Sonos, Inc. (Nasdaq: SONO) reported its results for the first quarter of fiscal 2026, the period that ended on December 27, 2025. The results paint the picture of a company going through a painful transformation. And while some progress has clearly been made, there is still a long way to go – and it remains unclear whether the company will ultimately be successful. However, we’ll look at where they are right now, the plan they roughly sketched out for next steps, and you can see what you think.

Learn all about the Sonos quarterly earnings for Q1 of 2026…

I can’t say the process that Sonos went through in 2025 was successful. New management was tasked with trying to turn around a company that in 2024 had seriously damaged its reputation. More importantly, it damaged its relationship with end-users, dealers, and integrators, thanks to an unbelievably bungled and surprisingly disastrous app rollout. This was a rollout that, at the very least, disrupted users’ enjoyment…and at the worst, even disabled scores of users’ systems in their homes – shaking the loyalty of an unknown number of previously happy Sonos customers.

End-user reaction was not hard to find. On various social media sites and messaging apps, consumers’ confusion, frustration, and out-and-out throbbing-neck-vein anger flowed freely. It was a level of invective rarely seen in the event of an app update.

Rushing the Patient Into Surgery

At the same time, the company had rolled out a new headphone product (Sonos ACE) that failed to deliver the level of sales it had expected, yet another mistake by former management. As former CEO Patrick Spence scrambled the team to try and get a handle on a rapidly deteriorating situation, the Sonos Board of Directors finally arose from what must have been a dreadfully fitful slumber to finally take control of the situation in January 2025.

The Board rushed the patient Sonos into emergency surgery. Could it be saved? The Board fired Spence and then named fellow board member Tom Conrad as interim CEO or, in this case, head surgeon. Conrad’s background was not an obvious fit for the task; he may not be the best surgeon to save the patient. But never mind that, this isn’t a carefully planned elective surgery! The patient is losing a lot of blood…we are in triage…hurry any doctor you can find into the operating room…STAT!

The first actions that new CEO Conrad took, made it clear just how dire things were at that point – the company was clearly in a fight for survival. Conrad cancelled the existing product roadmap, immediately cut several members on the executive team and hired replacements, and instituted companywide layoffs of 12% of employees (in addition to a layoff of 6% of the company staff in an earlier round of cuts).

In July 2025, the Board decided to make Conrad the permanent CEO going forward. So how did he do? I’m glad you asked.

