Company Turns To Forced Client Fees to Improve Its Results

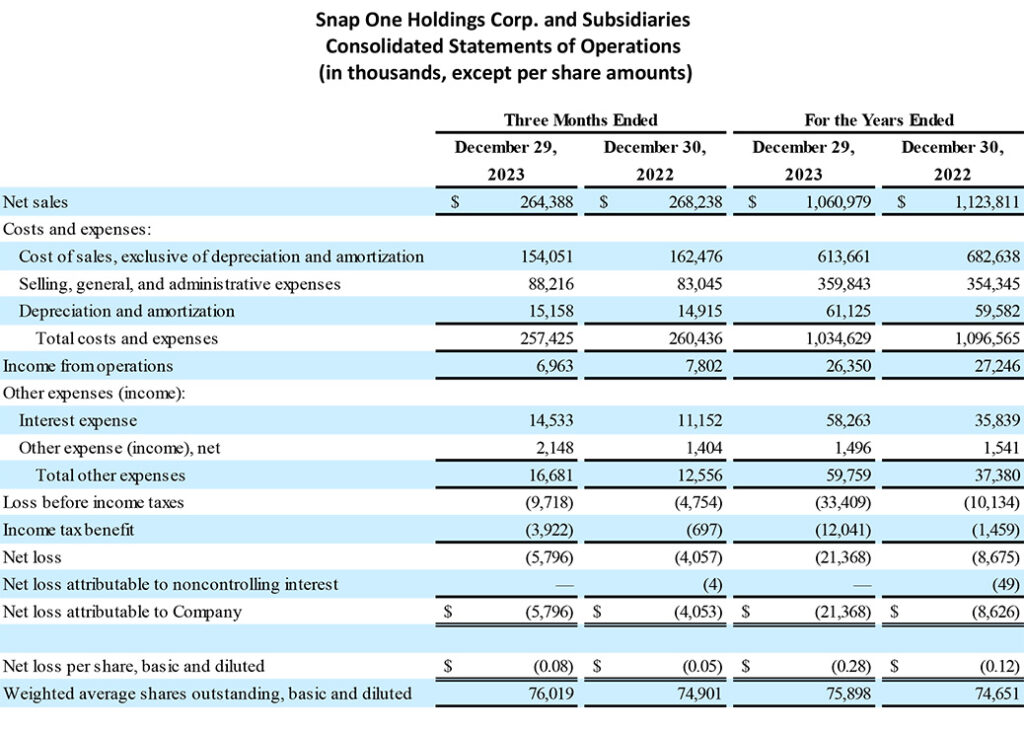

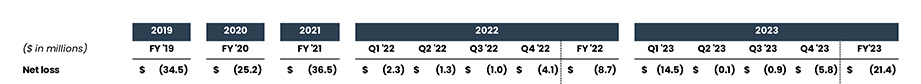

At the end of last week, Snap One Holdings Corporation [NASDAQ: SNPO] announced the results of its Fiscal Fourth Quarter and Full Year 2023. Much as we’ve seen quarter-by-quarter all year long, the company remained subsumed by a challenging “destocking” market, with Net Sales in Fiscal 2023 finishing down 5.6%, and its Net Loss last year increasing by another 146.3% this year. CEO John Heyman called it “another strong year.”

But was it truly “another strong year?”

See more details on the Snap One Fiscal 2023 performance

For those watching the performance of Snap One throughout 2023, it was pretty easy to predict this ending, with the company fighting a challenging macroeconomic environment, destocking from its overloaded dealers (although to a lesser degree by year-end), and a soft housing market depressing demand. And while the company can legitimately point to some of its financial parameters improving (adjusted EBITDA, for example) it seemed like a pretty disappointing ending. This is especially true when you consider that Snap One took some pretty dramatic actions – such as a couple of rounds of layoffs, back-burnering new acquisitions, scaling back new warehouse expansions, and more – to try and right the ship.

Hmmm…Something Sounds Familiar

In fact, Snap One’s CEO John Heyman, and CFO Mike Carlet, both told analysts that the challenging conditions will continue early in 2024 but they expect it to improve in the back half of the year. Hey! Wait a minute! Haven’t I heard that before?

