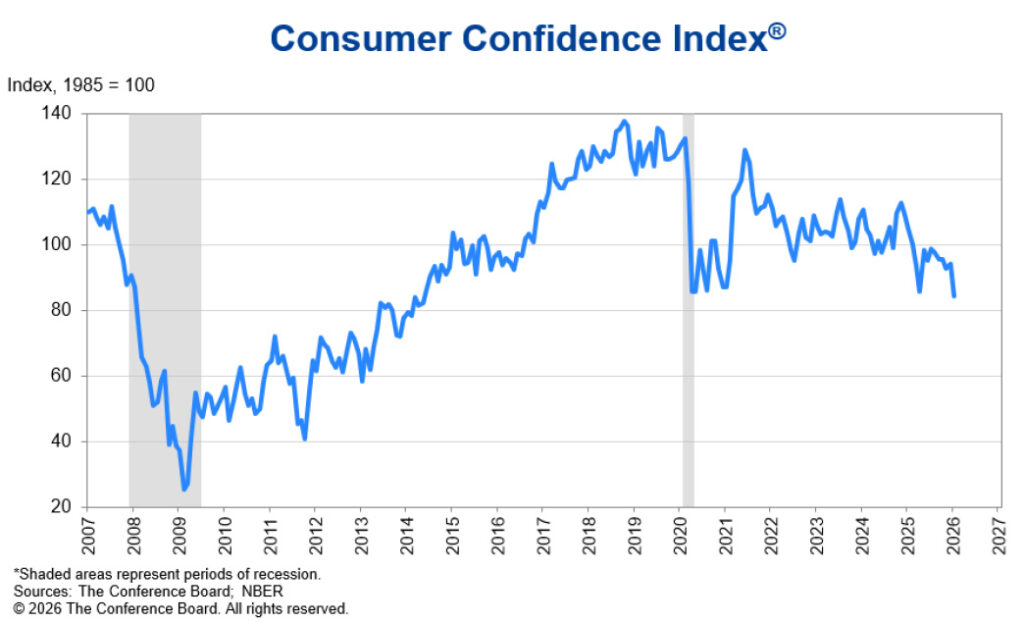

The Consumer Confidence Index surprised economists in January after experiencing a small uptick in December. According to The Conference Board, after a 5.1-point upward revision of December’s early reading, the index fell a surprising 9.7 points in January to a reading of 84.5 (1985=100). This is the most pessimistic that consumers have felt about the current situation and the near-term direction of the economy in 12 years!

Learn more about the January Consumer Confidence Index…

Consumer confidence has been generally declining since July 2025, but in December, confidence unexpectedly jumped 5.1 points to a reading of 94.2. Some economic watchers suggested perhaps the longtime pessimistic consumer had finally reached a turning point. But that thought was dashed in January when overall consumer confidence came in at a reading of 84.5 points, well below the 100 point of equilibrium. This is the lowest reading on consumer confidence since 2014. It is even lower than it was during COVID.