A Quick Summary of What the Q1 2026 Numbers Showed

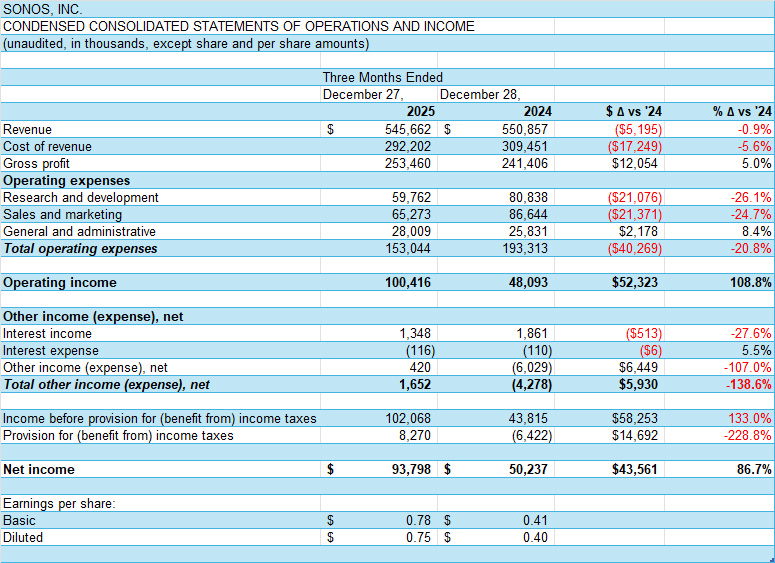

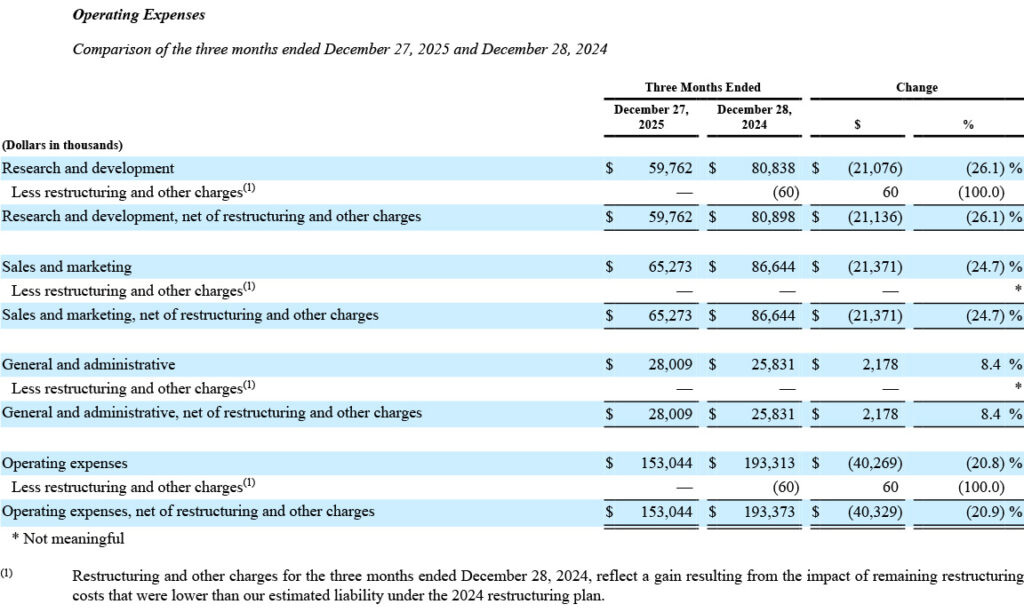

Boiling it all down, revenues declined slightly, but profits increased appreciably. In the wake of declining revenue, Conrad and CFO Saori Casey aggressively cut spending to reduce overhead and eliminate costs. This action drove up profits. I’m guessing this was one reason they threw out the old product roadmap – the company cut Research & Development spending by more than 26%. Also, Conrad wanted to change course from the one charted by Spence (more on this later), and the company cut sales and marketing spending by almost 25%.

When a company is spiraling out of control, you have to grab the reins and begin guiding it back by seizing on those items you directly have at your fingertips…such as discretionary investments in R&D, and Sales & Marketing. Much of these reductions, by the way, were due to the companywide layoffs, which reduced headcount, salaries, benefits, etc.

Fiscal 2026 is off to a good start for Sonos as we make progress toward a return to growth. We’re focused on coordinated execution across the growth dimensions that matter, from product and software to marketing and global expansion. With the announcement of Amp Multi, and with more planned later this year, we’re returning to product innovation that strengthens Sonos as a system, pairing great products with a simpler, more reliable, and more powerful platform designed to create long-term value for our customers, partners, and the business – all while maintaining our commitment to operational discipline.

Tom Conrad, Sonos Chief Executive Officer

A Wild Ride

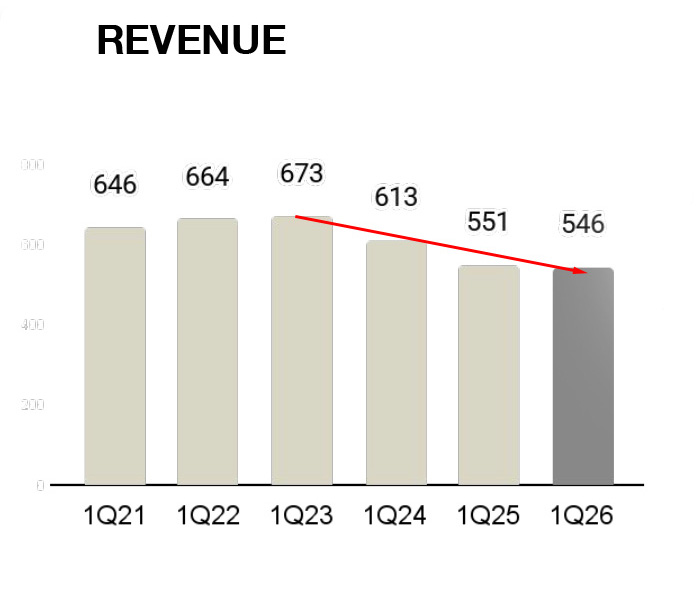

It was a wild ride, but the Q1 numbers suggest the company may be closing in on stability. Revenues in the quarter this year came in at $545.6 million, down $5.2 million or about 1% from revenues of $550.9 million in the first quarter of Fiscal 2025. That 2025 revenue figure of $550.9 million, by the way, was down a more substantial $61.9 million or 10.1% from revenues of $612.9 million in the first quarter of 2024.