That’s right…they said the same thing last year in their Fiscal 2022 report. However, the pickup in business in the last quarter or two that they predicted last year did not materialize. So we’ll have to wait and see if they have better results this year.

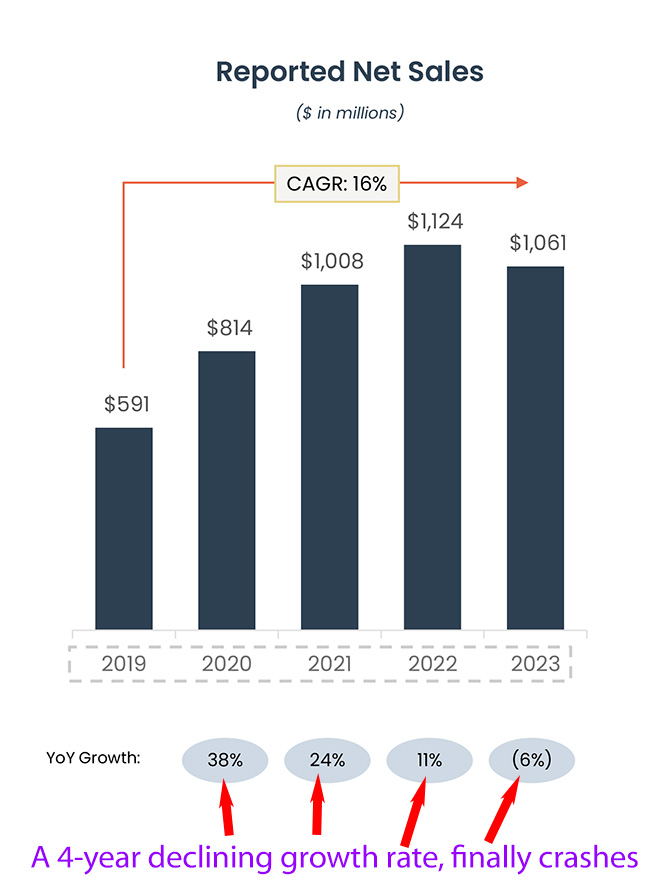

Doing a Deep Dive – Net Sales Slip

The company reported Net Sales of $1.061 billion in Fiscal 2023 which is down $62.8 million or 5.6% below the net sales of $1.124 billion in Fiscal 2022. The company says that this decline was largely due to “channel inventory destocking,” a common refrain over the last four quarters.

“Destocking” refers to the practice of dealers pulling products from their existing inventories to complete installations, rather than entering new orders to buy those products from Snap One. The company conjectured that dealers’ inventories were bloated due to their stocking up at usually high levels during times of supply chain shortages to secure inventory for future installations.

Snap One also said its dealers had purchased heavy quantities of products to beat impending price increases from the company. In past quarters, the company has also noted a dropoff in consumer demand due to high inflation, and other macroeconomic uncertainties.

