VOXX Stock Loses Over 12% of Its Value the Next Trading Day

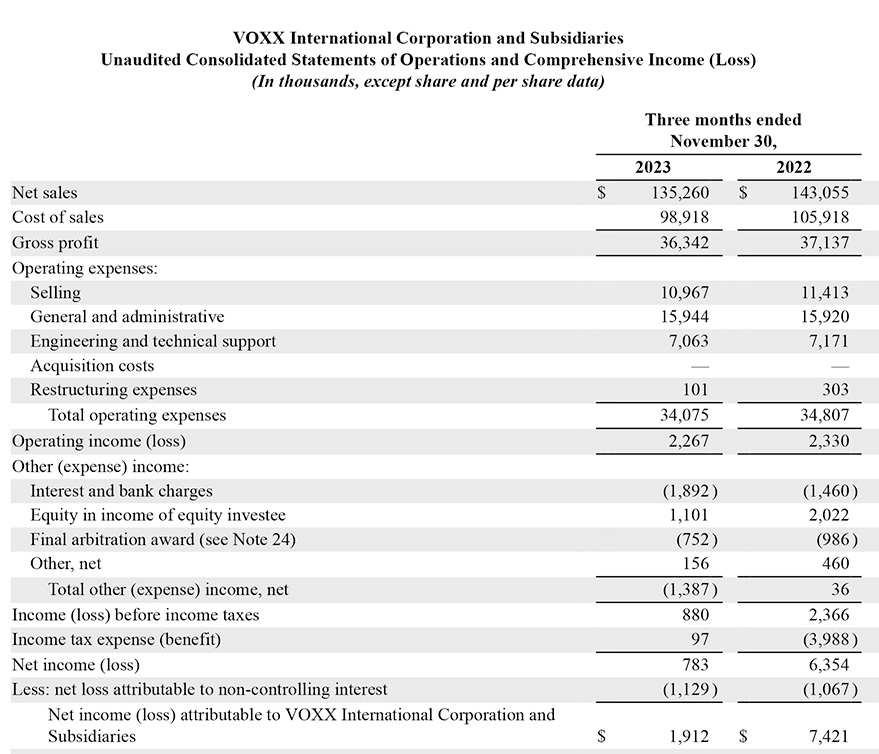

After the close of markets on Tuesday, VOXX International Corporation (NASDAQ: VOXX) released its Fiscal 2024 third-quarter financial results for the period ending November 30, 2023. Citing continued challenging macroeconomic conditions in 2023, the company reported that its third-quarter sales declined 5.4% and net income dropped 74.3%. CEO Pat Lavelle, who was participating in an analyst conference call on its earnings by phoning in from CES 2024, started his presentation somberly, saying to analysts that, “2023 has been tough for everyone, not just Voxx. Our entire industry has had a very challenging year.”

Learn more from the VOXX fiscal ’24 3rd quarter earnings report

I’ve been following VOXX’s deteriorating financial performance all year and they have been consistent in saying that 2023 has brought new challenges with declining consumer spending, high interest rates, credit card debt that “is very high”, and more – suggesting that these deteriorating macroeconomic factors combine to cause consumers to reign in their spending. Certainly, VOXX (owner of Onkyo, Integra, Pioneer, Klipsch) is not alone in this perspective. I’ve seen reports of a business downturn from other major industry companies, such as Masimo (owner of Marantz, Denon, B&W) and Snap One (Control4, Pakedge, OvrC).

Still, Lavelle – now sounding more optimistic – assured analysts that VOXX was prepared to rise to the challenge. He told them that the company is responding to the deteriorating economy by implementing a strong three-point plan.

Succeeding in Two Out of Three Key Objectives

The global economy remains challenging. And we’re doing all that we can to navigate through those challenges by focusing on three primary areas: protecting and growing sales in both the short term and long term, improving gross margins through supply chain and internal efficiencies, and lowering both our fixed and variable expenses.

During the quarter, we were successful in achieving two of these three objectives as our gross margins grew by 90 basis points and our operating expenses improved by a little over 2%. Sales declined roughly 5.4% with consumer up and automotive down, but overall operating income was the same as the prior year.

Pat Lavelle, VOXX Int’l Chief Executive Officer

As Lavelle’s presentation continued, he seemed to become even more energetic as he spoke of the approaching fiscal 2025, giving a bit of a preview of how the company will address that lagging third objective of sales by launching new products. But before we dig into those details, let’s take a look at the numbers the company reported for its third fiscal quarter.