So perhaps revenues are close to hitting a trough and bottoming out…

Revenues by Product Category

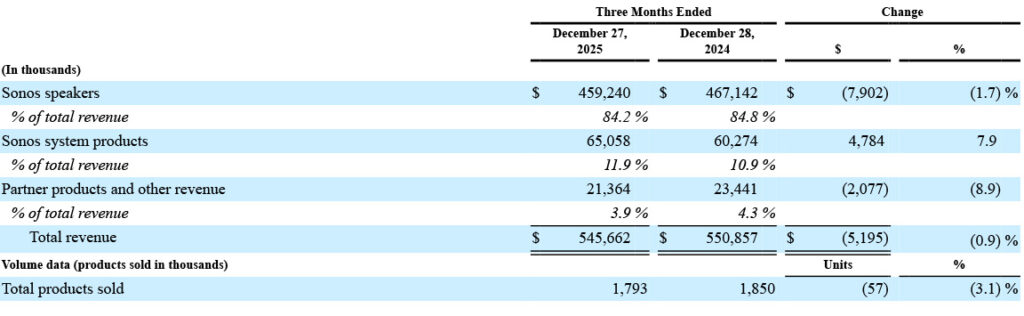

Still, elements of revenue generation continue to show signs of stress. For example, in a disaggregation of revenues by product, we see that the largest decline is in the Sonos speakers category, the category that includes most of what we think of when we think of Sonos, such as streaming speakers, soundbars, subwoofers, portable products, and headphones. Total revenue in the category came in at $459.2 million, down $7.9 million or 2% from revenues of $467.1 million in the same quarter last year.

The company said that the decline was due to “expected declines in Arc, as well as Sub and portables, partially offset by higher sales of Arc Ultra and Era 100.” The increase in Era 100 was the result of the company’s decision to reposition it by dropping its normal selling price.

Sonos System Revenues

Some of the $7.9 million drop in revenue in the Sonos speakers category was recouped by the Sonos system products, the category which largely represents products sold to integrators, such as the Port and Amp, and in the back half of 2026, will likely include the newly announced Amp Multi. Revenues in this category came in at $65.1 million, up around $4.8 million or 7.9%. That’s a nice percentage increase, but a much smaller category than Sonos speakers.

Keep in mind, however, that last year, Sonos system products dropped $24.3 million or 29% versus Q1/2024. So it’s been a bit volatile in its historical performance.

Sonos Partner Products

Finally, the last category, Partner products and other revenue, booked revenues of $21.4 million, down $2.1 million or 8.9% compared to revenues of $23.4 million in the same quarter the previous year. Partner products is kind of a catch-all category including sales of select in-ceiling/in-wall speaker products in partnership with Sonance (sold to custom integrators), but also sales through IKEA (a venture that does not appear to have been successful), accessories and other miscellaneous products. This category has been declining for years. Sonos offered no explanation for why the category continued to decline.

Finally, the company also reported that unit sales of products declined in the first quarter. Unit shipments of all Sonos products in the first quarter of 2026 came in at 1.793 million units this year, down 57,000 units or 3.1% as compared with unit shipments of 1.850 million units in the first quarter of fiscal 2025.

So, as you can see, it’s a bit of a mixed bag of results when looking at the various revenue breakdowns.

Revenues by Geographic Region

The same is true when considering revenues by geographic region. The company reported that revenues in the Americas grew just 1.3% in Q1 of 2026. But revenues in Europe/Middle East/APAC – the region known as EMEA – declined by 4.1%. Also, revenues from APAC (Asia Pacific) dropped 4.6%.

So while it’s true that the Americas is the biggest region, the revenue gain there was just $4.3 million. This was more than offset by the decline in international sales, with EMEA alone seeing revenues decline by $8.2 million and APAC experiencing a decline of another $1.3 million.

