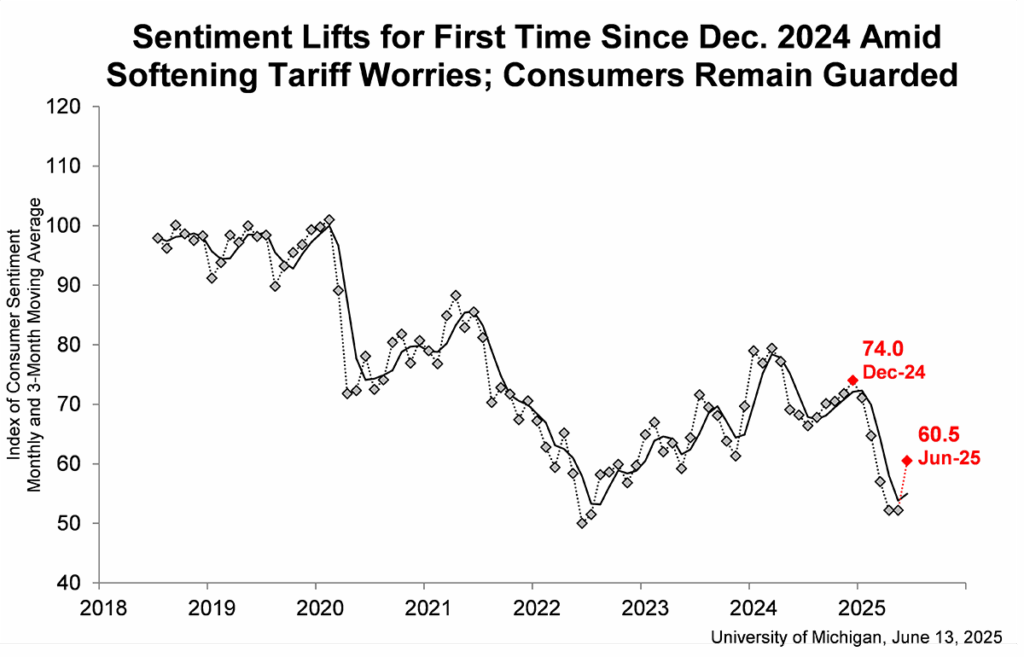

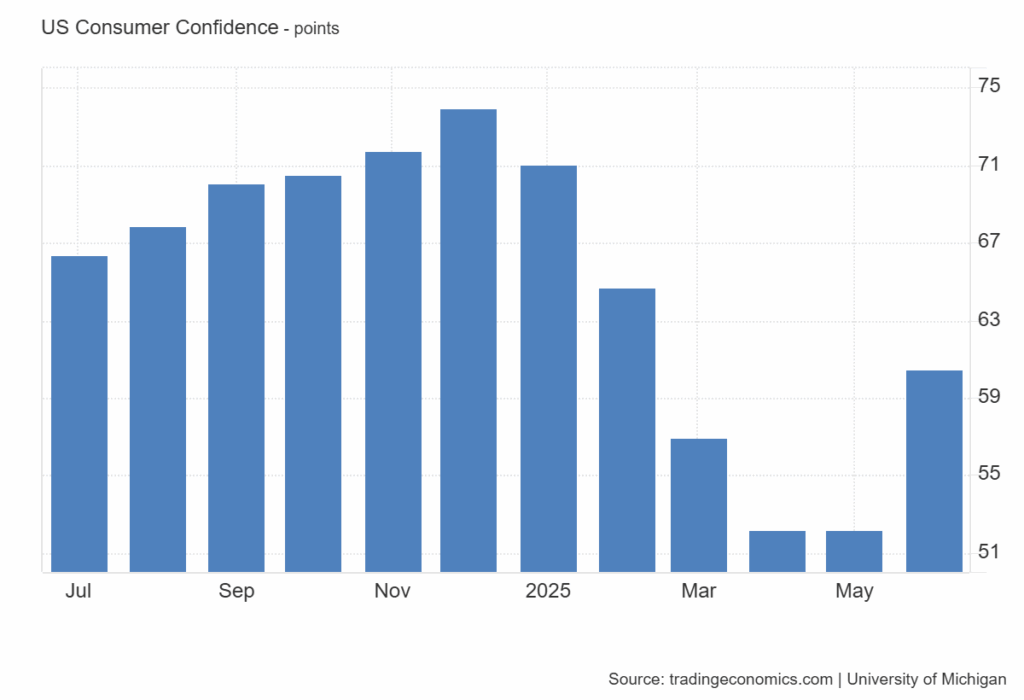

Thanks to the administration’s continued postponement of higher tariffs in international trade, consumer sentiment rebounded in a preliminary June reading. This is the first such improvement in six months as diminished tariff pressure resulted in a more positive consumer outlook.

However, the improved reading is still well below the reading in December 2024.

See more on the latest reading on consumer sentiment

Finally, after months of concerning declines in the reading of consumer sentiment as tracked by the University of Michigan’s Index of Consumer Sentiment (ICE), we find a positive rebound. According to U of M’s preliminary reading for June, consumer sentiment jumped to a reading of 60.5, up +15.9% over the final May reading of 52.2. However, that nearly 16% improvement remains about 20% below the reading from December 2024, when according to U of M researchers, “…sentiment had exhibited a post-election bump.”

As longtime Strata-gee readers know, U of M tracks consumer sentiment with three separate surveys: the Index of Consumer Expectations, Current Economic Conditions, and Index of Consumer Sentiment. Along with the already mentioned ICS 15.9% jump, the Index of Consumer Expectations jumped by +21.9% and the Current Economic Conditions increased by +8.1%. However, on a Year-over-Year (YoY) basis, each of these readings remains below the year-ago reading by -11.3%/-16.1%/-3.3%.

Refreshing to See a Rebound

Still, it was refreshing to see a rebound, even if only a temporary one. U of M noted that all five index components showed increases – especially noting a “steep increase” in short and long-run expected business conditions “consistent with a perceived easing of pressures from tariffs.”

Economists were anticipating a much more modest improvement. The consensus from a survey of economists showed the expectation was for an improvement in consumer sentiment to a reading of 53.5 – a notable 2.5% improvement over May’s 52.2 reading – but well off the actual 60.5 number.

Consumers appear to have settled somewhat from the shock of the extremely high tariffs announced in April and the policy volatility seen in the weeks that followed. However, consumers still perceive wide-ranging downside risks to the economy. Their views of business conditions, personal finances, buying conditions for big ticket items, labor markets, and stock markets all remain well below six months ago in December 2024.

Joanne Hsu, University of Michigan Director of Surveys of Consumers

Projected Inflation Rate Drops as Well

The U of M surveys also gauge consumers’ expectations for inflation. Here too, consumers moderated their expectations from 6.6% projected inflation rate in the May survey to a 5.1% rate in June. Similarly, their gauge for long-run inflation came in at 4.1% in the current survey, slightly moderated from respondents’ expectation of 4.2% long-run inflation in May. This is the second month that long-run inflation dropped.

Despite this month’s notable improvement, consumers remain guarded and concerned about the trajectory of the economy.

Joanne Hsu

Both of these latest readings for anticipated inflation and long-run inflation are at the lowest level in three months. While noting the softening projections for inflation, the report adds, “Still, inflation expectations remain above readings seen throughout the second half of 2024, reflecting widespread beliefs that trade policy may still contribute to an increase in inflation in the year ahead.”

Leave a Reply