Gentex Corporation (Nasdaq: GNTX), the new owner of Voxx, Premium Audio Company, Onkyo, Integra, and Klipsch reported the financial results for its first quarter of fiscal 2025 – the period that ended on March 31, 2025. Note that these results do not include the Voxx et. al. acquisition in its numbers, as that merger did not close until April 1, 2025. Gentex reported declines in sales, gross profit dollars, income from operations, and net income.

And all that happened before the new tariffs launched by the Trump administration took effect in full force.

Learn more about the Gentex results in the first quarter of 2025…

Zeeland, MI-based Gentex reported a rough quarter to kick off 2025, with both sales and profits dropping in the quarter. However, earnings per share came in a penny higher than originally forecast, so analysts like that. But with new tariffs launched at the beginning of April – the start of its second quarter…and the company beginning in earnest to integrate Voxx into its business – the next period isn’t going to be a cakewalk either. Gentex President & CEO Steve Downing commented on the obvious…

‘The Last Few Months Have Been Undeniably Chaotic…’

The last few months have been undeniably chaotic as we work to understand the impact that tariffs will have on our supply chain and sales channels. The extent of the impact to revenue for the year depends on how much our sales into the China market will be limited by the counter-tariffs that are in place for our exports, as well as, how much additional cost our OEM customers and consumers will be willing to pay for the additional import tariffs. While the tariffs will create some headwinds for the Company, we still believe that the product portfolio and the new technologies in development will provide a strong revenue trajectory over the next five years

Steve Downing, Gentex Corp. President & CEO

Gentex is unique compared to many other companies in that they both import goods from China, as well as export to China. Much of the earnings call with analysts was focused on what the company was anticipating would be the impact of tariffs. This is, of course, an impossible question for anyone outside of the White House to answer. Still, Downing told analysts they took a bearish perspective – in other words, cast a more conservative or pessimistic forecast based on its best guesstimate of the impact of tariffs.

First, though, let’s take a look at how the company performed in the first quarter.

A Deeper Dive into Gentex’s First Quarter Results

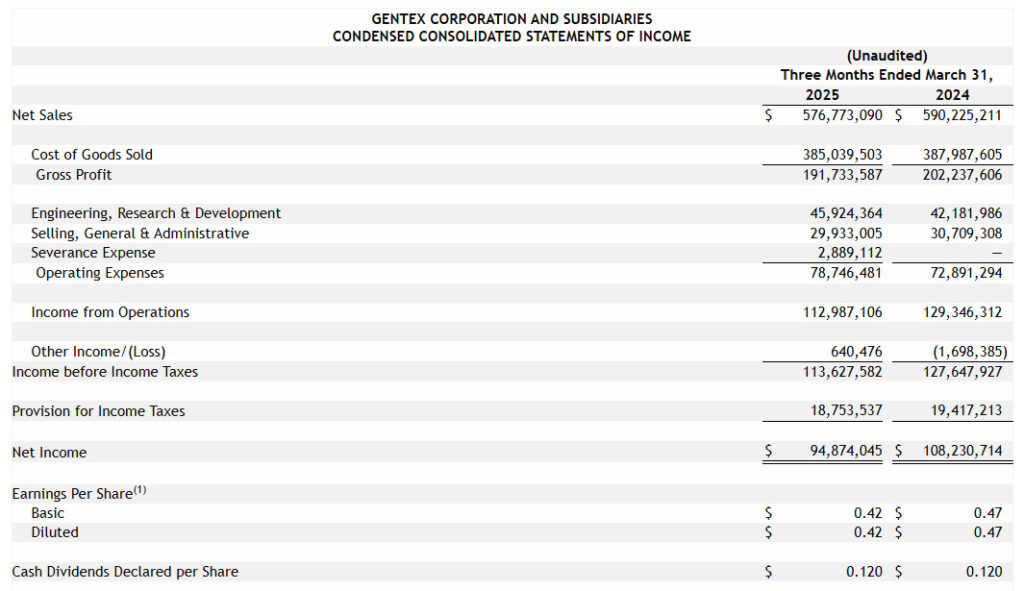

Gentex reported that quarterly net sales came in at $576.8 million, down $13.5 million or 2.3% compared to net sales of $590.2 million in the first quarter of fiscal 2024. As is typical for the company, it compared its results with an S&P forecast of global light vehicle production – which for the first quarter was projected to be a 1% increase.

