Realtors Say Economic Uncertainty Has Frozen Buyers/Sellers

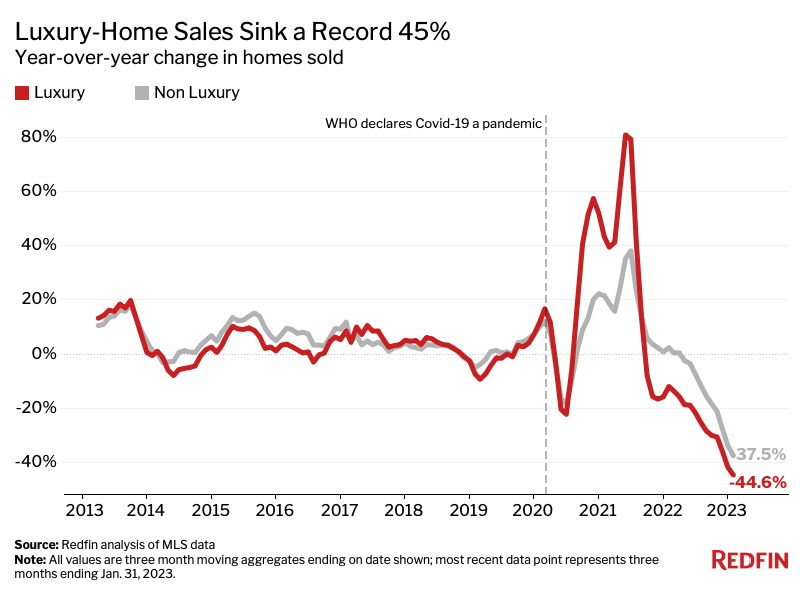

According to the latest data from national realtor Redfin, sales of luxury homes in the U.S. have declined a record -44.6% for the three-month period ending January 3, 2023, on a year-over-year (YoY) basis. That result outpaced the decline in sales of non-luxury homes of -37.5%.

See more on the collapse of luxury home sales; Is your market affected?

Throughout 2022 the housing segment has fallen into serious decline with inflation and limited inventory causing home prices to remain persistently high, along with mortgage rates climbing making homes less affordable. And these truths aren’t just hitting mainstream market housing, they are hitting the luxury home market as well.

In fact, the latest data from Redfin shows these trends are hitting the luxury home segment even harder. Luxury homes are defined as those homes in the top 5% of the home market (typically with a home value in the millions of dollars). With luxury home sales declining at a record pace of -44.6% in just the last three months, the segment has dropped to its second-lowest level ever recorded – a dubious achievement for sure.

Is The Party Over in Luxury Home Sales?

As many Strata-gee readers are serving the custom integration segment, this drop in luxury home sales is sobering. Adding insult to injury, while the overall market is declining as well, the luxury segment is declining faster and further than the middle segment of the market.

Says Redfin, “Many wealthy Americans are choosing to invest in assets other than real estate because elevated mortgage rates and softening housing prices have cast a shadow over prospective real estate returns.”

In How Many Metros Did High-End Residential Sales Decline?

Uncertainty is the main factor driving the luxury-market slowdown in Los Angeles. If you’re investing millions in a property, you want to make sure it will hold its value. Most luxury buyers and sellers are thinking, ‘Let’s just wait and see what happens to the market. When it stabilizes, we’ll be ready to go.’ Everyone is kind of at a standstill.

Alin Glogovicean, a local Redfin Premier real estate agent in Los Angeles

Redfin tracks the top 50 metro areas across the country and luxury home sales dropped in all 50 of them. In some of those markets, the decline was stunning. For example, Miami saw its high-end residential sales drop -68.7% in the quarter on a YoY basis. Also off was: Nassau County-Suffolk County, NY (-62.6%), Riverside, CA (-59.8%), Anaheim, CA (-59.3%), and San Jose, CA (-59%).

Even as Sales Declined, Home Prices Rose…Why?

It’s important to note that the luxury segment saw the greatest growth in sales during COVID, so this may be some form of a market correction – pulling back from unusual growth to unsustainable levels. Also, note that the markets listed above were already some of the least affordable around the country, so those teetering areas got hit harder by the changing economic impact on housing.

Ironically, because of the generally low inventory of available houses, prices continued to rise…even during this period of a downturn in sales. According to Redfin’s data, the median price of non-luxury homes increased 6.3% in the period on a YoY basis. The median price of luxury homes increased by even more – up fully 9%.

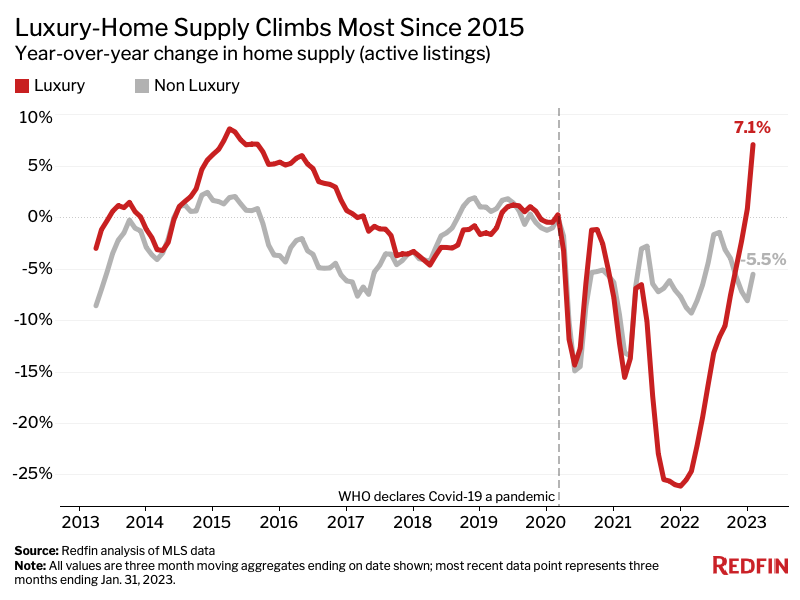

Sales Decline Causes Bump in Inventory – Though Still Historically Low

However, if there is any upside to this situation, it’s that this sales decline has served to improve the amount of available inventory of homes for sale. In fact, the report shows that home supply grew by 7.1% for luxury homes. This is a big contrast to non-luxury homes, which saw inventory continue to fall by -5.5% in the period compared to last year.

Still, even with this uptick, housing inventory overall remains at historically low levels. There are multiple reasons for this and Redfin notes specifically that there is a hesitancy by sellers to list their homes for sale right now because they don’t want to give up their low mortgage rates obtained when they purchased their homes some years ago.

Learn more about Redfin by visiting redfin.com.

Leave a Reply