More signs of a potential downturn in the economy are emerging almost every day now, causing red flag warnings to be popping up just about everywhere. The fact that there are multiple warning signs that come from different sources tends to reinforce the general thinking that the U.S. economy is quickly entering the danger zone.

See the red flags impacting the economy that have emerged since my last report

Let’s start this discussion by heading back to my home turf, Michigan, where one of the most respected reads on consumer sentiment – the Index of Consumer Sentiment – is produced monthly by the University of Michigan. In my economic report earlier this month, I provided the findings of another respected read on the consumer – the Consumer Confidence Index – also produced monthly by the business group The Conference Board.

As I told you then, in February, the Consumer Confidence Index (CCI) dropped by a significant 7 points – a very large decline in just one month. The Conference Boards analysts noted that 7 point drop was the largest decline of the CCI since August 2021, which was during the global pandemic.

How Are Consumers Feeling About the Economy? Not Good…

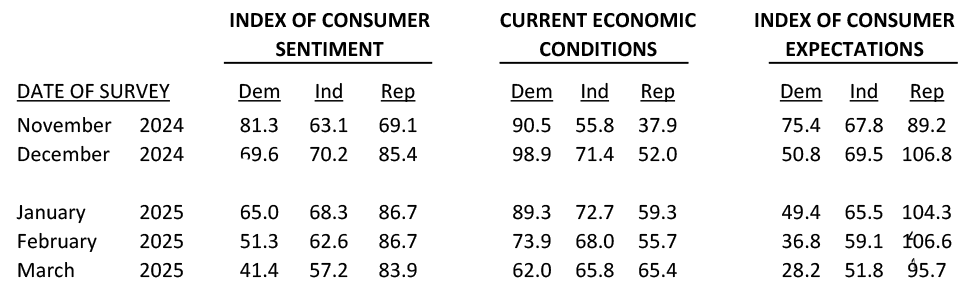

Now we learn from U of M that its Index of Consumer Sentiment (ICS) in March saw consumer sentiment drop another 11%…a huge number. The survey director, Joanne Hsu, noted that the decline cut across all groups of survey respondents, including “by age, education, income, wealth, political affiliations, and geographic regions.”

Interestingly, in December 2024, in the wake of the election, the survey bumped up to its highest level since April, as respondents were apparently quite optimistic that the new administration would pursue positive policies for a brighter future. However, since that reading, this is the third straight month in a row that consumer sentiment declined.

A Massive 22% Slide in Consumer Sentiment on the Economy in Just 90 Days

The Index of Consumer Sentiment is now down 22% since that optimistic bump up in December 2024. It is also down more than 27% from its reading in March 2024. Those are big drops and troubling readings.

The ICS has two basic subcomponents, survey respondents rate their “Current Economic Conditions” and they also reveal their thoughts for the future in the “Index of Consumer Expectations.” In the March group of surveys, all readings declined, although the CEC reading dropped only by 3.3% versus the February reading and by 23.0% compared to March 2024.

Consumers’ View of the Future Darkens; The Culprit? A High Level of Uncertainty

However, when it came to respondents’ rating their expectations for the future, we find a much more severe decline in their sentiment. The Expectations index reading dropped from 64.0 in February to 54.2 in March – a 15.3% drop. This reading also was a 30.0% decline over the March 2024 reading of 77.4. The data shows that consumers were pessimistic about the future in almost every factor, including personal finances, labor markets, inflation, business conditions, and stock markets.

Consumers participating in the survey cited the high level of uncertainty around policy – such as the administration’s tariff policy – and other economic factors. As U of M’s Surveys of Consumers Director Hsu notes: “[F]requent gyrations in economic policies make it very difficult for consumers to plan for the future, regardless of one’s policy preferences.”

A Rare Moment of Political Bipartisanship on the Economy

One interesting result of the March ICS – and an apparent rare moment of political bipartisanship – is that participants of all three major political groups (Democrats, Independents, and Republicans) independently projected a substantial decline in America’s future prospects.

From the report: “Despite their greater confidence following the election, Republicans posted a sizable 10% decline in their expectations index in March. For Independents and Democrats, the expectations index declined an even steeper 12 and 24%, respectively.”

