Blames Tariffs & Slowing Spending; Company to File Bankruptcy

Shocking news emerged at the end of last week as we learned that Southern California multi-location retailer Howard’s Appliance suddenly closed all stores. Local media is struggling to get details on the situation, but here is what we know so far: Howard’s Appliances, a large and formerly successful independent TV, Appliance, and Mattress retailer in Southern California, just days after Black Friday, suddenly announced to employees it would be closing in two days. No reason was provided, and all employees were laid off as of December 6.

There was no formal announcement circulated to customers, and some have taken to social media to complain that they had deposits on various appliances and were waiting for delivery…delivery that is apparently not coming.

Learn more about Howard Appliances closing…

Howard’s Appliance employees have also resorted to social media, expressing shock and anger at the sudden closing with very little warning. Many expressed anger over losing their jobs in the heart of the holiday season. Many others conveyed dismay and anguish over the impact that this closing will have on their clients.

An Especially Surprising Turn of Events Considering New Investment Just Months Ago

It was an especially surprising turn of events considering the fact that the company had recently received an infusion of cash from a new owner who had just acquired Howard’s in April 2025. That new owner is S5 Equity, a private equity company based in Newport Beach, California.

Howard’s Appliance was founded in 1946 by Howard Roach in San Gabriel, California. Initially, it was a radio repair shop – radios were a big business in those days. Over time, the company expanded product categories and locations to become one of the largest independent retailers in Southern California. With a total of 17 locations at its peak, Howard’s carried full lines of appliances, TVs, and mattresses.

One of the First to Offer Luxury Products and Experience Centers

They also were one of the first TV appliance dealers to offer high-end appliances and even opened several locations designed as its signature Experience Centers. These Experience Centers sought to cater to a higher-end clientele with a higher design concept styling and assortment.

On April 7, 2025, Howard’s was acquired by S5 Equity, a private equity company founded and run by the Steinhafel family. S5 itself is a relatively young company. It made its first investment in 2022, according to the Orange County Register. That first investment, in which it partnered with Prelude Wine Holdings, was in Wiens Cellars in Temecula, California. In August 2024, S5 acquired Hammacher Schlemmer, an online and print catalog retailer of “recreational goods.”

S5 Also Invests in Hammacher Schlemmer, Wiens Cellars, and Heartland America

In March 2025, S5 invested in Heartland America, an online retailer of more mainstream consumer products, such as electronics, home goods, apparel, and collectables. It is a very discount and deal-centric type of enterprise. Then, one month later, in April, S5 acquired Howard’s.

On its website, S5 presents its ideal target investment as described below.

At S5 we pursue acquisition opportunities in the lower middle market within North America. Our focus is companies generating revenue between $10 million to $500 million and often facing profitability challenges. Primary sectors of interest include consumer product, retail & eCommerce, media & publishing, technology, and manufacturing.

S5 Website

Acquisition About Building Upon Howard’s Legacy

At the time of the Howard’s acquisition, S5 said in its formal announcement that “This acquisition underscores S5 Equity’s commitment to investing in businesses with strong brand equity and untapped growth opportunities.”

Said Howard’s CEO Peter Boutros in the announcement: “With this acquisition, Howard’s is now poised for the future. It’s not just about sustaining our legacy – this acquisition is about building upon it.”

Shuts Down Howard’s Just Months After Acquiring It

Yet only about 8 months later, S5 shut Howard’s down. The company’s demise was so quick and so contrary to how the company told employees the partnership would work that many of them began to speculate on social media that perhaps S5 purchased the company for the purpose of shutting it down.

Yup I was an employee until the last minute when they just told me pack up and be out by 5 I am truly sorry to all my clients if I could have done anything I would have (they shut down the computers before they even told us). The ones that I do have the contacts for im recommending get in touch with their bank so anyone here should do the same. I loved howards but the last 2 ceos destroyed the company and absolutely FUCKED the employees. If any of you are here Merry Christmas and Goodluck i guess.

Bruffalobill, Reddit [unedited]

