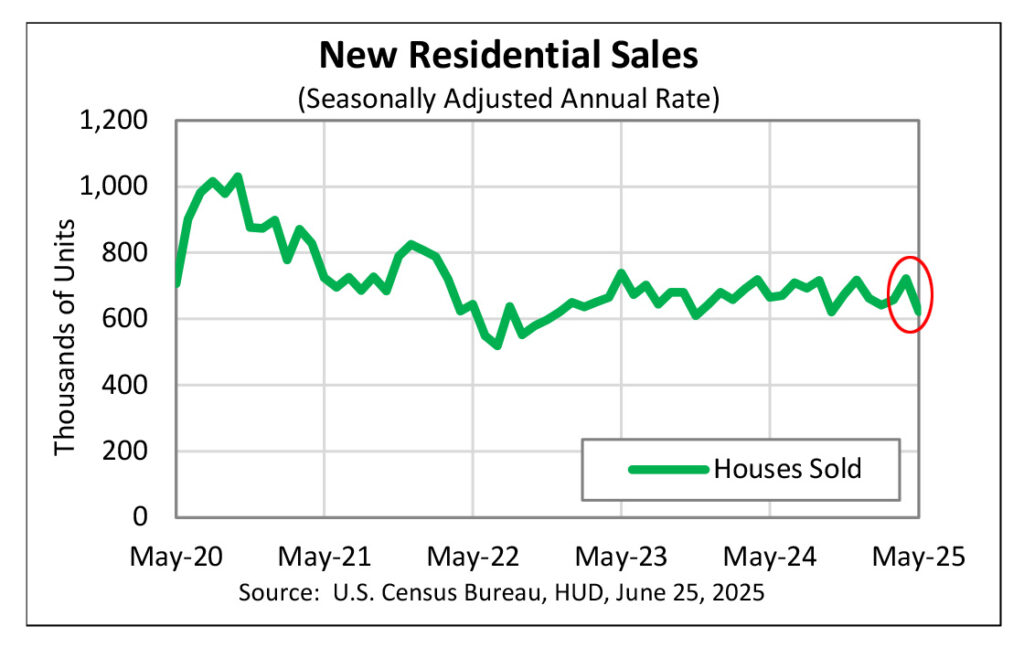

The latest government data on sales of newly built residential homes in May showed a significant drop of 13.7% as compared with revised sales in April. This data is a sign of continuing struggles for the housing industry, which is grappling with material cost increases and hesitant buyers concerned about still-high mortgage rates and the future of the economy.

Learn more about May’s new home sales dropping

The housing industry continues to show signs of distress in an increasingly brittle economy, and this latest report from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development is sure to add to that narrative. As a key component of our national gross domestic product (GDP), economists watch housing closely, and this double-digit percentage drop in new home sales in May has started a serious buzz among economic analysts.

Sales of new single-family houses in May came in at a seasonally-adjusted annual rate of 623,000 units according to the government’s latest data. This rate is fully 13.7% below the rate of 722,000 in April and 6.3% below new home sales of 665,000 in May of 2024.

The Most Dramatic Decline in the Last Three Years

This reading means that sales of new homes had the most dramatic decline in the last three years. The 623,000 reading is a seven-month low in new home sales.

The rate is also well below analysts’ and economists’ estimates. According to CNBC, analysts polled by Dow Jones had forecast new home sales dropping to 695,000 units. Reuters noted a separate poll it conducted of economists had predicted a decline to 693,000. Both polls were way wrong.

Housing is Stuck in a Funk

Most experts believe that housing is stuck in a funk with many witching variables spooking buyers away from deals:

- Mortgage rates – Mortgage rates averaged right around 7% in May, a number high enough to impact the affordability of homes for many Americans

- Housing prices – There has been a long-term trend of median prices continuing to rise over time, and even with slowing sales, that remains the case. In May, the median price of a new home was $426,600, 3% higher than a year ago. Couple higher prices with higher mortgage rates, and many buyers are priced out of the market. Worse yet, the Administration’s tariff program is causing builders to have to pay more for raw materials to build homes, such as lumber, steel, and aluminum

- Economic Uncertainty – Many builders and analysts are pointing to increasingly hesitant buyers who fear that the Administration’s tariff program will cause the economy to slow and perhaps drive greater inflation. This lack of confidence means many are shelving their plans to buy a new home at this time

The count of new homes sold is based on actual signed contracts, and while this can fluctuate widely from month to month, it is generally seen as a pretty good indicator of buyer sentiment.

While builder incentives may prevent a steep decline in new home sales, we see no real upside for sales in the months ahead given our forecast for mortgage rates to remain elevated and the labor market to soften.

Nancy Vanden Houten, Lead U.S. Economist at Oxford Economics, as told to Reuters

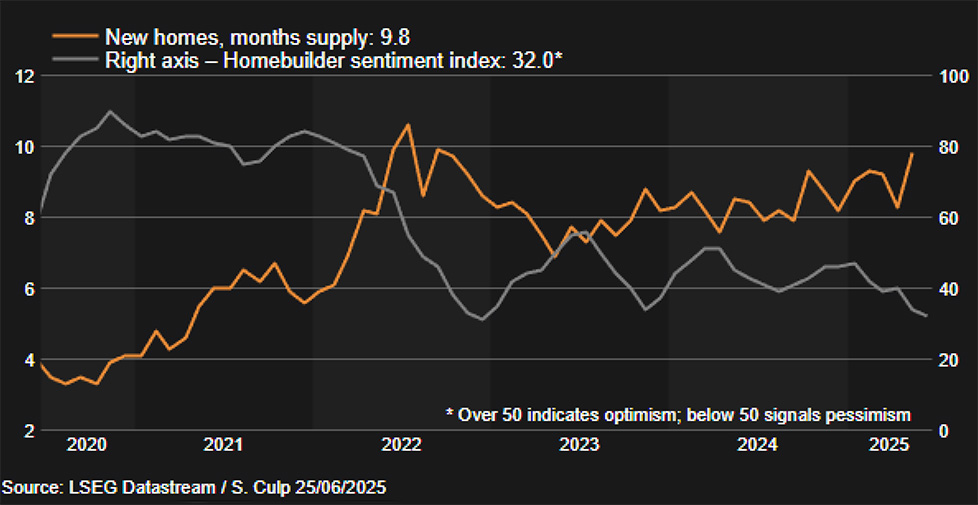

Inventory of Unsold New Homes is 15% Higher Than Last Year

In the meantime, this sales slowdown means that the available inventory of new homes for sale increased. According to the report, there are now 507,000 unsold new homes available, the highest level of inventory since October 2007. This inventory level increased by 7,000 homes in May, 15% higher than it was in May 2024. At current sales rates, that equates to a 9.8-month supply of new homes available for purchase.

The macro economy remains challenging, as mortgage interest rates have remained higher while consumer confidence has been challenged by a wide range of uncertainties, both domestic and global. Across the housing landscape, actionable demand has been diminished by both affordability and consumer confidence, and therefore has continued to soften.

Stuart Miller, Co-CEO of Lennar, a large national home builder, as told to CNBC

Jeremy needs to drop the interest rate.