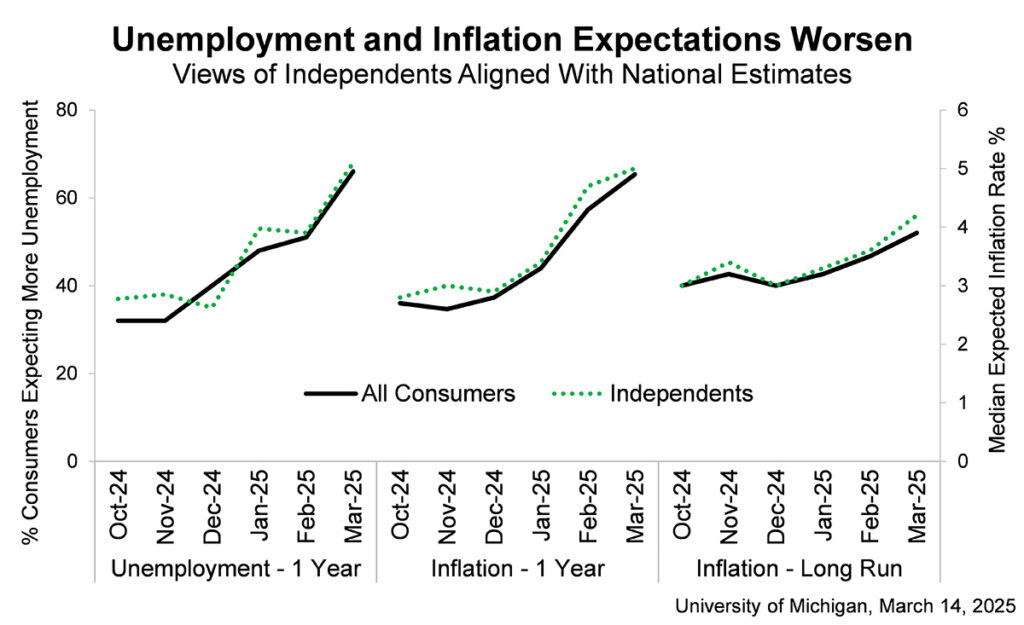

Consumers Believe that Unemployment & Inflation Will Rise in the Near Future

As another sign of the survey participants’ pessimistic outlook for the future, they project that both unemployment and inflation will rise precipitously in the near and longer-term future. Take inflation, for example. During the pandemic, inflation rose to a sky-high 7%. During the Biden administration, this rate was brought down to 2.9% by the end of 2024. Not exactly to the nominal 2.0% rate the Fed wants to normalize interest rates, but WAY better than 7%.

Now, survey participants predict that inflation will rise to 4.9% within the next year – a dramatic increase from the 2.8% we are at now. It’s even higher than the 4.3% inflation rate they projected in the previous month’s survey. According to U of M’s Hsu, an expected inflation rate of 4.9% is the highest reading since November 2022. She also notes that this latest survey marks the third consecutive month of respondents projecting an unusually large increase of 0.5 percentage points or more.

Not Just Consumers, Small Business Owners’ Optimism in the Economy is Fading Also

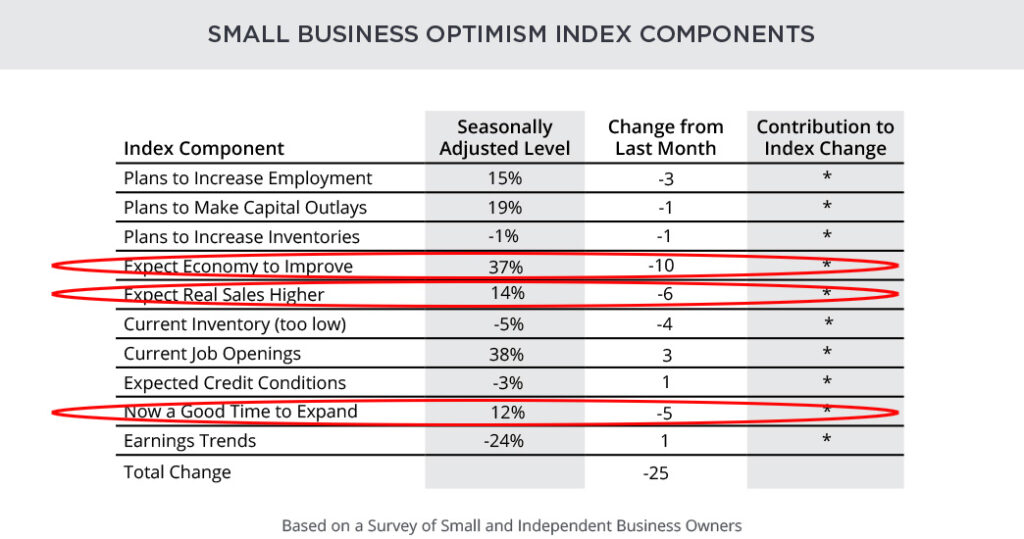

The National Federation of Independent Businesses (NFIB), a group that represents small business owners across the country, says its latest survey of members shows a notable downturn in business owner optimism, with its most recent February reading dropping 2.1 points, although it remains above a long term average rating.

