Permits Issued in June Send a Clear Warning Signal

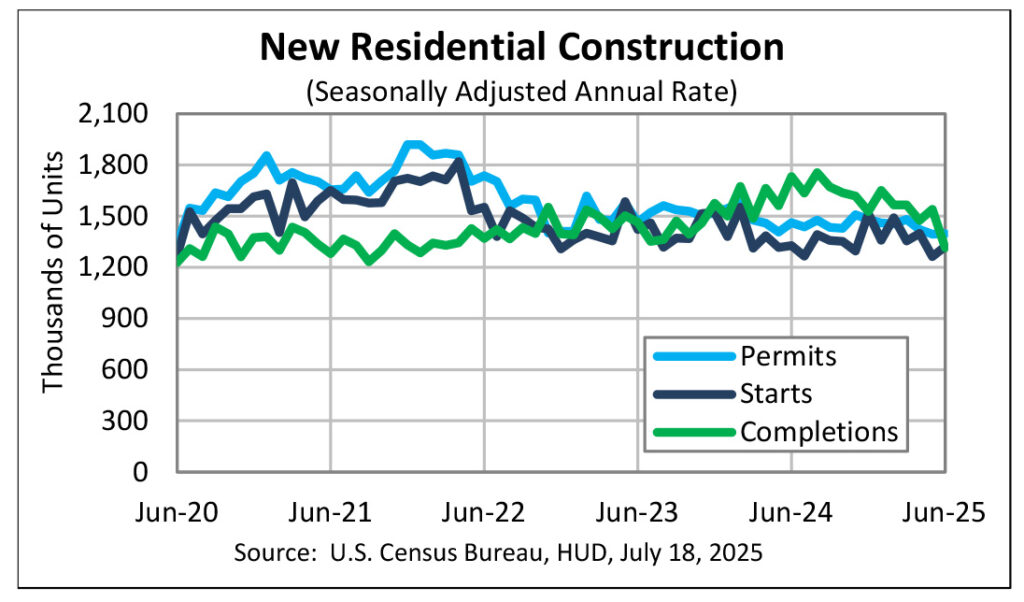

It’s a bit of a mixed bag in new residential construction data published today, generally known as housing starts. In June, the seasonally adjusted annual rate (SAAR) of the start of new home construction jumped 4.6% over the revised May rate. However, this rate remains 0.5% lower than the rate of construction starts in June of 2024, one year ago.

See the latest data on housing starts in June

New data released on Friday by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development showed that the rate of privately owned housing starts came in at a rate of 1.321 million units, up 4.6% over the revised rate of 1.263 million units in May. However, this rate was still below the June 2024 rate of 1.327 million units. This rate covers both single-family homes and multi-family homes summed together.

In May, as I previously reported, overall housing starts had taken a surprising drop, to a rate of 1.256 million, down 9.8% compared to April’s rate of 1.392 million units. So perhaps there was a bit of correction this June, but certainly not all of the ground lost in May was regained.

New Single-Family Housing Starts Drop 4.6%

June single-family housing starts, a figure I consider a more meaningful indicator for the custom integration industry, came in at a SAAR of 883,000 units. This rate was down 4.6% below the revised May rate of 926,000 single-family units started. Even worse, this rate is 10.0% below the rate of 981,000 single-family units started in June of last year.

The June single-family rate was the lowest level of starts in the category in 11-months. Analysts point to still-high mortgage interest rates, persistently high new home prices, and continued economic uncertainty.

On a regional basis, single-family starts dropped in all four regions, including Northeast (-2.9%), Midwest (-1.4%), South (-5.1%), and West (-6.3%).

Permits Issued in June Send a Clear Warning

Perhaps even more sobering, building authorizations (permits) issued for single-family homes in June, a leading indicator of future construction, came in at 866,000 units. This rate is 3.7% below May authorizations of 899,000 units, and fully 8.4% lower than authorizations of 945,000 in June of last year. In fact, the June permit number is more than a two-year low. This indicates a possible further dropoff in single-family home construction.

Analysts point to multiple issues impacting the industry’s ability to get back to a sustainable growth path, including tariffs driving inflation by raising the cost of building materials, which makes new homes less affordable, and the administration’s immigration crackdown, which has reduced available manpower on construction sites.

Builders Caught in a Deadly Pincer: Cutting Prices to Attract Buyers While Building Costs Rise

Everywhere builders look there are reasons to delay or scrap projects. The nation’s housing market outlook has never looked this troublesome. This could actually end quite badly for the economy.

Christopher Rupkey, Chief Economist at FWDBONDS

A recent survey of builders by the National Association of Home Builders showed that the percentage of builders who say they have to discount prices to attract buyers hit the highest level since 2022. Clearly, demand for new homes is softening. At the same time, builders are being forced into the clutches of a deadly pincer – with tariffs/inflation raising their construction costs on the one hand, while slackening customer demand is forcing them to discount prices on the other hand. This all adds up to a big squeeze on builder profits.

Leave a Reply