Mixed Results from Owner of CEDIA Expo and CEPro

Emerald Holding, Inc. (NYSE: EEX) (Emerald) owner of Emerald Expositions, a leading B2B exposition company, as well as the CEDIA Expo, CEPro, and Commercial Integrator media properties, announced its financial performance in the second quarter of fiscal 2023. While results were mixed with both increased revenues and increased losses, the company struck an optimistic tone, saying it is on track to generate $400 million in revenues and $100 million in “Adjusted” EBITDA (a measure of profits) in the current fiscal year.

See more on Emerald’s fiscal ’23 second quarter results

As long-time readers of Strata-gee know, I’ve been following the Emerald Expositions closely since they acquired the CEDIA Expo show from the Custom Electronic Design and Installation Association (CEDIA) back at the beginning of 2017. It was a surprising decision by the trade association, although it did net the group approximately $36 million.

A little later, Emerald went on to acquire several media properties from EH Publishing, including CEPro and Commercial Integrator. With these two acquisitions – expo & media – Emerald has gone on to become an important – if outside – influence on the custom integration industry.

Revenues Grew over the Same Quarter Last Year

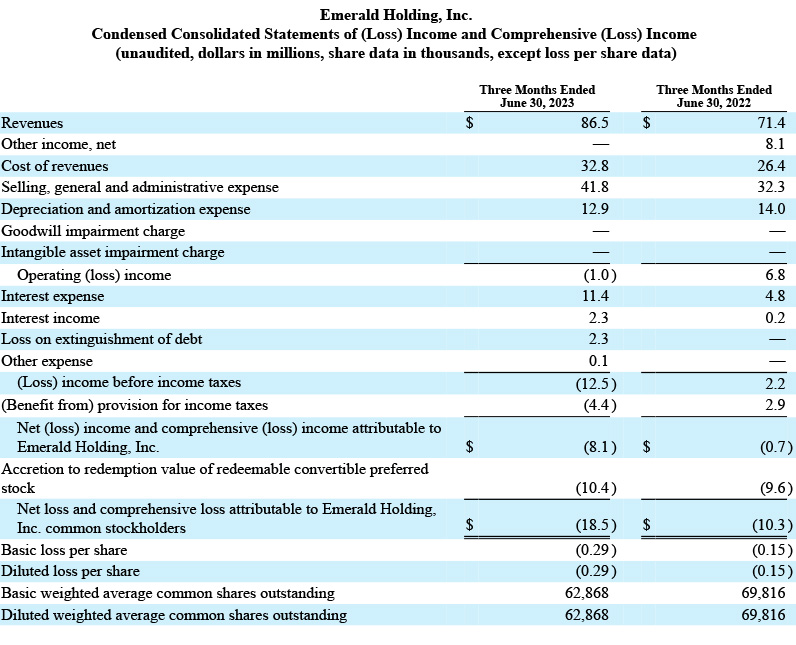

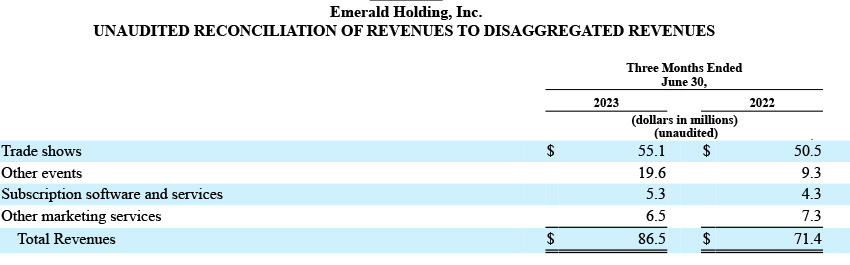

In announcing its results, the company understandably touted its 21% year-over-year (YoY) revenue growth. Revenues for the second quarter of 2023 came in at $86.5 million, an increase of $15.1 million or +21.1% over the second quarter of fiscal 2022. However, this top-line number is a little misleading, as it includes new acquisitions in that number that didn’t exist in the quarter last year. On an organic basis – taking out the revenues from newly acquired events, revenues came in at $79.2 million or an increase of $7.9 million or 11.1% over the revenues of $71.3 million in same quarter last year.

However, that is still a respectable double-digit percentage increase. Note that in calculating “organic” revenues, the company not only subtracted revenues from newly acquired events in this year’s numbers but also eliminated revenue figures for discontinued 2022 events and the revenue impact of changed schedules last year.

The strong recovery in live events is continuing to drive double digit growth at Emerald, with highly positive trends in both attendees and pricing. The work we’ve done to drive scale and efficiency by centralizing key functions and investing in our technological capabilities has made Emerald a powerful platform for both internal and external growth. By leveraging the investments we’ve already made, we expect to continue to drive both substantial revenue growth as well as meaningful margin improvement in this year and next. Our recent expansion into consumer live events, including NBA Con and the popular Overland Expo series, is helping to unlock new audiences for Emerald that will complement our core B2B portfolio. In addition, our investment into value-add products like our Elastic e-commerce software suite is driving ever greater value for our customers, which we expect to become a meaningful contributor to our strong cash flow generation over time.”

