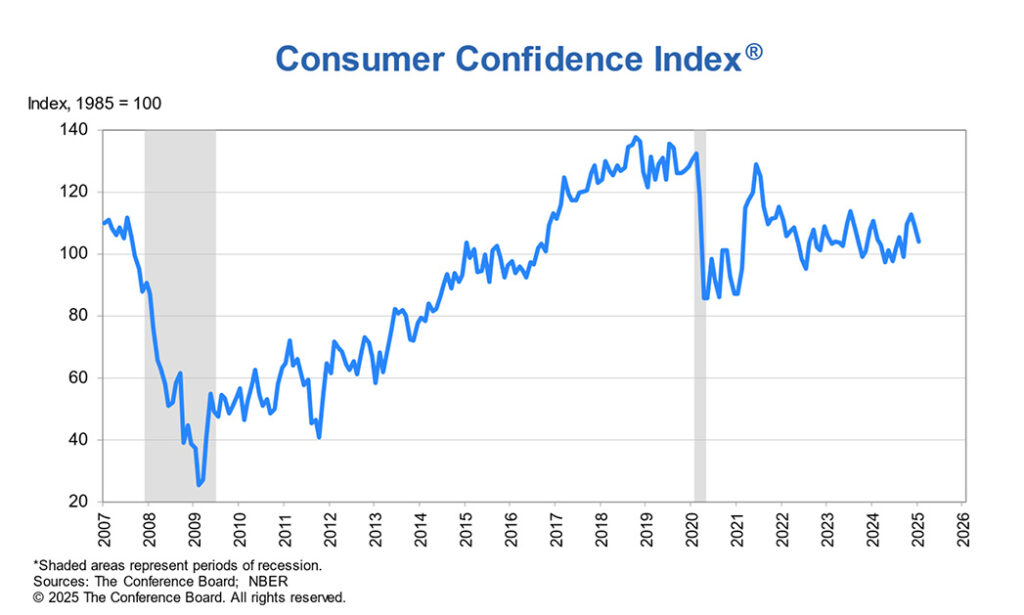

The Consumer Confidence Index (CCI), one of two major indexes tracking consumer sentiment on the U.S. economy, dropped in January, following what appeared to be a turning point to the negative side in late December. The CCI, a monthly survey of consumers conducted by The Conference Board and widely followed by economists as a reliable gauge that probes consumers’ thoughts on the economy – both in a rating of their present conditions…and in their rating of the near-term future prospects.

What does this unexpected decline mean for the economy?

See more on this drop in the Consumer Confidence Index

Consumer confidence declined in January 2025 to 104.1 (1985=100). This was a statistically significant 5.4-point decline from the revised December reading of 109.5. The December reading was revised upward by 4.8 points but was still down 3.3 points as compared to the reading in November.

