After the close of the stock market Wednesday, Sonos, Inc. released its fiscal 2023 second quarter (Q2) financial results. The numbers were pretty rough, but the company had previously adjusted its forward forecast downward. Yet even though the company’s latest Q2 numbers beat analysts’ revenue forecast and were in line with their guidance, the market reacted negatively. How negatively? Sonos’ stock lost more than 25% of its value on the day after the Q2 earnings were announced.

Why such a strong reaction? Read on…

See why investors were spooked after the Sonos earnings report

Before we delve into the why, let’s take a closer look at the what. Sonos’ second quarter is the 90-day period that ends on April 1, 2023. In releasing their results, the company issues a series of bullet points meant to represent the “Financial Highlights” of the quarter.

Here are those financial highlights, edited for brevity…

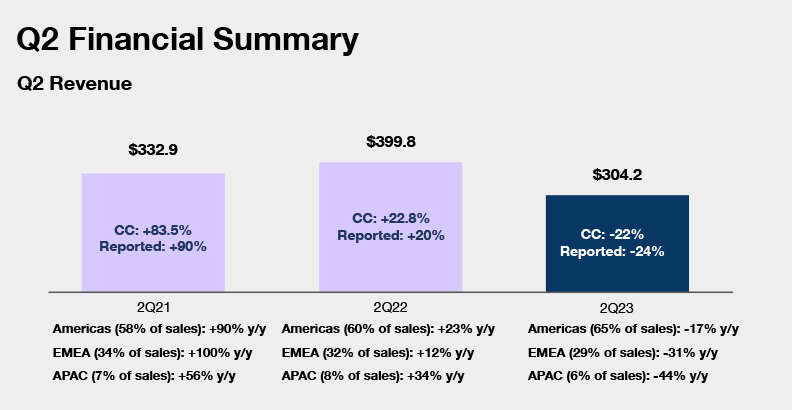

- Revenues declined 23.9% year-over-year (YoY) to $304.2 million

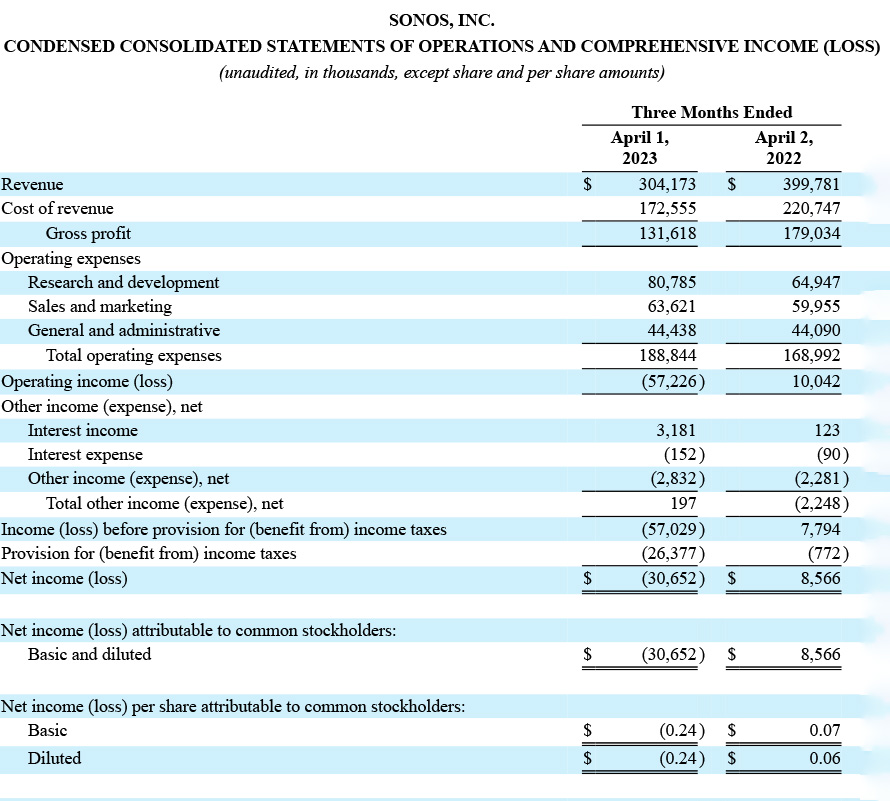

- Gross margin decreased a meaningful 150 basis points YoY to 43.3% – it was 44.8% in the quarter last year

- Sonos had a GAAP net loss of -$30.7 million versus a net profit of $8.6 million in the second quarter of 2022

- Non-GAAP net income of $5.7 million versus $36.8 million last year. This is a -84.5% drop from their own “adjusted” numbers

- Adjusted EBITDA of -$10.6 million compared to a positive $46.9 million last year

Remember, these are the “highlights”! You know you’ve had a tough quarter when all of your highlights are negative. To be fair, the company did introduce its new Era 100 and Era 300 speakers which is a positive development for them.

Though Revenues Declined, It was Less Than Expected

So it is true that analysts had anticipated a drop in revenues based on previously provided guidance from the company that contemplated a revenue drop of between -25% to -30%. So the -24% revenue decline was just slightly better than expectations. Although I note that this is the worst second quarter result in three years, as you can see in the chart above.

But what Wall St. had not been anticipating was such a dramatic drop in profitability. When you add a drop in revenue – even an expected one – with significant increases in almost all cost categories, your profits will most likely evaporate – as they did for Sonos.