Hervé Sedky, Emerald President and Chief Executive Officer

Troubling Elements of the Report

Operating Loss – There were, to my eye, some troubling elements to their report. For example, the company slipped from an Operating Profit of $6.8 million in the second quarter of 2022 to an Operating Loss of -$1.0 million in the quarter this year. That’s a negative swing of -$7.8 million or -114.7%.

Interest Expense – Yet another big swing that impacted results is Interest Expense. This year, the company booked $11.4 million in interest expense, which means this cost increased by $6.6 million or is 137.5% higher y/y.

Other Marketing Services – In a table disaggregating the overall revenue numbers, I couldn’t help but notice that only one business unit had a revenue decline – Other Marketing Services. This is a business unit that houses non-show revenues and that includes their publishing business, such as CEPro and Commercial Integrator as well as others serving other industries. The unit booked revenues of $6.5 million in the quarter this year as compared to revenues of $7.3 million in the same quarter last year. That is a decline of $800,000 or -11%.

Loan Maturity Date Extension – For reasons not directly addressed in the report (although perhaps obvious) the company took steps to extend the maturity date of their term loan. Originally scheduled to mature on May 22, 2024, the company has negotiated with the lender to push it back to May 22, 2026. This move cost Emerald a $12.5 million original issuance discount and an additional $2.8 million debt issuance fee.

Our outlook this year implies a more than 20% year-over-year increase in revenue and a 76% year-over-year increase in Adjusted EBITDA, reflecting both the strength of the recovery and our significant operating leverage. As we continue to closely monitor the current economic environment, we are pre-booking shows into the third quarter of 2024, giving us visibility into future revenues and confidence in the continued positive trends in attendance and pricing. In addition to the organic growth benefits, our investments into technology and centralizing key functions also contribute to our advantage in the M&A market, where the scale and operational efficiencies of Emerald’s platform make us a highly compelling consolidator in a fragmented market.”

David Doft, Emerald Chief Financial Officer

A Substantial Increase in Net Loss

Of course, for many investors, nothing is more important than the bottom line as THE key performance metric. Unfortunately, Emerald reported that it had a Net Loss for the quarter this year of -$8.1 million versus a Net Loss of -$0.7 million in the same quarter a year ago. This is a 1,057.1% increase in net loss.

The reason for the increased net loss, the company said in its press release, was primarily due to a higher interest expense (as I discuss above in the section “Troubling Elements of the Report”). Along with that, it noted another factor is that there was a one-time gain in the previous year related to the “measurement of contingent consideration.”

From Loss to Profit with the Stroke of a Pen

According to their “Adjusted” EBITDA – an analysis where they create a special formula that they believe gives a more accurate picture of results (but I typically ignore) – the company says that it had Adjusted EBITDA or profit of $14.6 million in the quarter this year as compared to an Adjusted EBITDA of $15.6 million in the same quarter last year. That’s a much more moderate profit decline of -6.4%.

Furthermore, the company goes one step further in this special analysis by excluding the event cancellation insurance proceeds they received in the quarter last year, yielding an Adjusted EBITDA of just $7.5 million in the quarter in 2022 vs an Adjusted EBITDA of $14.6 million in the quarter this year.

Just Like Magic

See…what they did there? POOF – just like magic, a Net Loss of -$8.1 million turns into a profit…er, an Adjusted EBITDA…of +$14.6 million! Don’t you wish you had paid more attention in math class?

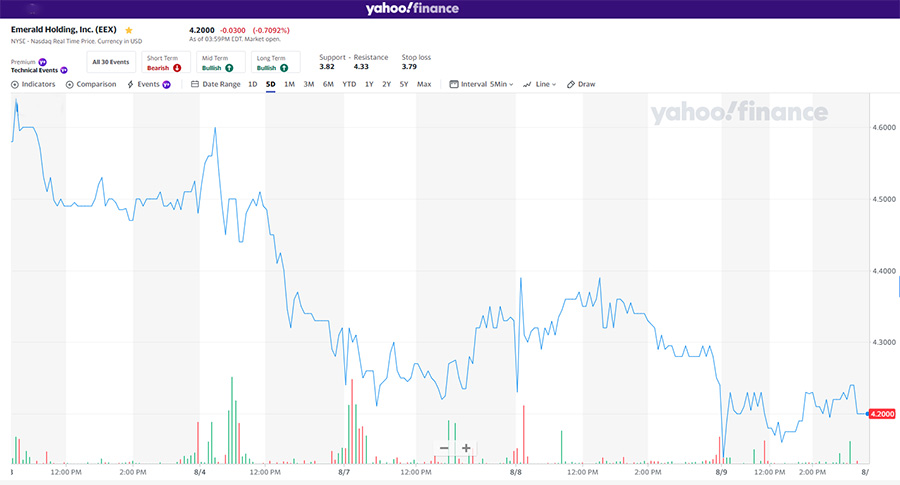

In the few days since Emerald announced its results, its stock value has declined -8.5%. By comparison, the Dow has been essentially flat.

To learn more about Emerald, be sure to visit emeraldx.com.

Leave a Reply