On Wednesday, Resideo Technologies, Inc. (NYSE: REZI), maker and distributor of tech products for homes and businesses and parent company of Products and Solutions, ADI Global Distribution, Snap One, Control4, and more, announced its financial results for the third quarter of fiscal 2025. The results looked pretty good. Then, on Thursday, its stock collapsed a stunning 23.75%. By comparison, the S&P 500 was down 1.1%.

Now, on Friday, in midday trading, Resideo is trending down again… yet another 1.5% decline. What’s going on?

See why Resideo is trending down in the wake of a positive Q3 report…

Resideo’s story of lost market capitalization is a tale of a Wall Street on edge…sweating out the details of each earnings report…looking for signs of trouble. Why is Wall Street on edge? Because a large number of financial firms are warning of an impending drop on the Street. This drop could be the AI bubble bursting, which could trigger a massive collapse in equity valuations. Or, the drop could be a correction, which can be a healthy repricing of equities to reset to a more logical valuation level.

Moody’s Announces 22 States are Showing Clear Signs of a Recession

Whether the approaching storm is a bubble burst or a market correction, either event could be a painful one…say a 20% drop in the S&P 500. And either could be even worse…a cataclysmic collapse of the market.

Adding to the rising angst, Mark Zandi, the Chief Economist at Moody’s Analytics, put out a report that warned that 22 states are already showing clear signs of a recession, putting the rest of the U.S. economy in a precarious position. Between this alarming note, the increasing impact of the ongoing government shutdown, lack of fresh economic data (part of the government shutdown), and rising concern over AI (the single largest driving force of S&P 500 growth) being oversold, the mood on Wall Street is – to say the least – tense.

Analysts are on Edge

And that means that equity analysts are on edge and easily spooked.

It is into this environment that Resideo released its latest earnings report. On the face of it, the report looked solid. Resideo executives must have been confident.

But let’s look at Resideo’s results and forecasts through the eyes of your typical analyst.

How Resideo’s Q3 Results Compared to Analyst Expectations…

- Revenues – Net revenues came in at $1.86 billion against analyst estimates of $1.87 billion. This is a very slight miss…pretty much a hit

- Adjusted EBITDA – Adjusted EBITDA, a non-GAAP measure of profit, came in at $229 million, compared to analyst estimates of $230 million. Like revenues, adjusted EBITDA came pretty close to being in line with estimates. In fact, many analysts would call it in line…

- Earnings Per Share (EPS) – The company reported a non-GAAP EPS of $0.89…a new record…versus analyst estimates of $0.69. That is a 29% beat!

So good revenues…and great profits. What’s not to love?!?!

How Resideo’s Forward Performance Forecast (Guidance) Compared to Analyst Expectations

Resideo’s problem came not from its performance in the past (the recently completed third quarter)…it came from its latest “guidance,” its estimate of future performance. See the list of Q4 and FY guidance issued by Resideo, along with analyst estimates for the same item.

- Q4 Revenue guidance – Resideo projects Q4 revenue at $1.87 billion (midpoint of a range) versus analyst estimates of $1.92 billion (above the entire range)

- 2025 full-year revenue guidance – The company forecasts full-year revenue at $7.43 billion-to-$7.47 billion versus analyst estimates of $7.51 billion…again, above the entire estimate range

- 2025 full-year adjusted EPS guidance – The company lowered its adjusted full-year EPS guidance (never a good thing) to $2.62 at the midpoint, a 6.8% decline. Analyst estimates came in at $2.76 – yes, higher than the entire range

Investors Really HATE a Double Guidance Miss

Investors don’t like a guidance miss…and they really hate a double miss. How can you know how investors are feeling? Simple, they let you know by selling your stock such that its value drops. That pretty much solves the mystery of why Resideo’s stock dropped so precipitously on Thursday.

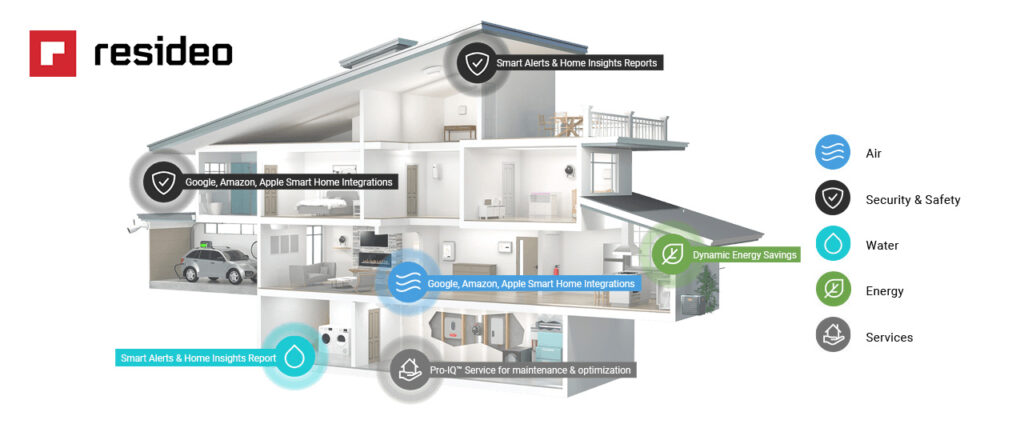

Learn more about Resideo by visiting Resideo.com.

Leave a Reply