Digging Into the Numbers

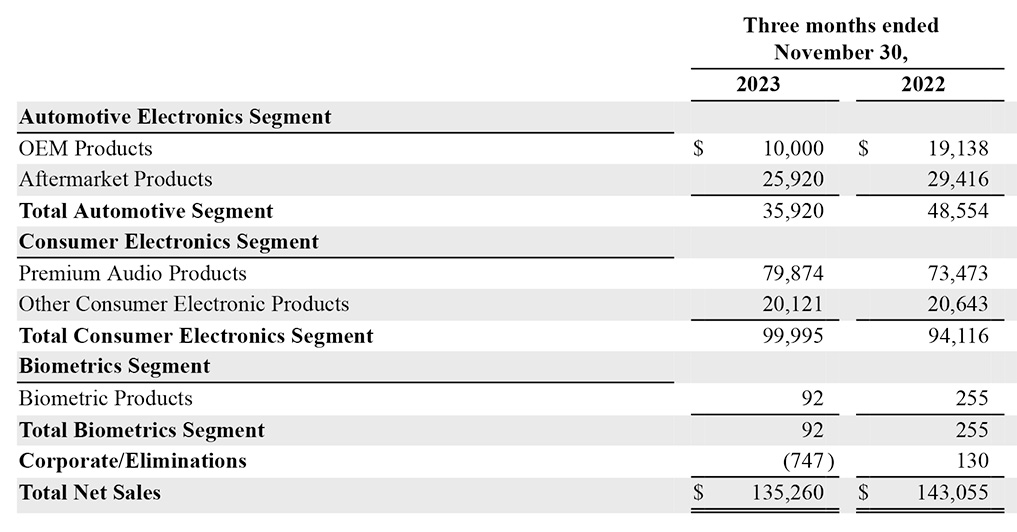

VOXX Int’l breaks down its business into three main segments – well, two major and one minor segment – Automotive Electronics, Consumer Electronics, and the much smaller Biometrics. Automotive Electronics includes subcategories of OEM products and Aftermarket products and the company is big in rear seat entertainment systems, vehicle security, and remote start solutions. In the Consumer Electronics segment, the company started with assorted speaker brands including Jamo, Energy, Magnat, and most significantly, Klipsch. Later, the company began to add electronics brands like Onkyo, Integra, Pioneer, and Elite.

Finally, the smallest segment for the company is Biometrics which consists largely of access control security systems using advanced technologies, such as iris scanners. This wholly-owned subsidiary operates under the Eyelock brand.

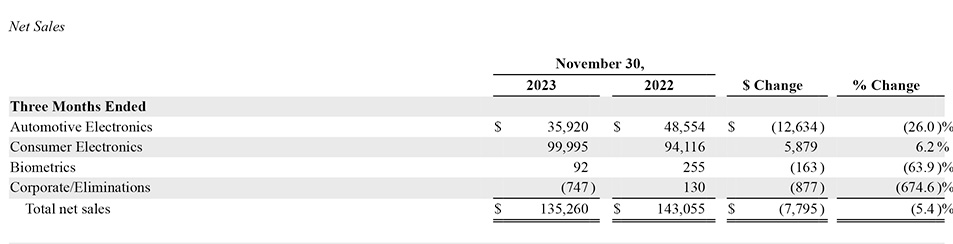

Drilling Down into the Numbers; Automotive Hits the Breaks

Net sales for the quarter came in at $135.3 million which was down $7.8 million or 5.4% as compared to the net sales of $143.1 million booked in the same quarter last year. While this quarterly sales decline was not as bad as some of the previous quarters, on a year-to-date basis, the company has lost $36.7 million in total net sales coming in at $360.8 million for the nine-month year-to-date period this year versus $397.5 million at the same point last year. That’s a big hole to fill.

In breaking down its sales result, Voxx noted that Automotive Electronics sales in the quarter were $35.9 million as compared to $48.6 million in the same quarter a year ago. This is a substantial $12.6 million or 26% decline in sales in the category. The company noted that the UAW strike was a big factor in this result (which, thankfully, is over).

Biometrics Segment Seems to Be on a Down Biorhythm Arc

In the Biometrics segment – by far the company’s smallest business segment – during the third quarter, net sales were just $0.1 million as compared to $0.3 million in the same period a year ago. The company says that the decline was due to a one-time large purchase in the year-ago period that did not repeat in the quarter this year. Lavelle also noted that the company had experienced a “lull in implementation” on several projects.

He says all of the various projects he’s mentioned in previous earnings calls “are still in motion.” But nothing, at this point has changed. He expects “nice growth” in the category in fiscal 2025.

Consumer Electronics Sales are Up, But Onkyo and Pioneer Sales are Down

In Consumer Electronics, the company booked net sales of $100.0 million, an increase of $5.9 million or 6.2% compared to net sales of $94.1 million in the same quarter last year. Premium Audio products led the way to this increase, a welcome development as this segment has been troubled almost all year long for VOXX. Premium audio sales were $79.9 million in the quarter, an increase of $6.4 million or 8.7% over the sales in the segment last year.

