With the final closing of its sale of Sound United to Harman International, Masimo Corporation (Nasdaq: MASI) has now submitted a Form 8-K/A with the Securities and Exchange Commission (SEC), which seeks to provide recast financials for its last three years, taking Sound United out of its numbers. Masimo also revealed the impact of some last-minute adjustments, as per its agreement with Harman.

Why would Masimo do this? Read on…

So why would Masimo go to all the effort – and it’s a lot of work – to go back three years and completely recast their financials as though Sound United never existed as part of the overall company? The main reason to do so is to provide investors with the ability to compare future reports of its performance with past reports of its performance.

Naturally, going forward, Sound United is no longer part of the Masimo picture. But if no adjustment was calculated, investors would lose the ability to compare future quarterly reports with historical records of performance. The only way to offer a true apples-to-apples comparison is to recast those past reports to genuinely reflect or align with the existing Masimo professional medical business. So this is not an unusual event at all.

What Results Would Have Been If Masimo Had Not Acquired Sound United

However, for those of us who have been watching Masimo’s financial performance over the last few years (like me) it was interesting to finally get to see a full reconciliation of just what the impact on Masimo was that Sound United represented. We also learn some new things, including some additional adjustments necessary at closing, that we didn’t have specific data on before.

So let’s dig in…

On May 6, 2025, Masimo and Harman entered into an agreement in which Masimo would sell and transfer to Harman its full equity interests “in Viper Holdings Corporation, a Delaware corporation (together with its subsidiaries, ‘Sound United’), which owns and operates the Company’s consumer audio business.” The price paid was $350 million in cash, “subject to certain adjustments.” On September 23, 2025 the transaction was fully closed.

At Closing: A Cash Receipt of $328 Million, And a Debt Payment of $271 Million

At closing, we now learn, Masimo received cash payment of $328 million, an amount which was “subject to certain post-closing adjustments pursuant to the Agreement.” Why only $328 million instead of $350 million? The filing doesn’t specify, however, typically in a transaction like this it can be something like some type of cash payment from Sound United transmitted to Masimo, leaving Harman to only have to pay the net amount to equal the whole amount of the transaction. Whatever it is, it’s not a thing.

We also learned that Masimo took this money and immediately used $270 million of it to pay off an unsecured $270 million term loan. In addition to that, the company also paid lenders accrued interest of “approximately $1,062,000” on said loan.

The Affect on Historical Financial Statements; A ‘Transition Services Agreement’

Said the filing: “The following unaudited pro forma condensed consolidated financial information is intended to illustrate how the above transactions would affect the historical financial statements of Masimo if the Transaction had been consummated at an earlier time as indicated herein.”

Finally, we also learn that, “In addition, the Company also entered into certain customary related transaction agreements at the closing with Buyer, including a transition services agreement.” This is also a common requirement, requiring the seller to assist the buyer for a certain period of time as they transitition personnel and operations to new management.

