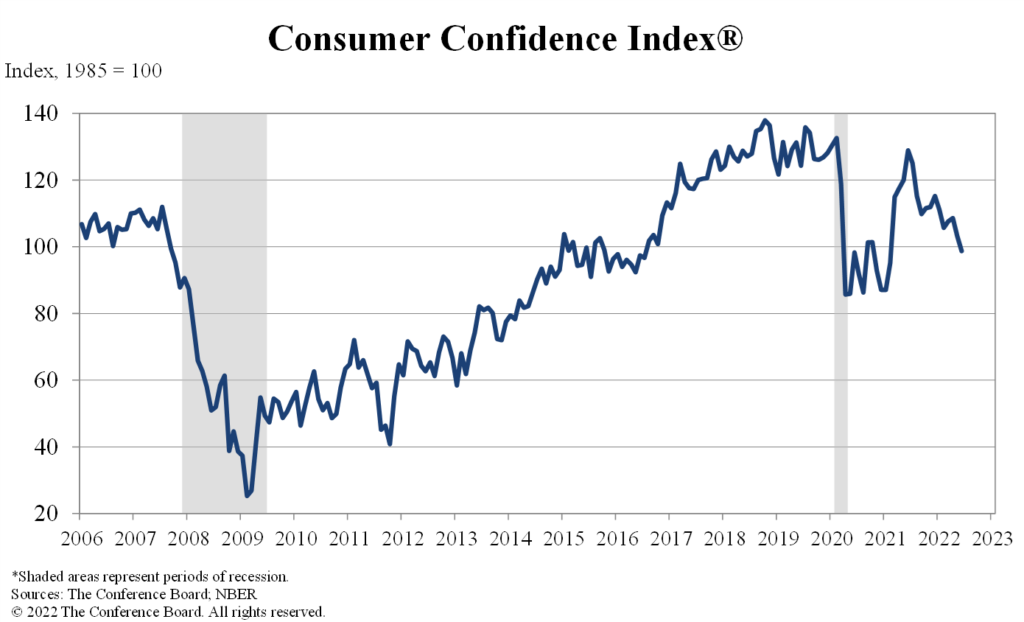

The Conference Board announced on Tuesday that consumer confidence in June, as measured by their Consumer Confidence Index, a key indicator of the state of mind of the U.S. consumer, has dropped to a reading of 98.7. This is the first time that the Index has been under its 100 reference level since a post-2020 pandemic recovery. Generally, a reading under 100 indicates a pessimistic consumer likely to cut back on spending.

This is the lowest reading for consumer confidence since February 2021.

See the latest on a declining consumer confidence index

Two weeks ago, I told you about the University of Michigan’s Index of Consumer Sentiment (ICS), which registered a sobering 14% drop in consumer sentiment in June as compared to May. This brought that index to a reading of 50.2, it’s lowest reading ever recorded. It was a sobering sign of the deteriorating state of consumer sentiment surrounding the economy.

Now, in a strong echo of the ICS result, the Conference Board’s Consumer Confidence Index (CCI) – considered by some to be the most reliable reference of consumer attitude – also recorded a notable decline, although not quite as dramatic as the U of M survey. In this case, the CCI reading in June came in at 98.7 or down 4.5 points from May’s reading of 103.2. What made the CCI reading notable is that this takes the index below its reference reading of 100 (the level the Index was in 1985).

Two Main Components to Index

Although the CCI had dropped below this key 100 level in 2020 during the pandemic, it had strongly rebounded in early 2021. This new reading is the lowest rating in 16 months, since February 2021.

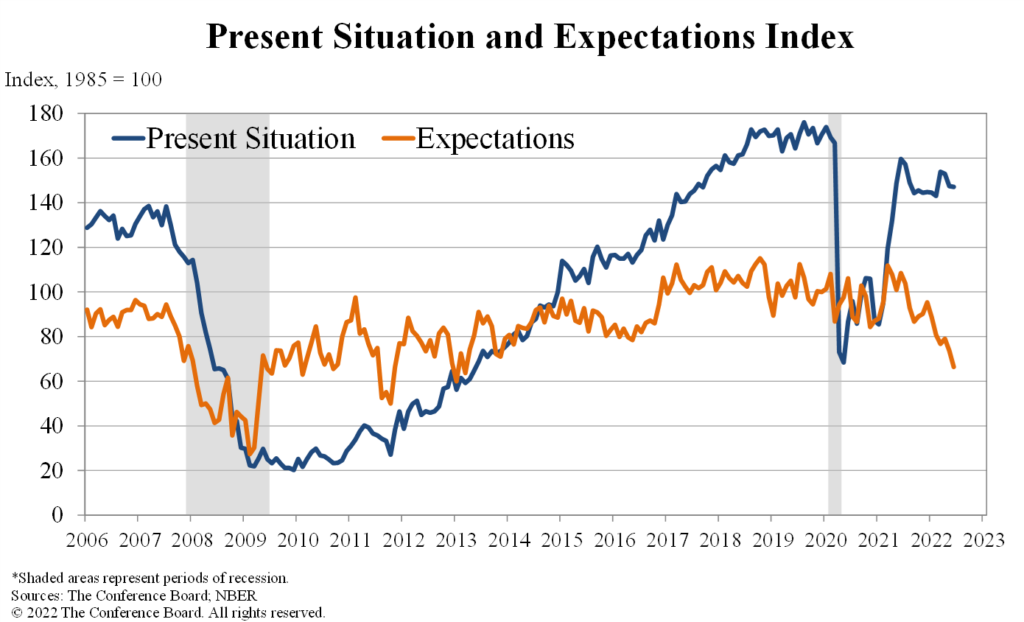

The CCI has two main components that are tracked separately and then combined for an overall reading. The first component tracked by the Conference Board is the Present Situation Index – an assessment by consumers of the state of current business and labor conditions. In June, this reading softened slightly, dropping to 147.1 in June, down from 147.4 in May.

Analyst: Data Points to Potential Risk of Recession by End of 2022

The second component is the Expectations Index – a reading which reflects consumers’ short-term outlook for income, business, and labor market conditions. Here is where there was a major shift in readings as the Conference Board said it “decreased sharply to 66.4 from 73.7.” This is the lowest reading for consumer expectations in 9 years, since March 2013.

Consumer confidence fell for a second consecutive month in June. While the Present Situation Index was relatively unchanged, the Expectations Index continued its recent downward trajectory—falling to its lowest point in nearly a decade. Consumers’ grimmer outlook was driven by increasing concerns about inflation, in particular rising gas and food prices. Expectations have now fallen well below a reading of 80, suggesting weaker growth in the second half of 2022 as well as growing risk of recession by yearend.

Lynn Franco, Senior Director of Economic Indicators at The Conference Board

While Somewhat Stable, Purchase Intentions Have Cooled from Earlier in the Year

Conference Board researchers also noted that while purchase intentions for cars, homes, and major appliances had held relatively steady, they were cooler than at the start of the year. Not only that but as interest rates continue to climb as the Fed tries to tame inflation, this cooling trend is expected to continue. The Board also noted that vacation plans have softened further due to rising prices which “took their toll.”

“Looking ahead over the next six months, consumer spending and economic growth are likely to continue facing strong headwinds from further inflation and rate hikes,” Franco added.

Leave a Reply