Organic Net Sales Decline 6.3%; Organic Net Income Slides 21%

Gentex Corporation (Nasdaq: GNTX) reported its financial results for the third quarter of Fiscal 2025, and for the first time, these results betray an impact from the Trump administration’s tariff program as well as slowing global economic activity. The company is also still struggling to more fully integrate Voxx International, acquired back in April 2025, into its operations and forward planning.

Organic results – which take Voxx out of the 2025 numbers for an apples-to-apples comparison with Fiscal 2024 results – showed a notable decline in net sales and a troubling double-digit decline in net income. Read on to see what the company said about these results…and to get my take.

Read all about the Gentix Q3 Results…

Gentex Corporation, the company says, is “a leading supplier of digital vision, connected car, dimmable glass, fire protection technologies, medical devices, and consumer electronics…” Even though consumer electronics gets bottom billing in the company boilerplate, it is the reason that Strata-gee started following the Michigan public company, as it is the new owner of important audio brands Onkyo, Integra, and Klipsch.

The Numbers Weren’t Terrible, But They Weren’t Great Either

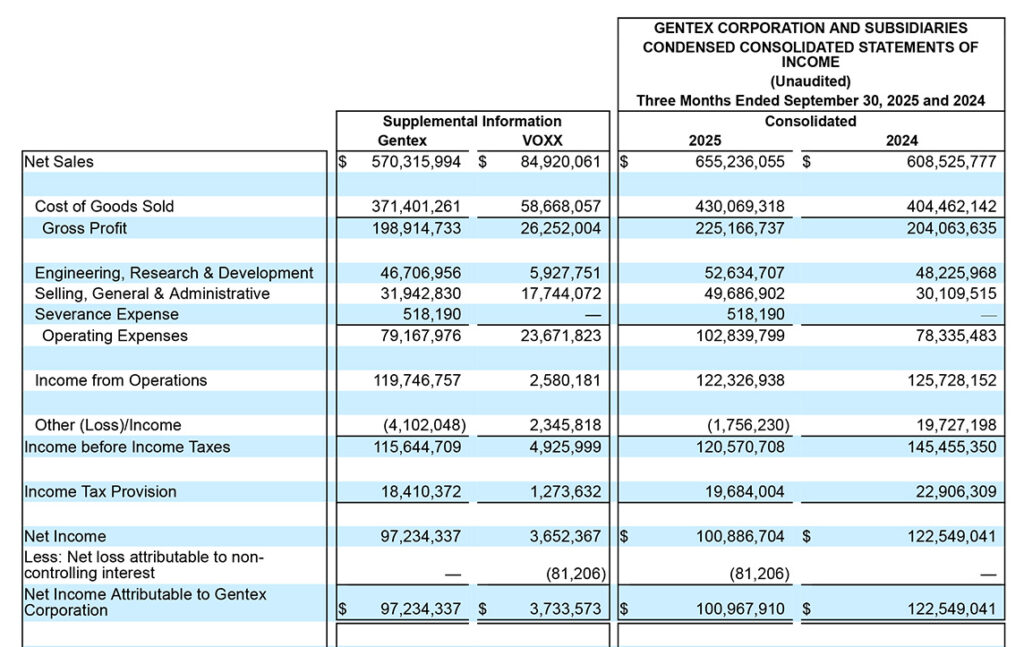

Like in the company’s second quarter report, the numbers were not terrible…but they weren’t exactly great either. On a consolidated basis, net sales came in at $655.2 million, up $46.7 million or 7.7%, compared to net sales of $608.5 million in the same quarter last year.

However, keep in mind that the company has the newly acquired Voxx results in its numbers this year, which aren’t present in the quarter last year. Voxx contributed total net sales of $84.9 million in the quarter, representing about 13% of total net sales.

Focusing on Organic Numbers for a Better Read on Ongoing Operations

To get a better sense of how continuing operations are performing, I like to look at “organic” results, in which the Voxx numbers are pulled out of the totals this year for a more accurate comparison. Gentex booked organic net sales of $570.3 million, a decline of $38.2 million or 6.3% compared to last year’s net sales of $608.5 million in the quarter.