Pro Forma Statements of Operation for Last Three Years

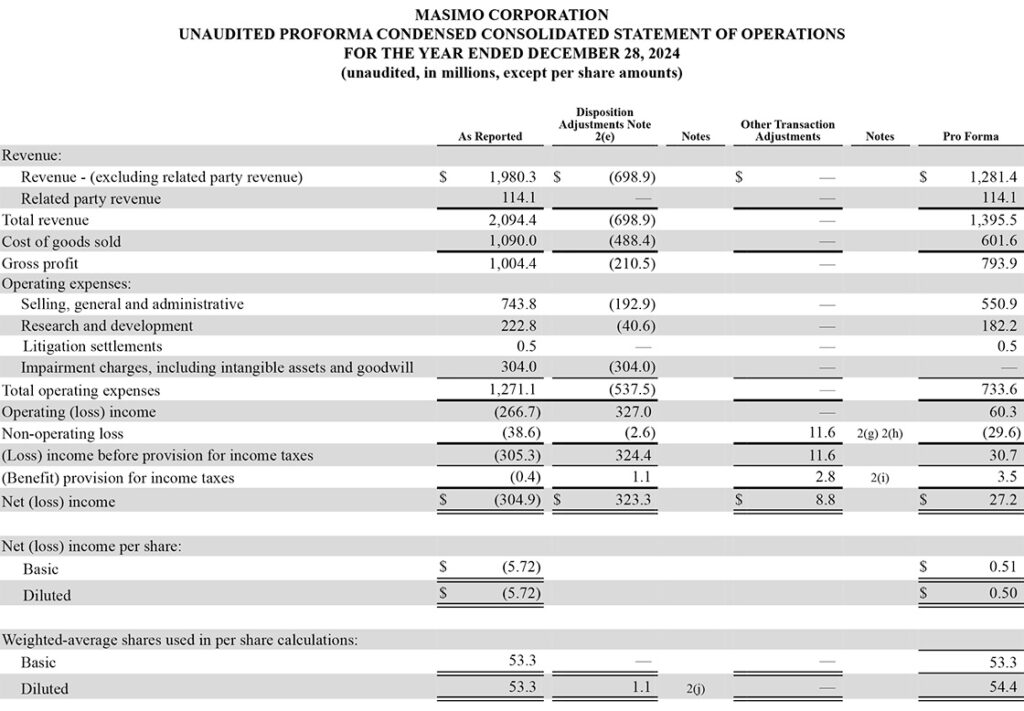

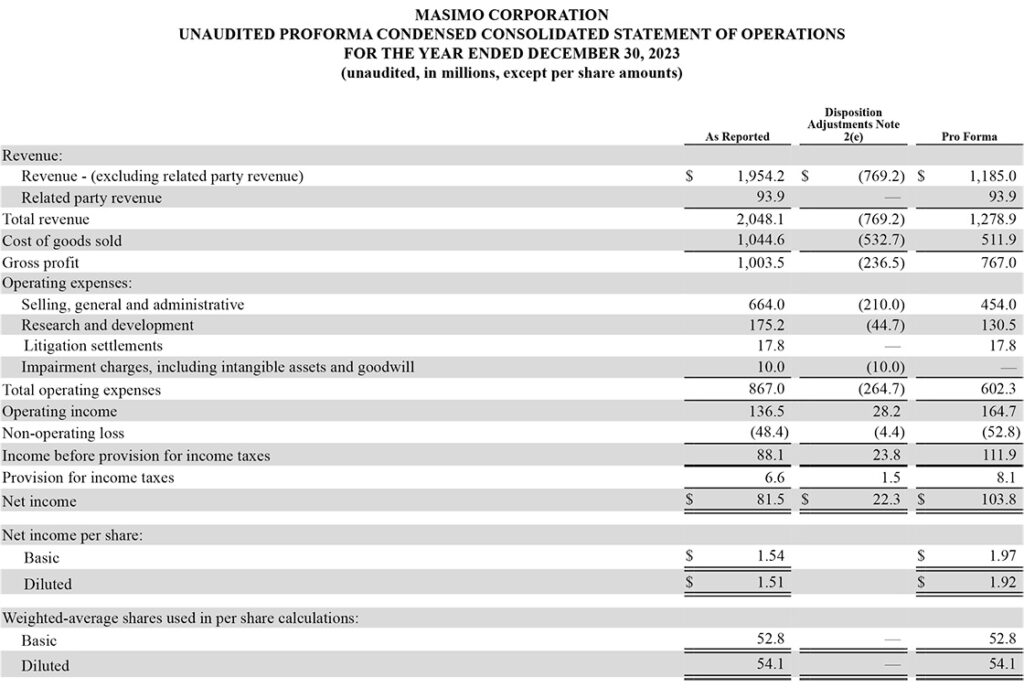

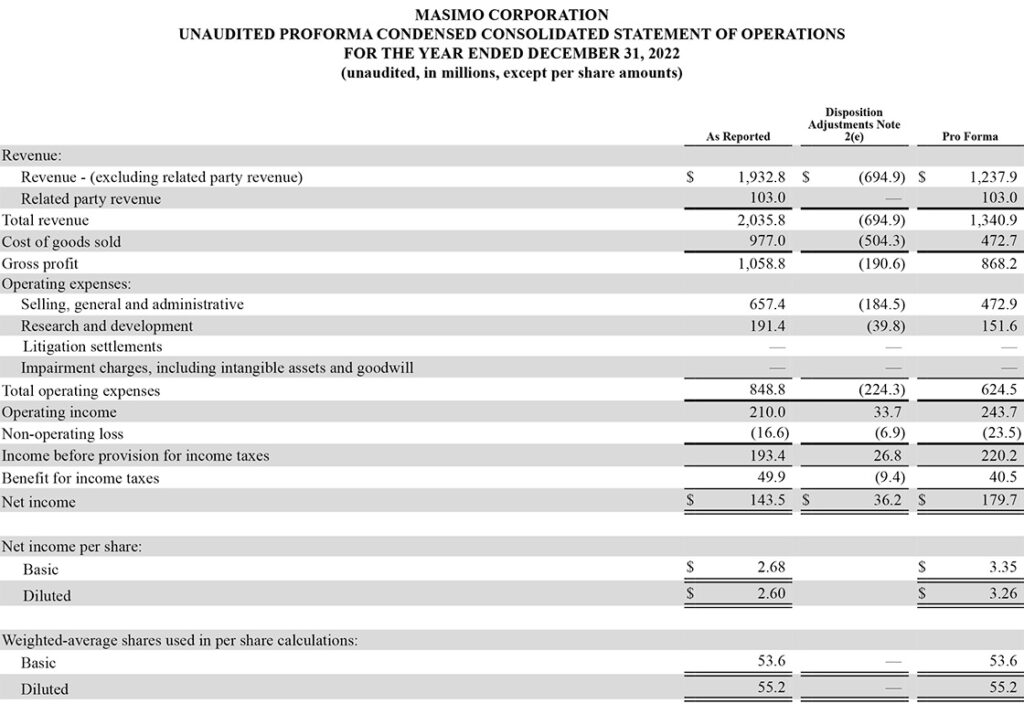

Below are the recast Pro Forma Condensed Consolidated Statement of Operations for each of the last three years: 2024, 2023, and 2022. These show both the originally reported results (“As Reported”), the new adjustments applied (“Disposition Adjustments”), any other adjustments (“Other Transaction Adjustments”), and the final new or Pro Forma result for comparison.

I’ll present each of the three recast Statements of Operation, which brief highlights of the changes.

2024 Pro Forma

The key numbers here include Total Revenue which dropped from a reported just under $2.1 billion to $1.4 billion Pro Forma. Gross Profit dollars dropped from $1.0 billion as reported to a Pro Forma of $794 million. A reported Operating Loss of $267 million was turned into a Pro Forma Operating Income of $60.3 million. And finally, a Net Loss of $305 million became a Net Income of $27 million. These are substantial changes to the positive side.

2023 Pro Forma

Here we see Total revenue dropped from a reported $2.048 billion to a Pro Forma total revenue of $1.279 billion. Gross profit dollars were much like 2024, from $1.004 billion as reported, to $767 million Pro Forma. Operating income grew from an as reported $137 million to a Pro Forma $165 million. Net income jumped from the as reported $82 million to $104 million Pro Forma.

2022 Pro Forma

The year 2022 was the year that Masimo acquired Sound United, so only part of the year was impacted. In any event, we see that Total revenue dropped from the reported $2.036 billion to the Pro Forma total revenue of $1.341 billion. Gross profit was originally a reported $1.059 billion, which dropped to $868 million Pro Forma. Operating income went from $210 million as reported to $244 million Pro Forma. Finally, Net income went from a reported $144 million to a Pro Forma $180 million.

For More Information…

To learn more about Masimo, visit masimo.com.

Leave a Reply