The overall housing market has been an economic laggard as the country has seen its economy rebound in the post-pandemic era. The reason for this is primarily due to an unusual combination of high interest rates AND high home prices AND limited available inventory of homes for sale. It is a triple witching that has bedeviled the housing industry in the post-pandemic era.

But is housing about to turn up?

See how the latest housing starts data is a positive sign for home construction

The economy continues to rebound with low unemployment, strong job growth, solid wage increases, declining inflation, and strong consumer spending. But one sector has been struggling during the post-pandemic period…housing. Multiple factors, such as those I mentioned above, have combined to depress home sales and scale back home construction – a major component of the overall gross domestic product (GDP).

Blue Skies Ahead for Home Builders

But now there are solid signs of a positive turn in circumstances for the housing industry – and it’s a turn that appears to have some legs. Even the highly conservative National Association of Home Builders economist Dr. Robert Dietz said recently in a communication to the organization’s members:

Despite elevated interest rates, home builder sentiment and construction starts are showing the potential for housing sector growth in the coming months.

Dr. Robert Dietz, NAHB Chief Economist

So let’s take a look at these metrics and see why some think they indicate a positive upturn is beginning right now.

Housing Starts Jumped Double-Digits in February

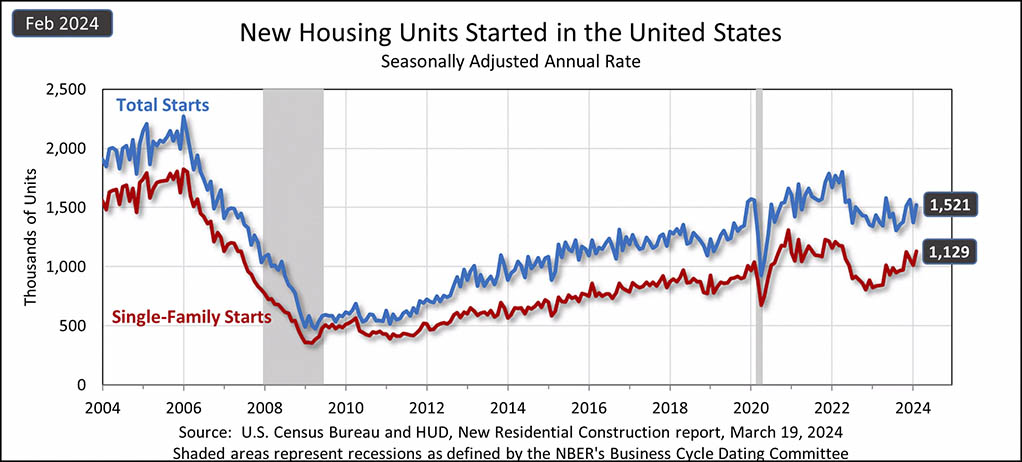

Overall housing starts in February came in at a seasonally adjusted annual rate of 1.521 million units which is a solid 10.7% above the revised January rate of 1.374 million units and 5.9% above the rate of 1.436 million units in February 2023. Overall starts include both single-family dwellings and multi-family dwellings.

Focusing in on the single-family housing segment, a more meaningful metric for the custom integration industry, starts come in at 1.129 million units which is 11.6% above the revised rate of 1.012 million units in January. But it was an eye-popping 35.2% increase over the rate of 835,000 single-family starts in February 2023.

The single-family starts reading was the highest it has been since April 2022.

Economists Take Notice of Jumps This Big

On a regional basis, single-family starts were: Northeast, +16.4%…Midwest, +40.2%…South, +16.6%…and West, -15.4%. Again, aside from the West region, these are pretty impressive gains in home construction starts around the rest of the country.

Economists take notice when this metric hits a double-digit percentage increase.