The Profit Picture is Not So Pretty

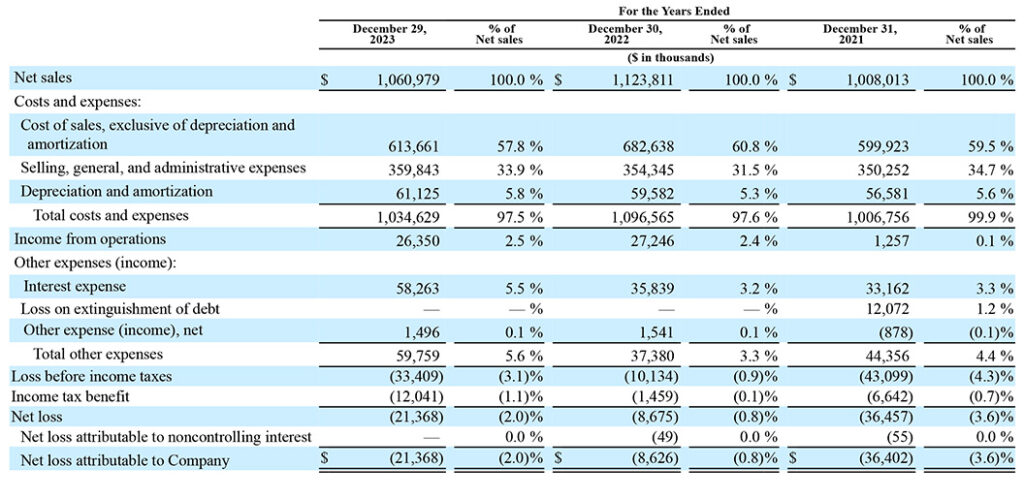

Snap One said that Income from Operations this year came in at $26.4 million, down $896,000 or 3.3% as compared to the $27.2 million booked the previous year. The difference was largely attributable to lower sales and higher Selling, General, and Administrative expenses, and higher Depreciation and Amortization expenses, partially offset by a lower Cost of Sales.

Perhaps more importantly, Snap One has lost money every year since it went public – even before – and it has lost money again this year. While the amount of this year’s loss may not be a record for the company, it is painfully greater than last year. Net Loss this year came in at $21.4 million which is $12.7 million worse than the Net Loss of $8.7 million in Fiscal 2022.

CEO: ‘We Delivered Another Strong Year…’

We delivered another strong year in 2023 despite continued global uncertainty, channel inventory destocking, and rising interest rates. During the year, our team remained committed to our growth strategies, which included improving the end consumer experience with innovative service models, accelerating integrator partner platform adoption, and expanding operating margin. In support of this plan, we recently launched Control4 Connect and Control4 Assist, which we believe will enable the industry to evolve by significantly improving the end consumer’s experience while building an important source of recurring service revenue, both for our partners and Snap One. Additionally, we launched many exciting new products, continued the expansion of our local branch network, and extended our position in key growth markets.

John Heyman, Snap One CEO John Heyman in a prepared statement

With continued momentum in the fourth quarter, we closed 2023 with $1.061 billion of net sales, a $21.4 million net loss, and $117.2 million of adjusted EBITDA, which represents strong year-over-year adjusted EBITDA margin expansion to 11.0%. We continue to believe in our long-term growth algorithm, and our 2023 achievements, such as numerous marquee industry awards and expanded profitability, give us conviction that we have developed the right strategy.”

It’s hard to blame Heyman for harping on the adjusted EBITDA figure, it’s about the only positive bullet point he can draw from an otherwise disappointing year. But even that, to me, feels like a stretch. Admittedly, I am generally not a fan of “adjusted” analyses, which is where companies develop their own unique and sometimes arcane formula that they suggest gives a more accurate picture of their results as compared to SEC-mandated, accounting industry-developed, generally accepted accounting principles (GAAP).

Net Loss was Bad, But ‘Adjusted EBITDA’ Looks Good

Snap One’s formula to create its Adjusted EBITDA factors in the addition and/or subtraction of 18 separate independent variables. While I am not a fan of this type of manipulation, it is completely legal as long as the company shows its work. It is also common practice among many if not most public companies.

The Adjusted EBITDA did improve, but only by a little – $3.1 million in dollars and less than 1% in margin, while the variance of many other critical data points moved by much, much more than that in a negative direction. If you’re a fan of adjusted analyses, as the company management is, you read this as a profit improvement, and that’s fine. But to me, it’s just one small data point out of many.

What a Difference a Year Makes

It was obvious to any objective outside observer that Snap One was struggling in 2023. Not only was that struggle evident in every quarterly earnings report it released, but it was engaging in less activity overall. In Fiscal 2022, for example, the company opened eight new warehouse locations (they like to call them “stores”), and they acquired three companies – Clare Controls, Parasol, and Staub Electronics.

However, in 2023, the company opened only four new warehouse locations nationally versus the eight locations in 2022. And perhaps even more obviously, they made no acquisitions…zero…zilch. Given Heyman’s imperative that Snap One must scale up its business, this was an obvious sign of the company pulling in its horns.

