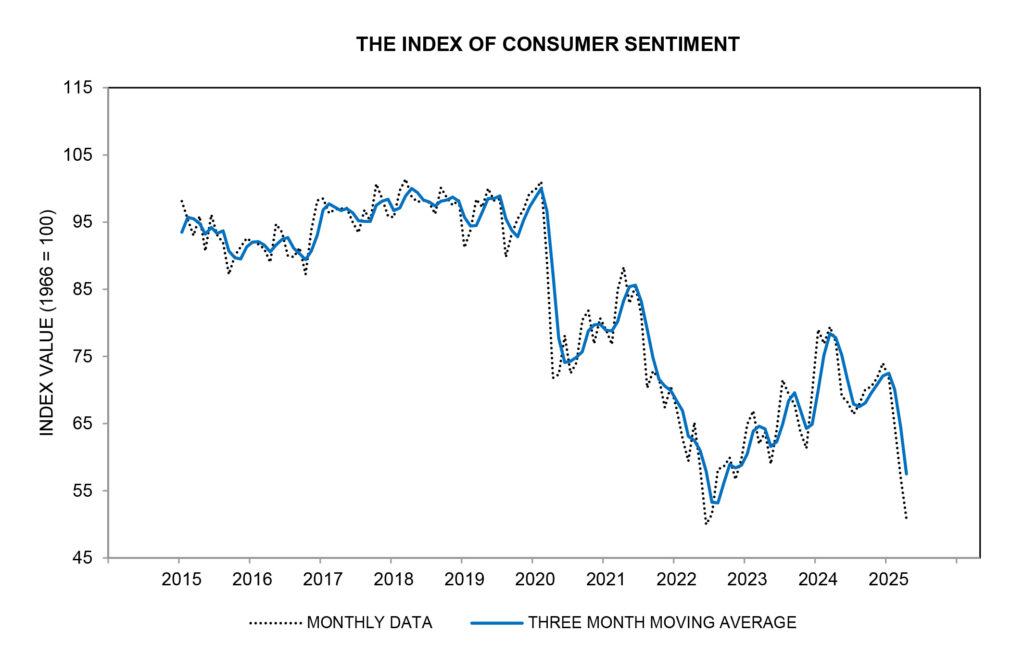

The University of Michigan (U of M) has released a preliminary reading of its Index of Consumer Sentiment (ICS) for April and it shows a continuing and startling slide in consumer sentiment, dropping another double-digit percentage from last month’s reading. In fact, this preliminary reading for April is the second-lowest reading in consumer sentiment in the entire 73-year history of the survey!

Learn about this decline in consumer sentiment that exceeded expectations

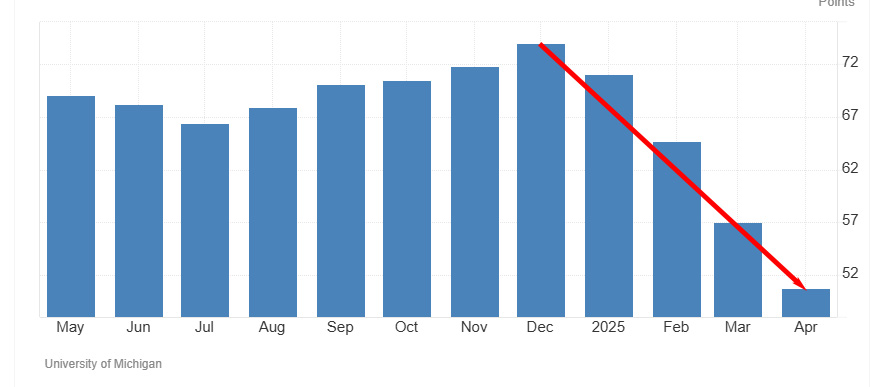

The unprecedented collapse in consumer sentiment has yet to hit a bottom, coming in at a reading of just 50.8 points in April, down 6.2 points or 10.9% compared to the reading in March of 57.0 points. This is the fourth consecutive month in-a-row – one of the most spectacular declines in consumer sentiment in the history of the survey which has run continuously for 73 years since 1952.

According to Joanne Hsu, U of M’s Surveys of Consumers Director, “This decline was, like the last month’s, pervasive and unanimous across age, income, education, geographic region, and political affiliation.” Clearly, consumers are becoming increasingly pessimistic about the U.S. economy – most likely as a result of the recent trade war launched by the Trump Administration.

