Sonos, Inc. (Nasdaq: SONO) announced its financial performance for the second quarter of Fiscal 2024, the period that ended on March 30, 2024. The numbers, as we’re seeing more consistently across a wide variety of consumer brands, were rough…really rough. Revenues in the quarter declined a nasty 16.9% and the company’s Net Loss more than doubled, increasing by a scary 127%.

Yet CEO Patrick Spence claimed in a statement that “…we delivered results that slightly exceeded our expectations…” Either they were expecting a really devastating result, or I’ll have whatever he’s having!

See more on the Sonos Q2 Fiscal 2024 results

I get it that CEOs often view their role as cheerleader-in-chief, but sometimes their comments are so far removed from reality that it almost becomes nonsensical. I feel that Spence is very close to the border between reason and folly with his comments included in the release on their Fiscal 2024 second-quarter results. There is little here to cheer…

Let’s Look at the Numbers and You Decide for Yourself

So let’s dig into the numbers and you decide for yourself if the company management is being reasonable with their spin on the company’s performance. The first thing I noticed about the company’s release is that there is very little to no commentary or analysis associated with presenting this quarter’s results. That is very unusual for them. But perhaps that is a sign of the sobering results they had to present.

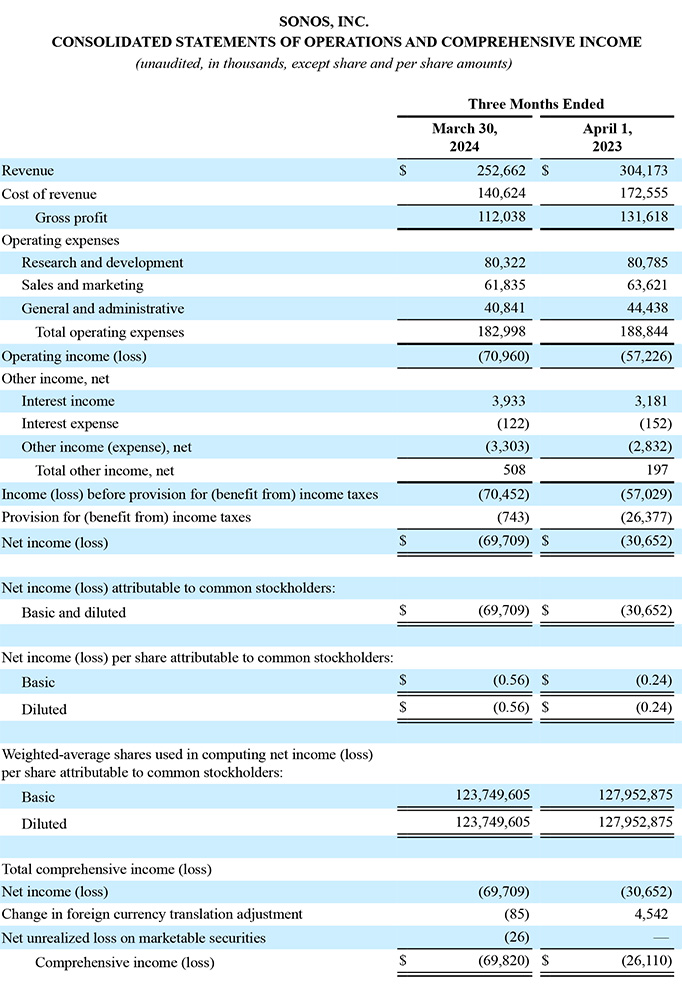

Revenues in the second quarter of fiscal 2024 came in at $252.7 million, down $51.5 million or 16.9% from revenues of $304.2 million in the same quarter in fiscal 2023. Unit sales in fiscal 2023 were just under a million units at 998,000. This year, unit sales came in at 747,000, more than a quarter million units fewer or a 25.2% drop in unit sales, as compared to the same quarter last year. These are big declines, folks.

Revenues by Geography; The Decline Appears to be Accelerating

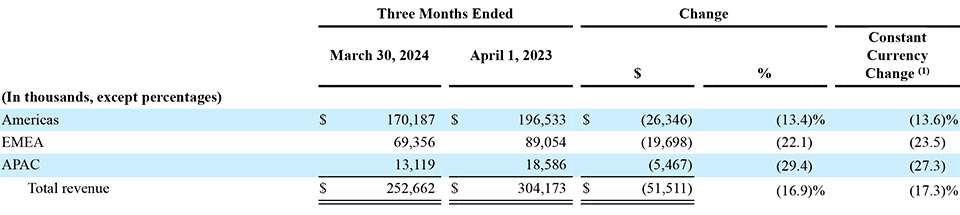

Looking at the performance trend sequentially, revenues in the first quarter of fiscal 2024 were $612.9 million, a decline of $59.7 million or 8.9% compared to revenues of $672.6 million in Q1 of fiscal 2023. Comparing the revenue performance of the first two quarters on a percentage basis – a Q1 decline of 8.9% versus a Q2 decline of 16.9% – Sonos’ revenue downturn appears to be accelerating.

The Q2 revenue decline this year was a pretty broad-based one, with each of the three major geographic regions reporting double-digit percentage declines – Americas (-13.4%), EMEA (-22.1%), and APAC (-29.4%). Compare these against the regional result from Q1 and you again see a difference: Americas (-1%), EMEA (-20.2%), and APAC (-19.6%). You see the same pattern suggesting that revenue declines are accelerating.