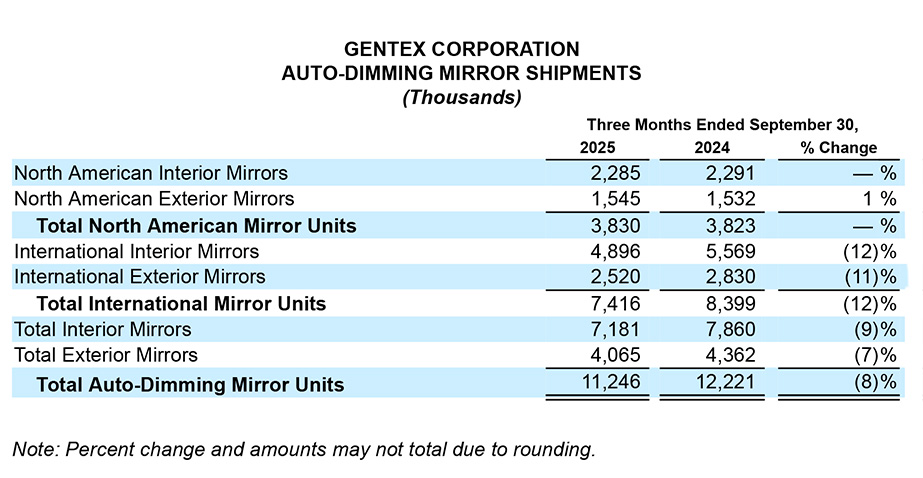

Gentex’s largest category of products that it manufactures are interior and exterior mirrors that are installed by the car manufacturer on an OEM basis. Consequently, their numbers are closely tied to auto manufacturers’ shipments. So it should be noted – and even the company admitted this – that its 6.3% decrease in organic net sales happened even though industry-wide light vehicle production in Gentex’s primary markets increased by 2% over the production levels in Q3 of fiscal 2024. Ouch!

No Pro Forma Numbers for Deeper Voxx Analysis

I also call your attention to the fact that in the formal announcement of its financial results from Gentex, the company made no effort to include pro forma numbers to represent Voxx’s performance from last year, as some public companies do to facilitate comparison.

Gentex CEO Steve Downing commented on the troubling net sales results, telling investors that in the “…third quarter…North American OEM revenue increased approximately 5% quarter-over-quarter, supported by robust production schedules and increased content per vehicle,” Downing said. But unfortunately for Gentex, net sales declined in other regions more than enough to offset that gain.

Gentex CEO Points to the Impact of Tariffs to Explain Challenging Results

It turns out that the global trade situation is troubled. “In Europe, revenue declined approximately 14% quarter-over-quarter,” Downing reported. He attributed Europe’s double-digit percentage decline to “customer-specific production challenges and a weaker regional vehicle mix.” Furthermore, the CEO said that in Europe, “light vehicle production volumes moved to lower trim-level vehicles that do not typically include higher-end Gentex features.”

But the situation gets even worse for Gentex as we move to other regions of the world…especially to China. Revenues in China, the company said, came in at just $34 million in the quarter. That result is fully 35% lower compared to revenues in China in the same quarter last year. Downing was direct as to the reason: “[This] decline reflects the ongoing impact of tariffs and counter-tariff actions.”

Financial Results Comparison Between 2025 to 2024

The Profit Picture Gets a Little Complicated; Yet Another Echo of Masimo

In the quarter, Gentex reported a consolidated (including Voxx results) gross margin of 34.4%. This is a 90 basis-point improvement over the consolidated gross margin of 33.5% in the same quarter last year. However, the core (organic) Gentex gross margin (pulling Voxx out of the numbers) shows a higher 34.9% gross profit margin. This is a 140 basis-point increase compared to the quarter last year. Why a higher gross profit without Voxx?

This can only mean that Voxx is a headwind to profits. And that is an echo of the Masimo and Sound United experience. Voxx was a non-core acquisition by Gentex, which is seeking to use it to help it penetrate new markets, but has not announced a strategy or plan on how it intends to do that. This is almost a direct echo of Masimo, which acquired a non-core company – Sound United – to help it penetrate a new market, but with no solid plan announced as to how it would achieve growth in that new market.