Down More Than 30% From December 2024 After the Last Election

As I mentioned above, April’s 50.8 reading is the second-lowest reading in the 73-year history of the Index of Consumer Sentiment. This reading was also down 26.4 points or 34.2% as compared to the reading of 77.2 in April 2024. It is also down 30% from December when consumers were most optimistic after the last election.

The lowest reading ever recorded for the ICS was in June 2022, when U of M reported an ICS reading of 50.0.

Consumers are ‘Petrified,’ One Analyst Says

Most analysts and commentators expressed surprise at the depth of this continued decline. A survey of analysts by Dow Jones had predicted another month of decline in April, but this number is about 3.5 points lower than economists’ projection of 54.6 points.

Consumers have spiraled from anxious to petrified.

Samuel Tombs, chief economist at Pantheon Macroeconomics (as reported by CNBC)

Readings on Both Current Conditions and Future Expectations Declined by Double Digits

The ICS has two sub-components – the Current Economic Conditions Index (CCI – how consumers feel about their economic circumstances now) and the Index of Consumer Expectations (ICE – what consumers expect to see in the near-term future). As you might suspect, both of these indexes fell in April, as well. The CCI came in at 56.6 points down 11.4% below March’s reading of 63.8 and 25.8% below April 2024’s level of 79.0. The ICE for this April was 47.2 or 10.3% below March’s 52.6, and 37.9% below the reading of 76.0 in April last year.

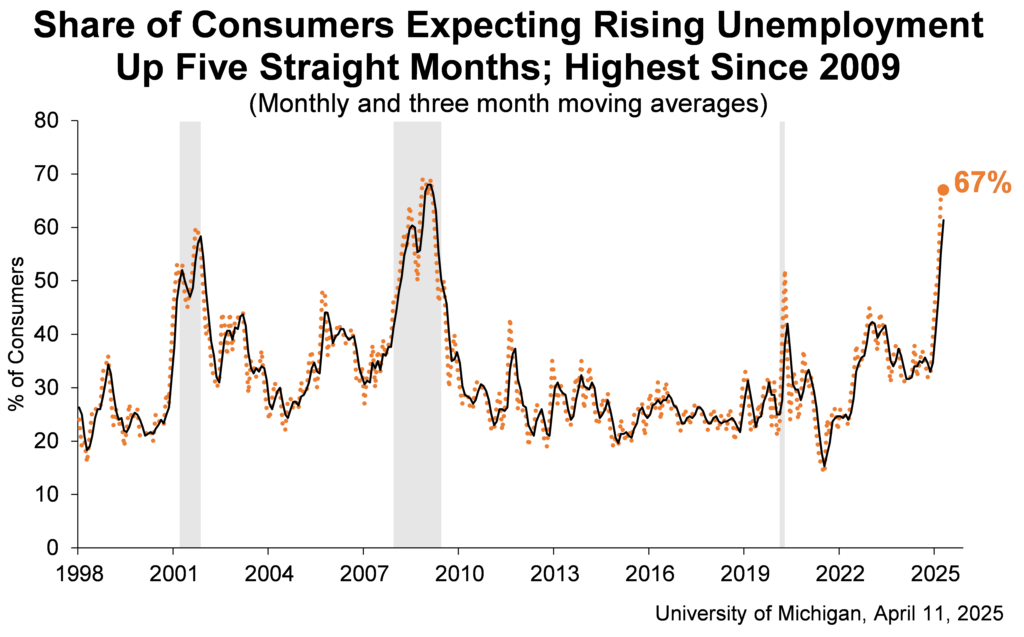

Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month. The share of consumers expecting unemployment to rise in the year ahead increased for the fifth consecutive month and is now more than double the November 2024 reading and the highest since 2009.

Joanne Hsu, U of M Director of Surveys of Consumers

Consumers Expect Unemployment and Inflation to Rise

One surprising result from this survey is that 67% of consumers now expect unemployment to rise in the year ahead. This is the highest number of consumers projecting that since 2009 during the last financial crisis in the U.S. Not only that, but survey respondents are now expecting a rate of inflation of 6.7%(!) in the year ahead. This is up from 5.0% last month…AND it is the highest projected inflation reading since 1981.

“The survey comes amid concerns that President Donald Trump’s tariffs will raise inflation and slow growth, with some prominent Wall Street executives and economists expecting the U.S. could teeter on recession over the next year,” said the CNBC report.

It should be noted that the survey’s data collection period concluded on April 8th, the day before the President announced a 90-day pause in the execution of the added reciprocal tariffs.

Leave a Reply