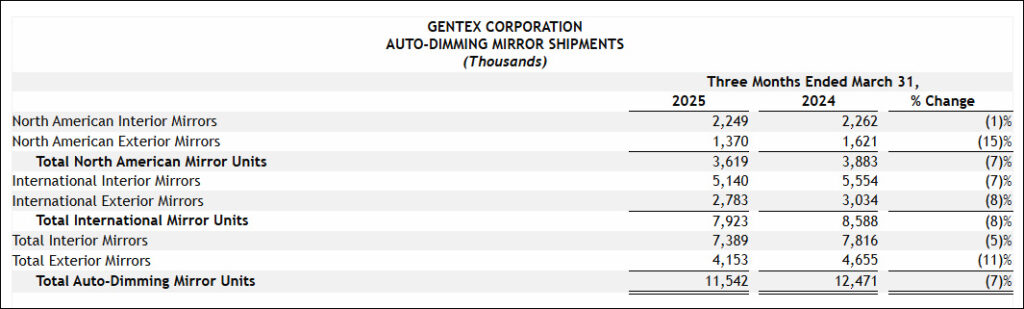

So Gentex’s decline of 2.3% is a notable departure relative to the overall market. However, the company pointed out that if you only compare industry results in the primary markets Gentex does business in, then the S&P comparable markets declined 3% – for a (slight) win for Gentex. Downing noted that exterior mirror unit shipments were down 15% quarter-over-quarter in North America and 8% internationally for a shortfall of around $25 million to $30 million in expected sales.

A Squeeze in Sales is Joined by a Grinding of Gross Margin

The squeeze in sales was joined by a grinding of gross margin, which in the first quarter of 2025 came in at 33.2%, down 1.1% from a gross margin of 34.3% in the same quarter last year. This decline in gross margin is said to be due to lower revenues, unfavorable product mix, and new tariff costs. However, the company said that on a sequential basis, it had a 70 basis point improvement in gross margin thanks to purchasing cost reductions and higher sales levels versus the fourth quarter of fiscal 2024.

Gross profit dollars in the quarter also declined, coming in this year at $191.7 million, down $10.5 million or 5.2% compared to gross profit dollars of $202.2 million in the same quarter the previous year. Gross profits were impacted by approximately $650,000 of tariff-related expenses.

An Operating Expense Increase is Largely Due to Severance Charges

The company reported that operating expenses increased in the quarter to $78.7 million, up $5.8 million or 8% as compared to operating expenses of $72.9 million in the first quarter last year. Interestingly, the reason for this increase in expenses was in part due to $2.9 million in severance expenses. Apparently, in an effort to reduce company headcount, it offered long-tenured employees incentives to accept early retirement. There was no information provided as to how many employees took them up on the deal, but it must have been pretty significant to incur a $2.9 million charge to expenses.

In addition to that, operating expenses were also increased by just under $1 million ($0.9 million) in unspecified costs related to Gentex’s acquisition of VOXX.

A Double-Digit Percentage Drop in The Bottom Line…Net Profits

So, lower sales + lower margins + higher expenses = lower profits. Gentex reported that income from operations for the first quarter this year came in at $113.0 million, down $16.3 million or 12.7% from the $129.3 million income from operations in the first quarter of 2024.

As well, net income for the quarter was $94.9 million or $13.3 million lower than net income of $108.2 million last year. That is a 12.3% drop in net income…you know the proverbial “bottom line.” The drop in net income “…was primarily driven by the changes [declines] in net sales and income from operations, compared to the first quarter of 2024,” the company said.

Disaggregation of Net Sales by Business Segment

Currently, the company has two main business segments it serves: Automotive and Other Net Sales. Automotive sales for the first quarter this year came in at $563.9 million which was $13.7 million or 2.4% lower than automotive sales of $577.6 million in the same quarter last year. The company pointed to a drop in auto-dimming mirror sales which decreased by 7% in the quarter this year versus last year. In fact, auto-dimming mirrors are far and away the company’s biggest product, and every version of the mirrors, both interior and exterior…sold domestically or internationally…saw sales decline anywhere from 1% to 15%.

