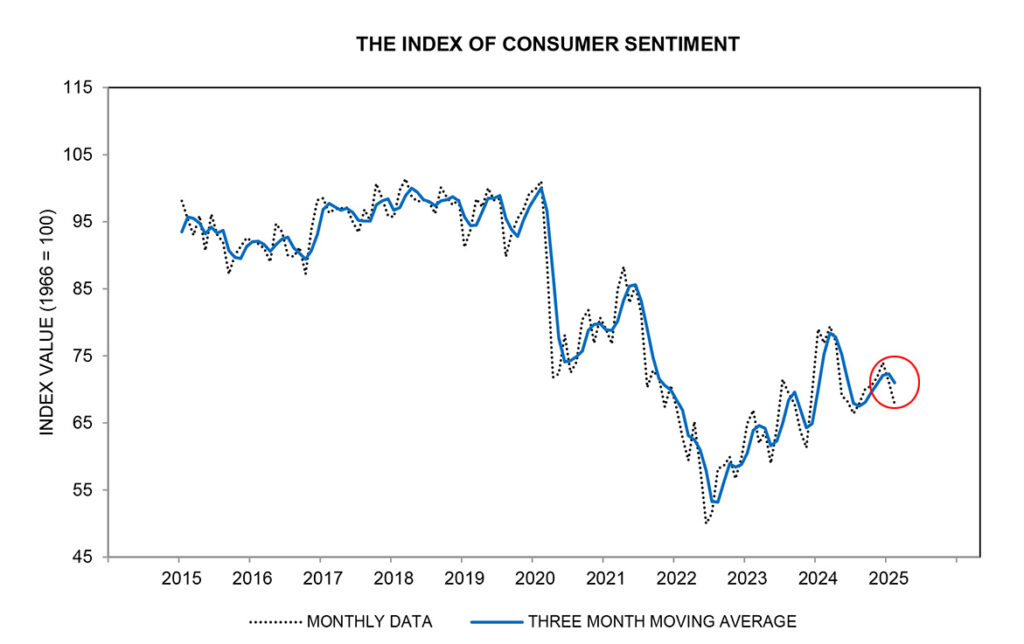

Another sign of a deteriorating consumer outlook arrived last Friday in the form of the Index of Consumer Sentiment (ICS), another highly respected data resource from the University of Michigan that is widely followed by economists, financial analysts, Wall Street, the Federal Reserve Board, government officials, the media, and more. Widely viewed as a reliable indicator of how consumers are feeling about their current circumstances, as well as their outlook for the future, and their expectations for inflation – it is a leading indicator of future economic direction.

The preliminary result of the ICS for February registered a significant drop in consumer sentiment. What is spooking consumers?

See more on the February Index of Consumer Sentiment decline…

I recently reported on The Conference Board’s Consumer Confidence Index taking a significant downturn, suggesting that consumers were turning pessimistic about the direction of the U.S. economy. Now we get this second reading, and it appears to support the conclusion that consumers are indeed souring on the direction of the economy.

Consumer Sentiment Fell in February for the Second Month in a Row

According to the preliminary data from U of M, consumer sentiment fell to a reading of 67.8, a statistically significant decline of almost 5% in February as compared to the level in January, and the second straight month of decline in a row. This reading was also a double-digit percentage drop (-11.8%) below the consumer sentiment reading in February 2024. U of M Director Joanne Hsu (pronounced shoo) notes that this is now the lowest reading on consumer sentiment since July 2024.

Note that this is the preliminary result and a final reading will be released later in February. The ICS includes copious amounts of data, including a breakdown by political affiliation. Interestingly, the February reading registered declines in sentiment for all major political affiliations.

The decrease was pervasive, with Republicans, Independents, and Democrats all posting sentiment declines from January, along with consumers across age and wealth groups.

Joanne Hsu, University of Michigan Director, Surveys of Consumers

The U of M surveys are conducted on a monthly basis and include querying consumers about the current status of their personal situation, known as the Current Economic Conditions, and also their outlook for the near-term future, known as the Index of Consumer Expectations. Each of these surveys have sub-components for a more detailed view of the ratings. All of this is then combined to create the Index of Consumer Sentiment for an overall reading.

The U of M Director noted that all five index components (of the Index of Consumer Expectations) deteriorated in February. Most startlingly, this was led by a 12% drop in buying conditions for durables. Says the report, this particular drop in durables was “…in part due to a perception that it may be too late to avoid the negative impact of tariff policy.”

Also peering into the future, consumers said that their expectations for personal finances declined by around 6% from the January reading. And again, this decline was seen across all political affiliations. The survey director noted that this took the personal finances rating to its lowest value since October 2023.