A Brighter Profit Picture

As I mentioned earlier, the company engaged in aggressive cost-cutting, including two rounds of layoffs – one in August of 2024 when 6% of the staff was let go, and the other in February 2025 when another 12% of the staff was let go. The company says these staff reductions, “… [have] created a more streamlined, agile organization.”

Certainly, these layoffs, as well as a series of other actions to cut overhead, allowed profits to make solid improvements. Thanks to a 5.6% cut in the cost of revenues, the company reported gross profits of $253.5 million. This is an increase of $12.1 million or 5% as compared to gross profits of $241.4 million in the same quarter last year.

Cutting Expenses Improved Profits

Total Operating expenses (OpEx) were cut by an impressive 20.8% or $40.3 million, coming in at $153.0 million versus total operating expenses of $193.3 million in 2025. This significant cut in OpEx allowed Operating income to more than double to $100.4 million, up $52.3 million or 108.8% as compared to operating income of $48.1 million in the quarter last year.

Likewise, Net income also improved substantially, with this years first quarter net income showing $93.8 million, an increase of $43.6 million or 86% over net income last year of $50.2 million. On a per share basis, that works out to a fully diluted EPS of $0.75/share versus $0.40/share in Q1 of 2025.

CEO Conrad Discusses Go Forward Strategy

So you can see from the results I highlighted above, the company was in triage mode, cutting expenses by, for example, implementing large employee layoffs, halting product launches and lowering R&D investments, cutting back on promotions to lower sales & marketing investments…and more. These cost reduction actions resulted in driving growth in earnings (something Wall Street likes). The company also lowered the pace of the multi-year decline, but still had another modest revenue decline.

It wasn’t perfect…it wasn’t pretty…but it was something – it was a demonstration of management getting its operations under some semblance of control. CEO Conrad outlined five key tactics – he called them “growth dimensions” to drive future growth.

The Five ‘Growth Dimensions’ in Sonos’ Plans

Growth Dimension #1, Product Innovation – After cutting R&D staff and investment, the company now says it is focused “…on creating products that are genuinely differentiated, deeply tied to the home, and designed to strengthen Sonos as a system rather than standalone devices,” Conrad told financial analysts on a conference call. I’d say there is dissonance in these two elements – cutting R&D staff and investment and launching a new roadmap of “genuinely differentiated” products.

Growth Dimension #2, Customer Advocacy – Now that the Sonos app has been fixed, Conrad believes the company can turn back to converting customers into advocates. Said Conrad, “When the system works well, customers trust it, expand it, and recommend it.” It remains to be seen if consumers are ready to advocate for Sonos again just months after a painful period of app failure.

Intentional and Effective Marketing

Growth Dimension #3, Intentional and Effective Marketing – The new CEO bragged about the company’s new Chief Marketing Officer (CMO), Colleen DeCourcy, whom he said is “…rebuilding our go-to-market engine around a full-funnel brand architecture that connects long-term brand storytelling with a clear, consistent system narrative,” Conrad emphasized. Sonos intends to emphasize its system approach to reinforce to users that they need to expand their SONOS system. Conrad reminded analysts that “Sonos is the easiest way to build a sound system for the home, and it gets better as you add to it.”

The Sonos CEO noted that in the past, the company relied too much on using marketing dollars to drive sales through consumer promotions. That will change, the company will market year-round with a more brand-building approach rather than a sales push result. It remains to be seen if a consumer brand like Sonos can throttle back on consumer promotions and still drive revenue growth. He may be asking too much of his new marketing team.

Geo Expansion…And, Of Course, AI

Growth Dimension #4, Geo-Expansion – Although the company is already distributed globally, Conrad told analysts that the company believes there is “a meaningful opportunity” to grow its international business. He did not explain what this opportunity was, or why the company hasn’t tapped into it up to now. Remember, both EMEA and APAC regions – international markets Sonos is already distributed in – experienced declining revenues in the first quarter of 2026. The only specifics he mentioned were not specifics – “the right mix of products, pricing, partnerships, and local relevance…” Huh?

Growth Dimension #5, <sigh> AI – Ok, that’s not exactly how he worded it. Rather, using his best corporate-speak, he said, “…tapping demand from emerging external trends.” Sonos intends to “explore new interaction models, including conversational AI, in the home…” AI is the king of the current buzzwords of the day, so perhaps it scored points with the analysts (if not me). To me, it feels like a defensive application of a hot buzzword, rather than a proactive implementation of a true Sonos differentiator.