Other net sales is kind of a catchall category that includes dimmable aircraft windows, fire protection products, and medical devices. This other net sales category had quarterly sales of $12.9 million which was off $300,000 or 2.3% compared to net sales of $12.6 million in the first quarter of 2024.

Gentex further broke out select item sales from this category, including fire protection, $6.7 million (vs $6.8 million last year); dimmable aircraft windows, $4.9 million (vs $5.8 million last year); biometric products, $0.9 million (last year sales not provided); and eSight Go medical devices, $0.4 million (no sales in 2024).

2025/2026 Performance Guidance

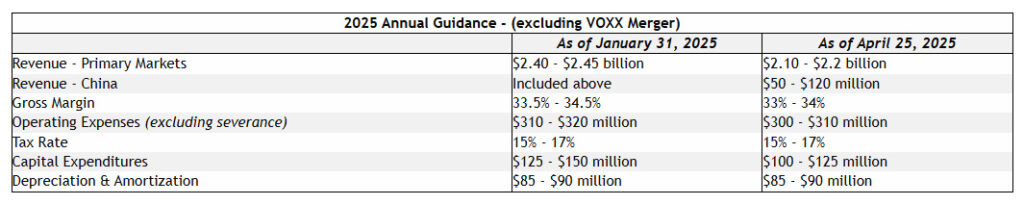

Many companies have recently withdrawn their forward performance guidance, as the rather chaotic tariff program changes make it practically impossible to estimate business until the Trump administration sets all tariff rates both for China and around the world. But Gentex gamely kept its guidance for 2025 – with some adjustments. However, it did withdraw its guidance for 2026 “…due to the significant uncertainty surrounding the China market as a result of the impact of incremental tariffs on Company exports to China; the economic impact of import and export tariffs on the Company’s primary markets; and work being done to finalize a more complete financial picture of the recently completed merger with VOXX.”

You can see the adjusted guidance for 2025, shown in the table here with both the original January 31, 2025 guidance and the reworked April 25, 2025 guidance. The company downgraded revenues, both primary and China, gross margin, and operating expenses.

Gentex Remains Bullish on Voxx Acquisition

The company remains bullish on what it anticipates it will gain from its merger with Voxx. It repeated a previously provided expectation that Voxx will add between $325 million and $375 million in revenues on an annualized basis. For 2025, Gentex expects a $240 million to $280 million upside – not including any impact from tariffs.

By the way, Gentex says it has already notified Voxx customers that there will be future price increases “…that will take effect throughout the balance of calendar year 2025.” Because of this, the company told investors that, “These price increases may create uncertainty in consumer demand for this year, which could affect the expected revenue contribution from the Voxx merger.”

In terms of profitability, we have made good strides in our gross margin recovery efforts, and will continue to execute the plan as well as additional opportunities that the team has identified to improve the long-term profitability of the business. In the short term, however, as we secure reimbursement for tariffs on imports, the gross margin percentage will be impacted as we add costs and reimbursements that don’t include margin dollars. As we move through the year, we will be monitoring revenue closely and adjusting expenses to align to the market conditions. Lastly, the strength of the Company’s balance sheet puts us in a favorable position to capitalize on the pull-back in our share price as we consider higher levels of share repurchases.

Steve Downing

Earnings Call with Financial Analysts

It was a very different kind of conference call with financial analysts conducted by Gentex. The only thing the analysts wanted to discuss was the topic of the day: tariffs. Downing told analysts that the 2025 performance guidance was pulled back in what he called a “bearish” forecast – meaning more pessimistic than optimistic. For example, in the original forecast, the company estimated its China business at $220 million to $240 million.

Now, in the latest revision, China was put into the guidance as revenues of between $50 million to $120 million. Essentially, they cut their forecast in half. But over and over again, Downing told analysts there is no way to know what the final tariff situation is until all negotiations have been finalized. So this is their best guess, where they were trying deliberately not to be overly optimistic.

Learn more about Gentex by visiting gentex.com.

Leave a Reply