Margin Improvement Offset by ‘Impact of Tariffs’

CEO Downing addressed the gross margin improvement: “The ongoing improvement in gross margin reflects the Company’s disciplined focus on cost control and productivity improvements.” But here, as with its decreased net sales result, the CEO noted that things could have been better.

The gross margin improvement was, however, partially offset by incremental tariff-related costs, which negatively impacted margins by approximatelly 90 basis points compared to the third quarter of 2024. Despite the incremental impact of tariffs on our business, the Company improved the overall gross margin to levels not seen in several years.

Steve Downing, Gentex Corporation President and CEO

Despite Disciplined Cost Control, Operating Expenses Increase

Despite a concerted effort to trim costs and lower overhead, including offering employees an early retirement incentive program to cut headcount, Operating expenses still increased in the quarter, both on a consolidated basis and on an organic basis. The company reported consolidated operating expenses in the third quarter this year came in at $102.8 million, an increase of $24.5 million or 31.3% over operating expenses of $78.3 million in the same quarter the previous year. The company attributed the bulk of the increased expenses to the Voxx acquisition.

However, even on an organic basis, operating expenses came in at $79.2 million, an increase of just under $1 million or about 1.1% compared to the $78.3 million in operating expenses last year. The company said this increase was due to Voxx acquisition-related costs and Gentex severance expenses.

Income from Operations and Net Income Decline

As a consequence of the above results, Gentex’s Income from operations declined in the quarter, both on a consolidated and on an organic basis. The company reported income from operations of $122.3 million on a consolidated basis (down 2.7%), and $119.7 million on an organic basis (down 4.8%)…compared to income from operations of $125.7 million in the third quarter of fiscal 2024.

Finally, Net income declined on both a consolidated and organic basis as well. According to the report, consolidated net income came in at $100.9 million which is down $21.7 million or 17.7%; and organic net income came in at $97.2 million, down $25.3 million or 20.7% as compared to net income of $122.5 million in the same quarter last year.

Segment Specific Sales

The company did provide a breakdown of sales by business segment. In brief, they are as follows:

Gentex Automotive – Net sales in Q3 were $558.0 million, down 6.5% compared to sales in the division of $596.5 million in the quarter last year. The company attributed this decline to declining international sales to Europe an China (as discussed above).

Gentex Other – This is a small catchall segment that includes dimmable aircraft windows, fire protection products, medical devices, and biometrics. Sales in this division were $12.3 million in Q3 this year, an increase of 2.5% compared to sales of $12.0 million in the same quarter last year.

Voxx – Voxx net sales in the quarter this year came in at $84.9 million. The company provided no official comparison to last year’s sales. So I looked it up. Unfortunately, the fiscal quarters between Voxx and Gentex do not exactly align. But in my report on Voxx’s results for its Fiscal 2025 second quarter – the 90-day period that ended on August 31, 2024, the company reported net sales of $92.5 million. This was down 18.6% compared to net sales of $113.6 million in the same quarter in its fiscal 2024.

So Voxx’s net sales this year are down roughly 8.2% from its not exactly aligned quarter last year. This seems like an inauspicious start for Voxx as part of Gentex.

Updated Guidance for Fiscal 2025 Annual Results; Another Voxx Drop?

Finally, the company made some adjustments to its guidance for its projected final Fiscal 2025 results. Most of these were minor adjustments that shade slightly positive, but mostly not in a big way. For example, Gentex now says Consolidated Revenue for the year will come in at $2.5 billion – $2.6 billion. Previously, it forecast $2.44 billion – $2.61 billion.

In the case of Voxx, it now forecasts an annual revenue estimate of $250 – $275 million. Previously, it had estimated annual revenue of $240 – $280 million. By the way, Voxx’s revenues in Fiscal 2024, the last full year for which we have data, were $468.9 million. The midpoint for Gentex’s fiscal 2025 guidance for its anticipated Voxx revenues is $262.5 million. If that is where Voxx’s revenues for fiscal 2025 land, that will be a stunning drop of 44% from its Fiscal 2024 results.

Learn more about Gentex Corporation by visiting gentex.com.

Leave a Reply