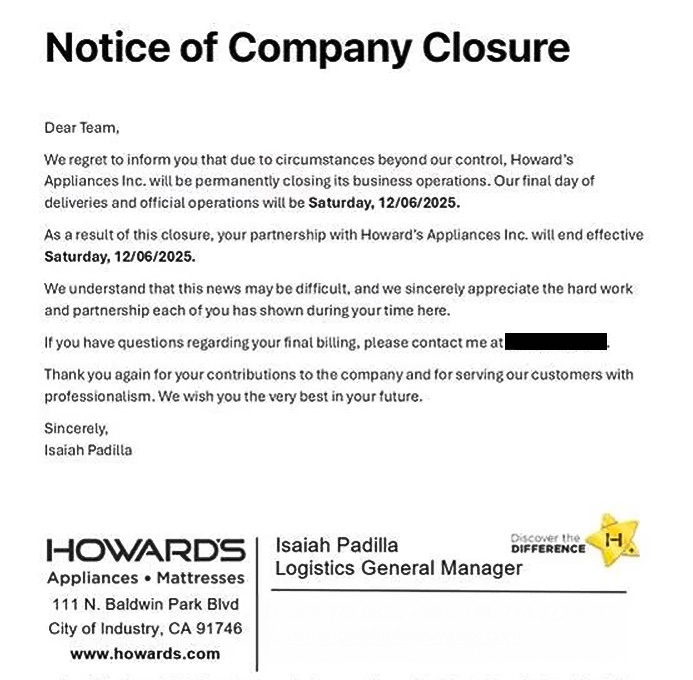

Notice of Closure to Employees Provided Just Two Days Before Closing

On December 4th, the week after Black Friday, employees received notice that the chain was shutting down on December 6th. They received a note from Isaiah Padilla, the company’s logistics general manager. This note was posted on social media, and I have included a copy of it below. Note that I have not independently verified it, but this note is consistent with how it was verbally described to me by another source.

Howard’s Lawyer Reveals Company Will File Bankruptcy

David Goodrich of the Golden Goodrich law firm in Costa Mesa, California, spoke on behalf of Howard’s with the Southern California News Group.

Despite our best efforts to overcome tariffs, declines in consumer spending, and other macroeconomic challenges – we have made the difficult decision to file for bankruptcy and close our doors. This was not a decision made lightly, but one that became necessary given the current economic landscape.

David Goodrich, with the Golden Goodrich law firm on behalf of Howard’s Appliances

Goodrich went on to say the company will file for a Chapter 11 bankruptcy, which provides the debtor protection from creditors to continue to operate (under court supervision) while creating a plan for court approval to ultimately exit bankruptcy as a viable business. The lawyer declined to give any specifics of the company’s situation, preferring to allow the filing to speak to those matters.

Nice excuse but, not ‘Buying it’ every pun intended – lol!

Retailers within a specific industry face similar direct tariff costs, the impact of those costs vary with each individual retailer based on what action they choose to mitigate cost increases. For those who decided that doing absolutely Nothing was best course of action will probably find their business in a similar state.

Howard’s manager Isaiah Padilla wrote they are closing the business operations due to “circumstances beyond our control” What exactly did Howard do to advert or mitigate cost increases or decline in consumer spending?

Options such as targeted marketing, lowering overhead costs where possible and promoting products with lower or no tariffs to weather the decline in consumer spending come to my mind

Doing NOTHING is Not a strategy its like watching choreographed SLOW DEATH

You know what action Howard had FULL CONTROL over – accepting NEW ORDERS and payment for items they KNEW they couldn’t deliver!

Number of customers complained on social media that they had paid for orders and were still waiting for deliveries.

Howard’s financial troubles started long before Tariffs why management didn’t use their most valuable resource marketing to hundreds of thousands of past customers well thought out marketing program handled properly, would have generated millions in new revenue

Sadly, Howard’s Appliance was losing market share and being brought down by negative reviews. Redefine Marketing Group stepped in to help manage their online reputation, starting with responding to negative reviews

You have no clue and your comments are BS. I worked for Howards for 25+ years. I saw and was part of the response they implemented as the appliance industry and foot traffic was slowing down. They brought in a new CFO which started cutting all expenses back , they laid off 1/3 of the sales and admin staff. This was way before S5. Sales were simply not coming back. Prior Leadership way overspent on fast expansion in areas that were not good. Specifically , West Hollywood, Agoura, Murrieta , and canoga park. The only group that actually did nothing was S5!! There was no infusion of cash from S5. In fact the current CEO at that time walked out and sued S5 due to them not helpinfg in any way with any money. However , S5 was taking huge executive salaries and a management fee!! Imagine that you take over a company that needs cash to help get back on their feet and you do nothing but take money out. I was there they did nothing, they didnt attend sales meeting which were done weekly , they stopped showing up to corporate, And many more items that I wont go into here. Howards was set up to fail by S5 , period. So get your facts straight before spewing BS.

Sounds very suspicious while David steinhefal and his dad mark own Erin cellars. And the father mark and his brothers and sisters. Own steinhafel furniture stores and mattress companies in Wisconsin. They also switched. To employees owned company and pulled. All the money out of the employed owned business. It sounds like a scam. They are stewing the employees and taking all the cash out of a the companies and making them. Employee owned. And leaving the employees with nothing They are scammers. And the attorney general needs to get involved.

Weins cellar. The steinhafel own. I meant