Homebuilder Sentiment Turns Positive for First Time in 7 Months

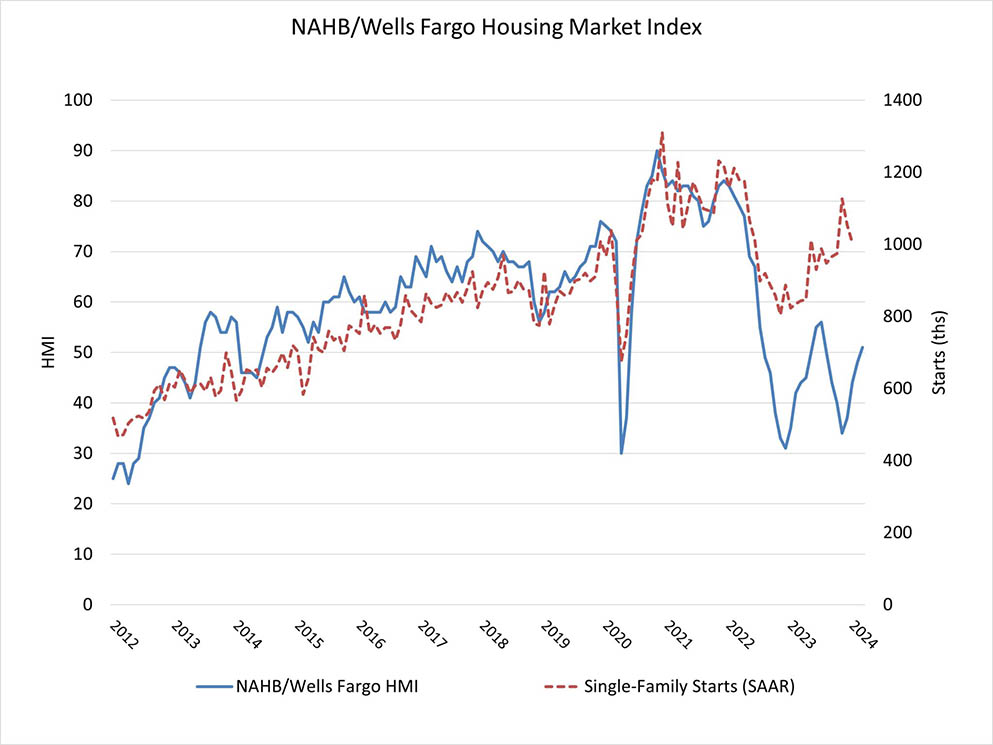

At the same time, a closely watched survey of homebuilder sentiment, the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), registered a positive reading of 51 in February, the first time it has been above the break-even mark of 50 since July 2023. This was the fourth consecutive month in a row that the survey has moved in a positive direction.

What’s driving builder sentiment? Well, there are many possible answers to that question. Largely, the variables that have been depressing the segment up to now can all be essentially swept away by just one thing…the Fed. Fed Chairman Powell announced this week that while inflation remains frustratingly stuck with readings around 3% – they consider an inflation reading of 2% to be their target “normal” – they still plan on beginning to cut interest rates later this year.

Declining Interest Rates Will Draw More Buyers; Builders Can Drop Incentives & Make More Money

In fact, the Fed says it remains on target to implement three interest rate cuts later in 2024. This will serve to bring down mortgage rates – a big drag on housing sales – and also will provide a further economic stimulus, motivating prospective buyers to get off the sidelines and buy a new home. When you add this potential tailwind to a shortage of existing inventory of new homes for sale creating increased demand to build more, and the fact that with lower mortgage rates builders can shelve pricing incentives to close more profitable sales – the future does indeed look bright for homebuilders.

Housing construction is likely to add modestly to economic growth in the months ahead as builders look forward to the Fed rate cuts that policymakers are forecasting for later this year. Housing construction has likely turned the corner in this economic cycle and will cease to be a drag on the overall economy.

Christopher Rupkey, Chief Economist at FWDBONDS to Reuters

Thank you for Publish this Amazing Blog