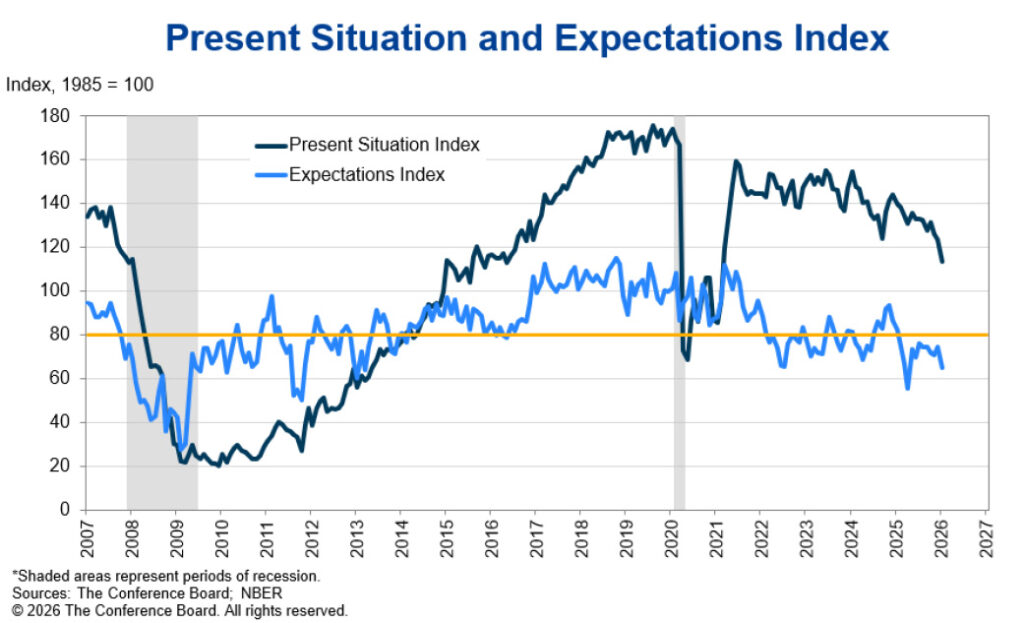

The Consumer Confidence Index (CCI) is made up of two separate sub-components, the Present Situation Index (PSI), which is a reading of how consumers assess their current business and labor market conditions…and the Expectations Index (EI), which is based on consumers’ short-term outlook for income, business, and labor market conditions. These sub-components then get combined to create the overall CCI.

Both the Present Situation Index and the Expectations Index Declined by Nearly Double Digits in January

In January, the PSI dropped by 9.9 points to a reading of 113.7. And the EI – consumers’ forecast of conditions for the near-term future – fell by 9.5 points to a reading of 65.1. That 65.1 reading is particularly concerning, as a reading below 85 in consumer expectations is considered an indication of an impending recession.

The reason economists watch the EI reading so closely is that it is typically tied to consumer spending. When consumers feel pessimistic, they tend to pull back on spending and…next thing you know…we’re in a recession.

Multiple Data Points in Any Sub-Component Track the Data in Others

However, it is true that the link between consumer confidence and consumer spending has not been as tightly connected recently as it has been in past years. However, it is interesting to see how much each of these data points in January, measuring a different element of consumer confidence, tracks the others.

Analysts noted that consumers offered comments along with this month’s survey that suggested the rising pessimism is due to prices remaining high, labor markets deteriorating, and – new this month – concerned express about healthcare costs. This is probably connected to the Administration’s passing of the spending package that cut the subsidies that helped to lower the cost of Affordable Care Act insurance policy premiums. Health insurance policy premiums are expected to rise dramatically…further stressing consumers’ financial situation.

All Five Components of the Consumer Confidence Index Deteriorated

Confidence collapsed in January, as consumer concerns about both the present situation and expectations for the future deepened,” said Dana M Peterson, Chief Economist, The Conference Board. “All five components of the Index deteriorated, driving the overall Index to its lowest level since May 2014 (82.2)—surpassing its COVID-19 pandemic depths.

Dana M. Peterson, Chief Economist for The Conference Board

I was struck by the language employed by The Conference Board in reporting the January results. In fact, I’m going to directly quote a section of the report so you can see for yourself what The Conference Board found – an unusually consistently negative result in January…

Conference Board Analysts Sound Surprised in the Report

“The Present Situation Index fell, as net views on current business conditions dwindled to just barely positive, at +0.1%. Perceptions of employment conditions also edged lower, with the labor market differential—the share of consumers saying jobs are ‘plentiful’ minus the share saying jobs are ‘hard to get’—continuing to flag. All three Expectations Index components also weakened in January. Expectations for business and labor market conditions six months from now fell further into negative territory. The outlook for household incomes became less positive.” [Emphasis in original]

It is really rare when all elements of this sophisticated survey track each other so closely, as we found in this January 2026 report. It’s also a little concerning, which may be why the report for January was a little longer than usual.

Demographic Data in Dramatic and Consistent Alignment

Digging a little deeper into the demographics for a more granular analysis, consumer confidence readings dropped for all age groups in January. Although the Conference Board analysts noted a slightly higher level of confidence among survey respondents under the age of 35 as compared to those aged 35 and older. Similarly, confidence amongst all generations trended down, with Gen Z remaining the most optimistic of them all.

Looking at results relative to income, confidence based on a six-month moving average moved downward for all brackets. Analysts noted that consumers earning less than $15,000 were the least optimistic of all of the income groups. Likewise, the decline in consumer confidence in January cut across all political affiliations. The biggest decline was amongst Independents in January. Interestingly, confidence has been trending downward with consumers of all political affiliations since September 2025.

Consumers Point to High Prices, Tariffs, Politics, Health Insurance, and War

Consumers’ write-in responses on factors affecting the economy continued to skew towards pessimism. References to prices and inflation, oil and gas prices, and food and grocery prices remained elevated. Mentions of tariffs and trade, politics, and the labor market also rose in January, and references to health/insurance and war edged higher.

Dana M. Peterson

Reuters called the January decline in consumer confidence to a reading of 84.5 points – the lowest level of consumer confidence since 2014 – a “surprise deterioration.” Economists polled by the news agency had forecast a reading of 90.9, which would have been a much more modest decline.

Leave a Reply