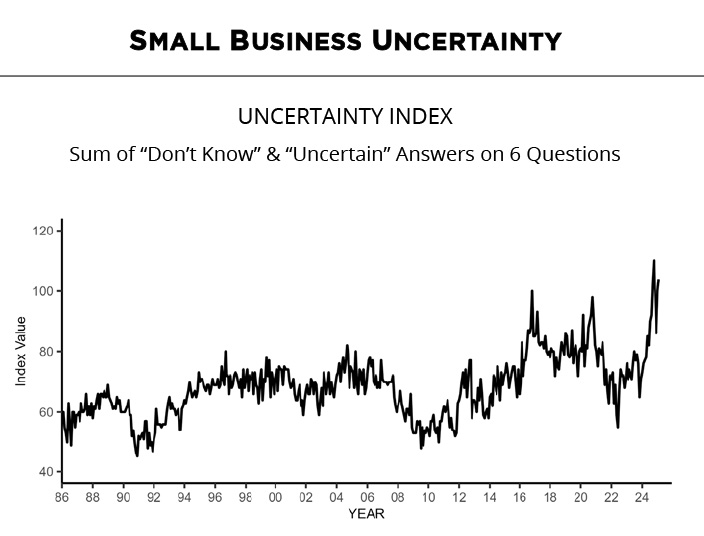

The group also says that the survey of business owners shows that uncertainty is rising. The key factors driving rising uncertainty are inflation and labor quality.

Number of Business Owners Expecting an Improvement in the Economy Dropped Dramatically

Notably, the net percentage of small business owners expecting the economy to improve in the next six months fell ten points from January to a net 37%. Just 12% of business owners said now is a good time to expand their business, down five points from January. This is the largest monthly decrease since April 2020.

Uncertainty is high and rising on Main Street – and for many reasons. Those small business owners expecting better business conditions in the next six months dropped, and the percentage viewing the current period as a good time to expand fell but remains well above where it was in the fall. Inflation remains a major problem, ranked second behind the top problem, labor quality.

Bill Dunkelberg, NFIB Chief Economist

More Red Flags: Multiple Reports Say Consumer Spending Is Down

RETAIL CLOSURES CONTINUE – Today we learned that Forever 21, Party City, Big Lots and Joann are the latest crop of multi-store national retailers shuttering their operations. Retail store closures hit their highest level since the pandemic in 2024, and appear to be continuing.

RETAILERS POINT TO SLACK CONSUMER SPENDING – According to the Wall Street Journal, Target, Lowe’s, and Fool Locker are all reporting declining consumer spending.

BUYING ESSENTIALS ONLY – In an earnings call yesterday, Dollar General’s CEO Todd Vasos told investors that many customers “only have enough money for basic essentials.” He also noted the company is picking up more sales to higher-income shoppers who are trading down to lesser expensive items. Dollar General normally does well in economic downturns, but its latest earnings report disappointed analysts.

Even Consumers Earning Just Under $100k are ‘Feeling Squeezed’

APPAREL SPENDING DOWN – Spending on apparel dropped 12% this quarter as compared to the same quarter last year. Kohl’s Department Store CEO Ashley Buchanan said that shoppers earning under $100,000 are joining lower-income shoppers in feeling squeezed.

THAT WON’T FLY – American Airlines, Southwest Airlines, JetBlue, and Delta have all lowered their Q1 sales forecasts as weather (and California fires), a smaller federal workforce, and heightened fears of plane crashes have resulted in fewer consumers traveling.

MORE ARE SOUNDING THE ALARM – Even more and bigger dealers are sounding the alarm about the consumer spending downturn. Walmart, McDonald’s, Dick’s Sporting Goods, and ever Costco – who says consumers are buying more lower-cost options, like ground beef rather than steak.

Data on the Luxury Market Has Declined

LUXURY LOSES ITS LUSTER – According to Citi, which tracks these things, luxury in-store and online spending dropped 9.3% last month YoY. This follows a 5.9% drop in January according to a report by Morning Brew.

NOT ONLY ABOUT TARIFFS – Clearly consumers are extremely concerned about a global trade war, and inflation is still bedeviling Americans. But Molly Liebergall of Morning Brew says there is more at play here than worries about tariffs. She notes in a report on Tuesday that wage growth has plunged over the last year across all wage groups…and checking and savings balances have declined, according to the Bank of America Institute.

As those of us from Detroit like to say, buckle up…it’s going to be a bumpy ride!

Leave a Reply