CEO Quickly Changes the Subject

Another thing I’d like to call your attention to. Did you read Heyman’s quote above? This statement was part of the press release announcing the company’s financial performance. His statement, which is intended to comment on Fiscal 2023 results – both financial and operational – only goes one or two sentences before he turns away from 2023 to a discussion of the future by mentioning Fiscal 2024 efforts with its new SaaS program – Control4 Connect, Assist, and Assist Premium.

In poker, they call that a “tell.” After calling 2023 “another strong year,” Heyman quickly changed the subject by introducing Control4 Connect and Control4 Assist in just the third sentence – programs that were non-existent in Fiscal 2023. And I’m not sure, but the phrase in the second sentence, “which included improving the end consumer experience with innovative service models,” seems to be a reference to these new programs as well.

As W.C. Fields once said, “If you can’t dazzle them with brilliance, baffle them with BS.”

Snap One’s CEO ended up speaking extensively about these programs during a Question-and-Answer session with financial analysts on the earnings call. I’ll get into that a little more later.

Deeper Dive into the Data – Problematical Product Mix Trend

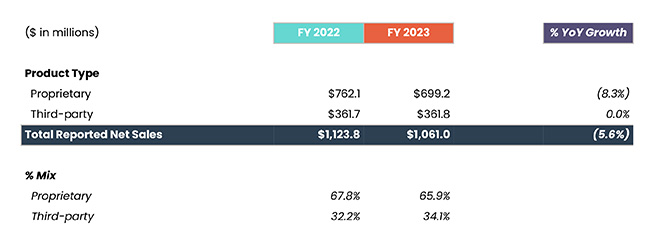

As is its normal practice, Snap One provided helpful tables disaggregating their revenue performance. Unfortunately, here too, we find continuing challenges that have bedeviled the company over the last year.

The first metric the company shared related to the revenues or net sales broken down by its two main types of products – Proprietary products (products from company-owned brands) and Third-Party products (products from other brands the company distributes). This is an important metric as the company is more profitable on its proprietary brands, yet the trend for several quarters now shows that sales of third-party products are growing faster than the company’s own brands. That means that 3rd party products are stealing a greater share of the sales mix and depressing profits.

As you can see in the table above, Snap One brands saw total sales drop 8.3% from $762.1 million last year to $699.2 million this year. The company says this decline was due to destocking, as well as issues surrounding YoY “net change in backorder fulfillment.” But third-party lines had a small sales gain of about $100k from $361.7 million last year to $361.8 million this year – performing stronger than the company’s own proprietary brands.

It would seem as though destocking would be brand agnostic, affecting all the products integrators stock and sell. But here we see that 3rd-party brands did substantially better than the company-owned brands. This means that there was yet another shift in the sales mix between proprietary/3rd-party of 67.8%/32.2% in Fiscal 2022 to this year’s mix of 65.9%/34.1% – roughly a 2% shift in mix.

I should also mention that Snap One had a substantial number of new products launch in Fiscal 2023, a reality that should have helped them grow their proprietary sales as dealer’s couldn’t be sitting on inventory of these new products. Yet the trend continued unabated all year.

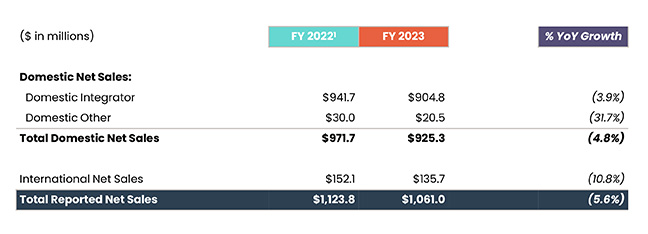

Revenue Disaggregation by Geography

The next form of revenue disaggregation the company provides is sales broken down by geography. The company breaks that down as “Domestic Integrator,” “Domestic Other,” and “International Net Sales. While domestic integrator and international net sales are fairly obvious, you may not be familiar with domestic other. The company defines Domestic Other as “…revenue generated through managed transactions with non-integrator customers, such as national accounts.”

As you can see in the table above, sales through Domestic Integrators dropped from $941.7 million in Fiscal 2022 to $904.8 million – down 3.9% – in Fiscal 2023. Domestic Other had an even more dramatic drop from $30.0 million last year to $20.5 million this year, down 31.7%. This gives us an overall Domestic total of $925.3 million which is down $46.4 million or 4.8% versus the net sales of $971.7 million last year.