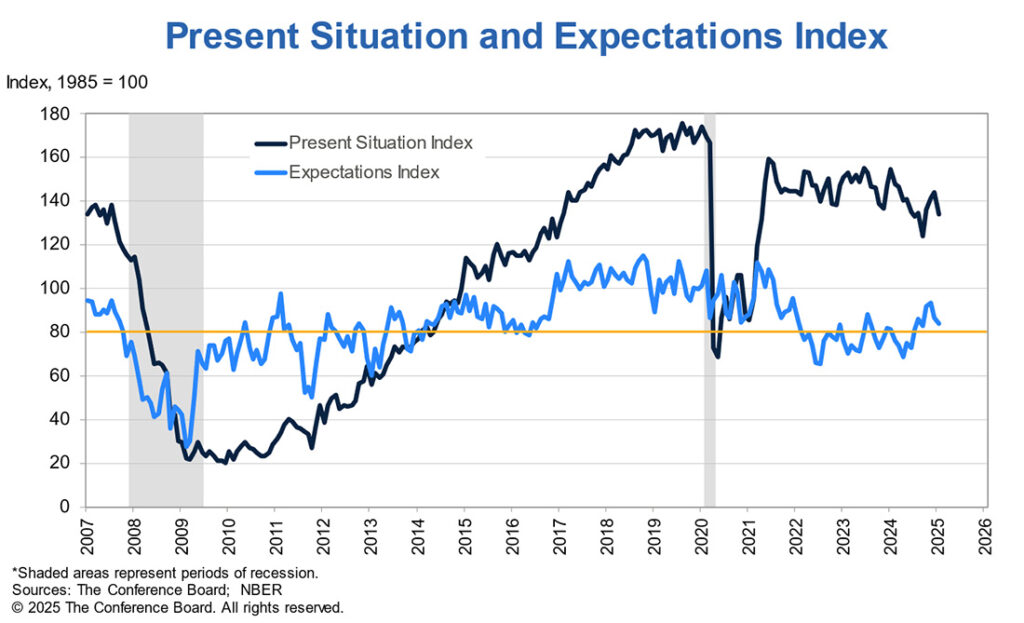

Consumers’ View of Their Present Situation Declined Even More Sharply

Notably, the Present Situation Index – the reading of consumers’ present assessment of current business and labor market conditions – fell even more sharply, by 9.7 points to 134.3. The Expectations Index – based on consumers’ near-term future outlook on income, business, and labor market conditions – declined a more modest 2.6 points to a reading of 83.9.

All five components of the Index deteriorated but consumers’ assessments of the present situation experienced the largest decline. Notably, views of current labor market conditions fell for the first time since September, while assessments of business conditions weakened for the second month in a row. Meanwhile, consumers were also less optimistic about future business conditions and, to a lesser extent, income. The return of pessimism about future employment prospects seen in December was confirmed in January.

Dana M. Peterson, Chief Economist at The Conference Board

Results May Be Tied to the Change in Administration

Many analysts are interpreting this sudden…and unexpected…drop in consumer confidence as related to the change this month in administrations in Washington DC. As you can see in the image below, the Wall Street Journal’s headline is one of many media outlets noting the correlation between the drop in consumers’ confidence to the beginning of a new administration.

On the flip side of the coin, consumers “remained bullish about the stock market, even if a bit less so than at the end of 2024.” However, purchasing plans for homes and cars were flat in January. Also, plans to purchase appliances were flat. But interestingly, purchase plans are “…still down for electronics on a six-month moving average basis.”

Up-and-Down Results Pattern

In fact, this up-and-down result pattern in seemingly similar items was evident throughout the survey. For example, consumers expressed intentions to purchase additional services in the months ahead – “especially dining out and streaming.” However, “vacation plans continued to trend downward at the start of 2025.”

The Conference Board also noted that the average 12-month inflation expectations increased from 5.1% to 5.3% in January. The Board notes that this is likely due to “stickier inflation” in recent months – a reality that caused the Fed to hold interest rates steady, rather than drop them again.

Caution is the Watchword of the Day

No doubt, at this point you have probably already set your budgets for 2025. But this sudden and unexpected decline in consumer confidence suggests we should all be a little more cautious as we move forward into 2025. Keep in mind that this is just one data point on the consumer, more will be forthcoming. However, consumer spending accounts for 70% of GDP and if this deterioration in consumer confidence continues, it could lead to a more significant slowdown in economic activity.

See more on The Conference Board and the data it compiles by visiting conference-board.org.

With the plutocrats and oligarchs now in control of (1) the executive branch, (2) both houses of Congress, and (3) the Supreme Court, I can’t imagine a sustained economic slow-down. The oligarchs won’t allow it. My prediction: the next 4 years will see a net gain in asset values (goods, equities, homes, etc), but not without a few normal and short down cycles. Those down cycles will be the Fed’s excuse to trigger QE money print (debt), which will then trickle up to the oligarchs (who are ultimately on the receiving end of that debt).

The redistribution of wealth from the broad middle classes to very top classes will accelerate, the middle classes will go even deeper into debt, the country will become increasingly socially polarized. And here’s the real problem. The broad middle classes will be told that their worsening plight is because of immigrants, communists, gays, DEI, baby killers, environmentalists, globalists, etc.. It’s an age-old strategy: divide and conquer: Get us so riled up against one another that we don’t look upward and see where all our wealth and power have actually gone. This is how nations die.