Here’s something interesting: The company says that the increase in the Premium Audio segment was primarily due to increased sales of “premium home theater speakers and wireless speakers domestically and internationally.” However, Voxx noted that this increase was partially offset by declining sales of Onkyo and Pioneer products. Nowhere in its formal press release, nor in the analyst conference call does the company provide specific sales figures for the Onkyo and Pioneer business.

Premium Audio is Finally Regaining Some Momentum, But Onkyo & Pioneer are Not

But in the company’s formal SEC 10-Q filing, I was able to find this, “As an offset to these increases, the Company experienced a decline in domestic sales of its Onkyo and Pioneer receiver products of approximately [$3.8 million] during the three months ended November 30, 2023 as a result of a slowing of the economy and decreased consumer spending in comparison to the prior year.”

Not only that but for the nine-month year-to-date period, the company revealed that net sales of Onkyo and Pioneer receivers have dropped a total of $11.6 million as compared to the previous comparable fiscal period. This explains why Lavelle never mentioned Onkyo/Pioneer in his discussion with analysts. In past quarters, he has specifically promised analysts that the company would enjoy great growth with these brands. But in 2023, that does not appear to be the case.

Premium Audio Turnaround ‘is a Big Positive for Us’

Still, the company is pleased that Consumer Electronics grew and that Premium Audio was the primary driver. Addressing this development, Lavelle had this to say to analysts:

So let me start with Consumer as we have a lot of new news to report. Consumer sales were up over 6% in Q3 with Premium Audio as the driver. This is a big positive for us, as the segment has been on the decline since the big bump we had from COVID. We made a lot of changes and investments and they’re starting to pay off, as evidenced by the growth this quarter amidst very challenging global economic environments.

Lavelle

CEO Shares Surprising Industry Data on Analyst Call

In order to make a point, VOXX’s CEO took a moment to share some of the latest market data from research firm NPD. Quoting NPD data from November, Lavelle says industry-wide speaker sales are down 17%. But, he noted, VOXX’s speaker sales were “only” down 9%. Sales of AVRs in the industry were said to be down 15%… “And we were down 14%,” he said.

His point? “The takeaway – somewhat positive – is while our Premium Audio sales are down year-to-date, we are growing our market share…especially domestically,” Lavelle said, perhaps a little too confidently. “And the new products and the new categories that we introduced here at the show and those that will launch in the early part of next year should help drive future growth into fiscal ’25.”

New Products Showing or Launching at CES 2024

The CEO wrapped his portion of the presentation by proudly pitching analysts on several of the new products the company was showing at CES 2024. Saying VOXX has “a complete lineup on display under all of our audio brands,” he called out a couple of what he believes are significant product introductions. First up was a new soundbar product that is co-branded Klipsch and Onkyo.

Called the Klipsch Flexus System – powered by Onkyo – Lavelle noted that this is the first product “that combines the strength of Klipsch’s acoustics with Onkyo’s electronic technology.” Saying the company has “high hopes” for this line, it will come on the market “this year.” The company is showing Flexus at CES 2024, but according to some reports, they are NOT demonstrating it.

Lavelle also pointed out the company’s new line of party speakers, called Klipsch’s “Gig” series. Says Lavelle, “Party speakers are one of the hottest categories in the industry. It is competitive, but the market is open.” He also noted the Klipsch Music City line of portable Bluetooth speakers.

There were several other new initiatives, including a new line of RCA hearing aids. Will these new products reignite sales growth?

What Did Investors Think About All of This?

As I said earlier, VOXX released its results after the close of markets on Tuesday, January 9th. Shares in VOXX stock closed that day at $10.85/share. Then, share value almost immediately collapsed in after-hours trading after the company released its earnings report. You can see this clearly on the stock chart below.

On Wednesday, the first trading day after the earnings were announced, the stock value bounced around all day, with more sellers of the stock than buyers, but in the afternoon, the trend looked decidedly down. Then, the stock price took a nose dive in the last couple of hours of trading to close at $9.51. That means the value of the stock dropped an impressive 12.35% in just one day. By the way, stock markets overall rose on Wednesday and the NASDAQ – the exchange that VOXX trades on – itself closed up over 111 pts or three-quarters of a percent the same day.

By mid-day on Thursday, the value of VOXX stock had dropped another 8%. This suggests that investors are perhaps losing patience with the company as yet another quarter’s results were disappointing. Or perhaps investors are skeptical of the company’s plan to stimulate future sales growth.

To learn more about VOXX, visit voxxintl.com.

Leave a Reply