Interestingly, even though the company has identified international expansion as one of its goals, they saw International Net Sales come in at $135.7 million, a slide of $16.4 million or 10.8% compared to net sales of $152.1 million last year.

The company offered no specific explanation for these declines other than those previously mentioned about sales declines overall.

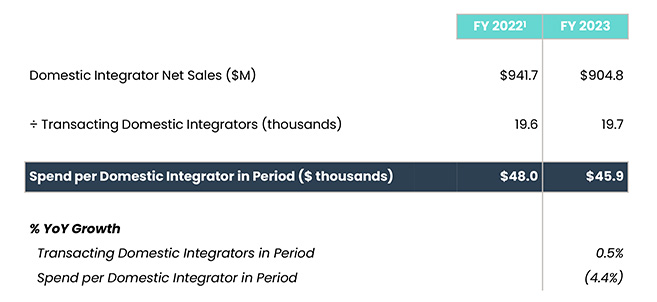

Key Performance Indicators

The final drill-down analysis the company offers is called “KPIs” which is corporate-speak for key performance indicators. Snap One has long told the investment community that its growth engine or flywheel is to grow both the number of integrators that they transact with…AND…grow their “share of wallet” or sales per integrator. Against these KPIs, the company stumbled in Fiscal 2023.

As you can see in the above table, the company did grow the number of integrators it does business with, but only by 100 integrators nationally, from 19,600 in Fiscal 2022 to 19,700 this year – only a half-percent increase. At the same time, sales through integrators dropped overall by 3.9% from $941.7 million last year to $904.8 million this year. This results in the “spend per domestic integrator” dropping from $48,000 last year to $45,900 this year, down 4.4%.

Company Projects Projects Careful Forward Guidance

Looking ahead to 2024, we continue to be confident in our ability to drive growth. Still, we expect to see lingering headwinds in an uncertain macroeconomic environment, and we believe that it is prudent to continue to take a pragmatic approach to our 2024 outlook.

John Heyman

The company has issued its first forward guidance for anticipated financial performance in Fiscal 2024. True to Heyman’s word, the forecast for Net Sales is in the range of $1.060 billion to $1.130 billion. Remember, Net Sales in Fiscal 2023 was $1.061 billion, so the company is slightly below last year’s sales on the low end of the forecast…to growth of 6.5% in sales on the high end.

Snap One does not provide guidance on Operating Income or Net Income (Loss), only on Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted EBITDA Growth. Here they forecast Adjusted EBITDA dollars to come in between $120 million to $128 million, as compared to $117 million last year. The projected margin grows from last year’s 11.0% to 11.3% this year throughout the range. The range represents Adjusted EBITDA growth of between 2.4% on the low end and 9.2% on the top end.

While the macroeconomic uncertainty persists, we have a resilient business model, and we are excited to implement our strategy for 2024 and beyond.

Heyman

Financial Analyst Conference Call Q&A Reveals New Details on Control4 Connect & Assist

What About Those KPIs?

As is its custom, Snap One held a conference call with financial analysts to discuss its Fiscal 2023 results. As part of this, they opened the call up for questions. The first question from a Morgan Stanley analyst asked for clarification on the company’s strategy regarding their KPIs on integrator headcount and spend. As the company had always touted its goal to grow its integrator network, with only 100 new integrators added in 2023, I suspect analysts found that number underwhelming. Also, “spend” per integrator went down in 2023, so both KPIs appear unmet.

Analysts wanted to know what the company’s expectations are for KPIs for 2024. CFO Mike Carlet jumped in and suggested that the integrator count is expected to remain stable in 2024. The company, Carlet said, is focusing on driving “share of wallet” gains as it executes on its new Control4 Connect and Assist platform adoption initiative.

Carlet also said that Snap One believes the market overall in 2024 will be flat to down 5%. So with an emphasis on platform adoption, share of wallet growth, and market share gains, he believes the company has the right plan for existing conditions.

