previous year. The company noted that even this 1% increase was impressive considering that “light vehicle production” by the automotive manufacturers (Gentex’s customers who install their automotive mirrors) was down 2% in the quarter.

Total VOXX contribution to consolidated net sales in the quarter was $78.8 million. Note that Gentex does not provide VOXX’s organic performance (compared with its results from last year). Keep reading…I’ve got you covered!

‘Pleased With Our Sales Levels’

Given the overall weak light vehicle production in our primary regions, we are very pleased with our sales levels this quarter. This is particularly notable given the impact that tariffs and counter-tariffs have had on demand for our products, especially in the China market. Overall sales into China for Gentex during the quarter were approximately $33 million compared to our beginning-of-year forecast of $50 to $60 million for second quarter sales into the domestic China market. Despite revenue headwinds related to tariffs and reduced sales into the China market, the Company more than offset these challenges through strong growth in Full Display Mirror (FDM) and other advanced features, along with incremental revenue from the VOXX acquisition.

Steve Downing, Gentex President and CEO

In this public announcement of the quarterly results, the company did provide a detailed breakdown of sales of Gentex products both by type of automotive mirror and by geographic region. But it offered no such information on any of the VOXX/PAC products…neither automotive electronics nor consumer electronics. It is possible that when the company follows up with a more formal 10-Q filing with the Securities and Exchange Commission (SEC), we may get more of those details.

Profit Picture Potentially Presents a Problem

Gentex said that its consolidated gross margin came in at 34.2%, a nice 130 basis-point increase compared to a gross margin of 32.9% in the same quarter last year (which again does not include VOXX). The core Gentex gross margin (pulling VOXX out of the consolidated number) came in at 35.3%. a 240 basis-point increase compared to the second quarter of 2024.

Did you see that? When taking VOXX out of the numbers, Gentex’s gross margin improved…substantially. Interestingly, the company had no comment on that. Instead, it offered a more favorable quarter-over-quarter discussion, noting that the gross margin improvement this quarter, when compared with the first quarter, “was primarily driven by purchasing cost reductions, improved mix, and operational efficiencies, that were partially offset by tariff related costs that were not reimbursed in the quarter.”

I will show you below why the gross profit margin declined when VOXX’s numbers were added to the Gentex results. We’ll get to that in a minute.

Operating Expenses Jump 45%

Consolidated operating expenses during the quarter this year were $106.8 million, compared to operating expenses of $73.7 million in 2Q of 2024 (again, which does not include VOXX). That is a $33.1 million or 45% increase in operating expenses. Says Gentex, “The increase was primarily due to the VOXX acquisition, which accounted for $23.9 million of the increase (excluding acquisition and severance costs).” On top of this, the company incurred an additional $2.5 million in acquisition-related costs and $6.8 million in severance-related expenses…neither of which existed in the second quarter of 2024.

Operating expenses attributable to VOXX came in at $26.1 million. This includes nearly $600,000 in VOXX-specific severance expenses and another $1.5 million in other acquisition-related costs. This means that the VOXX’s division is worth about 12% of revenues, but more than 24% of operating expenses.

Taking VOXX out of the picture yields a Gentex core operating expense of $80.7 million compared to $73.7 million core operating expense during the same quarter last year. That is an increase of $7 million or 9.5%, much more modest than 45% with VOXX in the picture. The company notes that the increase includes $1.0 million in additional acquisition-related costs and $6.8 million in severance-related expenses, which weren’t factors in the quarter last year.

Why Operating Expenses Jumped So Much

Are you wondering about those millions of dollars in severance expenses and additional acquisition expenses? CEO Downing steps in to provide an explanation…

Operating expenses have moderated substantially in 2025, which is in line with our expectations, strategy, and execution stemming from our cost reduction programs. During the second quarter, the Company incurred severance-related expenses of $6.8 million, of which $6.2 million were related to core Gentex operating expenses, and were driven by early retirement incentives offered to long-tenured employees. The Company also incurred approximately $2.5 million in transaction costs, of which $1 million was related to core Gentex operating expenses during the quarter. Adjusting for those items, core Gentex operating expenses were down slightly on a quarter-over-quarter basis.

Steve Downing

Income From Operations…and…’Other Loss’

Total income from operations in the quarter this year came in at $118.5 million, up $3.6 million or 3.1% compared to income from operations of $114.9 million in the second quarter of 2024, which does not include VOXX. Core Gentex income from operations (excluding VOXX) came in at $123.8 million, an 8% increase over the same quarter last year. Once again, the profit picture looks better when VOXX is not included.

Why is that the case? Because, while the Gentex business unit booked an income from operations, the VOXX unit generated a fairly significant “loss“ from operations of $5.2 million.

In an item the company calls “other loss,” it notes a loss of $3.0 million in 2Q of Fiscal 2025, as compared to an other loss of $13.6 million in the same quarter last year. The company notes that during the quarter this year, it took a $6.2 million impairment charge “related to one of the Company’s equity method investments.” But hey, that’s better than last year in the same quarter when the company had to take a $16.6 million loss “resulting from the fair value adjustment of its investment in VOXX.” Yikes!

Net Income…The Proverbial Bottom Line

Consolidated net income for the quarter this year came in at $95.7 million, up $9.7 million or 11.3% compared to a net income of $86.0 million in the same quarter the previous year. The company attributes the increase in net income to “higher income from operations, supported by gross margin expansion and slightly lower operating expenses.”

Core Gentex net income was a more impressive $105.8 million, up 23% compared to the same quarter last year. And, again, the VOXX unit booked a net loss of $4.4 million.