Which Products are Selling and Which Aren’t?

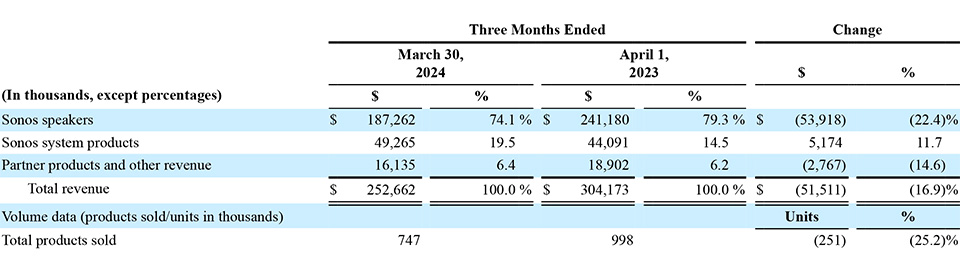

In looking at revenues broken down by product category, the company reported that Sonos speakers, by far its largest category with its flagship wireless speakers, saw revenues of $187.3 million which is down by $53.9 million or 22.4% compared to revenues of $241.2 million in the same quarter last year. Partner products which includes its joint venture with Sonance, IKEA, and others, reported revenues of $16.1 million which is down $2.8 million or 14.6% compared to revenues of $18.9 million in the quarter last year. Finally, Sonos system products (largely Sonos components) is the only segment to show an increase – with revenues of $49.3 million which is $5.1 million or 11.7% higher than revenues of $44.1 million in the same quarter in 2023.

The company said in SEC filings that the revenue decline was “due to softer demand across all regions and challenging market conditions, partially offset by normalization of ordering levels in our installed solutions channel.”

Results ‘That Slightly Exceeded Our Expectations’

Thanks to the hard work of our team, and the strength of our brand and product portfolio, we delivered results that slightly exceeded our expectations in our second quarter despite the challenging environment. Today marks the launch of our completely reimagined Sonos app, which is our most extensive app redesign ever. This is a major step in enabling our multi-year product cycle and sets us up well for the launch of our highly anticipated new product later thisquarter.

Patrick Spence, Sonos CEO

The profit picture was equally ugly, although the company has made great effort to take multiple steps to cut costs. Sonos generated an Operating Loss of $71 million, which is $13.7 million or 24% higher than the Operating loss of $57.2 million in the same quarter in fiscal 2023.

Net loss came in at $69.7 million, which is $39.1 million or 127.4% higher than the Net loss of $30.7 million in the quarter last year.

New Product a Hail Mary?

What Sonos seems to be really banking on is the long-rumored new category that will launch this year. While the company has never officially revealed this new product, it is said to be in a multi-billion dollar category. Several leaks around the industry say the new product will be in the headphone category.

The window on this new product has slipped a bit, but the company says it will be rolling out in the third quarter – so just around the corner. Sonos has said they expect this product will add at least $100 million to this year’s revenues.

Key Initiatives in the Quarter

Spence sought to reassure analysts on a conference call that the company pulled out all the stops to turn in the best results possible. To this end, he spoke of the following key initiatives:

- All-New Sonos App – The company has launched a completely revamped Sonos App, “Our most extensive app redesign and re-architecture yet,” the CEO said.

- Expanded Distribution – Starting in March, Sonos became a first-party seller on Amazon.com in the U.S. Spence says this initiative will help to expand their reach to new customers.

- Offered ‘Install Base’ Customers Special Upgrade Deals – In the second quarter, Sonos experimented with reaching out to “our most loyal, longest-tenured customers” with limited-time upgrade offers.

Financial Analysts’ Skepticism was Showing

Yet even with all of these initiatives, Spence made it clear that their categories remain “challenged” in the current economic environment. And that sentiment was clearly felt by many of the analysts on the conference call with the company. One analyst from Raymond James asked how they felt any of their new partnership initiatives would compare “…to previous partnerships like the IKEA one that weren’t as successful in gaining new customers.” (Spence kind of talked around this question and didn’t take the bait.)

Another analyst (with Morgan Stanley) questioned Spence’s enthusiasm for the upcoming new product introduction, “…because we see most consumer companies flagging real caution in mind of the spending environment. Your outlook for this new product has been unwavering. So can you maybe just help us connect the dots? What’s driving the confidence as we see maybe some of the macro outlook, especially as it relates to consumer spending, remain kind of unchanged, negative, maybe deteriorating?”

Maybe Only Growth is Via New Product

In a nutshell, Spence said he is confident in sales of the new product in a new category, because 1) It’s a new category for us (which means it’s incremental revenues for Sonos; 2) It’s a large category (for plenty of ramp up); and 3) He says it’s a growing category.

I couldn’t help but notice that some of the analysts were expressing some real reservations about the plans expressed by Sonos management. That, I think, is significant.

Learn more about Sonos by visiting sonos.com.

The new app is almost useless. They have lied about it keeping all the existing features. See the seething Sonos forums for more info.:

https://en.community.sonos.com/controllers-and-music-services-229131

wow .. This “statement” shows the level of arrogance this CEO has to it’s customers.

Plan A : Immediately recall the update and revert back to the one that works.

Sincerely apologize to your once loyal customers that you and your team got this badly wrong.

call a meeting and find out how the hell this was allowed to happen, sack those responsible, build a new team who actually know what they are doing.

Then YOU should also Resign ….. it was on your watch