Snap One Holdings Corp, soon to be part of Resideo Technologies’ ADI distribution business, reported their financial performance for the first quarter of Fiscal 2024 yesterday. In the wash, it looks much like its other recent quarterly reports – sales decline, losses increase, sales shift from its own proprietary brands to third-party brands, etc. But a couple of things did change, starting with my assessment that much less effort than usual was expended in creating this pretty thin report than is typical for them…there isn’t even a quote from CEO John Heyman or anyone in management…and the company even chose not to hold an earnings conference call with analysts as they typically do every quarter.

I suspect that this is due to the fact that the entire company – and its investors – are simply waiting for the new owners to take over.

See more on the Snap One Q1 Fiscal 2024 financial results

Here is the second sentence of the press release announcing the results of the first quarter of Fiscal 2024 for Snap One – “On April 14, 2024, Snap One executed a merger agreement, whereby Resideo Technologies, Inc. (‘Resideo’), a leading manufacturer and distributor of technology-driven products and solutions, agreed to acquire Snap One in an all-cash transaction for $10.75 per share (the ‘Merger’).” And with that, the noticeably short release offered a bare-bones read on the company’s performance. the entire press release text (aside from the financial tables) was only a little over one page long…and almost half of that was bullet points.

Announcement Starts with the Future, Rather Than the Past Performance

The first three paragraphs or about half the page spoke only about the impending merger with Resideo. The remaining half and about a paragraph on page two represented the entire document (financial tables were attached on separate pages). Even the financial tables had no commentary, although a few did contain footnotes offering mostly definitions.

I think this is the shortest quarterly report I’ve ever seen from this company – or any company approaching their size.

Separately, Snap One filed a Form 10-Q with the Securities and Exchange Commission (SEC). This filing is a requirement by the SEC and while they too include the report of the financial results for the quarter, they add a lot of additional details, information, and analyses. A Form 10-Q generally runs anywhere from 60-120 pages. For example, Emerald’s 10-Q, which was just filed yesterday, is a total of 104 pages long. Snap One’s is 48 pages. It meets all of its requirements for included information, but the analyses seem a little thinner than I am used to from this company.

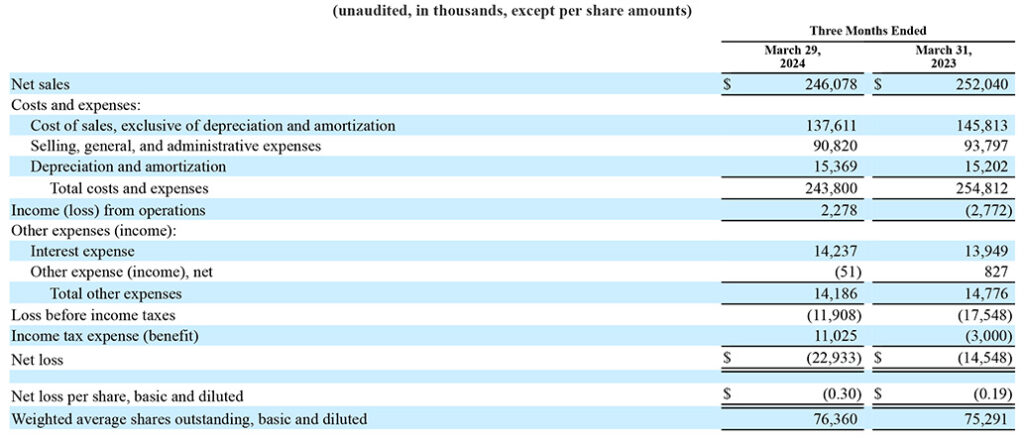

Q1 of Fiscal 2024 – Net Sales Decline Again, Losses Increase

So let’s dig into what we have here. As I mentioned above, Fiscal 2024’s Q1 looks much like other reports from Snap One. The themes I’ve mentioned multiple times in past quarters, appear to be continuing at the company to this day.

For the first quarter this year, Snap One reported Net Sales of $246.1 million which is down $6 million or 2.4% as compared to net sales of $252.0 million in the same quarter last year. Why are sales continuing to decline? Here is what the company says:

“…we estimate that a significant portion of this year-over-year [net sales] decrease is represented by a decline in organic net sales, partially offset by a decrease in the pace of channel inventory destocking. Organic performance reflects a decrease in sales volume, partially offset by growth from the continued ramp of local branches opened in the past year and the cumulative impact of proprietary product price adjustments taken in the past year.

