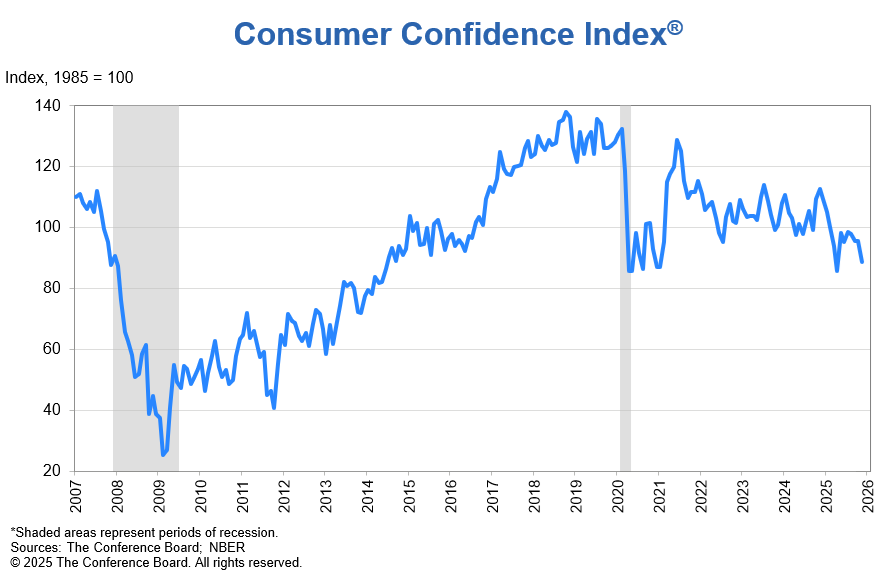

Last week, business group The Conference Board released the results for its November Consumer Confidence Index, a survey to gauge how consumers are feeling about the current and near-term future economy. The group reported a significant decline of 6.8 points in consumer confidence, a result that tends to support a similar finding by the University of Michigan Index of Consumer Sentiment, as I previously reported earlier in November.

Learn more on the November Consumer Confidence Index…

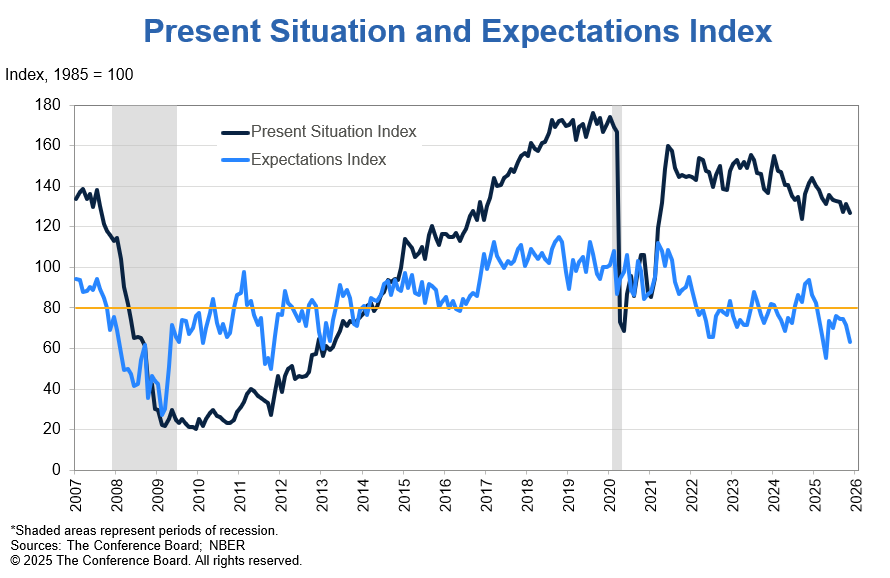

The Consumer Confidence Index (CCI) is comprised of two component surveys: one, a gauge of how consumers feel about their current situation – the Present Situation Index (PSI) – and the other on consumers’ outlook for the short-term future – the Expectations Index (EI). Both of these components showed solid declines, with the Expectations Index showing the greatest drop, indicating that consumers are feeling particularly pessimistic about future prospects for income, business, and labor market conditions.

Both the PSI and EI are then combined to create the overall rating known as the Consumer Confidence Index. As mentioned above, the CCI dropped a substantial 6.8 points to come in at a reading of 88.7 in November as compared to a reading of 95.5 in October. This is the lowest CCI level since April.

Economists Had Expected a Substantially Higher Reading

According to CNBC, economists surveyed by Dow Jones were expecting a substantially higher reading of 93.2. “Consumers soured on the current economy and their prospects for the future, with worries growing over the ability to find a job,” the CNBC report noted.

The Consumer Confidence Index is centered on a base reading – 1985=100 – which indicates the point at which consumer sentiment is at stasis or equilibrium. A reading over 100 indicates growing optimism, while a result under 100 reveals pessimism.

Lowest Level of Consumer Confidence Since April

Consumer confidence tumbled in November to its lowest level since April after moving sideways for several months. All five components of the overall index flagged or remained weak. The Present Situation Index dipped as consumers were less sanguine about current business and labor market conditions. The labor market differential—the share of consumers who say jobs are ‘plentiful’ minus the share saying ‘hard to get’—dipped again in November after a brief respite in October from its year-to-date decline.

Dana M. Peterson, The Conference Board Chief Economist

The survey results showed that consumers have current concerns, as measured by the Present Situation Index, which dropped by 4.3 points. But the future apparently looks even darker to consumers, whose outlook for the near-term future, as measured by the Expectations Index, dropped by a more substantial 8.6 points to a reading of just 63.2. According to the Conference Board, the EI has been tracking below a reading of 80 for ten consecutive months – a fact which signals a recession ahead.

Confidence Eroded for All Demographic Categories

All three components of the Expectations Index deteriorated in November. Consumers were notably more pessimistic about business conditions six months from now. Mid-2026 expectations for labor market conditions remained decidedly negative, and expectations for increased household incomes shrunk dramatically, after six months of strongly positive readings.

Peterson

Economist Peterson noted that confidence eroded for all demographic age groups, with the exception of those under 35 years old. Confidence also fell for consumers in nearly all income cohorts – although it ticked up slightly for those earning less than $15K annually. However, this group remains the least optimistic among all income groups. Finally, confidence dropped with consumers of all political affiliations, but the decline was steepest among those identifying as independent voters.

Consumers Point to ‘Prices and Inflation,’ ‘Tariffs and Trade’ As Main Factors

Consumers’ write-in responses pertaining to factors affecting the economy continued to be led by references to prices and inflation, tariffs and trade, and politics, with increased mentions of the federal government shutdown. Mentions of the labor market eased somewhat but still stood out among all other frequent themes not already cited. The overall tone from November write-ins was slightly more negative than in October.

Peterson

CNBC’s report noted that on the same day that the Conference Board released the Consumer Confidence Index, payroll processing firm ADP released a report that showed that companies cut an average of 13,500 jobs over the past four weeks. This report reinforced the pessimism expressed by consumers concerning job prospects in the next six months.

Consumers Expect Inflation to Rise Further

Finally, survey respondents expect the rate of inflation to rise, with the median estimate of inflation over the next twelve months coming in at 4.8%. Inflation is currently 3.0% (September reading).

Learn more at conference-board.org…

Leave a Reply