Strata-gee VOXX Organic Analysis – ’25 vs ’24

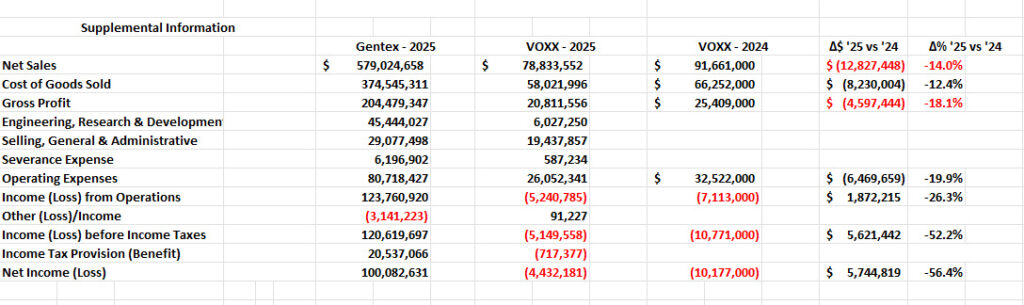

One thing that frustrated me as I read this report is that Gentex made no effort to provide any type of organic analysis to show how VOXX was performing as part of Gentex versus when it was an independent company. So I’ve put together a rough and dirty analysis to provide Strata-gee readers with just such an analysis.

One problem with this analysis is that VOXX, when it was an independent entity, utilized a different Fiscal calendar. So I can’t exactly match the data, but I think we get pretty close. This report is based on Gentex’s Fiscal 2025 second quarter, which is the 90-day period that ended June 30, 2025. The Voxx quarter that most closely matches that is its Fiscal 2025 first quarter report which covers the 90-day period ending May 31, 2024.

Key Data Shows that VOXX is Still Struggling, Even Under Gentex Management

I only pulled out a few key pieces of data, but it was enough to show me that VOXX is still struggling with revenue declines and running a business that is generating losses rather than profits. The good news for Gentex is that it looks as though those losses are moving in a more positive direction, with losses decreasing.

If you’ll refer to my spreadsheet above you’ll see a total of six columns of data: reading from L-R, the first is the data item (i.e. Net Sales), the second column is Gentex ‘Core’ results, the third column is VOXX’s Core results under Gentex management, the fourth column is VOXX’s results as an independent company in the comparable quarter a year ago, the fifth column is the delta (difference) in dollars between VOXX’s 2024 & 2025 results, and the sixth column is the delta in percent.

VOXX Net Sales Decline and Generates Losses

You can clearly see, for example, that VOXX’s net sales in the quarter this year of $78.8 million were down $12.8 million or 14.0% from its net sales of $91.7 million in the comparable quarter last year. Gross profit dollars dropped from $25.4 million in 2024 to $20.8 million this year. VOXX generated a $5.2 million loss from operations and a net loss of over $4.4 million.

On the plus side, operating expenses dropped by $6.5 million, almost 20% year-over-year. And all losses were at a lower rate compared to last year. These are long-term trends that VOXX has struggled with for years, but Gentex is a new leader and losses appear to be moderating.

What Spooked Me? The Parallels Between Masimo/Sound United and Gentex/VOXX

So I think it’s fair to say we have to give Gentex time to learn the VOXX business and apply their different skill set and see if they can continue to vector VOXX back to profitability and sales growth. However, I mentioned earlier that reviewing the materials, listening to management in an earnings call, and learning more about their plans spooked me a little. Why?

Because I am hearing echoes of Masimo & Sound United. How so? Let me list the parallels between the two…

IRRATIONAL EXUBERANCE – I learned this expression from former Fed Chairman Alan Greenspan who was describing something he sees regularly on Wall Street when the market gets over-excited and drives valuations to unreasonable levels. I realize that Masimo & Gentex management are trying to sell the positivity of their plans to financial analysts, but sometimes the exuberance just goes over the top. I heard that regularly from Joe Kiani at Masimo, and I’m hearing it again from Steve Downing & team at Gentex

MARGIN DISPARITY – One of the key irritants to Masimo investors was the dramatic disparity between the margins that the company commonly generated in its professional medical business and those it could earn in consumer electronics. In the eyes of investors, Sound United’s results just kept polluting and pulling down Masimo’s better results. I see it here as well, at least two financial analysts asked Downing what he was going to do about the lagging margins in the VOXX business.

Needs a Strong Plan Effectively Communicated

POOR ARTICULATION OF STRATEGY – The day that Masimo acquired Sound United, the price of its stock collapsed as investors just didn’t get it. Masimo literally lost 38% of its market cap in one day. And yet the company failed to ever effectively communicate its plans, other than a couple of vague references to a hospital-to-home strategy. Deja Vu…it’s happening again – Gentex has spent scant time articulating a powerful strategy to demonstrate how acquiring VOXX will turbo-charge its business. There’s been some effort – using its auto industry contacts to broaden placement of VOXX’s automotive electronics products…take advantage of VOXX retail partners to open doors for Gentex’s PLACE line of smoke detectors…and use Onkyo/Klipsch to open doors in the home automation space for its expanding HomeLink (originally garage door openers) line. But I’m not sure investors are following this.

DUBIOUS PLANS – Furthermore, even if they did do a better job of articulating their strategy, I find some of these plans dubious. Masimo’s Joe Kiani clearly did not have a deep understanding of the audio business – nor did anyone else on his staff. Likewise, I find Gentex’s professed plans to be very lightly conceived – most likely from someone who does not truly understand the audio and consumer electronics business. I’m sure they are smart people and can learn as they go. But history has shown me this can be a very costly form of education

Learn more about Gentex by visiting gentex.com.

Leave a Reply