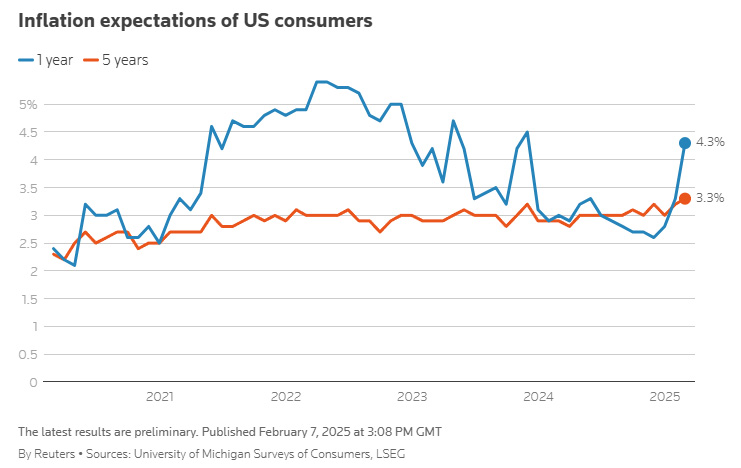

Many consumers appear worried that high inflation will return within the next year. Year-ahead inflation expectations jumped up from 3.3% last month to 4.3% this month, the highest reading since November 2023 and marking two consecutive months of unusually large increases. This is only the fifth time in 14 years we have seen such a large one-month rise (one percentage point or more) in year-ahead inflation expectations.

Joanne Hsu

Why is consumer sentiment so important? It’s pretty simple – 70% of U.S. gross domestic product (GDP) is based on consumer spending. When consumers are confident and feeling good about the economy they more freely spend their money. If the consumer turns pessimistic and feels the economy is heading in the wrong direction, they will save their money and not spend.

How big is consumer spending? Consumers spent about $13 trillion in 2024…that’s with a “t”.

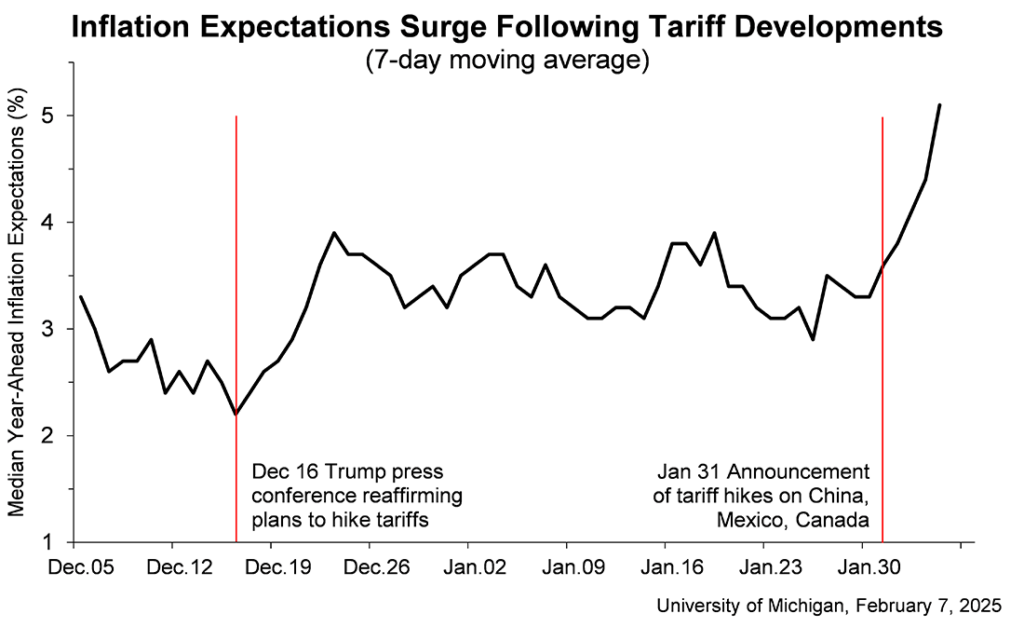

Consumers Link Tariffs and Inflation

In an interesting analysis by U of M, it juxtaposed survey results against key events related to the new administration’s tough talk on implementing tariffs. It’s pretty easy to see that consumers see the tariff plans being rolled out now as creating greater inflation and negatively impacting their personal situation and the economy overall.

And Consumers May Not Be Wrong – Inflation Resurges to Hit 3% in January

It is quite possible that consumers may not be wrong about the future of rising inflation. In the latest data released today by the Bureau of Labor Statistics, U.S. inflation rose to 3 percent in January – a result that will almost certainly convince the Federal Reserve Board to halt its plans to reduce interest rates to stimulate the economy. This new reading shows inflation increasing by 0.5% in January as compared to the reading in December.

According to a report in the New York Times, Austen Goolsbee, president of the Federal Reserve Bank of Chicago described this latest report on inflation as “sobering.”

Even Experts Note the Risk of Inflation is Increasing

Former Fed economist now at UBS Alan Detmeister, said of the administration’s proposals, including tariffs, “The risks are to higher inflation and lower growth.” He went on to tell the Times that much will depend on what is actually implemented – adding that the economic outlook is “very uncertain.”

Hold on to your hats! We are headed into stormy economic weather!

See more on the U of M Index of Consumer Sentiment by following this link…

Leave a Reply