Recently introduced Amp Multi is an Example of Sonos’ Differentiated Innovation

To demonstrate that the company is embarking on product innovation now, Conrad introduced analysts to the Amp Multi, which he called “best-in-class multi-zone amplification” – a description that is clearly debatable within the CI community. It is, he declared to analysts, “…a clear expression of our system strategy.” He added, “Amp Multi allows Sonos to be built directly into the architecture of sophisticated homes.”

Amp Multi, Conrad declared to the analysts, will help its installers and integrators “…take on larger projects, work more efficiently, and grow their businesses with Sonos as a trusted system at the center.”

Keep in mind that Amp Multi will not be available until sometime in the second half of 2026. As far as its innovation, in multiple integrator interviews, the reviews I’ve received so far are decidedly mixed. I would characterize the responses I’ve gotten so far as ranging from “meh” to a product designed by someone who doesn’t truly understand the custom integration market. Sonos says Amp Multi was built in collaboration with several unnamed custom integrators. I haven’t found them yet, but if you are one of them, I would like to speak with you either on or off the record.

‘A Lot’ of New Products Planned for 2026

In any event, Conrad is promising a lot of new products in 2026. It seems as if that will be hard to deliver with its reduced R&D manpower and investment. But we’ll just have to wait and see.

Sonos’ challenge is designing products for two completely different channels – the consumer channel and the integrator channel. Products optimized for one channel are not necessarily optimally configured for the other. They are two completely different use cases with usually two different customer types. Certainly, there is likely some degree of crossover, but I would argue there are more differences than commonalities.

In fact, I would argue that the early success of Sonos’ first few generations of its wireless streaming speaker systems was in part due to them being almost anti-integrator. Easy to install and operate, the attraction to the customer back in those early days was that they didn’t require an expensive integration project to fill their homes with music.

Company Releases Guidance for the Second Quarter of 2026

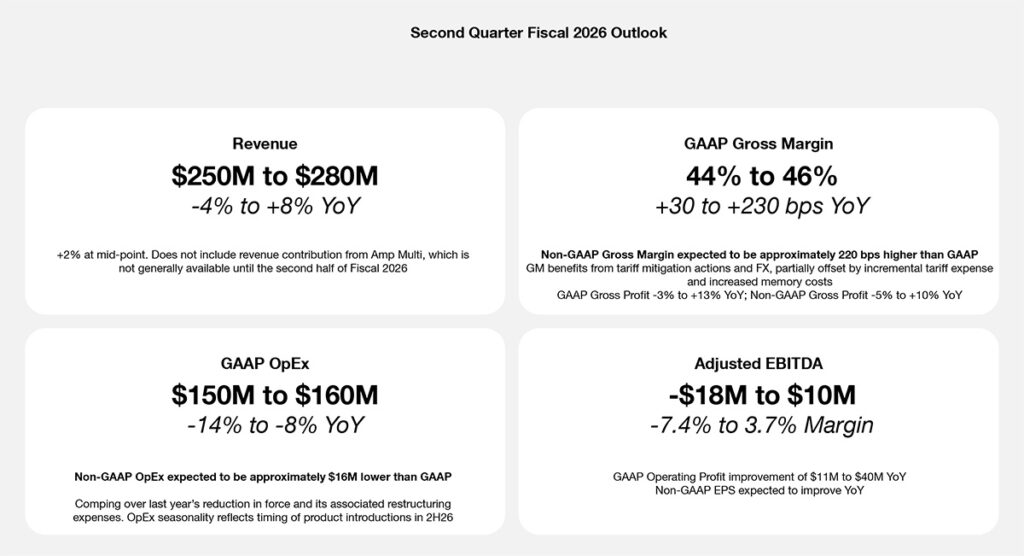

Finally, the company released its outlook for the second quarter of 2026. Interestingly, the company is expecting revenues to be up just 2% at the midpoint guidance of revenue between $250 million to $280 million. Considering the first quarter was down 1%, this implies a first half rate of growth that is flat…zero growth. So I guess we have to wait until the third quarter for the promised “return to growth.”

For more information on Sonos, visit www.sonos.com.

Leave a Reply