Tell Us How Control4 Connect & Assist are Being Received; ‘Great Press Coverage…with the Exception of One Columnist’

The next question came from an analyst with JP Morgan, who asked how the reception to the new support programs – Control4 Connect and Assist, has been going. Heyman assured the analyst that, of the reception, “I could literally have not been more pleased…and I’m an optimist.” Heyman said that the announcement was “quite notable in the industry.” He said the announcement was met “with great press coverage, maybe with the exception of one columnist” (Hmmm, I wonder WHO he is referring to?).

The company held a summit with “the top couple of hundred” of its Control4 integrators. He said they spent two or three days with them and their reception “was staggering.” Referring to the Assist program, which is an optional offering, Heyman said, “The dealers may or may not pride themselves on the level of service they provide the end customer. It was amazing to me that people really see [Assist] as a way to provide their end customer with more service.”

Heyman added, “And they can’t do it themselves. They just don’t have the manpower to staff seven days a week, 24 hours a day.”

Gee, sounds really rosy, if a bit backhandedly critical. Then Heyman acknowledged, “There’s always nitpickers out there in terms of social media and so forth. But we continue to educate them and what’s been really interesting is watching other dealers educate the nitpickers.”

What is the Value of These New Programs for Snap One?

Heyman said the company expected to have between 15,000 and 20,000 Control4 Connect subscribers by the end of year one of the program, which will really begin to ramp up in May. For now, the program is only rolling out to the U.S. As far as the Control4 Assist and Assist Premium optional programs, Heyman told analysts the company expects “to have a much lower attach rate for them, less than 10% of the subscribers.”

He then began to explain to analysts Snap One’s expectations for “recognized revenues” from the program. “And so this year we expect to have a fairly small amount of recognized revenue, roughly $2 million,” Heyman said. “But that increases, you know, quite significantly next year into the $10s of millions as the install base grows and we make this available outside the United States.”

Subscriptions will grow about 50,000 a year, Heyman says. While the company offers a free tier for small and single-room systems, most Connect subscriptions will be for $250 per year. Of that amount, 40% ($100) is shared with the integrator, Snap One keeps the rest. For the optional premium Control4 Assist and Assist Premium programs, with $900 and $3,000 pricing tiers, integrators only get a 30% share, “…since we do more work, you know, we man the phones there.”

Right now, Heyman told analysts, we do about $13 million with 4Sight and Parasol. Add that to the roughly $2 million in Connect subscriptions and they’ll be at around $15 million for year one, he said. Moving ahead five years and he anticipates 270,000 subscribers worth about $95 million.

“That’s all highly profitable, recurring revenue,” Heyman said emphatically. He also told analysts that at some point the program will get extended to the existing installed base of 500,000 or so end users. Right now, the programs are only for new connections. “This is why we’ve invested well over $10 million over the past couple of years building this” Heyman said.

“We think it can transform the P&L of our company, but we also think it can transform the P&L of every integrator out there who is trying to develop recurring revenues,” Heyman crowed.

You Called it ‘Highly Profitable,’ What Kind of Margins Does Snap One Expect?

The next question came from an analyst with Jeffries who asked Heyman if the margins would be the “normal SaaS-type margins, like 80% or something, or would there be some other costs in there we should just keep in mind?

“The way I would think about that model is of $1 of revenue, we share 40% with the integrator – so 60% goes to the [Snap One] bottom line,” Heyman responded. “There’s some costs against that – call it 5% other variable costs – and so think of that as kind of a mid-50s margin product.”

Heyman added: “Then with the Assist offerings, think of them similarly. But we have a smaller share for the integrator, they only get 30%. We get 70%, but we’re still at mid-50s gross margins because we have to do some work there in terms of cost of sales – specifically labor.”

Control4 Connect & Assist – ‘Can Transform the P&L of Our Company’

It certainly sounds like Snap One is relying on the new Control4 Connect & Assist programs to drive both revenue and profit growth. At one point during the analyst Q&A, Heyman said he believes these programs will transform Snap One’s P&L (profit & loss). Could this be what these programs are really all about?

Learn more about Snap One by visiting snapone.com.

Leave a Reply