From Release: ‘Snap One Reports Fiscal First Quarter 2024 Results’

Is There Something Bigger at Play Here?

Long-time readers of Strata-gee will recognize Snap One’s pointing to “channel inventory destocking” as a major factor in the company’s underperformance last year. I was surprised to see the term make an appearance in this quarter as well. Is it possible that destocking is really meta for a decline in consumer demand for smart home products? It would seem to me that after four or five quarters of blaming destocking, that situation should have either resolved itself – or there is something bigger at play here.

Snap One also reported that its Net Loss came in at $22.9 million, or $8.4 million higher (deeper?) than the $14.5 million net loss in the first quarter of fiscal 2023. The company had projected that fiscal 2024 would be better than fiscal 2023. They must be really disappointed with this result.

As you may know, I am not particularly a fan of non-GAAP (generally accepted accounting principles) “adjusted” analyses that many companies provide. But the performance this quarter was so rough that even its “Adjusted net loss” came in at $10 million versus an Adjusted net income of $3.4 million in the quarter last year.

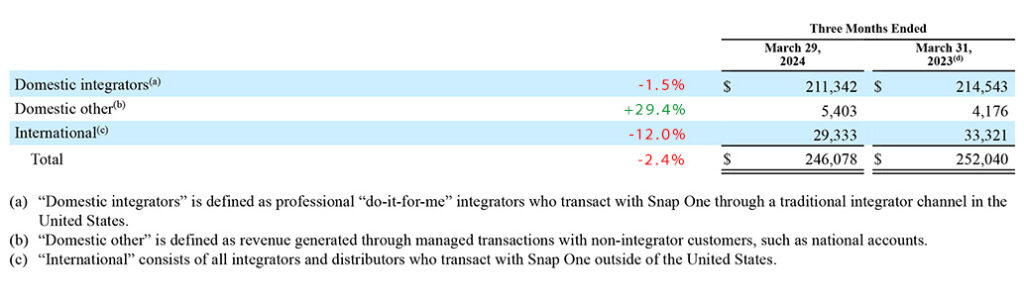

Disaggregation Data – Sales by Geography/Dealer Type

As they have done in the past, the company also provided data on a disaggregated basis, providing more detail on trends in sales generation. There are two key analyses that provide more color to some of the company’s internal trends – Net sales broken down by geography and dealer type…and sales broken down by product type (Snap One proprietary brands v. third-party brands the company distributes).

Integrators are the Biggest Category, National Accounts had the Biggest Growth

Here too, we see the continuation of some interesting themes that have emerged in past quarterly earnings reports. First up, revenues disaggregated by geography/dealer type. As you can see in the table above, the company breaks its business down by Domestic integrators, Domestic other (non-integrator national accounts), and International dealers. I have added the percentage change to the left of the results.

As you can clearly see, both domestic integrators and international integrators saw their business with Snap One decline by -1.5% and -12.0% respectively. Interestingly, the company had once targeted international sales for strong growth but has never been able to get that going. The only channel for growth is with non-integrator national accounts…which although still small in dollars, by comparison, the category grew by an impressive 29.4%.

Disaggregation Data – Net Sales Broken Down by Product Type

Finally, we turn to net sales broken down by type of product. As you most likely know, Snap One owns a large stable of products that are their proprietary brands…products they plan, design, build, and sell. The company also distributes products for other third-party brands. It is an important distinction because Snap One makes more money when it sells its own brands – they are more profitable – than it does when it sells other 3rd party brands.

But the company has been bedeviled for quite some time now with a troubling trend – the sales mix for several quarters has been trending towards more sales of 3rd-party products than its own brands, depressing profits. And we see that – yet again – a new quarter with the same old result. Looking at the table above, proprietary products saw sales in the quarter decline by 4.5%. At the same time, sales of 3rd-party products grew by 2.2%, shifting the mix again in an unfavorable direction for profit generation.

Can Resideo Change the Trajectory of Snap One’s Business?

So now, we wait for the acquisition by Resideo to close to see what changes will come of that. Can one company with stagnant results (Resideo) find a way to stimulate growth in another company with stagnant results (Snap One)? This all remains to be seen.

However, it sure seems like something needs to happen. Consider this factoid – with a net loss of $22.9 million, Snap One just lost more money in the first quarter of fiscal 2024 than it lost in all of fiscal 2023 (net loss of $21.4 million).

Learn more about Snap One by visiting snapone.com.

Leave a Reply