Almost Every Cost Category Increased

Some examples include: Research & Development costs increased +24.4%, Sales & Marketing costs increased +6%, and General & Administrative expenses increased +1%. These cost increases combined to drive Total Operating Expenses up from $168.9 million to $188.8 million or 11.8%. As a result, the company went from an Operating Income of $10 million in the quarter in 2022, to an Operating Loss of -$57.2 million the same quarter this year.

‘We are Reducing Our Expectations for the Second Half’

This quarter we made outstanding progress in delivering on our product roadmap with the launch of two new game-changing products, the Era 100 and 300, both the best of their kind. And we entered a new product category with our SaaS-based Sonos Pro offering.

Patrick Spence, Sonos CEO

Though our second quarter results were in-line with our guidance, we are reducing our expectations for the second half of Fiscal 2023 due to softening consumer demand and channel partner inventory tightening. As a result, we are taking swift action to reduce our operating expenses and protect our profitability. We remain focused on ensuring that Sonos will emerge from the current choppy consumer environment in a position of strength: we are profitable, we are debt free, and we have a huge market opportunity. Continuing to innovate is critical to delivering on our long-term growth ambitions and I have every confidence in our ability to continue to do so.

Select Sales Analysis

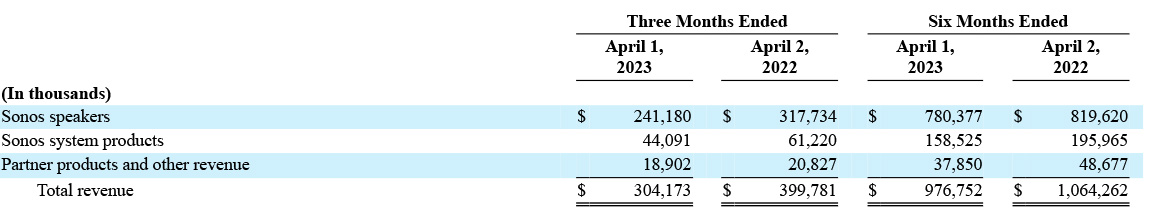

In looking at tables of disaggregated sales, we find a sobering trend. For example, in sales broken down by product category, all categories declined in the quarter this year. The company has three basic categories of products, direct sales of their own smart speaker systems called Sonos Speakers, sales through custom integrators called Sonos System Products, and sales through partners such as Sonance and IKEA called Partner Products.

As you can see in the table above which shows both the second quarter and the first half of the year, all categories declined. Sonos speakers declined -24% in the quarter, Sonos system products declined -28%, and Partner products declined -9.2%. Partner products declined the least, but it is also the smallest category.

How Sonos Spooked Wall Street – Revised Guidance Downward for the Rest of the Year

I think probably the biggest impact on investors was the company attributing their disappointing performance to slackening consumer demand and channel partner inventory tightening. In fact, demand is dropping so much, the company was forced to revise its fiscal 2023 guidance downward.

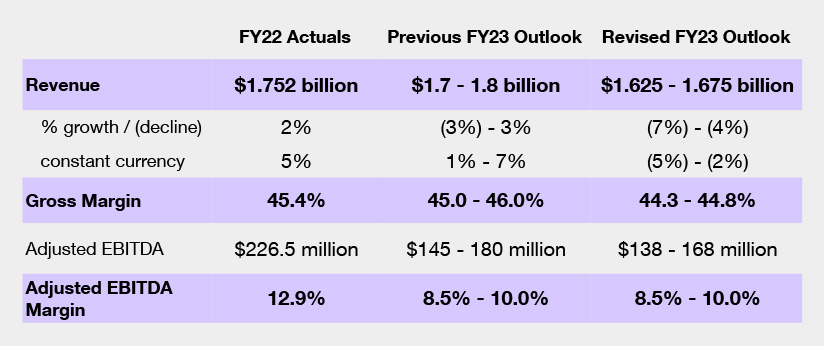

Think about that for a moment. We are already halfway through fiscal 2023 and the company says these negative trends are serious enough that it necessitates a revision of their expectations for the remainder of the year. The company now says total annual revenues will decline anywhere from 7% to 4% to revenues of between $1.625 billion to $1.675 billion. Originally they had projected a range of between $1.7 billion to $1.8 billion for a percentage range of -3% (decline) to +3% (growth). They no longer anticipate any opportunity for revenue growth in fiscal 2023.

For comparison purposes, fiscal 2022 annual revenues came in at $1.752 billion.

Sonos Stock Value Loses More than 25% Next Trading Day

The reaction to the Sonos report by investors on Wall Street was immediate and brutal. When the market closed on Wednesday, Sonos stock closed at $21.15. Then Sonos released their second quarter results. In after-hours trading, the price of Sonos stock crashed. On Thursday, when markets reopened, the opening bid on Sonos shares was just $17.00 and it finally closed at the end of the day at $15.85, down -25.04%.

Learn more about Sonos by visiting sonos.com.

Ted, I listened to the earnings call. I got the feeling the softening of demand was across the consumer electronics industry.

Earlier in the morning a Deloitte seminar on working capital trends discussed a trillion dollar decline in working capital for the 3,000 public companies they sampled. They considered it a sign of economic weakness.

Do you think consumer demand is softening across the whole audio sector or is it selective and limited to specific companies?

Steve,

Great question. I am collecting data to determine the full scale of the drop-off in consumer demand in our industry. I would say it’s looking like it may be across the board.

Sonos is just one more data point that reinforces the overall trend.

Ted