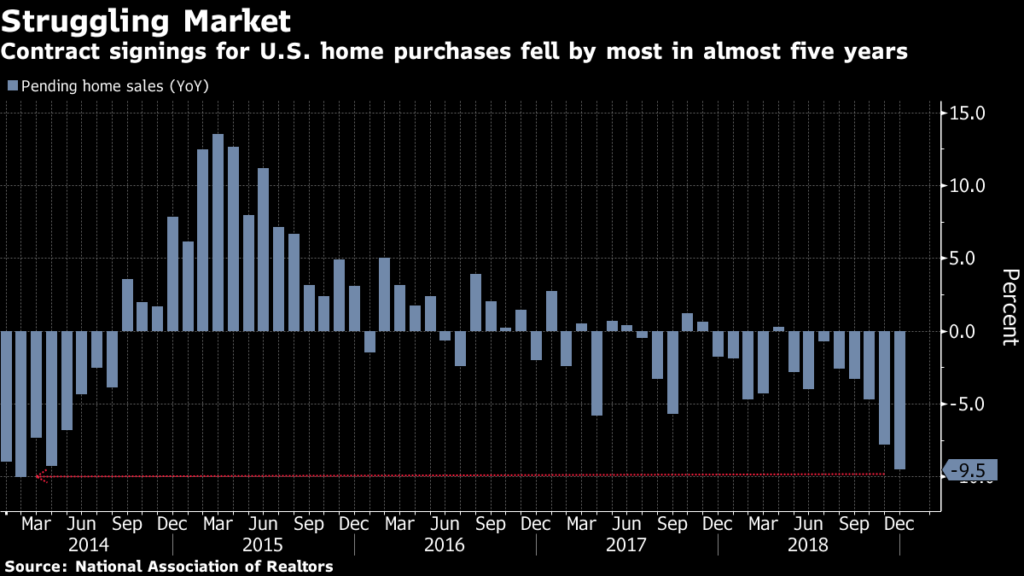

In a result that was not expected by most industry analysts, contract signings to purchase previously owned homes dropped in December for the third month in a row. The news is widely viewed as yet another indicator of a housing industry slowdown, along with declining affordability and rising housing and mortgage costs.

See more on this drop in pending home sales…

Perhaps even more of note, the reading for December is down fully 9.5% from the same month a year earlier. This is the worst drop since early 2014 or in almost five years.

Multiple Factors Spooked Buyers in December

Analysts pointed to multiple factors that combined to affect home buyers sentiment in December, including: high home prices, scarce inventory, wild stock market swings causing concerns, the uncertainty surrounding the partial government shutdown, to name a few.

Pending home sales are considered a leading indicator to future existing home sales, which are tabulated when the deals close – generally one or two months after contract signings. Contract signings start the process of the existing home sales purchase.

“The stock market correction hurt consumer confidence, record high home prices cut into affordability and mortgage rates were higher in October and November for consumers signing contracts in December.”

Lawrence Yun, Chief Economist for the National Association of Realtors

Some Indicators Show Positive Turns

However, recently some more positive indicators give some hope to those who follow the home market for a bit of a recovery. Mortgage rates have declined slightly from their higher levels in October and November, and the Fed has signaled that they will hold off for the time being on interest rate increases due to the obvious signs of a cooling economy. These changes could combine to tip the scales more favorably for home buyers.

On a regional basis, the West saw a small increase in pending home sales of 1.7%. The other three of the top four regions all saw declines. The greatest decline was in the South where contracts declined by 5%.

Slowing Price Increases May Help Affordability

The National Association of Realtors now predicts that home prices will increase 2.2% in 2019. This rate of increase is an 8-year low and well below the 4.8% home price increase last year. If consumer income increases in 2019, that should help homes look more affordable to buyers.

Leave a Reply